4 Key Insights You Should Know About Scicom Berhad (0099) Before Investing

normanyap

Publish date: Sun, 17 Dec 2017, 10:07 PM

Scicom Berhad (KLSE: 0099) is a Malaysian based company involved in Business Outsource Processing consists of Customer Lifecycle Management, e-Commerce Solution and e-Government Solution. They have a consulting-led approach to implementation and expertise with own intellectual property and enabled technology to make processes smarter, organisations and governments more efficient and ultimately the customer experiences better. The Group has been generating consistent and increasing net profit at CAGR of 25% since 2013 until 2017. However, Scicom share price has dropped significantly due to the released of quarter results. What went wrong?

Here are the 4 key insights you should know about this company:

#1 High Profitability & Healthy Financial Position

Keeping track on a company’s sales and net profit are important as it reflects the company profitability. In term of sales, Scicom has been performing very well since 2009 until 2017. More interestingly, their sales rocketed from RM160.1mil to RM199.5mil (CAGR of 8.3%) from 2013 to 2017. Same goes to net profit from RM 14.9mil to RM 45.4mil (CAGR of 25%) in 4 years. What drove this sudden surge? We will get back to this question as it links to CEO’s good capital allocation behaviour.

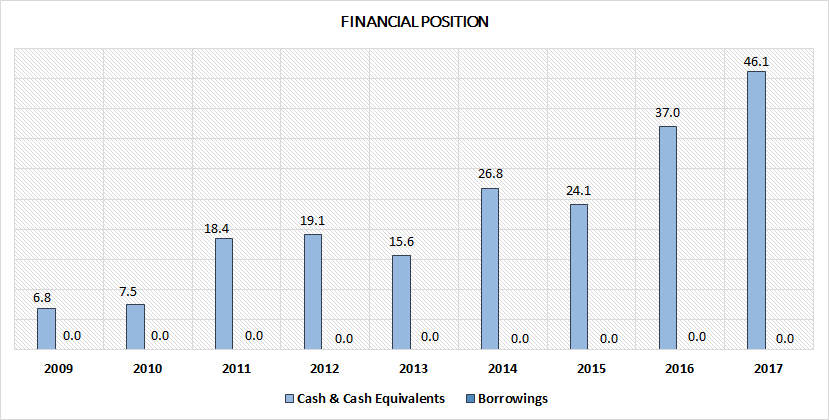

At a very quick glance, Scicom’s ROE grew from 18% to 43% from 2009 to 2017. Of course when a company’s ROE is high, we need to be cautious because the inflated ROE might be due to decreasing Shareholder’s Equity or high borrowings. After dissecting Scicom’s financial position, it seems that they have zero debt since their listing in Bursa and their cash has been increasing from RM 6.8mil to RM 46.1 million in 8 years. This also means Scicom capital structure is very straight forward which has no obligation to pay any form of interest.

Apart from reviewing Scicom’s profitability and financial health, we need to ensure whether this company is able to manage their working capital. Management of working capital involves managing inventories, account receivables and payables and cash. By referring to the chart above, Operating Cashflow (OCF) has been increasing since 2009 to 2017 from RM 9.1mil to RM 36.5mil. Generally in business services, the capital expenditure to maintain client’s current services is low. However, if there are any new development and deployment, the capital expenditure will have a sudden spike up.

The sudden drop in OCF in 2016 to 2017 is due to high changes in working capital for receivables and payables. In 2017, Scicom recorded RM 8.16mil receivables and paid out RM5.79mil in payables compared to 2016 where Scicom collected RM 1.14mil in receivables and delayed RM 0.39mil in payables. Hence, this explains why the OCF in 2017 has declined.

#2. CEO’s Clear Direction in Diversifying and Enhancing Earnings

Customer contact management has been Scicom’s core revenue since 2009 and it is vital for the Group to expand and extend their capabilities across different platforms to mitigate the risk from relying on one type of service. This is because any loss of contract in Scicom’s customer contact management segment will definitely impact the Group’s financial performance.

(Source: Scicom’s Annual Report 2014)

In FY 2014 annual report, Group CEO Leo has announced that Scicom plans to continue to drive growth while mitigating risk by diversifying their business services to education, e-government and e-commerce solutions. At the same time, Scicom has incurred “Marketing Expenses” amounted to RM 10.6mil which has never happened throughout their listing in Bursa Malaysia. How does the marketing expense incurred inflate Scicom’s earning and profit margins? This is picked from CEO’s statement.

“In FY2014, we initiated the marketing of our government service delivery model along with large scale vocational training projects in targeted emerging markets” – by CEO Leo Ariyanayakam

Even though Scicom has never revealed their customer base and does not share segmental revenue under ‘Customer Service’ division, it is clear that in 2014 Scicom has secured large government contracts which have fatter margins and sales.

By reading CEO’s statement above and financial results, it is clear that Leo knows how to divide his business resources and other sources of capital to different projects and initiatives to diversify and enhance Scicom’s earnings.

#3 MSC Malaysia Status by Malaysia Digital Economy Corporation (MDEC)

MSC Malaysia status is a recognition awarded to companies by Government of Malaysia through MDEC for ICT and ICT facilitated businesses. With MSC Malaysia status, the government grants additional incentives and privileges to qualified companies.

How do companies qualify for MSC status and how does the structure works? Certain conditions such as 30 Knowledge Workers in 5 years, 20% of income must be generated from export activities, 30% of investment within designated area located and RM 5 mil capital expenditure in 5 years (Source: https://mdec.my/faq/msc-malaysia).

These conditions have to be met before applying for MSC status and there are new KPI set by MDEC. MSC status is further split into four different categories and the conditions are as follows.

(Source: MDEC website)

Now what is Bill of Guarantees (BOG)? These are incentives from Government of Malaysia that reflects government’s intention to provide an environment that is conducive to the development of MSC Malaysia Status entities. (Comment: Don’t really understand this part, MSC Status only for IT company right? Correct me if I’m wrong)

As for Scicom Berhad, they were granted MSC status since 2002 and renewable in every 5 years. Since 2002, Scicom managed to renew their MSC status on 2007 and 2012 where they enjoyed 100% tax exemption. However, MDEC has revised their KPI which puts Scicom under Tier 3 MSC status and can only enjoy 70% tax exemption for FY2015-2017. The reason Scicom is under Tier 3 is because their main business is located outside of Cybercity centre at Menara TA One, Jalan P.Ramlee Kuala Lumpur. In other words, they are unable to relocate their business centres to MSC Cybercity or commercial building within the boundary of MSC Cybercity.

(Directory for Cybercities https://mdec.my/directory/cybercities-cybercentres/wilayah-persekutuan)

(Criteria for Cybercities https://mdec.my/msc-malaysia/msc-status-qualifying-criteria)

Scicom share price has decline significantly from RM 2.32 in June 2017 to RM 1.63 in December 2017 (30% drop). This is because Scicom has not received any confirmation from MDEC to renew their MSC status and investors are sceptical that Scicom will be able to renew their MSC status. Before that, we should look at how Scicom renewed their MSC status and how long does it take for MDEC to give confirmation.

After digging through the quarterly reports, I found that on 5th Nov 2012 (released date of FY2013 Q1 report), Scicom has submitted their renewal application in full. But the official confirmation from MDEC arrived only at 29th Aug 2013 (released date of FY2013 Q4 report). This suggest that it takes about 10 months for Scicom to renew their MSC status. Even though the Client Charter states that MDEC requires 30 days to review and seek approval, sometimes MDEC requires more time to review and give approvals.

Today, Scicom achievement of the MSC condition and KPIs has been presented to MDEC as reported on 25th August 2017 in their Q4 quarterly reports. But the assessment from MDEC has not been completed as of 13th November 2017. Since it takes about 10 months to obtain approval and confirmation as per 2012 application, the late assessment by MDEC should not be viewed as major hiccups faced by the company.

#4. Generous Dividend Payout Ratio

Scicom has been declaring about 70% dividend payout ratio despite not having dividend payout policies. The decline in share price is mainly due to possibility that Scicom unable to renew their MSC status which will affect their net profit.

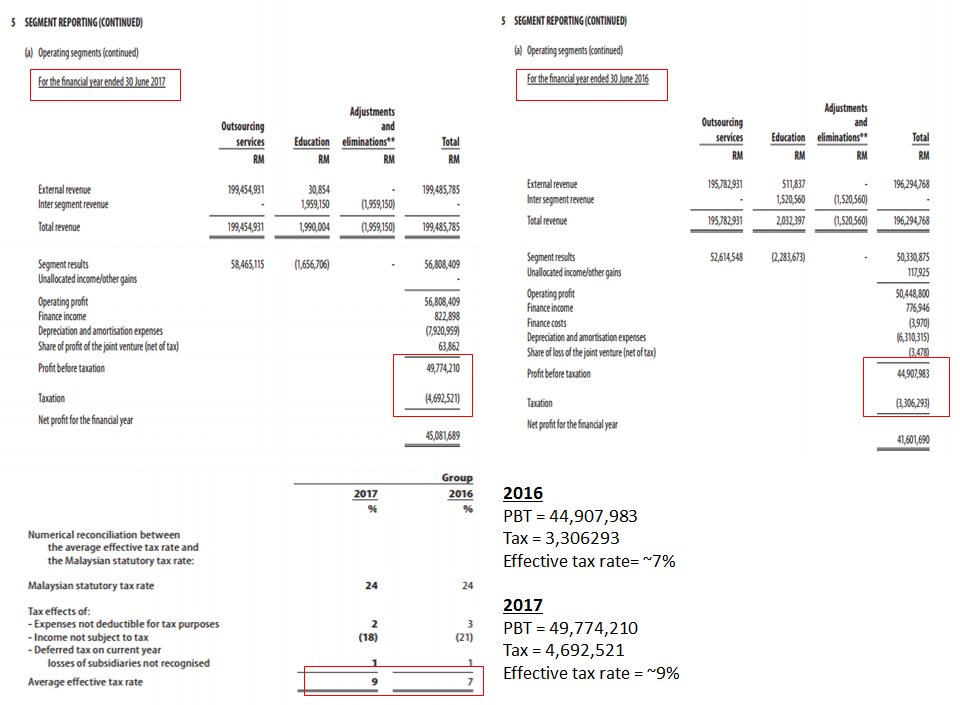

As shown below, the effective tax rate chargeable in FY 2016 and 2017 are 7% and 9%. In these annual reports, it clearly shows that the taxable amount is directly obtained from ‘Profit before Tax’. Based on the effective tax rate, Scicom’s dividend yield can be projected by referring to its current share price (at the time of writing this article, RM1.63).

(Source: Scicom Annual Report 2016 & 2017)

Conservative assumption (Effective Tax rate at 24% for FY2018)

- Assuming PBT grow at 10%, Effective Tax Rate = 24%, Payout ratio at 70% and share price 15th December 2017 at RM1.63, that gives us a Dividend Yield of 5.1%.

Aggressive assumption (Effective Tax rate at 9% for FY2018)

- Assuming PBT grows at 10%, Effective Tax Rate = 9%, Payout ratio at 70% and share price 15th December 2017 at RM 1.63, that gives us a Dividend Yield of 6.1%

In summary, if PBT grow at 10%, payout ratio remain at 70% and continue to enjoy 70% tax exemption, investors would be enjoying 5.1% or 6.1% dividend with the current share price of RM 1.63.

My Insights

Scicom definitely has their competitive edges by looking at their business model and how this company ride through difficult times and continue to enhance their earnings. Given the fact that their profitability is growing, strong financial health coupled with good cashflow movement, it is indeed every investor’s dream to ride along with this company. However, investors must be aware of future uncertainty such as bad economic environment which will Scicom’s Contact Centre, e-commerce, e-government business and inability to renew MSC status.

“When the herd believes something is risky, their willingness to sell usually reduces the price to the point where it contains very little risk” - Norman.Y

You may find other articles here (http://www.stocksinsights.com/)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Intelligent Contrarians

Created by normanyap | Nov 11, 2017

Discussions

Hi Jon,

Thank you for your time and appreciate your feedback. May I know why do you think so?

2017-12-18 21:43

The article help me to understand Scicom business position better.

Thanks.

2017-12-27 19:59

Hi HiddenDragon,

Appreciate your feedback for us to support this community. You can also subscribe in our website for more updated blogs.

www.stocksinsights.com

2017-12-29 13:41

Jon Choivo

I have never seen an article so long and so lacking in value.

2017-12-18 10:13