Will ARB follow suit with AGESON rally? (My 2 cents)

jvjason5292

Publish date: Tue, 02 Aug 2022, 02:56 PM

Will ARB follow suit with AGESON rally? (My 2 cents)

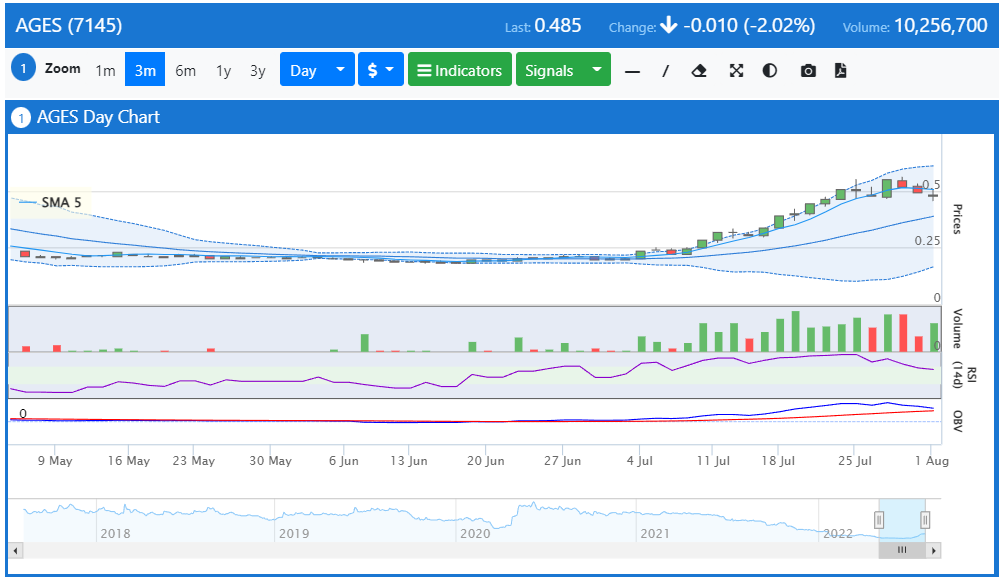

Against the headwinds of scepticism by investors, AGESON had shown us a marvellous gain in a very short period of a month, rallying from the lows of RM0.200 – RM0.205 range post consolidation to the height of RM0.550 few weeks ago.

We do not have the crystal ball to answer what had caused the rally, but this is most likely caused by a deep emergence of value when the company is trading at merely 3.54 times PER, even at the time of writing now, where some of its closest peers are trading at a minimum of 6 to 8 times PER.

My sincere commendation to the patient investors who waited out for the rally.

The next very important question that investors should ask – will ARB follow suit on AGESON’s rally?

Before answering the million-dollar question, there are a few pointers that investors should take note of.

1. Both companies had similar major shareholders

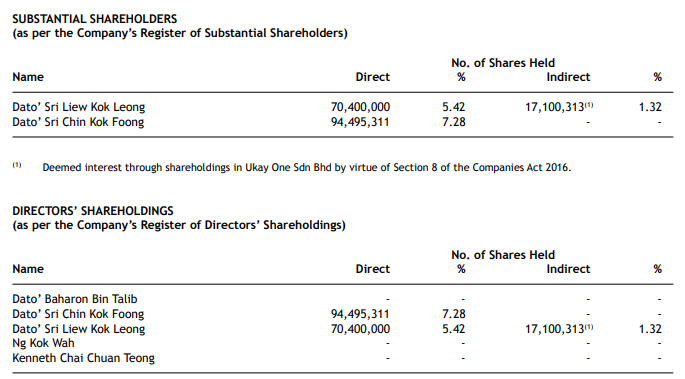

In the latest annual report by AGESON, we can clearly see that both Dato’ Sri Liew Kok Leong and Dato’ Sri Chin Kok Foong held substantial number of shares of the company. Not to mention they had also increased their shareholdings by undertaking the rights issue by the company in May 2022 as a vote of confidence for investors.

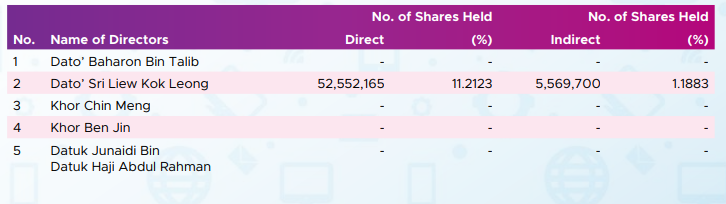

As for ARB, once again we can see the name of Dato’ Sri Liew Kok Leong emerges as the substantial shareholder for the company. In fact, I believe Dato’ Sri Chin Kok Foong also had vested interest in ARB through the investing arm of Ukay One Sdn Bhd. But we are not sure of that – what we are sure of is that both companies are well managed by these two successful entrepreneurs.

2. Deeply undervalued

One of the important, if not the most element of investment is valuation. If you work out correctly on your earnings forecast but messed up the valuation part, chances are you will end up in overpaying for a company.

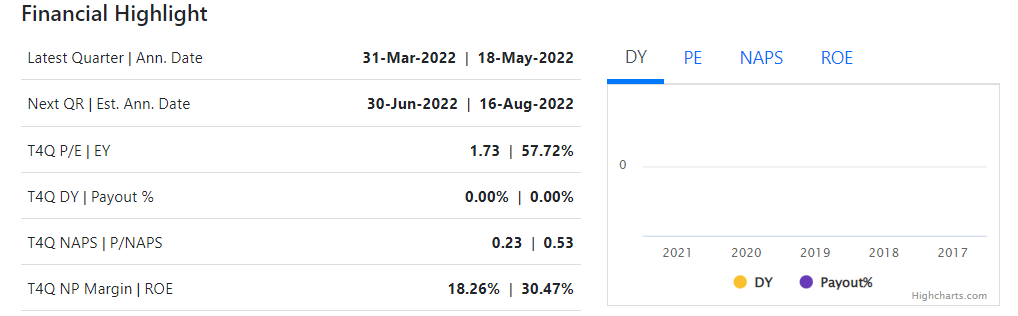

Prior to the rally of AGESON, the company is trading at approximately 1.50 times PER. This is largely in line with the valuation of ARB, which is only 1.73 times – not to mention the fact that the company is listed in main market under the technology board, software subsector.

Hence, it is very likely that we can see a similar value recoup action for ARB.

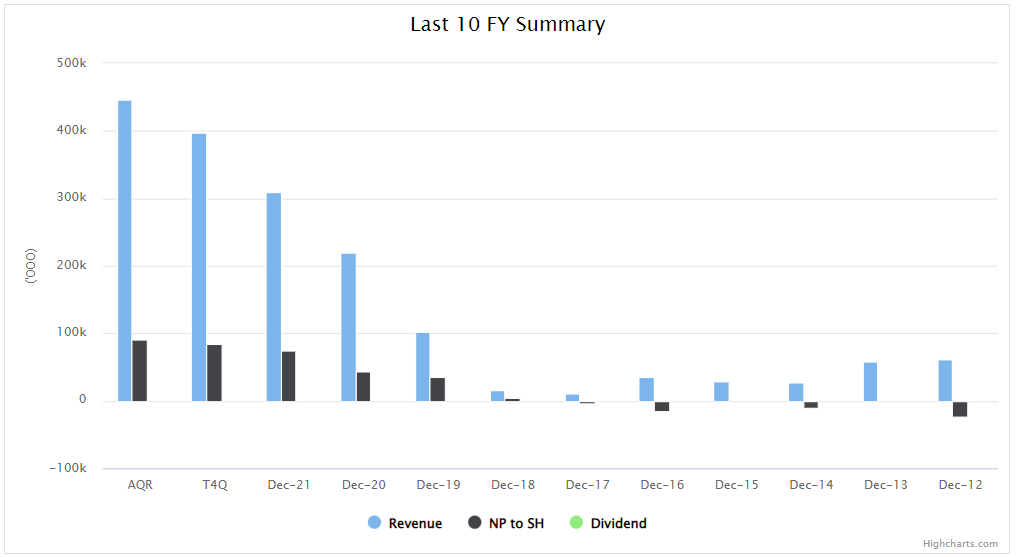

Notably, ARB had also been performing super well in their financials since the turnaround initiatives by Dato’ Sri Liew Kok Leong back in Q4FY19. Even with steep margin of safety, the company is still trading at a relatively very cheap valuation.

3. Consolidating share price

As per the price movement for AGESON, the company did consolidate for months before showing a stellar ROI to its investors, and I believe this is the same for ARB at current juncture, which represents a good buying opportunity for those who have not invested in the company yet.

I rest my case here.