Happy January - Solana soars! Part 2

DividendGuy67

Publish date: Sun, 19 Jan 2025, 04:36 PM

Introduction

See my first article here.

After that article, Solana continues to soar - these cryptos move very fast even on weekends!

So, what have I done since Part 1, and looking forward (a happy part), how should I think about taking profits over the weekend?

Background to my RM147,000 Crypto Account

A brief background to my 147K account. I first opened this in late December for both personal and professional reasons. I actually already have access to trading Bitcoin and Bitcoin related stocks, ETFs, Options, but I also wanted to diversify my Bitcoin holdings. Additionally, as we come to the end of the year which is bonus and salary increment time, unfortunately, due to my company constraints, the salary increments outlook was not positive and quite low really, to only average 2% for average member. I know my team will be disappointed, and I am looking for a way to retain my team, so, as we talked and talked, I noticed some interest in Bitcoin, and then decide to show them how to make a side income with my guidance. It's not meant to teach them to be financially free from trading - but just a one time opportunity thing in anticipation of the tough times ahead. As trading profits are highly uncertain, my initial outlook for them starts with becoming a 4 year investor first - but if market gives quick gains, then, once they made enough, we will exit and then wash our hands completely, with no further obligations. Only those who agreed to 4 year outlook then joins.

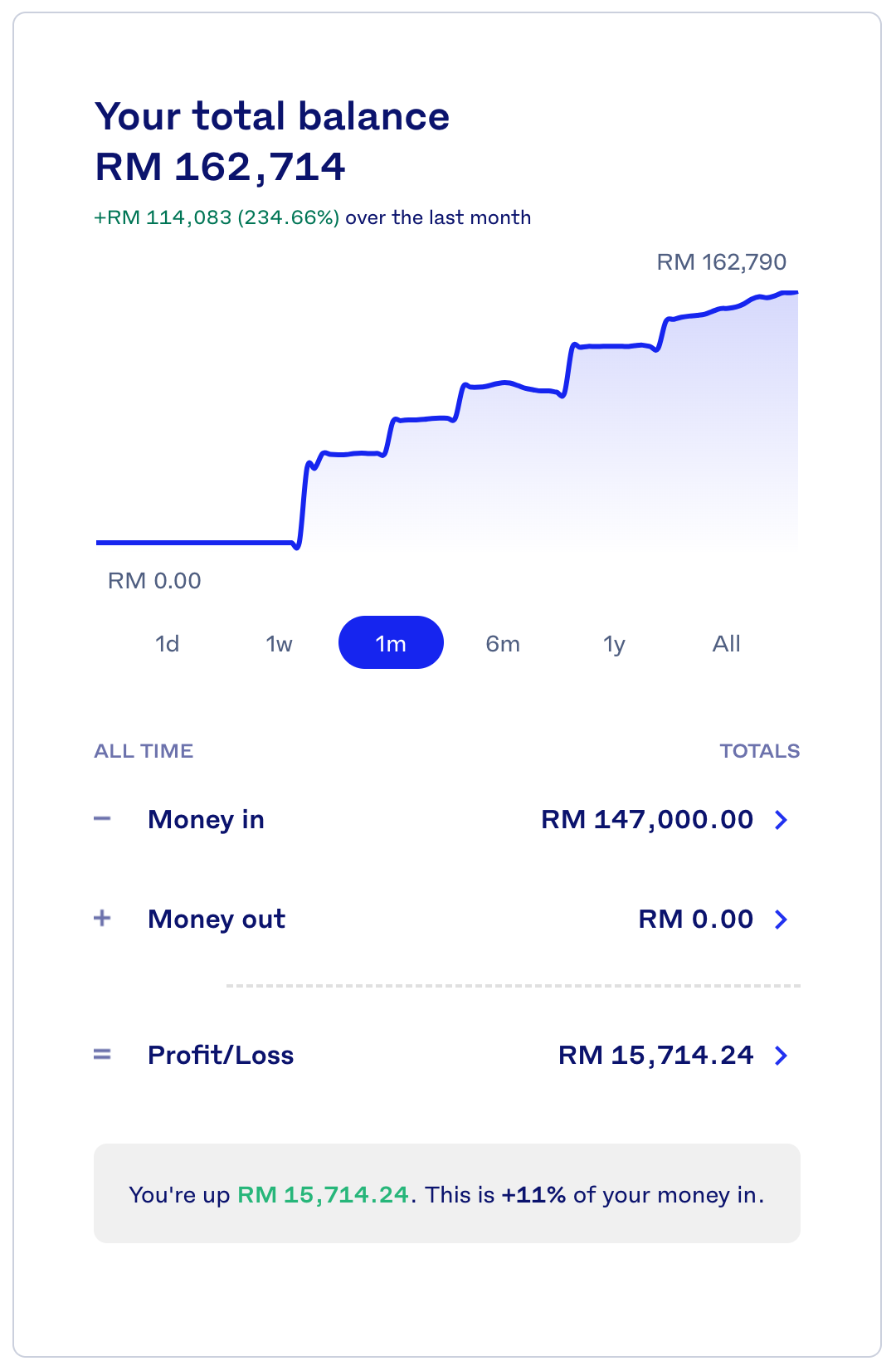

The 147K Account Result

Markets are volatile. The account is now up +11% in just 3 weeks or so. Solana helps.

Solana's Contribution

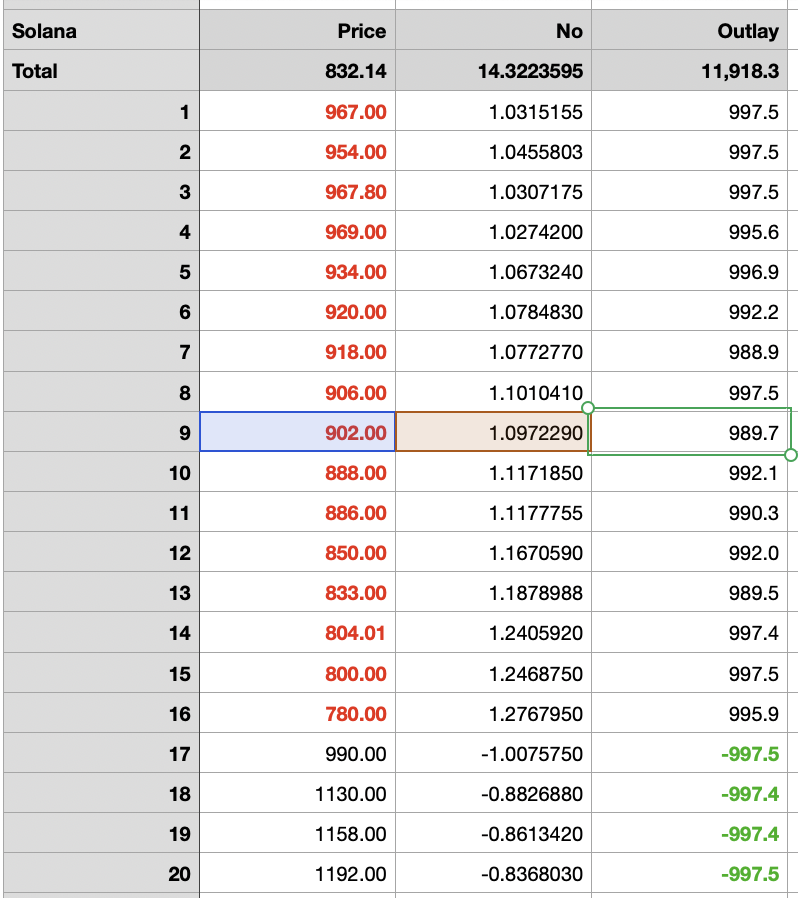

Here's what I did mindlessly so far. Let me summarize my trades.

1. If you look at the "Outlay" column, they hovers around RM1k. This is my DCA amount - every trade is just RM1k. I use Luno Malaysia and for Limit orders, they only charge 0.25%, regardless of amount as long as it is above RM100 iirc.

2. I made 16 DCA - generally, the lower the price the more units I add whilst keeping the outlay constant.

3. After price has exceeded my highest buy price at 990, then, I then start to exit with 1K each. At every point, the market value of the remaining stocks exceeded RM16k i.e. I am not diluting the value, but taking chips off the table.

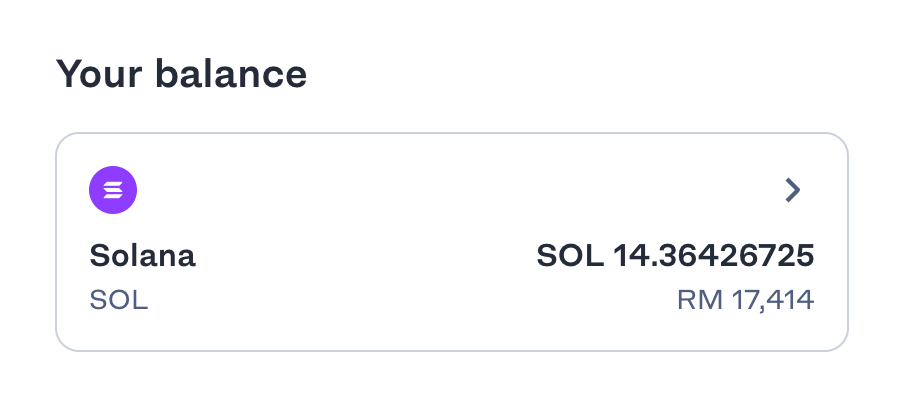

4. I have taken RM4k off the table already. The Market Value of my remaining units is around RM17.4K+ (market moves). The point is it is larger than my original RM16k i.e. I am now in a very good spot.

5. As a teaching tool, I am tempted to just ask to close all so that my arrangement is terminated ... this is appealing. However, I am not doing it like this in my much larger USD account.

So, what's an easy way to exit this arrangement at a profit?

Reflections:

1. In Part 1,you will see that the chart time-frame is 1Hourly. In general, when we are in the accumulation zone, we drill down to lower time-frames and start our scaling in.

2. The short answer to my question is to go to a higher time-frame like Daily and start to see where is the "typical" resistance. A simple way is to use the Fibonacci Expansion 1.618 target.

Looking at the Daily chart, we see:

1. Solana broke out to new all time highs - that is very clear. It's all "blue skies" from here, with no resistance.

2. RSI is at overbought levels after breakout, so, 1.618 Fibonacci expansion is not unreasonable for a "blue sky" position.

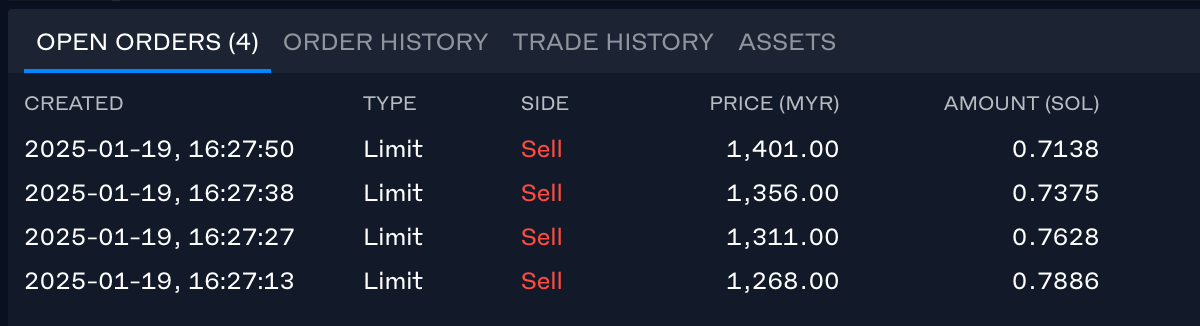

3. However, most people feel good to take profits on the way up. So, I design a simple Fibonacci expansion looking at 4 various levels - 1.272, 1.382, 1.500, 1.618.

4. So, now we can key in these orders to sell at these 4 levels.

5. As they approach resistance, we may want to project and see if we were to take profit at all these levels, what would be the remaining amounts at 1.618 level? A quick calculation showed that at 1.618 level, the market value of remaining unit will be around RM15.9K, slightly below RM16k. Additionally, if it gets there, we will have already taken RM8k out or 50% of our investments. It suggests, we may around 50% gains if it get that far and that is nice. It sounds like a plan as it is still very early stages to exit completely from Solana IMHO. And because it is traded by novices, it feels good to take some profits off the table to reduce risks given the objective and purpose of the trade.

6. Objectively, it is not a good trading to take profits so often, but the goal is to instill a DCA approach, after identifying accumulation zones, after identifying the right instrument where we are bullish on for the long term. The objective is to have a mindless DCA approach where we keep getting good news after good news, every time we profit take and "it's a nice feeling".

7. There are many alternatives to profit take of course. E.g. the passive reactive approach i.e. wait until we see the top, and then, put a trailing stop loss and then exit without monitoring. However, my views on crypto is that that is just opening yourself up for being stopped out ... and typically, it will cause regret ... to novice, the feeling of taking profits each time it makes a new high is a "nice feeling" (even if objectively, it is not the best). Other alternatives can include monitoring key target resistance levels and see how it behaves in case it shoots past 1.618 but this is not our objective. At some point, I want to exit this arrangement, less profits works for me.

We must respect markets that Markets can do ANYTHING.

So, we enter the 4 profit take sales order.

Sanity check. If price hits 1,401, the remaining units we have is 11.3197. Multiply by 1,401 = 15.9K, close to 16K. This works.

Summary and Conclusion

If Solana ends up becoming the 2nd most important crypto to replace Ethereum, then, we may regret doing all these profit take because it could be another 3X from here. However, it may not happen during this cycle (who knows) and it is not our goal here. But after hitting 8 profit takes and taking off 50% of the chips there, I can wash my hands off this endeavour and that is my objective.

If you are a maximalist trader, of course, it is far too early to take profits ... the first level MIGHT be the 1.618 at way overbought levels taking off everything there and still keep 16K (that could be one way, or be more aggressive) looking to buy back on healthy dips (e.g. split trading and investing 50/50). So many alternatives to profit taking.

For this 147K account, no need to be so precise. Remember these are your team mates. Their happiness and peace of mind is paramount. It's only to help them tide the short term.

All the best!

Disclaimer: Just a random guy on the internet. Not Financial Advice. You are solely responsible for all your investing and trading decisions.

Also, if you like the free content of this article and if you feel this free content is better than any paid content you are making, please don't bother to "like and subscribe" because there is no button for you to like and subscribe! haha. I am really just a random guy on the Internet!