MAG Holdings - Strategically Leveraging Government Initiatives to Boost Investor Confidence

PalaniR

Publish date: Wed, 12 Jul 2023, 05:06 PM

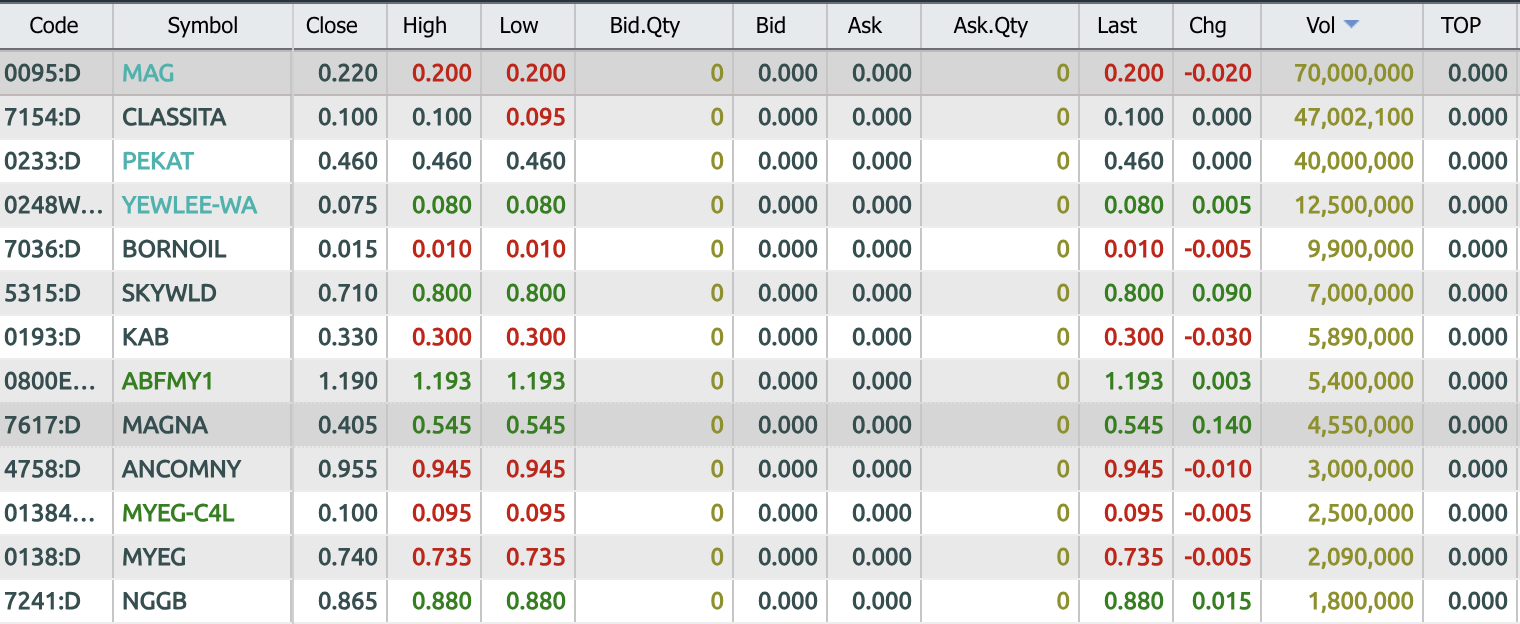

In a recent major shift in shareholding, MAG Holdings witnessed 70 million of its shares, or 4.39% of the total shares, being traded off-market on 12th July 2023. This significant transaction, conducted at RM0.200 per share, piqued the interest of market watchers and investors alike, as the purchasing party is said to be a Government Linked Company (GLC) - which is expected to be parties related to MOHR Malaysia, according to sources.

This development aligns seamlessly with the Malaysian government's renewed commitment to address food security issues. Given the country's ongoing struggle with food inflation that has adversely affected the B40 population - the bottom 40% of income earners - such a shareholding change is indicative of a larger shift. The dire inflation has forced many households into poverty, catapulting food security into the spotlight in the national agenda.

In response to this crisis, the government has advised adopting best practices from other nations. This includes placing food security at the forefront of national policy, harnessing the power of Fourth Industrial Revolution technologies, bolstering investment in research and development, and fostering public-private partnerships. Notably, MAG Holdings aligns perfectly with these recommendations, which, according to the country's economic outlook report for 2023, form the foundation of the government's strategy.

Known as one of the largest providers of whiteleg shrimp in Malaysia, MAG holds a formidable position in the nation's aquaculture industry. The company's ability to breed and process up to 5.5k MT and 6k MT of Vannamei prawns annually, respectively, is commendable, especially considering the high-density breeding conditions.

A testament to its operational efficiency is MAG's impressive Feed Conversion Ratio (FCR) which ranges from 1.5 to 1.7. This metric, which measures the efficiency of an animal's conversion of feed into weight gain, points to MAG's proficient handling of risk mitigation within its aquaculture operations.

In line with its successful domestic ventures, MAG is broadening its investment portfolio with a RM22 million venture into Indonesian shrimp farming. This diversification involves acquiring a 50% equity stake in Lim Shrimp Aquapolis Pte Ltd and forming a strategic partnership with PT Gerbang NTB Emas.

The company anticipates the venture to yield an average annual net profit of RM6.9 million within four years of commencing shrimp processing operations. Additionally, the formation of a PMA Company in Indonesia will secure exclusive licensing rights for a shrimp processing and cold storage plant on Sumbawa Island, further enhancing MAG's prospects with a tax-free status for three years.

Overall, the recent changes at MAG Holdings point towards an advantageous alliance with government initiatives. Such strategic alignment holds the potential for a robust financial outlook, fortifying investor confidence in the process.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|