ATS (0072) - Potential ROI 700%

Stockiss

Publish date: Mon, 28 Dec 2020, 08:54 AM

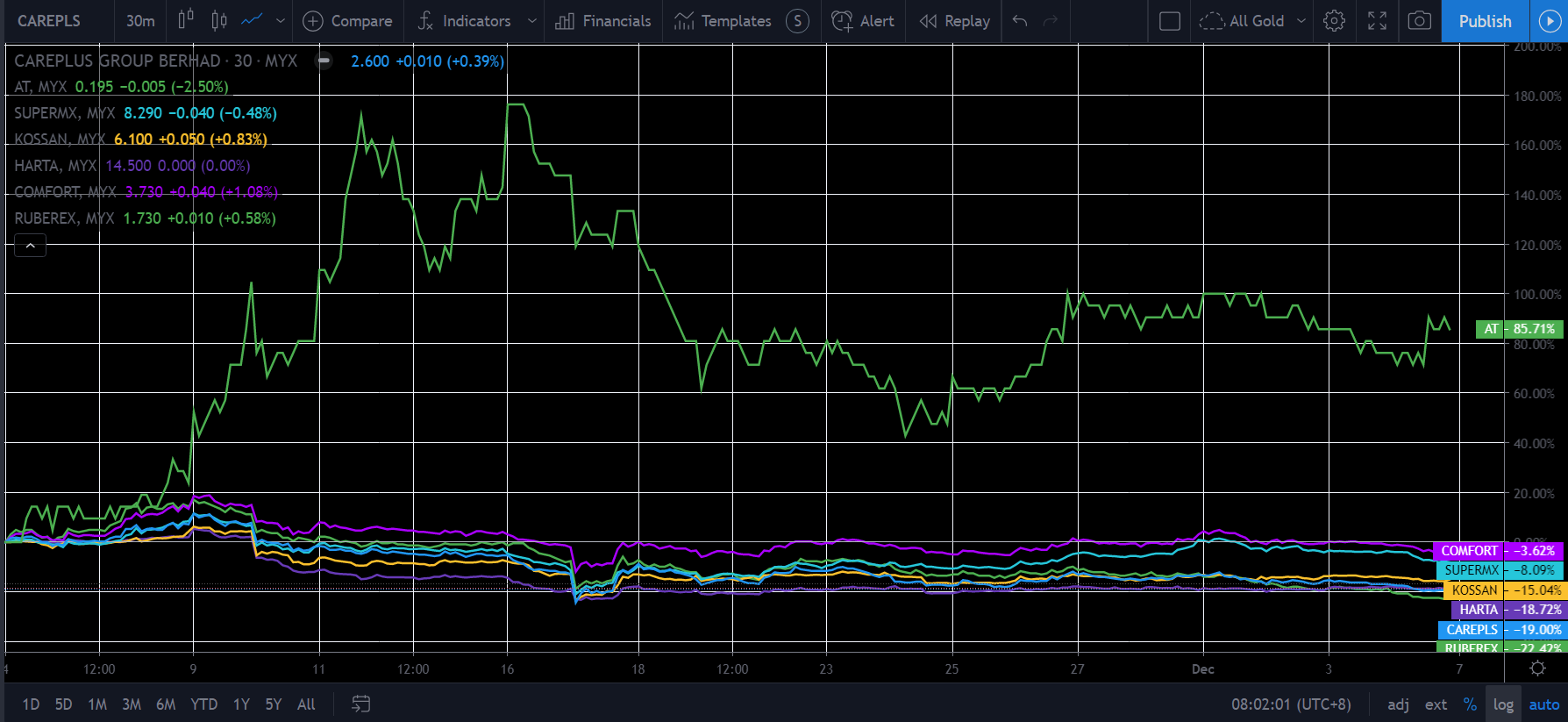

1. The above chart presented comparison between ATS (0072) with all glove counters for the last 30 days. ATS standout from the rest of the glove counters with a gain of 85.71% while the rest have actually fallen negative over the same period of time. ATS outstanding gain remained extra-originally higher than the rest despite falling off it's peak in mid Nov.

Source file link - https://drive.google.com/file/d/1PEt5D7S-4KrJd4JfgvopIui8oMdwYSP_/view?usp=sharing . Credit to Shariwu.

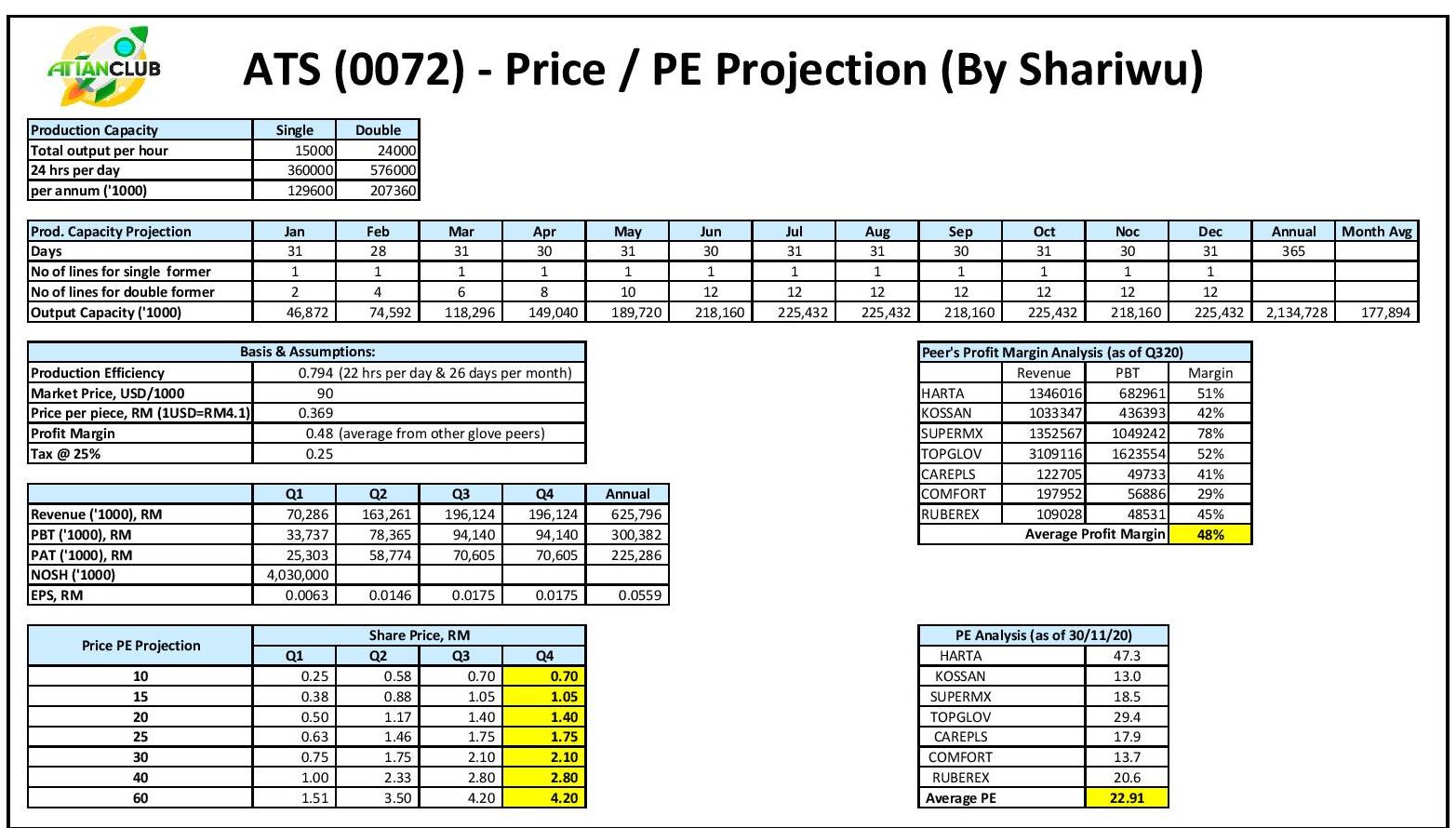

2. The most compherensive Price / PE projection that computed on it's monthly production capacity basis, average profit margin and PE projection from peer. At PE 20, ATS's price could reach between RM0.50 in Q121 and RM1.40 by Q221 when full production line running. From it's current price as on 30/11 at RM0.20, this will return a 150% by Q121 and 700% by Q221.

The projection is base on production capacity projection but in actual reality, market sentiment is always ahead of reality. Carepls PE peaked at 65X in Aug 20 before fallen to it's current level of 17X . IF ATS could replicate such performance, it's potential return could reach RM4.60, a whopping 2,200% ROI.

3. Successful Full Dip Run & CE Marking Approval.

The line is tested full dip run successfully on 26 Dec 2020 and obtained CE Marking approval to export to Europe countries.

Everyone has a freedom of choice, one could choose to

Option 1 - Early entry at low to maximise return

Option 2 - Wait till production commencement to chase high.

Option 3 - Stay aside and miss out extra-ordinary high ROI.

This is probably the last opportunity to ride on the glove wave in the once in a century pandemic.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

Telegram Group - ATIAN Club Enrolment - https://forms.gle/eL43VzhLq8qeESx36

To get the latest updates, facts and constructive discussion for ATS (0072)

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

Disclosure / Disclaimer :

The author hold shares and interest in ATS and related stocks, thus readers are advised to perform their own due diligence and research before making any decision. This is NOT a recommendation to buy / hold / sell nor providing a financial advice / consultancy. Any information shared is purely for educational purposes only. Past performance is not indicative of future result and share trading is speculative in nature. All readers are strictly on Trade At Your Own Risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Gloves Century Rally

Discussions

Everyday promoting AT means something very wrong with this company...BEWARE of lohchin !

2020-12-28 21:12

Believe me this AT going to the drain soon. Look at the glove stocks all heading south for more than one week already. Glove businesses going to get burst soon.

2020-12-28 21:18

If really over supply, then wouldn't it be so much cheaper to try AT than paying high price for others highly over priced glove counters ? Since all of them will be affected. AT has not much room to drop and it has others biz beside glove

2020-12-29 12:40

eh i 90% speculators in I3 already say glove over but here trying to promote AT glove ? mana logic ?

Better buy TG, if lets say glove already over AT will need to cover the overhead cost for preparing a kilang for nothing

2020-12-29 19:45

EKOVEST 3 MONTH AGO 0.52 NOW 0.53 CAN BUY? I CANT FIND ANY CHEAP STOCK NOW. PLEASE GUIDE ME.

2020-12-30 10:52

If someone goes to buy ATS after reading this article, then should be very innocent person.

2020-12-30 14:33

Hey, you miss out one option

Option 1 - Early entry at low to maximise return

Option 2 - Wait till production commencement to chase high.

Option 3 - Stay aside and miss out extra-ordinary high ROI.

Option 4 - Stay aside and no need cut loss later

2020-12-30 16:06

The title misleading.If bought from low at after March 15 2020.But buy from after the middle.It wont up tht much.Some-more there market cap.

2020-12-30 22:53

i wonder how many people is laughing hard then they read this post

2021-01-11 15:14

jonsuk67

So basically, buy the price now and wait up to a year to achieve the maximum result.

2020-12-28 10:19