What investors should know about FAST (KLSE: 0084) beyond rights issue

koxkox

Publish date: Wed, 17 Nov 2021, 01:25 AM

What investors should know about FAST (KLSE: 0084) beyond rights issue

Time and time again, investors would react negatively towards rights issue due to its cash calling nature. And being one of the fast (pun-intended) expanding company, FAST had suffered from the knee-jerk reaction from investors too.

Fortunately, 12.0 cents seem to be the very bottom of it, and we could easily observe that investors are still actively collecting FAST’s shares. I rarely would tell people that I found the next gem, but I found the next gem. This is it.

Let me point it out for you, on 3 key things that you should note about FAST.

Involvement in the semiconductor space

Let us take an excerpt from the introduction of the company from the website.

Fast Energy Holdings Berhad, an investment holding company, manufactures and distributes specialized fasteners and related precision turning and machining parts for the electronics, telecommunication, computer peripherals, and automotive industries. It also manufactures and trades in epoxy encapsulant materials for optoelectronics industries; mold cleaning rubber sheets; and electronic hardware products. In addition, the company offers training analytical and consultancy services; bunkering, oil bunkering, and vessel chartering services.

Although the company had changed its name, but the core profit generator is still the semiconductor business. We all know that semiconductor businesses would thrive in the coming years, due to increase in semiconductors in all kinds of equipment. Semiwiki had provided very good insights on some key semiconductor growth drivers.

Once the semiconductor supply catches up with demand, growth in 2022 will be dependent on the economy and the demand for end equipment. The International Monetary Fund (IMF) in July forecast global GDP will increase 6.0% in 2021 as the world recovers from the pandemic. The IMF expects the recovery momentum to carry into 2022 with 4.9% growth, up from the May forecast of 4.4%. Canalys expects the smartphone market to bounce back to a 12% gain in 2021 after a 7% decline in 2020 primarily due to pandemic related manufacturing disruptions. Canalys shows 2022 smartphone growth of 5%, higher than the growth rates in the four years prior to the pandemic. IDC has not updated its PC forecast since May, where it called for an 18% increase in 2021 and a 5% decline in 2022. In 2Q 2021 PC shipments showed a slowing of growth, but the year 2021 should still show a double-digit gain in PC units. IHS Markit projects light vehicle production will be 83 million units in 2021, up 11% from 2020. Vehicle production in 2021 has been limited by semiconductor shortages. 2022 light vehicles should be up a strong 9% as the industry catches up to pre-pandemic production levels.

Well, in short, FAST is poised for growth, and it is one of the cheapest price-to-sale semiconductor company in the whole market.

Expansion plan in petroleum related products

As we mentioned that the first half of FAST is made up from semiconductor segment, the rest of it was actually in petroleum products, commodities, and bunker oil.

Further, it trades in petroleum products and commodities, including bunker oil. The company operates in Malaysia, the United States, Europe, and Asia. The company was formerly known as Techfast Holdings Berhad and changed its name to Fast Energy Holdings Berhad in July 2021. Fast Energy Holdings Berhad was incorporated in 2004 and is headquartered in Shah Alam, Malaysia.

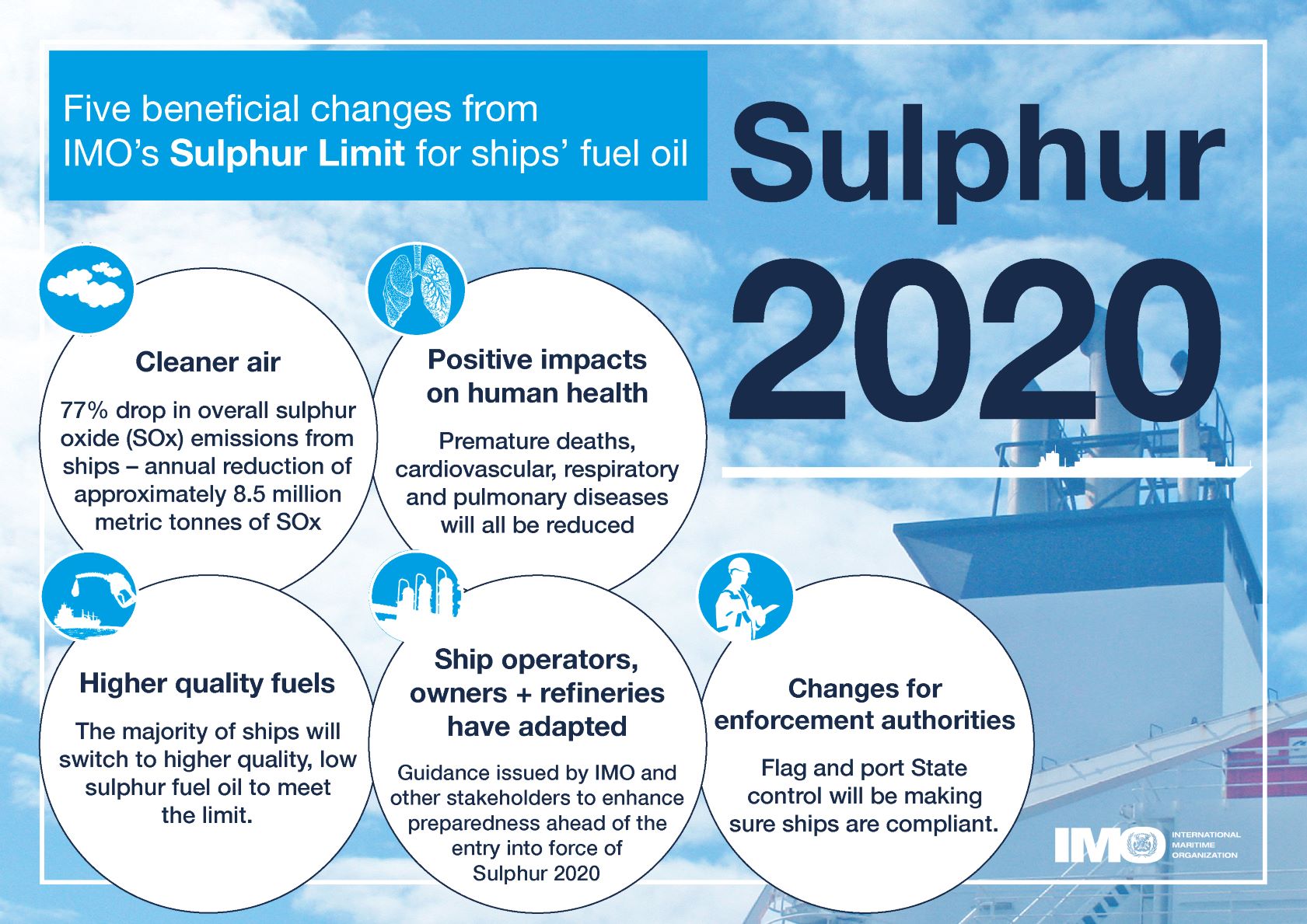

Some of you may have not know about it, but some of the bunker oil that ships, and vessels are using are actually “dirty oil”, or fuel with high sulphur content. Pursuant to the implementation of IMO 2020 and ESG drive, the market will be moving towards low sulphur fuel oil – which is what FAST had billions worth of contract on hand waiting to be utilized. In fact, FAST is only one of the two listed companies in Malaysia who was involved in the LSFO business.

Obviously, the market have not factor in the potential growth of FAST who is involved in the sector. But luckily for non-investors yet for the company, tomorrow will be the ex-date for rights issue, which is the next topic we are going to talk about.

Salient details of the rights issue

For investors who had held onto their shares pass tomorrow or 17th November 2021, in case you are reading this article from the future, you will be entitled to subscribe for 2 rights share with detachable warrants on the basis of 1 free warrant for 2 rights share subscribed, which means you will be rewarded for helping to fund the company.

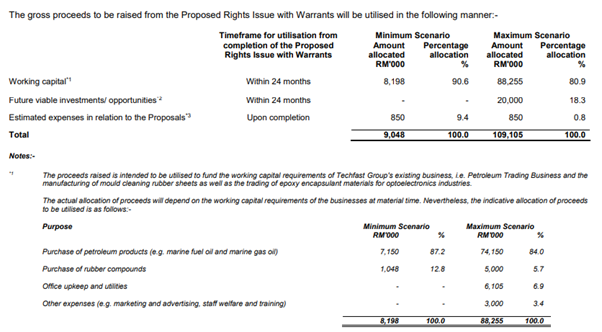

I understand that some investors are concerned on how the proceeds will be utilize, and as you can see here, majority of the fund will be channeled to purchase of petroleum products, which is marine fuel oil and marine gas oil to fulfil their multi-billion contract.

If you are holding existing shares for FAST, I suggest you oversubscribe it for the sake of free warrants. If you don’t, you might lose out massively as people are rushing to oversubscribe the shares to lower their costs – this, is an industry secret.

Back to the company level, we could see that the management is serious on expanding their footprint in the oil business, and I believe the bottom line of the company could jump in few-fold manner in no time. Now is practically the best chance to invest in FAST!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Just Being Real

Discussions

18/10/2021 bought 0.215 18/11/2021 closed 0.115 ( MUST READ ) Dont missed out

2021-11-18 21:26

.png)

Investor 999

It is good to have dream!

2021-11-17 20:49