A Dividend Portfolio - All Time High Profit Watermark

DividendGuy67

Publish date: Wed, 15 May 2024, 10:25 PM

Just for informational purposes.

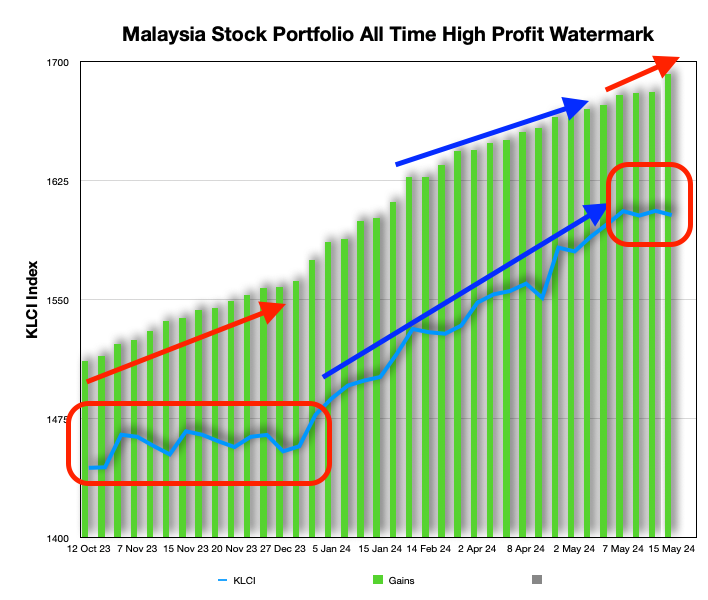

7 months ago, I thought it would be interesting one day, to show how a real life Malaysia dividend stock portfolio performs relative to KLCI benchmark. So, I started to keep track of my dividend portfolio's all time high profit watermark level. Unfortunately, it has to be done manually, since my online broker software cannot do this for me.

This portfolio originally comprised of at least 33 stocks of above average quality business, entered with at least 4% per annum dividend yield, most when its prices are generally lower than average, near my own definition of "accumulation zones" i.e. available at fairly attractive prices.

So, what this means is that after the start date, every time my dividend portfolio made a new all time high, I note the new high profit, the KLCI and the date. I didn't think I missed a day, but I cannot guarantee, and it's not audited.

So, my tracking showed that this portfolio has made new all time highs of at least 37 times. The frequency is almost 25% i.e. roughly once every 4 days or so, it would make a new all time high again. It's clear the KLCI has been in a bull market.

The time gap between the 2 points varies.

- The shortest period between the last high and the next new high is 1 day.

- The longest period is 46 days so far.

- The quantum increase between 2 high watermark levels varies too.

A couple more observations.

1. The Red drawings is quite typical for a portfolio of good quality dividend stocks - when the KLCI index moves sideways in a box say, the portfolio continues to climb to make new highs, due to payment of regular dividends and the behaviour of prices to eventually return to previous levels (or higher) after dividend payment, for good businesses. This is the power of good quality stocks paying dividends.

2. The Blue drawings is also quite typical of a dividend portfolio, in that when the KLCI index climbs fast following the blue arrow, the portfolio grows too but at a slower rate i.e. it tend to lag behind. But for me, over this period, it still made returns higher than EPF by a margin.

The gains are enhanced slightly due to trading gains (I couldn't separate them out without a lot more work), but in general, the latter is relatively smaller, and so, even if I did the work to exclude trading gains, I don't expect that to change the overall picture of the above chart. Similarly, I also have a some small amount of profit taking and a small amount of rotation into better quality stocks available but I don't think it will change the shape of the picture above.

So, I'm very thankful and incredibly grateful to Mr Market and my dividend stocks! The overall performance met (and exceeded) my original investment objectives. I hope the past 7 months of manual tracking, just to create this chart, show something interesting, one that is typically observed over decades too and not just 7 months.

Best wishes!

More articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Jan 22, 2025