SHCHAN COULD IT BE THE NEXT SUBUR?

golengkaki

Publish date: Fri, 15 Oct 2021, 12:24 PM

Hi everyone it's friday and the weekend is approaching yayyy

Before we end the week let us introduce SHCHAN to you guys

SHCHAN is quite interesting and we will share some of the infomation to you guys

But before we go in details let us share on their company information

Incorporated in 1962, SHC was previously involved in feedmilling and poultry breeding. Since 2007, the Group divested this business and ventured into oil palm plantations. Currently, our Group has a plantation landbank on mineral soil of approximately 10,997 hectares in Sarawak.

In 2017, the Group diversified into the provision of energy and facility management services. In particular, this includes the engineering, procurement, construction, operations and maintenance of district cooling systems.

Together, these two segments form the core business activities of our Group.

Ok after having a glance on their company profile let us guide you guys through on some of the interesting information on SHCHAN

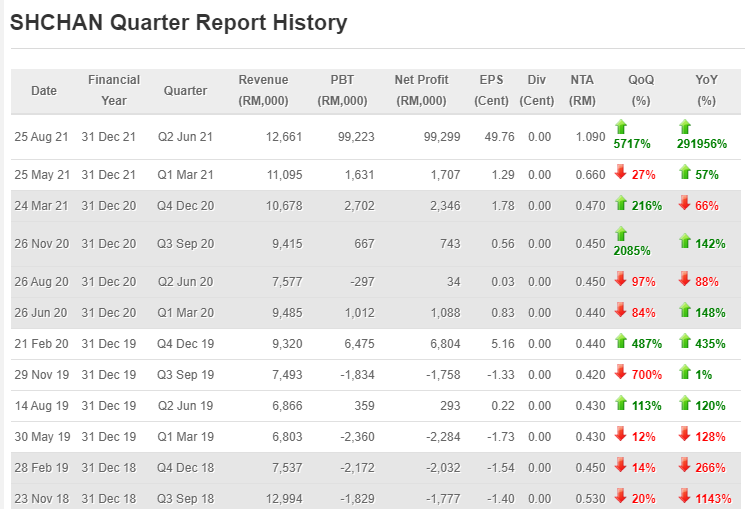

1, SHCHAN revenue is increasing steadily over the years and posted one of the strongest quarter

2. Palm oil price has been on the rise and it's definitely a good news for SHCHAN

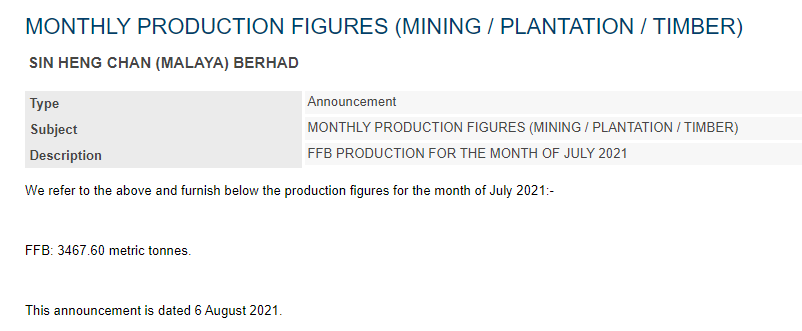

3. SHCHAN FFB production also has been increasing which is also a good news for them as it will translate to higher profit in tandem with the current bullish palm oil price.

Ok guys let us share something more interesting than the information above

SHCHAN acquired Tunas Selatan Pagoh Sdn Bhd (TSP), a facility management and construction outfit. Concluded earlier this month, the RM145.9 million deal was fulfilled by RM70 million in cash, RM36.3 million via the issuance of 110 million shares in SHC at 33 sen apiece and the remaining RM39.6 million via the issuance of 120 million new irredeemable convertible preference shares (ICPS) at 33 sen each.

For more details please read this article

https://www.theedgemarkets.com/article/sin-heng-chan-gains-traction-after-tunas-selatan-pagoh-acquisition

After looking into all these information

Plantation sector has been on the headlines recently for couple of reasons

Source: https://www.theedgemarkets.com/article/where-next-ma-play-plantation-could-be

There has been some major plantation companies taking over into smaller players in Bursa

Secondly with the latest news SUBUR TIASA which is a plantation company got a takeover news at 0.65 which is below their NTA of RM 2.93 and Subur Tiasa has been on the uptrend since minority shareholders were advised last Thursday that the unconditional mandatory takeover offer from the company's major shareholder Tiong Toh Siong Enterprises Sdn Bhd (TTSE) is “not fair and not reasonable.

Source: https://www.theedgemarkets.com/article/subur-tiasa-share-price-hits-limit

How does this relate to SHCHAN?

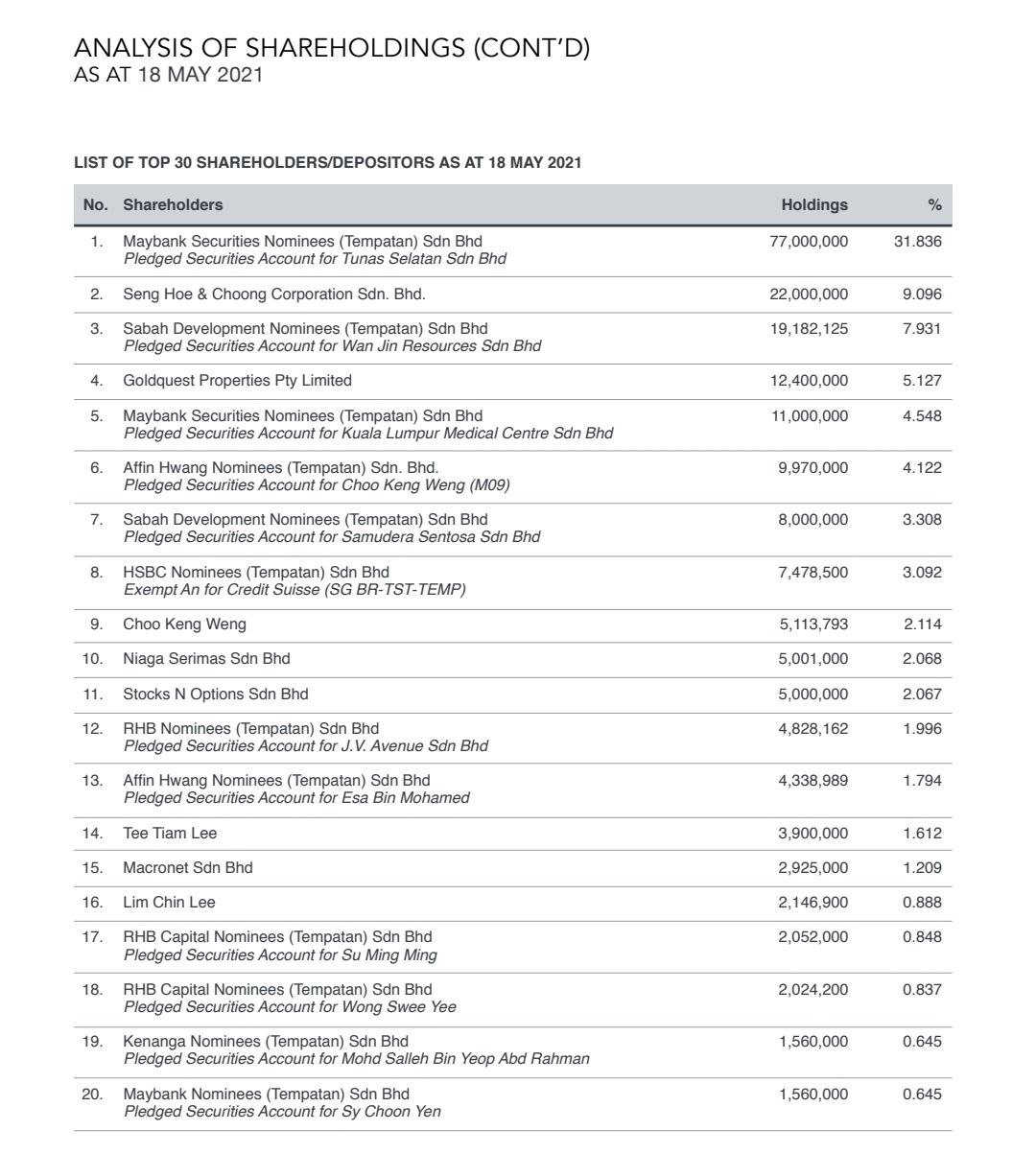

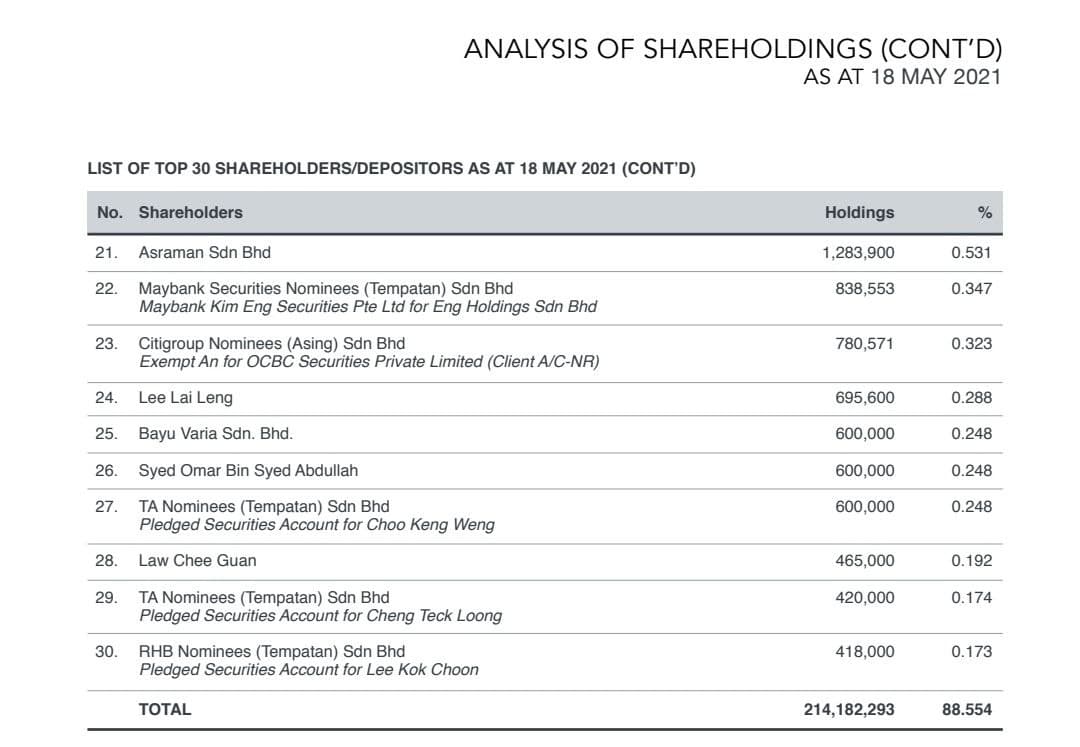

As we mentioned above SHCHAN top 30 shareholders already hold about 88% of the shares issued in which they could privatize their company due to the fact Tuju Selatan is now the major shareholder and they are a construction company and also palm oil price is on the rise and this is the best time for them to take advantage of it to go private.

SHCHAN NTA is RM 1.09 and we believe a potential privatization could happen because with recent volume transacted since 7/10/2021 there is some sign of a potential corporate exerice as the volume on 7/10/2021 was about 30m shares it is the highest ever volume transacted for SHCHAN history.

As a conclusion we strongly believe SHCHAN could become the next SUBUR TIASA due to the reasons given above.

Disclaimer: Author is just sharing his/her opinion please don't take this as buy/sell call. Kindly consult your financial consultant for more information.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

Can the writer of this article please explain the sudden huge net profit in its latest financial result to justify this company isn't a con-man tricky accounting practices to project such high false profit?

2021-11-21 13:56

Blacksails

A dead cat counter only bounds once in a red moon?

2021-11-21 13:48