Portfolio All Time High Profit Watermark - June Update

DividendGuy67

Publish date: Tue, 11 Jun 2024, 11:28 PM

For informational purpose only.

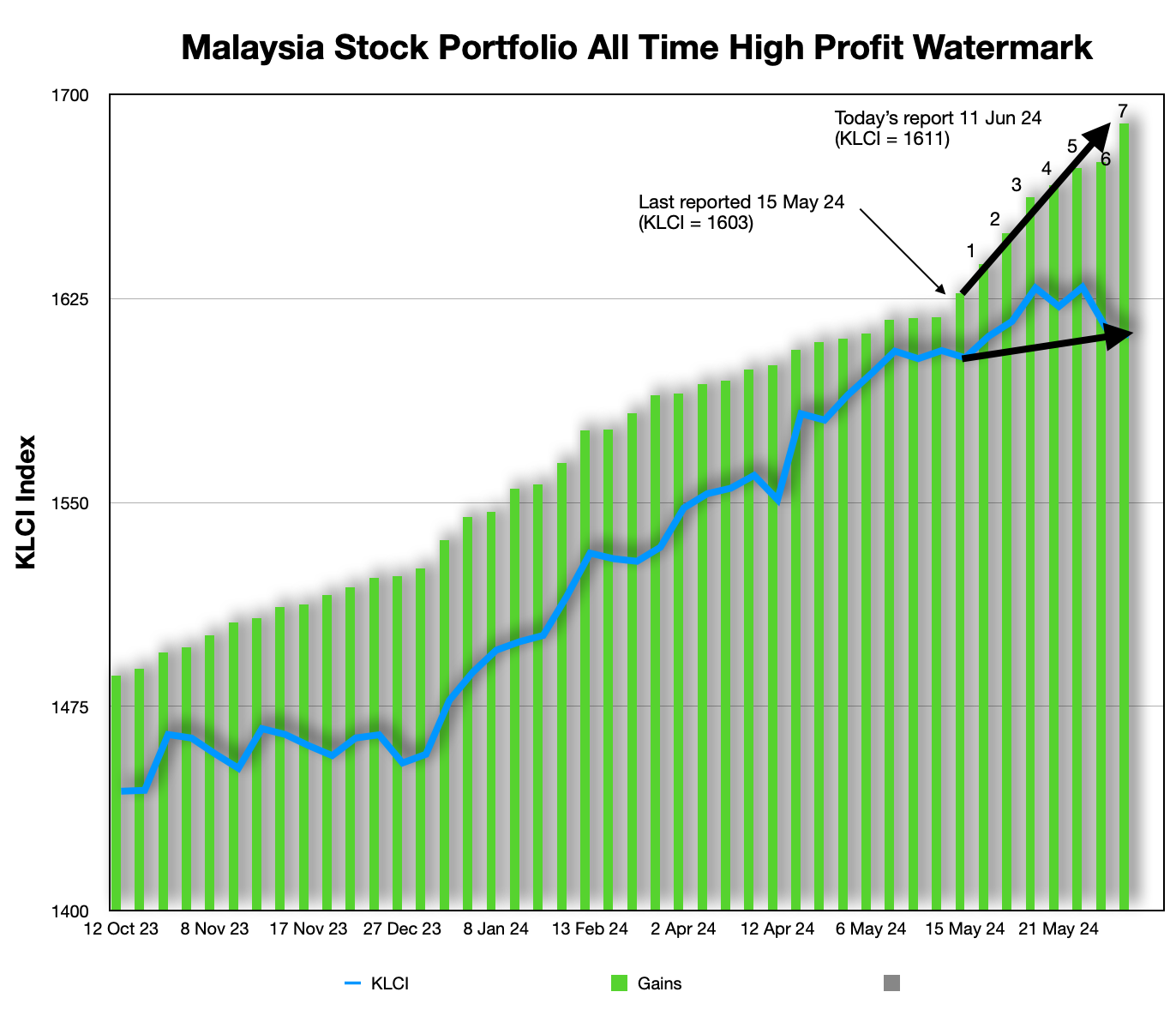

My last post on "All Time High Profit Watermark" was on 15 May, which is nearly 4 weeks ago. Since 15 May:

- KLCI gained 8 points, from 1603 (15 May 24) to 1611 (11 June 24) vs.

- My portfolio made 7 new all time highs. (see chart).

Worth mentioning:

- Today's new high watermark is the biggest one day spike since tracking 8 months ago.

- The frequency - 7 times - is also higher than the average frequency in a month.

- The average frequency is around 5-6 times in a month - since I started manually tracking from 12 Oct 2023 (8 months ago), total number of new high watermark is 44 times.

Here's a chart summary.

Feeling extremely thankful to Mr Market!

As the market value of my portfolio increases, my expected annual dividend income from my portfolio has also been on a rising trend (albeit at a much slower rate).

My portfolio characteristics (as of 11 June 2024) as follows:

- I have 54 open positions. The median position size is around 1.9% portfolio, but ranges from 0.3% to 9.5% of portfolio

- 40 / 54 have expected dividend yield larger than 3% per annum (so, this is mostly a dividend portfolio that is either equal or higher than FD rates).

- 14 / 54 stocks are either nil dividend yield / lower than 3% dividend yield i.e. nearly all of them are trading (than investing) positions.

- Zero leverage products. No warrants. Not interested in derivatives or loans or gearing.

- The investing stocks I own are similar - net cash, or low debt, but pays nice dividends.

- Only shorter term trading positions can have debts. E.g. CAPITALA. However, position size is extremely small % of portfolio (low 5 digit) and this is a trading position. Paper gain is 40% at the time of writing. However, even if CAPITALA were to go to zero (unlikely), it will only be a tiny dent to my yearly dividend income.

- Current dividend yield on cost is around 5.5% per annum. This is now on par with EPF rate, except stock portfolio can also provide larger price gains which EPF cannot provide.

I am not a professional, nor a full time investor. I am just a retail, individual investor who holds a full time job, with very strong mathematical background.

- Today's biggest ever single day gain is luck - I didn't do anything. All I did was identify that we are in a bull market for my holdings and I sit tight and let the market does its work.

- In general, most of my research, study, new ideas occur on weekends. I plan my trades and I then execute my plans by entering the trades via GTC limit orders and then ignore the market. I let market decides whether I deserve to enter the trade or not. It doesn't feel like work at all.

- I hate watching price ticks intraday - I feel this is a complete waste of time. So, I almost never monitor the market during trading hours, as I am deeply engaged in my day time job which I love doing - in fact, my leanings is still to do something after I retire that is not market related, like writing, or teaching. So this is just part time (but a serious endeavour, as this is preparation, to generate future passive income for me and my wife, when I eventually retire.).

- I also hate real time market moving "news". I rarely read "news".

- I like to read Quarterly Reports typically days or weeks after it comes out. I like to read Annual Reports typically days or weeks after it comes out. I like to read IB analyst reports, but totally ignore their Buy/Sell recommendations, and typically found myself doing the opposite of what is recommended by them. Being late a few days or a few weeks doesn't seem to cause a negative impact my investing results, as my investing style is similar to Warren Buffet who has been my idol for decades, with some tweaks for Malaysia Bursa conditions. But I have zero interest to be an investment manager or mange other people's monies.

My original investment goal is to aim for a modest 9% per annum, with roughly 50:50 dividend:price gains. I don't believe in being very aggressive for several reasons:

- This is a 7 digit dividend stock portfolio, as one part of many, to prepare for retirement in a few years time. If you have RM1 million portfolio, 9% equals RM90,000 per annum gain, a very decent amount already - why be greedy for what?

- This is part of a diversified plan with other assets such as EPF balance, FD balance, properties, unit trusts, life insurance policies, etc.

- Many investors will already be grateful for the monthly income arising from 9% p.a. returns on this stock portfolio alone (excluding EPF interests, FD interests, and other passive income), and so are we.

- The original capital that went to invest this dividend stock portfolio was smaller than EPF balance, smaller than FD balances plus other assets. Due to higher returns, it is now the largest asset class. But no desire to trim down yet, because markets still look like a bull market i.e. the right thing to do is to sit tight - chart wise, hasn't yet approach selling zones.

As events transpired, the price gains portion has substantially exceeded the dividend yield, clearly beating my original goals by significant margin.

- I am beating the KLCI index since portfolio inception by over 5%-7% per annum.

- For a highly diversified portfolio of 54 stocks, with majority leanings on dividends, this short term result has surpassed my own expectations when I first started.

Nevertheless, the proof of the pudding is when markets and KLCI eventually crashes.

- Make no mistake, markets always crash, it's just a question of when.

- Also, before it crashes, it will also make new highs - this is just the nature of markets.

- So, I do believe in selling when the markets eventually approach selling zones.

- I do technical analysis on markets and KLCI (monthly updates typically). Through this, I hope to be able to identify the selling zones to raise cash, and accumulation zones to buy more stocks.

- For now, it's in the do nothing zone for me mostly, and I must respect my discipline.

Always feeling grateful and thankful to Mr Market!

Disclaimer: As always, you are fully responsible for your own investment and trading decisions.

More articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Jan 22, 2025

ongkkh

Thanks for sharing

2024-06-12 07:19