Safe haven in REITs

11wenhao11

Publish date: Sun, 27 Nov 2022, 08:38 PM

In times of market volatility, real estate investment trusts (REITs) are considered a safe haven investment.

According to one of the Research, local REITs offer decent yields of at least 5%, while improving consumption trends with the reopening of the economy will see a higher number of people entering malls.

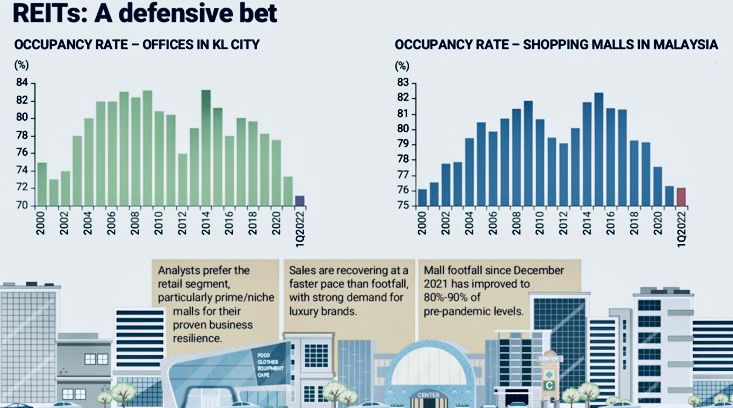

“Shopping mall footfall since December 2021 has improved to 80% to 90% of pre-pandemic levels. Tenants’ sales are also recovering at a faster pace than footfall, with strong demand for luxury brands,” the research firm said in a REIT sector outlook as part of its second-half 2022 market strategy report.

Explaining why it was “overweight” on REITs, they also noted that the sector index had outperformed the FBM KLCI by 12.5% in the first half of 2022.

“In the short to medium term, REITs act as a defensive stronghold and should continue to outperform relative to the FBM KLCI, as market sentiment may turn bleak and defensive amid stagflation/recession concerns,” it said.

According to the research firm, Malaysian REITs still offered decent excess return potential over fixed income instruments.

However, one factor which may dampen the sector’s prospects is the rising interest rate environment. They can make acquisition costs of new assets more expensive if REITs are financing their expansion by borrowings.

This could lower distributable income, which, in turn, may lead to smaller dividend payouts and yields.

Despite this, we believes the impact from a rate hike “would be manageable as local REITs have healthy gearing levels”. Additionally, the potential earnings recovery could offset some of the negative impact.

Last week, Bank Negara raised the overnight policy rate (OPR) to 2.25%, which was the second interest rate hike this year. Analysts do not discount more OPR hikes by year-end.

The research firm believes the encouraging and improving quarterly results will keep the sector resilient, with earnings set to fully recover back to pre-pandemic levels in 2023.

“Office REITs offer higher stable yields, followed by retail REITs, which will be boosted by an earnings recovery, especially when international tourist arrivals go up,” it said.

However, it pointed out that about nine million and five million square feet of net lettable area (NLA) for retail and office spaces, respectively, would be completed in the next two years. Inflationary pressures could also dampen consumer sentiment.

“There is a risk that the recovery in tenant sales may not be sustainable, as cash aid and price ceilings on goods would eventually come to an end, diminishing consumers’ purchasing power,” it added.

Against this scenario, the reseacher said it remained selective and preferred the retail segment, particularly prime/niche malls for their proven business resilience. Its picks in the sector are Sunway-REIT, Sentral-REIT and IGB-REIT.

Likewise, analyst expects the strong recovery pace in the retail segment to continue despite the risk of the inflationary environment lowering consumers’ purchasing power.

It said retail sales in the first quarter of this year (1Q22) grew 18.3% year-on-year, as shopper traffic returned to major shopping malls.

“Encouragingly, the stronger sales were recorded despite Covid-19 cases peaking above 30,000 per day in early-March, and hence, the surge in footfall reflected the strong pent-up demand, as well as relaxing restrictions, and the successful vaccine program in the country,” the research firm said in a June 28 report.

They are also cautious on the downward pressure for offices coming from a change in working arrangements and a supply glut. On the other hand, it observed that more players were coming in the industrial segment.

“Both Capitaland Malaysia Trust and Sunway-REIT have announced acquisitions of industrial properties as part of their plans to have a higher of proportion of industrial assets in their portfolio.

“We think opportunities in the segment remain strong, as reflected by Axis-REIT’s growing acquisition target this year,” the research firm said, noting that REITs had started 1Q22 on a stronger-than-expected recovery following the reopening of the economy.

speakup

Best REIT : Alaqar

2022-11-28 16:20