The Untold Secrets of TWL Holdings Berhad

cenzur19

Publish date: Sat, 30 Mar 2024, 11:50 PM

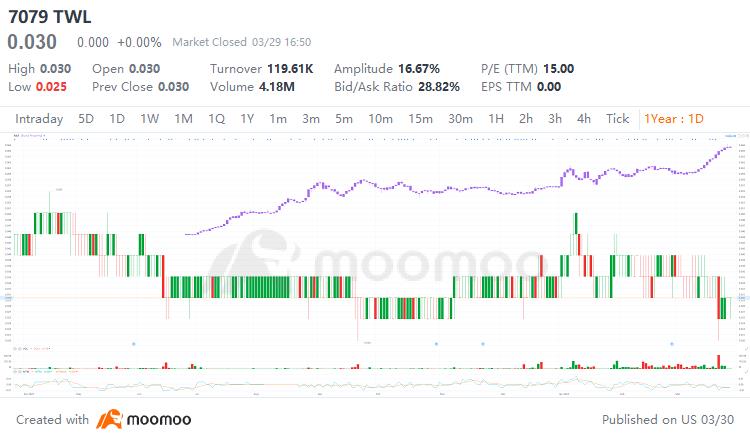

TWL Holdings Berhad (TWL), or formally known as Tiger Synergy Berhad, had in the past 3 quarters delivered good sets of financial results. However, the share price of TWL did not mirror the performance of Bursa Malaysia Properties Index.

For the uninitiated, TWL is a diverse company with plantation and timber, property and construction, and cement batching business. As the concession agreement of the timber segment comes to a close, the company will cease to recognise revenue and profit from the timber business, which would be replaced with the plantation business.

So far, TWL has completed one flagship project, namely the Bukit Sri Putra with GDV RM160.17 million, which consists of 170 units of 3-storey linked houses.

The photo here perhaps would be more relevant for investors who are interested in the company’s prospects. TWL had back in 2021-2022 launched Telaris Alam Impian which has a GDV of RM196.80 million, and now the project is fully sold, with foundation works (initial 20% progress claim) completed, and pending recognition of revenue and profit into the company.

Notably, this is a completely fresh revenue and profit recognition, which could yield a net margin of over 30% according to sources, as the land costs were relatively low at circa RM10.0 million, and construction manpower and materials were controlled in-house.

The construction of the project is expected to be completed within 2 years, which means the project could yield approximately RM30.0 million per financial year to TWL, excluding the few upcoming projects of the company:-

• TWL Alam Impian (Affordable Housing Project) with GDV of RM330.0 million, 1,000 units on 11.9 acres of freehold land.

• Pangsapuri Harmoni TWL (Affordable Housing Project) with GDV of RM207.5 million, 715 units on 5.49 acres of freehold land.

• Taman Pinggiran USJ (Affordable Housing Project) with GDV of RM216.3 million, 746 units on 6.19 acres of freehold land.

• Putra Heights Project (Affordable Housing Project) with GDV of RM273.35 million, 1,139 units on 8.75 acres of freehold land.

• Sungai Buloh Project (Affordable Housing Project) with GDV of RM160.0 million, 571 units on 5.5 acres of freehold land.

Beyond these projects, TWL had another 4 projects in their development pipeline, which is expected to provide the company with a foreseeable stream of income going forward.

So, why did the share price of TWL remain low at the current level?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-02-01

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL