AXISREIT | 2 Key Insights That Will Change Your Perspectives

normanyap

Publish date: Tue, 03 Apr 2018, 10:25 PM

Overview

Axis Real Investment Trust (AXREIT) was listed since 3rd August 2005 on Bursa Malaysia. They are involved in office, logistics warehouse and industrial real estate investment trust. Their portfolio consists of properties in the Klang Valley, Penang, Johor and Kedah. Now, let’s view their progress in term of total net lettable (NLA), number of properties and Asset Under Management (AUM).

- AXREIT Financial Health Status

In my previous post, I’ve talked about IGB REIT and compared against peers under Retail REITs. For AXREIT, I will compare against ATRIUM REIT because they have the same business model involving logistic warehouse and offices.

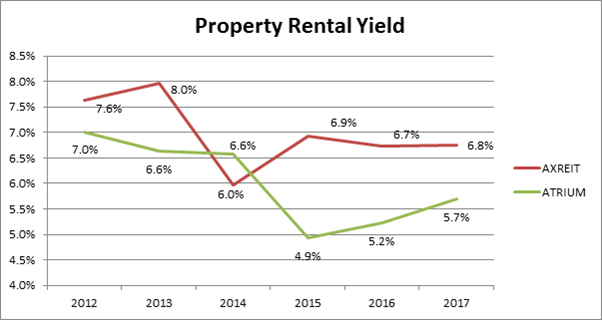

Firstly, the Property Rental Yield needs to be growing because it is their main source of income! AXREIT Rental Yield is by far more superior than ATRIUM REIT. This is due to strategic property location which enables AXREIT to generate higher net rental income. If your Rental yield is higher than your competitor, it simply means you are running the business smarter and more efficient.

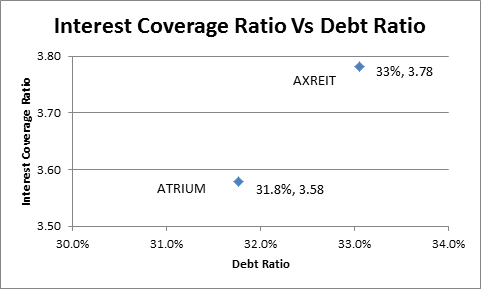

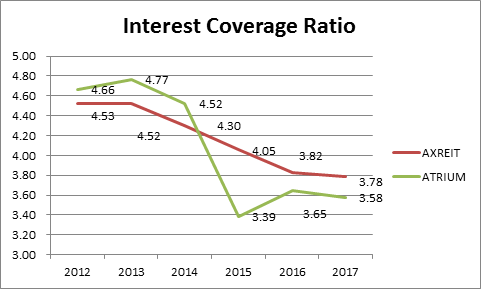

Secondly, we need to check whether AXREIT is over leveraging or are they able to pay their finance cost comfortably. The chart below refers to Interest Coverage Ratio Vs Debt Ratio. You may refer to my previous post about these metrices. So, the chart tells us that AXREIT has 33% of Debt Ratio (it tells how AXREIT’s total assets is funded by debt), while their Interest Coverage Ratio is at 3.78 higher than ATRIUM, 3.58. In other words, the operating cash flow generated by AXREIT is 3.78 times their debt expenses. The higher the better! Why it matters to investor?

Imagine you invest in a company where their Operating cash flow = RM 1 mil and your debt expense = RM 1 mil. Literally, your interest coverage ratio is at ratio 1. All the operating cash generated by you is used to pay all the debt expenses!

If this is the case, how will the company pay you dividend when all their cash generated are used to pay debt expenses?

For AXREIT Financial Health, I would say that AXREIT does not have major problem serving their debt and Property Rental Yield has not declined much for the past three years. The reason their Interest Coverage Ratio declines is because they are borrowing more to increase their AUM, in return generating higher net property income.

Will this be a major risk? It is not a major risk because AXREIT is still able to serve their finance cost and has been paying dividend consistently. To add on, the rise in interest rate by Bank Negara Malaysia (BNM) has little effect to AXREIT’s operating cash flow.

- What Is AXISREIT Intrinsic Value?

Before we deep dive into AXISREIT valuation, we need to identify the foreseeable property income due to aggressive expansion of Asset Under Management (AUM) by AXREIT and the consequences of raising funds through Private Placement.

They have recently completed Nestle Distribution Centre which is expecting to generate gross rental income of RM 19.22 million and estimated gross yield of about 7.6% per annum. Remember that we need to consider the operating expenses here to arrive at “Net Property Income”.

Since 2013 to 2017, the Net Property Income has been hovering around 86.5% to 87.0% against the Gross Rental Income. Hence, the expected net property income would be RM 19.22mil x 86.5% = RM 16.6 mil which is about 11.3% of 2017’s Net Property Income (RM 146 mil). This additional income will only be reflected starting of June 2018 according to AXREIT.

At the same time, the management team said it is aiming to achieve RM 292mil worth of industrial asset acquisition in 2018 due to logistics and manufacturing growth especially with the current growth of e-commerce space.

All seems to be very positive because the increase in Asset Under Management will eventually boost rental income. But have you ever wondered how did the management raise funds to pay for all these acquisitions and development (such as NestleDC)? This is where it gets interesting.

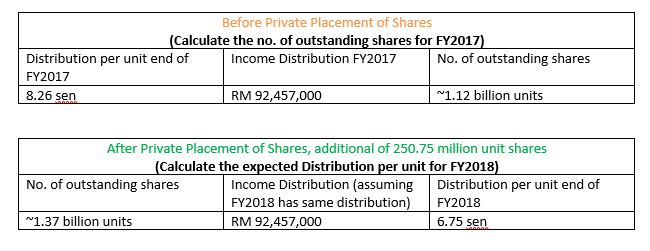

On 26th April 2017, AXREIT announced that Private Placement of shares will take place and 250.75 million new units will be issued representing 20% of fund size of 1.25 billion units. Raising funds via issuance of new shares will dilute shareholder’s earning because there will be more people wanting the same size of pie!

Are you saying the Private Placement will dilute our dividend payout in term of distribution per unit? Yes, if AXREIT continues to declare the same amount of dividend.

Always practice a more conservative approach and assume in FY 2018 AXREIT will declare the same amount of dividend payables at RM 92,668,000 (declared during FY 2017). As I’m writing this article, the share price of AXREIT is at RM 1.26. Here I will be showing you how I obtain the Intrinsic Value.

The two tables above show how Private Placement will dilute your DPU if your income distribution to shareholders remained the same. If we were being conservative on the Income Distribution for FY2018, what will be Dividend Yield in FY 2018 investors are expecting at current share price of RM 1.26?

Dividend Yield = RM 0.0675 / RM 1.26 = 5.35% yield.

As a bonus for all value investors, the average dividend yield for AXISREIT since 2014 until 2017 is 5.5%. So what is the intrinsic value of AXISREIT if we were to value it using dividend yield?

RM 0.0675 / Intrinsic Value = 5.5%

Intrinsic Value = RM 1.23 (Conservative)

“Continue to develop a contrarian mind set and it will bring you very far” – Norman Yap

DISCLAIMER: This is not a recommendation to purchase or sell the above mentioned stock but merely for educational purposes only.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Intelligent Contrarians

Created by normanyap | Dec 17, 2017

Created by normanyap | Nov 11, 2017

Discussions

Can u share ur view ? Because dividend yield is really high and what is the intrinsic value on M-Qreit

2018-04-08 17:32

tltsb5617

Norman , what do u think of insight view of MRCB-QREIT performance ? My email is teana6888@gmail.com, i found ur Axis Reit intrinstric value very informatic ,i purchase it before and fortunately never subscribe right issue

2018-04-08 17:30