ESCERAM: Beneficiary of the glove boom

HL Research

Publish date: Mon, 20 Jul 2020, 08:44 AM

After a few years of poor returns for the KLCI, Malaysian investors are now seeing an unprecedented once-in-a-lifetime opportunity with the glove boom. Our investors at a glance:

- Experienced retail investors would have already taken advantage to make back their 2018-2019 losses and shift their funds away from growth-stagnant "value" stocks.

- Day trader uncles enjoying the volatility - 10%-20% swings almost on a weekly basis.

- Fund managers and investment banks finally buying in into glove companies despite lofty valuations, entering late and influenced by FOMO.

- Fish sellers, chicken rice sellers, college students, etc. are opening brokerage accounts as we speak to buy in.

There is a wise saying by a guy named David Tong / WealthArchitectToU, "Don't chase high ah." I am inclined to agree.

Nevertheless there looks to be a major opportunity in ES Ceramics Technology (KLSE: ESCERAM (0100) ), based on the fact that it's current price level is undemanding relative to the glove boom beneficiaries.

It follows an almost similar price trend to the big glove players although not a glove manufacturer itself.

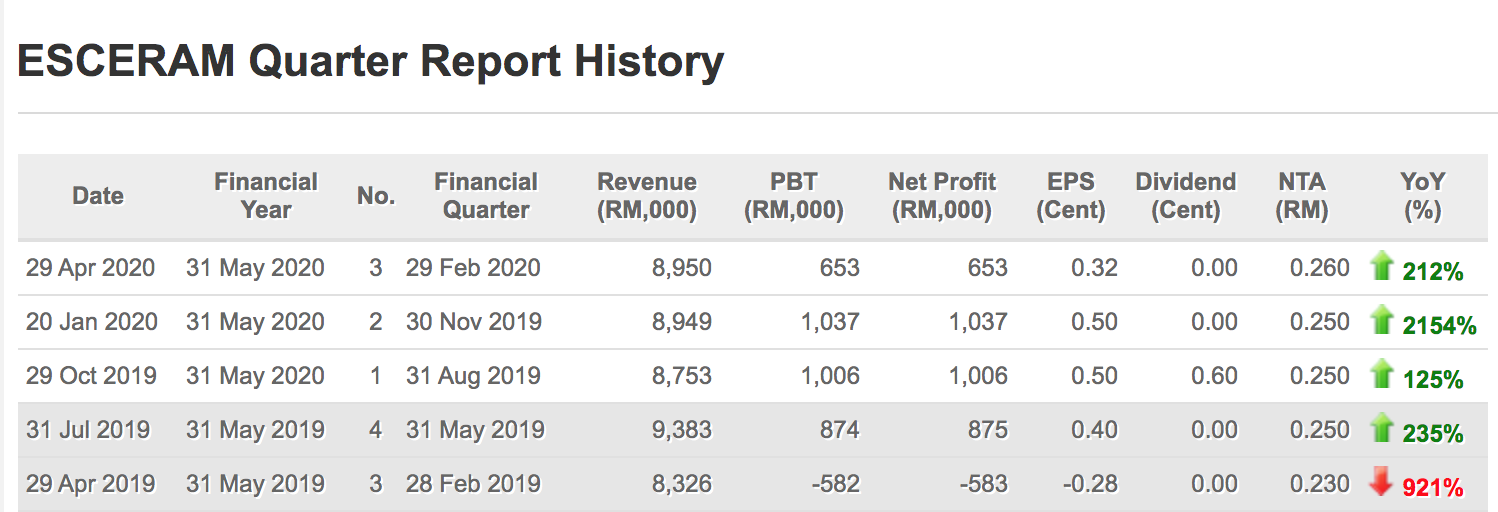

And most importantly, SHOWS CONSECUTIVE PROFIT GROWTH and FUTURE GROWTH POTENTIAL.

(These are two key factors in an upward price trend, especially in the KLCI).

Some background:

You can read up all about their business on their corporate website and on i3investor. To summarize, their main business is in manufacturing glove formers for the glove industry.

https://www.esceramics.com.my/

When do glove companies need glove formers? Well, when they embark on an expansion of course.

Valuation

I would not get too caught up in the numbers, although it is pertinent to verify its fundamentals.

- They have no debt

- Relatively cash rich at ~RM20mil

- PE of 30 (very good for a company primed for growth)

- Profit margin between 7%-11%

Right, let's move on to the growth story.

A brief history of H1N1:

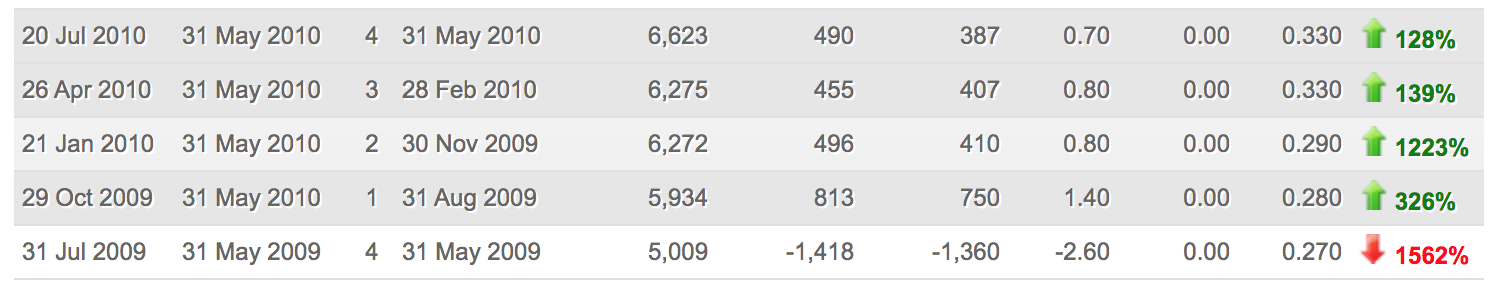

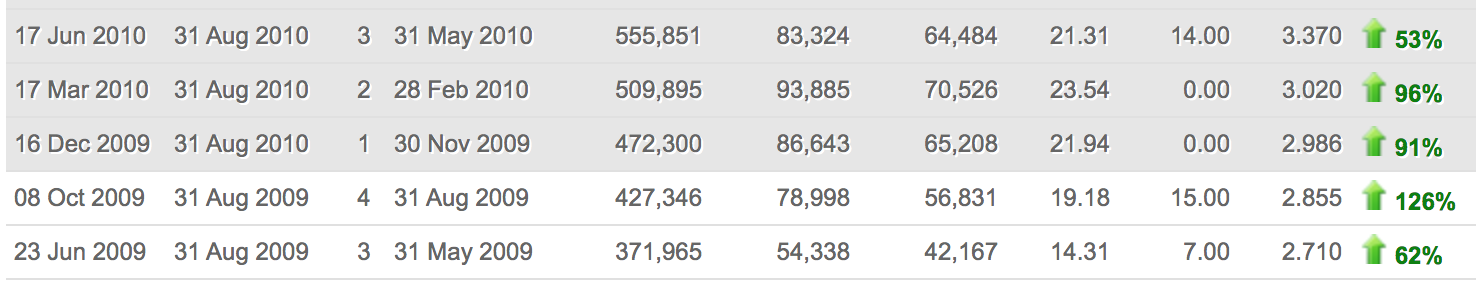

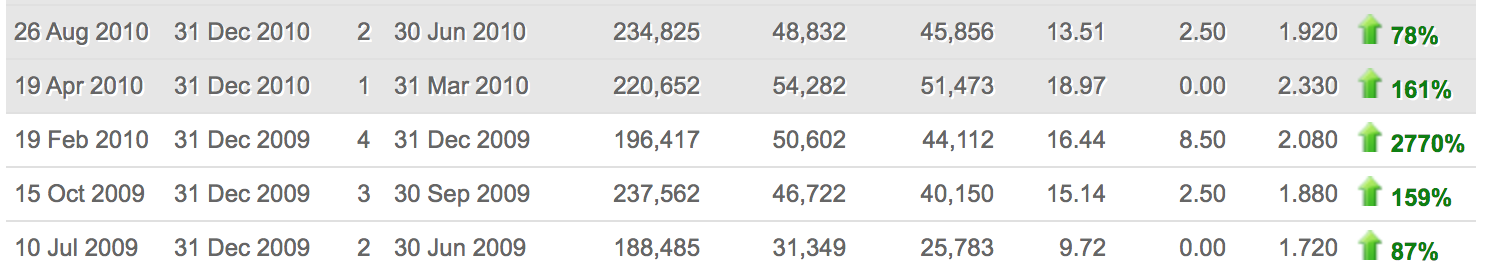

During the H1N1 Swine flu pandemic, ESCERAM experienced 4 consecutive quarters of stable profit growth from Apr 2009 - Apr 2010. This period of revenue and profit growth for the company correlated with that of TOP GLOVE and SUPERMAX.

ESCERAM:

TOPGLOVE:

SUPERMAX:

The correlation above is very promising. We are talking about a once-in-a-lifetime opportunity not only for glove makers, but also for ancillary companies who have a stake in the game like ESCERAM.

Where is the growth?

We know that all the major glove companies in Malaysia, Top Glove, Supermax and Comfort Gloves, are embarking on production lines expansion in order to meet the worldwide demand. ESCERAM is perfectly positioned to take advantage of this opportunity.

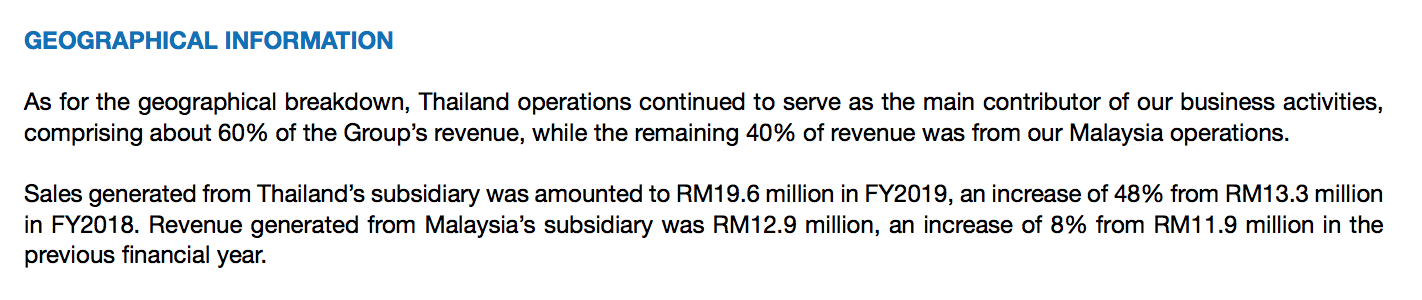

Nevertheless what really interests me is its business in Thailand, where it comprises 60% of the groups revenue, and had achieved 48% growth in FY2019. While Malaysians are gloating "Malaysia Boleh" because of their supposed moat in the glove industry, in reality Thailand also is a major producer and is the world's largest rubber producer, hence they enjoy the low manufacturing costs as well.

Below is an extract from ESCERAM's 2019 annual report:

The Thai business has essentially fueled 4 quarters of consecutive revenue and profit growth. Malaysia biz is good, but the Thai biz has been a game changer.

Verdict:

At 54 sen, it still has plenty of legs to run considering the exponential growth it is about to undergo. The industry is going through an unprecedented phase; how well ESCERAM does entirely depends on whether their management can make the right moves in an almost perfect setting.

FYI: 4Q2020 report is projected to be released in the last week of July.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HL Research

Discussions

This article is v true . Gloves counters has all gone up a lot .

Esceram still not really up a lot .

I guess anything below 70 still can consider

2020-07-20 21:07

wehcant

The timing of this article is quite revealing.

2020-07-20 14:43