Seagate & Western Digital benefits from AI & Generative AI storage demand

kkwong13

Publish date: Thu, 06 Jun 2024, 11:26 PM

Seagate & Western Digital benefits from AI & Generative AI storage demand

Summary

- Artificial Intelligence (AI) and generative AI require substantial memory and storage capabilities for extensive datasets and training models.

- Nvidia is a leader in AI and generative AI with its GPU chips, while Seagate and Western Digital are major storage beneficiaries.

- Seagate and Western Digital are major beneficiaries of the increased storage demands for AI, with HDDs expected to dominate data centers for the next 10 years.

- Seagate’s HAMR and WDC’s MAMR advanced technologies will keep HDDs in the forefront of demand over SSDs through 2030

The major storage beneficiaries are Seagate and Western Digital. Flash storage will continue to support high-performance computing systems, while large-capacity HDDs will remain the most economically viable storage solution for storing the immense amounts of data generated and utilized for predictive analytics.

According to The Information Network’s report entitled The Hard Disk Drive ("HDD") and Solid State Drive ("SSD") Industries: Market Analysis And Processing Trends, more than 90% of exabytes in cloud data centers are stored on HDDs, and the remaining 10% are stored on SSDs.

HDDs continue to offer approximately five times better cost efficiency per bit compared to equivalent flash solutions, and we anticipate this difference to persist through the end of the decade.

Looking ahead, HDDs are expected to maintain market share, thanks in part to advances that continue to increase capacities while maintaining performance. I forecast that HDDs are well-positioned to dominate data centers for the next 10 years.

WD CEO: ‘Clearly, HDD plays a big role in the AI storage life cycle

Western Digital’s third quarter results were boosted by a strong rise in disk revenues along with increased demand for SSDs.

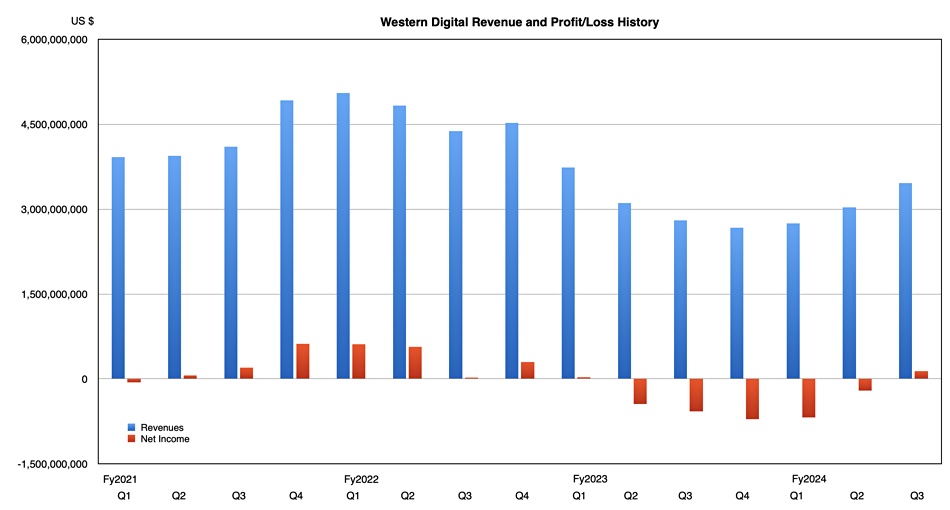

Its revenue slump is ending. Earnings in its third fy2025 quarter rose 29 percent year-on-year to $3.46 billion, beating its $3.3 billion outlook, and it made a $135 million profit, after five consecutive loss-making quarters.

This contrasts with HDD maker rival Seagate where revenues of $1.66 billion were down 11 percent year-on-year with a $25 million profit. WD made $1.75 billion in disk revenues, overtaking Seagate after years of playing second fiddle. Seagate’s bet on HAMR technology is not, so far, paying off.

WD CEO David Goeckeler said in prepared remarks: “As evidenced by our excellent third quarter results, Western Digital continues improving through-cycle profitability and dampening business cycles by leveraging our strategy of developing a diversified portfolio of industry-leading products across a broad range of end markets.”

Financial Summary

- Gross margin: 29 percent vs 29.3 percent a year ago

- Operating cash flow: $58 million vs -$110 million a year ago [turn around cash flow, more upside]

- Free cash flow: $91 million

- Cash & cash equivalents: $1.9 billion

- EPS: $0.63 vs $0.34 last year [+85% YoY]

Flash revenues were $1.7 billion, up 30.5 percent annually, while disk revenues of $1.75 billion rose 17.1 percent annually and overtook the SSD earnings after three lagging quarters. Nearline drive revenue reached a six-quarter high point. HDD exabyte shipments increased 41 percent quarter-on-quarter and the average HDD selling price increased from $109.00 a year ago to $145.00.

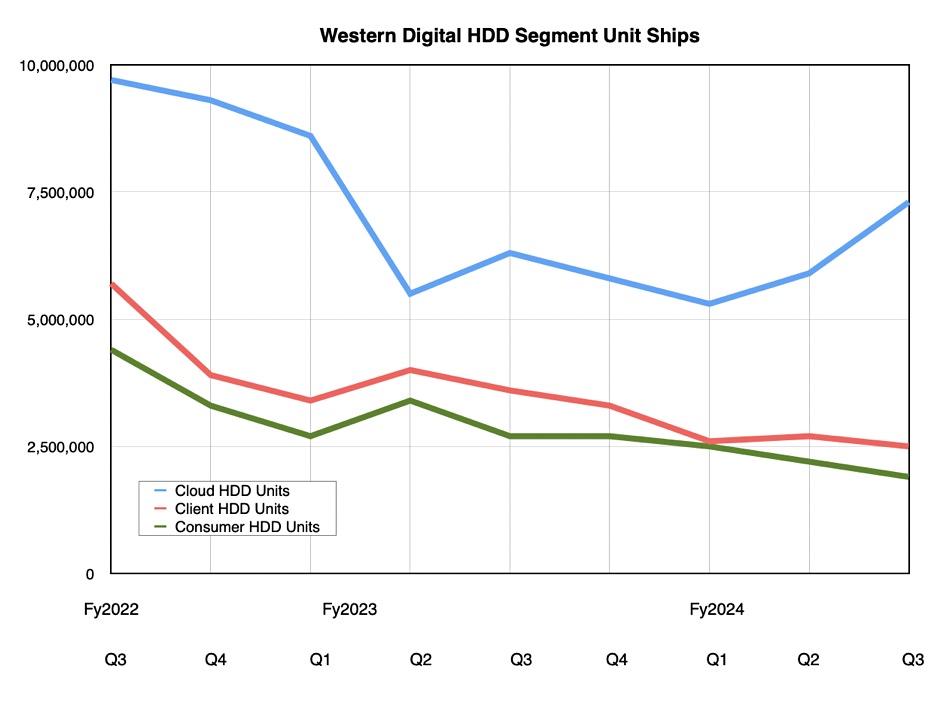

Disk units totalled 11.7 million, down 7.1 percent annually but the second consecutive quarterly rise. Cloud buyers bought 7.3 million drives, 15.9 percent more than a year ago, while there was a 30.7 percent Y/Y drop in client drive (non-cloud OEM and enterprise) units to 2.5 million and a 29.6 percent drop in consumer drive shipments to 1.9 million. Cloud buyers bought 62 percent of WD’s disk drives in the quarter and represent its largest unit shipment and HDD revenue market. Gpesckeler said the quarter saw WD’s largest HDD sequential exabyte growth in some time.

Two of the three main market segments were affected by rising HDD demand while all three were affected by SSD revenue rises:

- Cloud (up 29 percent to $1.56 billion) was 45 percent of total revenue with growth primarily attributed to higher nearline shipments, improved nearline unit pricing, and flash revenue up both sequentially and year-over-year.

- Client rose 20 percent annually to $1.17 billion and was 34 percent of total revenue. Sequentially, the increase in flash ASP more than offset a decline in flash bit shipments while HDD revenue decreased. The year-over-year increase was driven by growth in both flash and HDD ASPs and flash bit shipments.

- Consumer at $730 million was up 17 percent annually and represented 21 percent of total revenue. Sequentially, both flash and HDD were down at approximately similar rates and in line with seasonality. The year-over-year increase was driven by growth in flash bit shipments and ASP.

Goeckeler: Clearly, HDD plays a big role in the AI storage life cycle as well as the whole ingest phase, because all of the big data lakes and all of the raw data sets; those are all going to be stored on HDD. It’s just the economics of where you store that data, and how do you access that data. It’s all that part of the AI pipeline, if you will, is going to be HDD.”

And SSD’s role: “Now, you have all of these other new use cases around training and inference, and those are all going to be SSDs. So, it’s really about growth as opposed to substitution. And that’s what’s so exciting about this. And obviously, once you get the models trained, then the models are going to turn out more data, which is going to be stored on HDD.”

WD expects Q4'FY2024 quarter revenues to be in the range of $3.6 billion to $3.8 billion, increase vs $3.46 billion last Q3'FY24 revenue. The $3.7 billion mid-point would represent a 38.8 percent annual increase, making for a $12.94 billion full year.

Stay happy, stay invest!

Generative AI such as ChatGPT can produce a wide variety of content, including text, images, videos, and more. As organizations leverage these models to create content for marketing, design, virtual environments, and other applications, they will need to store the generated content. This can lead to a substantial increase in the volume of data that needs to be stored in cloud servers and data centers.

For training generative AI models, diverse and extensive datasets are required. Organizations might collect and store large datasets to train these models effectively. These datasets may consist of text, images, videos, and other types of data, contributing to increased storage demands. For example, nearly four million videos are uploaded daily to YouTube and their file sizes can be thousands of times larger than a single image. Platforms like YouTube need data centers with massive storage arrays to accommodate this volume of content.

The major storage beneficiaries are Seagate and Western Digital. Flash storage will continue to support high-performance computing systems, while large-capacity HDDs will remain the most economically viable storage solution for storing the immense amounts of data generated and utilized for predictive analytics.

According to The Information Network’s report entitled The Hard Disk Drive ("HDD") and Solid State Drive ("SSD") Industries: Market Analysis And Processing Trends, more than 90% of exabytes in cloud data centers are stored on HDDs, and the remaining 10% are stored on SSDs.

HDDs continue to offer approximately five times better cost efficiency per bit compared to equivalent flash solutions, and we anticipate this difference to persist through the end of the decade.

Looking ahead, HDDs are expected to maintain market share, thanks in part to advances that continue to increase capacities while maintaining performance. I forecast that HDDs are well-positioned to dominate data centers for the next 10 years.

Investor Takeaway

Generative AI such as ChatGPT can produce a wide variety of content, including text, images, videos, and more. As organizations leverage these models to create content for marketing, design, virtual environments, and other applications, they will need to store the generated content. This can lead to a substantial increase in the volume of data that needs to be stored in cloud servers and data centers.

For training generative AI models, diverse and extensive datasets are required. Organizations might collect and store large datasets to train these models effectively. These datasets may consist of text, images, videos, and other types of data, contributing to increased storage demands. For example, nearly four million videos are uploaded daily to YouTube and their file sizes can be thousands of times larger than a single image. Platforms like YouTube need data centers with massive storage arrays to accommodate this volume of content.

The major storage beneficiaries are Seagate and Western Digital. Flash storage will continue to support high-performance computing systems, while large-capacity HDDs will remain the most economically viable storage solution for storing the immense amounts of data generated and utilized for predictive analytics.

According to The Information Network’s report entitled The Hard Disk Drive ("HDD") and Solid State Drive ("SSD") Industries: Market Analysis And Processing Trends, more than 90% of exabytes in cloud data centers are stored on HDDs, and the remaining 10% are stored on SSDs.

HDDs continue to offer approximately five times better cost efficiency per bit compared to equivalent flash solutions, and we anticipate this difference to persist through the end of the decade.

Looking ahead, HDDs are expected to maintain market share, thanks in part to advances that continue to increase capacities while maintaining performance. I forecast that HDDs are well-positioned to dominate data centers for the next 10 years.

For example, Seagate’s HAMR (Heat-Assisted Magnetic Recording) and WDC’s MAMR (Microwave-Assisted Magnetic Recording) are advanced technologies designed to enhance the storage capacity and performance of hard disk drives (HDDs), a type of data storage device that uses spinning disks to store information magnetically. Both HAMR and MAMR aim to overcome the limitations imposed by the superparamagnetic effect, which becomes significant as data bits are packed more densely on HDD platters.

For example, Seagate’s HAMR (Heat-Assisted Magnetic Recording) and WDC’s MAMR (Microwave-Assisted Magnetic Recording) are advanced technologies designed to enhance the storage capacity and performance of hard disk drives (HDDs), a type of data storage device that uses spinning disks to store information magnetically. Both HAMR and MAMR aim to overcome the limitations imposed by the superparamagnetic effect, which becomes significant as data bits are packed more densely on HDD platters.