ATS (0072) - ATG Kamunting Facts Check

Stockiss

Publish date: Sun, 17 Jan 2021, 08:47 PM

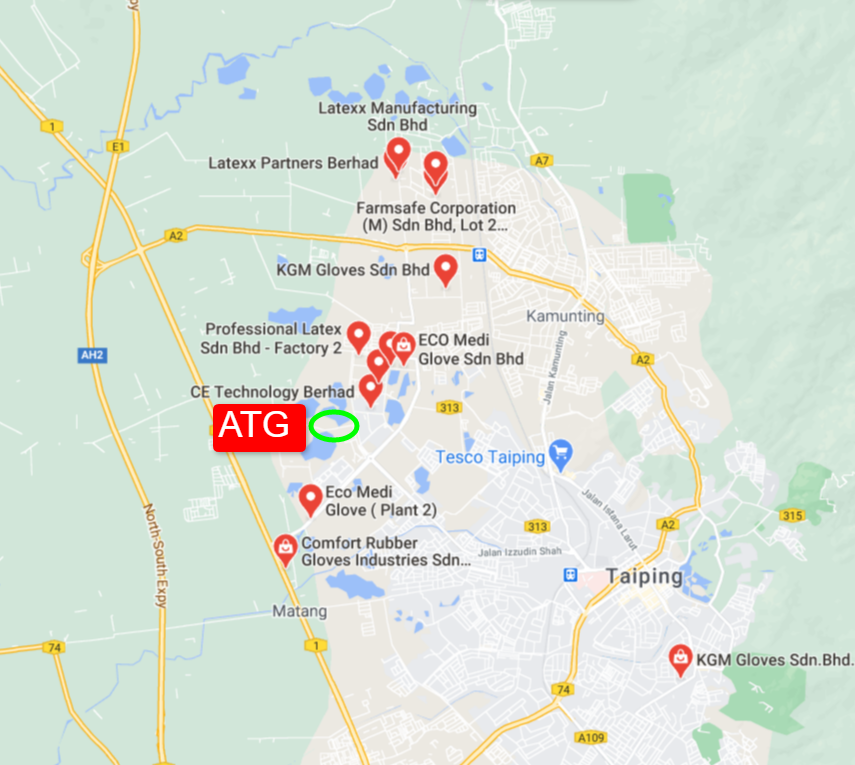

1. ATG Kamunting location displayed along with other glove factories nearby. The primary reason that ATG chosen Kamunting because it is well known as the Glove Valley in Perak.

The advantage is that it has large poll of experience and skilled local workforce nearby and it is more affordable than in Ipoh as Kamunting is a smaller town with lower living standard.

Here is the video taken on the ATG Kamunting land (credit to Syed Luqman)

2. Those who missed buying in time at low caught with their pants down and now trying to create fear to gain better entry price. Also for those who lazy to read, I summarised several points for everyone to ponder. All facts are abstracted from https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=110774&name=EA_GA_ATTACHMENTS

i. Using last PP to fund

Each PP proposed has it's purpose and usage clearly listed and if the fund raised used for other purposes, it is VIOLATING Bursa rules. It must seek share holder approval and announced thru Bursa for change of fund usage purpose. So, RM190k was paid with a balance RM1.91mil to be paid upon signing SPA for a purchase value of RM8.4mil.

An earnest deposit sum of Ringgit Malaysia One Hundred and Ninety Thousand

(RM190,000.00) only (“Earnest Deposit”) was paid to Vendor pursuant to the

letter of offer dated 29 December 2020. The deposit sum of Ringgit Malaysia One

Million Nine Hundred and Ten Thousand (RM1,910,000.00) only (“Balance

Deposit Sum”) shall be paid to the Vendor’s solicitors as stakeholder upon the

signing of the Agreement as security for the due performance by the Purchaser

of the payment of the difference between the Purchase Price and the Deposit

Sum (“Balance Purchase Price”). Upon the Purchaser paying the Balance

Purchase Price amounting to Ringgit Malaysia Eight Million and Four Hundred

Thousand (RM8,400,000.00) only in accordance with the terms of the

Agreement, the Deposit Sum shall be credited towards payment of the Purchase

Price.

ii. Diverting Fund to Cash Out

If a company cashing out, the last thing to do is to use it's CASH FUND to buy a fixed asset by CASH. Company is a separate and independent entity from the Directors, much so with Listed Company where it's account is audited by major audit firm and accountable to SC for public interest. So, those haters who claimed it is to divert the fund raised thru PP to cash out is really brainless and those who influenced by such brainless claim could only blame themselves for not using their brain.

iii. Next PP to fund

It is clearly stated that the funding could be a combination of options to be decided at later stage. It is currently UNKNOWN when the land acquisition and land title transfer will be completed, when the plant building will start and how soon it could be completed, how much time needed to build and install the 60 lines but yet many jump in to put cart ahead of the horse by speculating the source of funding.

If PP is the source of funding, it has it's due process to adhere and would be officially announced thru Bursa, nothing to speculate on.

SOURCE OF FUNDING

The Purchase Consideration is expected to be financed through a combination of internally

generated funds of the Group, bank borrowings and/or proceeds from exercise of the

Company’s outstanding convertible securities (i.e. warrants 2020/2025 issued by the Company

and expiring on 17 May 2025 and employee share options granted). The exact funding mix will

be decided at a later stage after taking into consideration of the Group’s gearing level, interest

costs as well as internal cash requirements for the Group’s business operations

iv. Expanding 60 more lines

Some were even bashing on the need to expand to another 60 lines when the first plant of 13 lines yet to be fully operational. Anyone with business sense know this is a once in century opportunity to capitalise on global glove demand with ever-rising ASP. This is called forward planning for long term business.

The acute shortage of medical gloves supply are well known facts that is reported regularly over main stream media, just a quick search on google for past week news

- https://www.nst.com.my/business/2021/01/658136/kossans-gloves-orders-fully-taken-until-end-2021

- https://www.thestar.com.my/business/business-news/2021/01/13/hartalega-expects-glove-asps-to-rise-by-50-in-q3

- https://www.supplychaindive.com/news/nitrile-glove-supply-chain-procurement-MSC-Industrial/593145/

- https://www.theedgemarkets.com/article/malaysian-medical-glove-exports-face-more-delays-amid-shipping-container-shortage

- https://www.thestar.com.my/business/business-news/2021/01/14/stable-glove-demand-seen-post-pandemic

- https://ksusentinel.com/2021/01/15/disposable-gloves-market-2020-healthcare-industry-demand-for-disposable-gloves-to-stay-strong/

v. Investor's Concerns

IF those who are really concerned, could actually get a copy of the agreement for inspection below. The terms and conditions are laid out clearly in black and white, nothing to speculate on.

DOCUMENTS AVAILABLE FOR INSPECTION

A copy of the Agreement is available for inspection at the registered office of the Company

located at 35, 1st Floor, Jalan Kelisa Emas 1, Taman Kelisa Emas, 13700 Seberang Jaya,

Penang during normal business hours on Mondays to Fridays (except public holidays) for a

period of three (3) months from the date of this announcement.

Conclusion

As a diligent share investor, everyone should spend their time to research and analyse to make an informed judgment. Short-term trader may make a quick buck but will not always gain on each of his trade but a long term investors surely gain much more if made a low entry and persisted for long term growth along with the company.

This is NOT a miracle story but a real life experience of an Engineer who made millions from his investment in Tesla

https://www.330ramp.com/blog/2021/1/11/the-tesla-multimillionaire-who-refuses-to-cash-his-lottery-ticket

"I currently own 14,850 Tesla shares with a cost basis of $58 per share. My initial was 2,500 shares at $7.50 per share in March of 2013. This initial purchase cost me $19,000 and is currently worth about $2.2 million."

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

Telegram Group - ATIAN Club Enrolment - https://forms.gle/eL43VzhLq8qeESx36

To get the latest updates, facts and constructive discussion for ATS (0072)

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

Disclosure / Disclaimer :

The author hold shares and interest in ATS and related stocks, thus readers are advised to perform their own due diligence and research before making any decision. This is NOT a recommendation to buy / hold / sell nor providing a financial advice / consultancy. Any information shared is purely for educational purposes only. Past performance is not indicative of future result and share trading is speculative in nature. All readers are strictly on Trade At Your Own Risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

usedor1

Everyday sing song about AT also no use la. If the company is really that good everyone will automatically buy, no need you ATians to sing song everyday

2021-01-18 15:06