Ifuturebest

Can You Capture This Rare Arbitrage Opportunity on Bursa?

AssetArtisan

Publish date: Fri, 23 Feb 2024, 01:47 PM

“Are there still any investment opportunities left in Malaysia?”

“…Why not?”

That was the gist of a conversation with a friend of mine from a multinational company, where we looked deeper into the investment landscape in Malaysia. The surprising bit was the underestimation, and the lack of confidence in our local market.

The truth is, Bursa Malaysia isn’t the simplest playground for investors, but with the right moves, there’s good money to be made.

Let me give you an example:

Techbase Industries Berhad, formerly known as Prolexus Berhad, is in the midst of executing a rights issue to raise funds. This company, is relatively well known within the investment community with their integrated business model of both textile and apparel, with exposure to North America, Europe Asia and emerging markets. Some of the clients for the company include Nike, Converse, Under Armour, Disney as well as GAP.

And in the early days of 2024, Techbase has introduced a plan for rights issue, offering 5 ICULS for every shares investors own.

What does ICULS mean?

In short, ICULS stands for Irredeemable Convertible Unsecured Loan Stocks, it is basically a debt tool that allows investors to turn it into the company’s share.

But why jump on Techbase’s rights issue? The lure lies in the arbitrage opportunity .

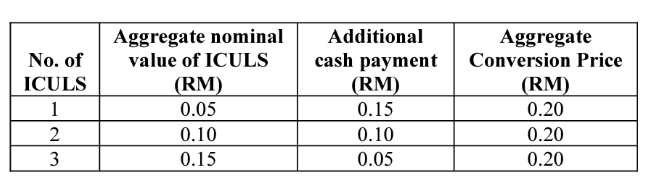

Based on the circular provided by Techbase, the ICULS’ indicative conversion price is RM0.200 (which was fixed later on). This would mean that the ICULS subscriber could either surrender 4 ICULS back to the company in exchange for 1 share Techbase Industries, or to pay the price difference depending on the units surrendered.

You may refer to the table below:

You see, ICULS right issue is unlike ordinary rights issuance. The most distinctive feature is, ICULS would not immediately dilute the shareholdings of the company, and hence would result in a much lower adjustment on Techbase Industries’ share price on ex-date.

“Does the company need to pay interest to ICULS holders?”

Well, yes. But at a very friendly rate of 0.10% per annum, which would definitely not strain the financials or balance sheet of Techbase.

Looking at the recent announcements made by Techbase, the conversion price is now pegged at RM0.200 and the post-rights issue share price (TERP) expected at RM0.2367, that’s a sweet 15.50% discount off the TERP.

Feeling lost?

Let’s break it down. Each ICULS costs RM0.05. Regardless of the conversion method, your capital outlay remains RM0.20 per share. If you flip those shares at the TERP of RM0.235 to RM0.240, you’re in for a profit. Even if the share price dips to RM0.220 post-TERP, you’re still pocketing at least a 10% gain. And remember, for every Techbase share, you get to buy 5 ICULS. That’s a potential 50% profit on a conservative TERP estimate!

IF Techbase’s share price happened to move to RM0.226 post-TERP, then the value of the ICULS itself effectively became RM0.110 (RM0.260 — RM0.150 subscription), which is double from the initial subscription price, representing a profit of more than 100% per ICULS … times 5!

ICULS is not a new instrument to the market. If we look at well-known companies such as Sunway Berhad, the company had a rights issue of Irredeemable Convertible Preference Shares (ICPS) in 2020 at RM1.000 per share. Since Sunway was very much favoured by investors, the ICPS of Sunway had already moved up to RM2.620, representing a substantial gain of 162% for investors.

Looking at another example, TWL Holdings Berhad, has undergone a rights issue with Redeemable Convertible Unsecured Loan Stocks (RCULS) with free warrants, on the basis of 10 RCULS and 2 free warrants on the basis of 10 existing TWL shares held. Today, TWL’s RCULS is worth RM0.030, where the subscription price is merely RM0.020 per share, representing a 50% upside, whereas the warrants of TWL is currently RM0.015, which is effectively a free profit for the investor.

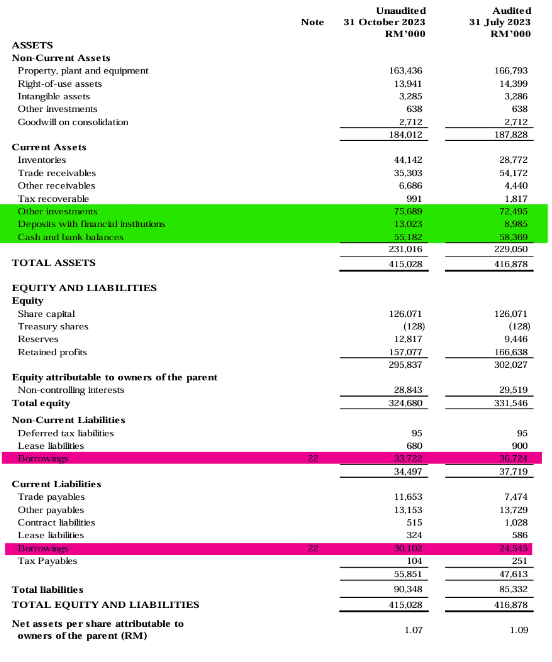

Fundamentally speaking, Techbase’s Net Tangible Asset (NTA) per share stands tall at RM1.070, making the current share price of RM0.270 look incredibly undervalued, especially after TERP adjustment.

As of now, Techbase boasts RM55.2 million in cash, RM13.0 million in bank deposits, and RM75.7 million in other liquid assets, against a debt of RM63.8 million.

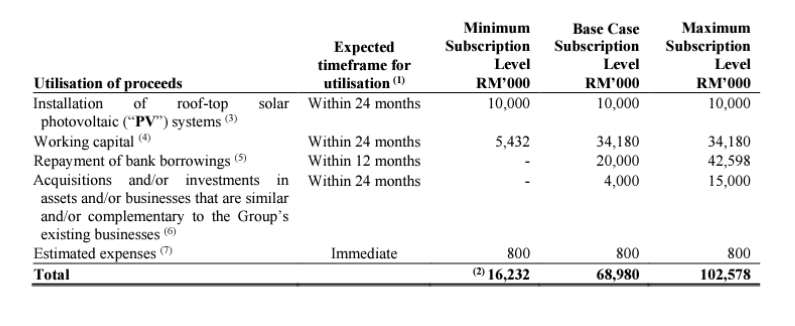

So, arbitrage aside, Techbase now presents a solid investment case based on its undervalued balance sheet alone. And with the rights issue, the company’s cash reserve is set to balloon by at least RM16.2 million from guaranteed subscribers, potentially hitting RM69.0 million if fully subscribed.

In a nutshell, while many overlook Malaysia’s market for investment opportunities, ventures like Techbase’s ICULS rights issue remind us to keep our eyes peeled for those rare arbitrage chances on Bursa Malaysia!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

star899

AssetArtisan,

Would you like to give some comments on NOTION VTEC as well ? Thank you.

2024-02-24 23:01