With the promise seen in ES Ceramics Technology (KLSE: ESCERAM (0100) ) as highlighted in our initial analysis, we found it necessary to dive deeper into the unknown to ensure that we are not flushing funds into a dud stock. Therefore it is important to:

-

find out what we don’t know in order to derive logical assumptions.

-

be objective in order to make sound investment decisions.

A half-hearted but necessary Technical Analysis

One of the first things that piqued our interest in ESCERAM was the steady increase in trading volume from late April, leading to the massive spike on June 1st, coincidentally just right after the 4Q2020 book closure ending 31st May. During this time it hit a 5-year high of 0.735, with 137 mil shares trading hands.

It may very well be speculative price movement, but the trading pattern strongly indicates accumulation from insiders throughout the 4Q accounting period, between the price range of RM0.35 - RM0.50. The brief breakout on 1st June led to high trading volatility, followed by the distribution phase as short-term traders exited.

Since then it has been stuck in a congestion box between RM0.45 - RM0.55. This is the period when the IBs attempt to flush out weak / disinterested traders, by boring them to death with the lack of activity and upward price movement.

Anyway, I will avoid diving further into the TA, as the FA and human behavior aspects are of greater interest to us. The above is just to point out very familiar devious strategies from fund managers and IBs to influence share prices in the Malaysian market.

We do not doubt that ESCERAM has garnered their attention. I mention again, 137 million shares trading hands in one day.

It wasn't always rosy…

A decade ago, ESCERAM had its fair share of profitability and cash issues. In fact, 4Q2011 was one of the worst quarters for them. During this time, they suffered a RM6.45 mil loss, due to provision for diminishing value of subordinated bond investment of approximately RM1.5mil, provision for slow moving inventory (RM2.8mil), plus several other write-offs. (the provision for slow moving inventory is likely due to excess production from H1N1 in 2010)

Nevertheless, we are talking about a decade ago, and everybody now knows that ESCERAM's management has since straightened out their business model and books. A cash-rich ACE market share is quite rare, but we’re more interested in the profit growth anyway.

Competitors

We conducted an investigation of other glove former producing companies in Malaysia:

CeramTec

Gateway Industrial Corporation

Gotaj Ceramics

Mediceram

Shinko Ceramics

FormTech

Diving in, we see that most of them are negligible players, either lacking economies of scale, having a small customer base, or an absence of quality certifications.

Below are ESCERAM’s credentials:

(if you have a German’s seal of approval, you know you’ve got something special)

It is evidently a small industry in terms of competitors. CeramTec Malaysia and FormTech would be their closest competitors with their production levels, but ESCERAM by far has the largest production capacity in the country. In any case, all three companies will get plenty in their respective piece of a very large pie.

Note:

ESCERAM started in 1998, initially producing 240,000 formers annually.

In 2005, this number went up to 80,000 units per month.

Then in 2010, the Edge reported that ESCERAM was the biggest manufacturer of hand formers in the country, with a running capacity of 250,000 - 300,000 units per month, compared to Ceramtec’s 150,000 units.

As of 2018, ESCERAM was producing at least 400,000 units per month.

We do not know what is Ceramtec’s running capacity now. However, it is unlikely that they have surpassed ESCERAM - an unknown to be verified with their management.

MCO

The question on most people's minds when awaiting the quarterly results of companies during the previous reporting period: were their businesses impacted by the MCO restrictions? We also have to ask this question with respect to ESCERAM, even if any potential impact is only short-term and does not affect their once-in-a-lifetime windfall opportunity.

We cannot rule out that ESCERAM’s business was impacted by the movement control order which began in March.

At the same time, we also cannot rule out that ESCERAM had applied for special permission to operate, seeing that they fulfill the criteria set in point 47 of MITI’s specification:

We foresee that their glove former production will struggle to play catch-up to the demand. This leads us to our study of demand.

Unprecedented demand of glove formers due to Covid19

One of the few concerns is that ES Ceramics may not be able to keep up with demand in present circumstances, even at 100% production capacity.

This is what they have to keep up with:

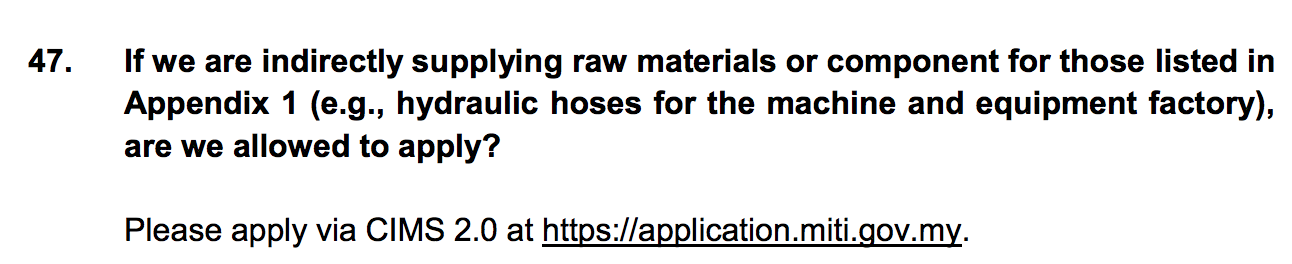

Not to be outdone, Sri Trang is ramping up capacity of an additional 3.4 bil gloves a year for the next 5 years:

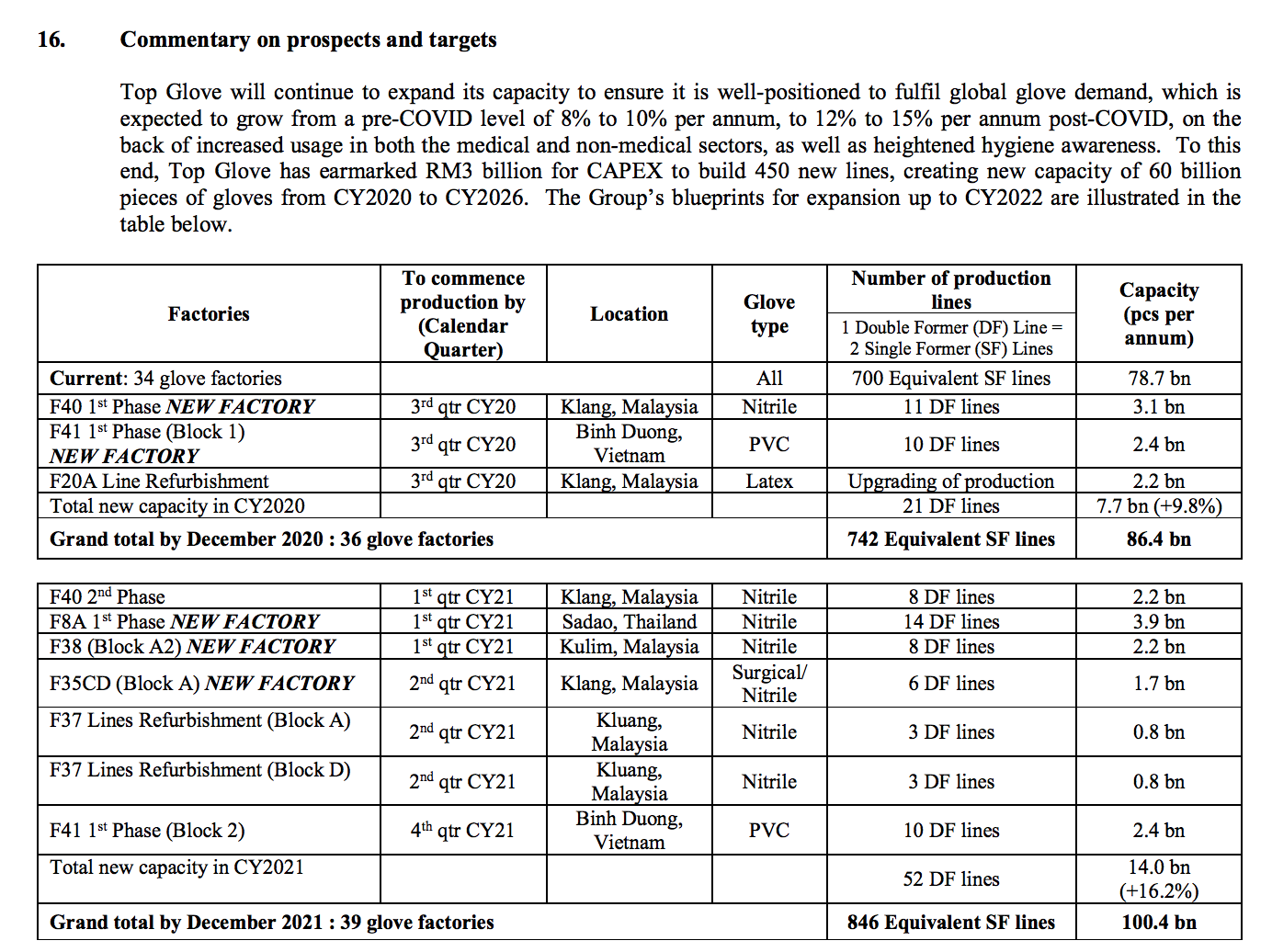

As mentioned before, we are seeing a very large piece of the pie for the glove former industry, based on the ramp-up of the global glove production capacity.

Revisiting Thailand Operations

I neglected to mention the other big glove player with a factory in Songkhla - Top Glove. Of course, this would trigger some speculation - but we are just stating the obvious. Top Glove's Thailand factory is located in Sadao, and the additional capacity to be added there is 3.9 bil by 2021.

A side point to note: what we do know is that ESCERAM’s major customer only constitute 10% of the group’s revenue. Meaning that ESCERAM likely has more than one customer in their Thailand operations.

What about Malaysia?

This statement alone by the CEO is enough to make me bullish about ESCERAM's Malaysian operations.

Target price

As the IPO price was 55 sen in 2005, we see anything below this as the perfect opportunity to accumulate. But of course, all this is meaningless to you and me unless a forecast TP can be reasoned out. It is always easy to make a buy call, the hardest part is determining when to sell.

We will make a modest assumption that the bottom line and EPS will gradually return to the same levels as FY2017. With its bumper year looming for FY2021, we expect the 2017 EPS to be easily achieved as a minimum.

Forecast FY2020 EPS: 1.82 sen

Forecast FY2021 EPS = 3.10 sen

Taking it's current PE of 30 which we find undemanding, we are looking at a target price per share of RM0.93.

This is of course a simplistic valuation, which we will revise once we receive guidance from ESCERAM's management in the upcoming 4Q result.

Risks to this forecast include:

- increase in raw material price

- increase in operating costs / delayed automation activities

- labour shortage

- absorption of market share from lesser competitors

sensonic

TCS Group Holding listing tomorrow. BUY OR NOT??

2020-07-22 23:28