An Analysis on Favelle Favco

Ricky Yeo

Publish date: Wed, 27 Jan 2016, 06:25 PM

Oil price began to fall from mid-2014 throughout 2015 and currently isn't showing any sign of recovering. Most O&G companies have been dragged down by this crisis and companies that directly or indirectly servicing the industry are not spared as well.

Favelle Favco's share price hit a peak of RM3.80 in May 2014 and subsequently dropping gradually throughout 2nd half 2014 and 2015 to RM2.40 last November before recovering slightly. Although results for the past few quarters have been holding up well partly thanks to MYR depreciation but clearly orders from the O&G and offshore sector is falling as most oil and resources sector companies decided to either cut back or delay capital expenditure in anticipation of ongoing low oil price scenario and potential slowdown at China as well. And the situation is made worse with many oil companies laden with huge debts during those aggressive expansion years at the peak of oil price.

However I believe that Favelle Favco has been a convenient victim of 'throw the baby out with the bath water' and it is not surprising at all with 70% of their orderbook coming from offshore sector. We will look at the impact of the oil crisis on the business, the crane industry and valuation of Favelle Favco.

Background

Favelle Favco has a long history dating back to 1923 started by Edward Arthur Favelle and Harry Cole. Muhibbah Engineering acquired Favelle Favco in 1995 and Kroll Cranes in 1997. Kroll cranes was started in 1956 by F.B.Kroll in Denmark. They remain headquartered in Denmark to this day. Currently Mac Chung Hui is the CEO/MD of Favelle. He is the son of Mac Ngan Boon, co-founder and MD of Muhibbah Engineering.

Favelle and Kroll are both involved in crane manufacturing. Whereas Favelle focus on tower, offshore and power plant cranes, Kroll focus mostly on bridges and shipyard with both overlap in construction and power plant cranes. One thing in common is that both are focused on making large and heavy duty cranes. Their jobs mainly involve tendering, designing, manufacturing and delivering cranes.

The Industry

The crane industry derives most of their business from property developers, government projects, infrastructure & contractors. The industry is cyclical in nature as private and government sector tend to spend more during good years and cutback on bad days. In saying that, most crane manufacturers operate globally thus they are less susceptible to the economy of a particular country unless there is a global recession.

In crane manufacturing, most businesses are won through tender. Although in some cases buyers do directly approach a crane manufacturer for a customized crane or jointly research and produce crane model due to the requirement of a particular project they are undertaking.

There are many factors for construction companies to decide which crane is best suited for a construction project. These include the goal of the project, crane's reliability, cost, safety, regulations etc but mainly it is from the point of engineering and money.

For example, Manhattan is filled with skyscrapers on every corner. The streets that blanket the island are not as wide and it is hard to manoeuvre for large object. Therefore the size of a crane from delivery to site erection can be a main consideration when selecting a crane. Or take wind turbine and bridge construction. Some of these locations have extremely high wind condition. Thus the design of the crane to withstand these wind speed become a critical factor.

A crane can cost somewhere from 4 to 10 million each. But it is relatively small when compared to the cost of a construction project which typically cost few hundred millions. Take Burj Khalifa as an example, which is estimated to be $1.5 billion at cost. While a sizeable of that comes from meeting & planning, the remaining is material cost

What developers are more interested with is how fast and safely can a crane deliver the job. As with any construction project, speed is everything. Productivity is money. In Manhattan, the wages of a worker can cost $100 per hour when benefits are included. Cutting down construction time by a few months means millions in cost savings.

Another trend is that power plants (i.e nuclear or coal) & bridge developers are leaning towards the use of prefabricated elements as it offer several benefits in terms of construction time, safety, environmental and cost.

All of these factors contribute to the fact that mega structure builders are constantly searching for high capacity cranes that can deliver the job faster.

The Business

Enters Favelle. Favelle is well-known for its high speed high lift M-series diesel crane. They have also introduced MK-series electric cranes due to ongoing shift in client preference. But power wise, diesel crane is still the king.

Power is everything when it comes to building mega structure, be it towers or power plants. Powerful high speed crane can lift more, lift heavy and lift fast, which all results in cost savings. As one project manager explains:

"..It's because of the high speed. You're going up 1,000ft. You're pouring concrete, you can't go up slow or the concrete will set in the bucket. It's a labour intensive job, and time is money. It's all about line speed. The Favelle Favco can pick up a whole trailer load of steel with single part line..The concrete buckets are only 15,000lb, but the Favelle Favco 760 will pick up 55,000lb single line.."

Favelle derive around 70% of their business from offshore while the remaining comes from tower, power plants & construction. They provide other service such as rental cranes, winches & after-sales repair but main contributor comes from crane manufacturing.

Favelle started to venture heavily into offshore crane around 2000s partly under the influence of Muhibbah’s business in O&G, the increase in oil prices and proximity of O&G clients such as Keppel from Singapore, one of the recurring customer and the biggest oil rig builder.

While offshore crane is mainly focused on Asia countries like Malaysia, Singapore, Korea & China, tower crane business is more diverse geographically, serving whichever countries that wants to build the tallest buildings from One World Trade Centre in US, Taipei 101 in Taiwan, Burj Khalifa in UAE and now KL118, well in Malaysia.

Clients from power plants are pretty diverse as well but mostly came from developing countries such as Russia, China & India due to population growth putting pressure on demand for more energy.

Below we will analyse the some of the forces shaping the industry.

Competitive advantage

Barrier of entry

In crane manufacturing industry, the barrier to entry is considered medium. On one hand, expertise in engineering is all you need to build a crane. There are no advance technologies that can prevent companies from entering the industry. The true challenge for new entrants lies in their ability to establish reputation.

Cost of the crane is not a major buying decision for a construction company (which is a route entrant would normally take to enter a particular market by introducing a low cost option, such as the airline industry). They tend to go for crane companies with a reliable history because the risk of choosing an unproven manufacturer can be huge in many ways.

Crane down time can cost a lot of money from project delay to repairing. Safety & litigation can be a huge risk too if accident happens. And there’s the risk of after-sales service if new manufacturer decides to exit the industry after a few years. Most crane manufacturers also have patents for their own crane design thus it isn't as simple as stealing design.

So it is safe to say that new entrant would need a considerable sum of capital to establish their reputation and invest in R&D to enter the market. Therefore normally new entrant would rather acquire an existing company in the industry rather than starting from scratch.

Forces of supplier

The materials required to build a crane are mainly aluminium, copper, steels and electrical stuff. These materials are all commoditized so Favelle is not subjected to any supplier pricing control or dependent on any supplier in particular. Although margin can be affected by an increase on cost of material, generally they are able to pass it onto the buyers.

Forces of buyer

The majority of buyers are contractors on behalf of government and private builders. Since cost of a crane is not the major priority for these buyers but rather the capability of the crane of getting the job done, the forces from buyers are somewhat limited. And buyers do not buy in bulk either thus that reduce their bargaining power.

You see standardization generally leads to commoditization and commoditization leads to price competition that benefits the end users aka buyers. For a buyer when it comes to selecting a standardized product like airline seat, people rarely say 'I want to fly with Airasia'. They pick the cheapest seat available. Thus airline companies are intense competitors, which normally lead to price war at the benefit of buyers.

In the case of crane manufacturing, all crane models differ to a certain degree. They are not standardized products thus it is not easy for buyers to say 'I can get the same kind of crane for xxx price, can you match that price?".

Intensity of rivalry

One known fact from my research is that all competitors are bigger in size and more diversified compare to Favelle. Some of Favelle's competitors include Liebherr, Manitowoc and Zoomlion. And it is not unusual at all for developers to deploy several cranes from different manufacturers on a given project.

Examining the intensity of rivalry is particular hard as market shares for competitors are hard to obtain. But I am inclined to believe the competition is average to highly competitive but not to the point of killing each other. One of the reasons is that over the past decade or so Favelle has been able to maintain their ROIC at around 20% with profit margin increasing from 3% a decade ago to around 10-11% currently. And no doubt this is partly due to Favelle sticking to where they are good at rather than jumping into other crane market that they do not have an edge on.

And as mentioned above, competitors tend to compete on features and capabilities rather than price. Customized products do lessen competitions to a certain degree.

From the analysis above, I would classify it as a company with narrow moat. The supplier and buyer side of the industry does not seem to have a great power of stripping profitability away from Favelle. Barrier to entry, which dictates how fast will excess return revert back to cost of capital, is considered average to high because it isn’t easy for entrant to establish reputations in an industry that focus on safety, reliability & capabilities.

However in saying that, I do notice there is a trend where China crane manufacturers are slowly building up their reputations in the industry as the new entrant.

By now you will have an idea that crane manufacturers doesn't really compete on price or manufacturing capabilities. But rather it comes down to their engineering capabilities to design cranes that meet the demand of today's mega structure. Engineering, design & patent are their edge. And that comes from investing in research & development.

Numbers

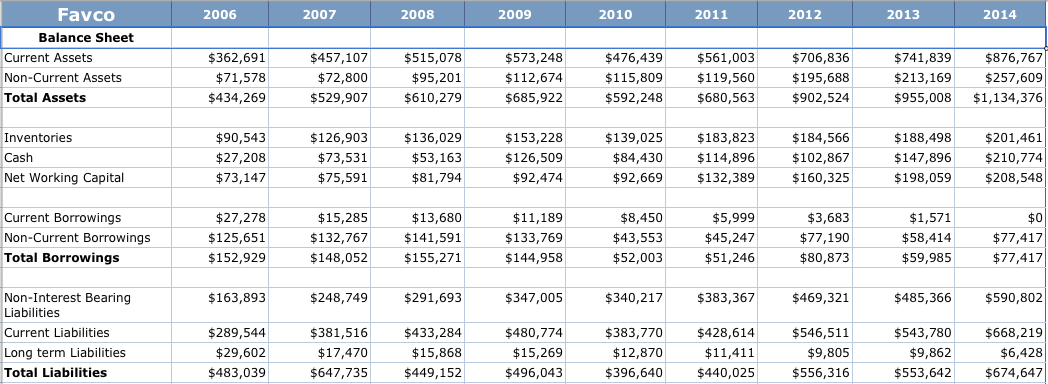

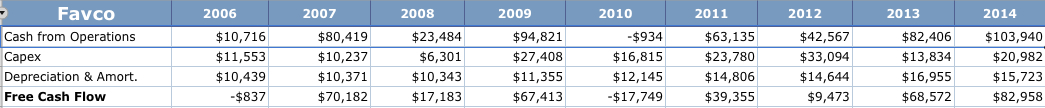

Now that we understand the industry and business, we shall connect the story to the figures. Most of the figures are self-explanatory. And it does show that the management has done a great job in turning the business around since acquiring it.

Some of the impressive numbers are profit margin growth and higher asset turnover, both leading to increase in ROE from low-mid teens to high teens. And this is done at the back of reducing debts by 50% over the period. ROIC growth is higher and gives a more accurate picture as ROE is diluted by the growing cash balance.

Another thing I must point out is how efficient the operation has become over the past 10 years by looking at the numbers. You can see net working capital (Current assets - current liabilities) went from 73 mil to 208 mil in 8 years which is fairly normal. The reasoning behind is as your business grows, you need to invest more in working capital i.e. inventory, receivables, payable etc. However at the same time cash balance went from 27 mil to 210 mil. If you only take into account 10% of the cash required for working capital, the net working capital has not grown much at all. Meaning less money tied up in working capital all the while revenue more than doubled.

Business model is considerable light in fixed assets as all they need is a big piece of land to build cranes and conduct research. Most assets are current with cash taking up 25% of that.

When you started to connect the story to the numbers in annual reports everything is easier to understand. Favelle do not need that many plant, property or equipments to build cranes. All the need is a big enough piece of land for inventory (which turnaround every 118 days), places to research cranes, and places to assemble cranes together before shipping to the site.

They sell are or less 100 cranes per year and cranes are made from very basic materials and electronics so you don't really need to invest a lot in expensive machineries. But rather majority of the assets are in receivables and inventory. Crane buyers don't care how beautiful your crane looks either, all they are after is performance. So all Favelle need is pushing the engineering boundaries, the rest keep it to a minimum.

Research & Development

Before my research into Favelle, my impression of the company is just as a manufacturing company, like “oh you want a crane, here I’ll make one for you”.

But now it becomes apparent that how well will Favelle do in the future comes down to their ability to innovate and continue to roll out new models that meets the demands of mega structure builders. And that mean’s investing in research & development.

Unfortunately, Malaysia companies are too shy to disclose this information. But from a reference I can take from Manitowoc’s annual report that they spend 1-2% of their revenue on R&D, as well as a RHB report dated back in 2013 mentioning Favelle spend around that percentage of revenue on R&D, it is safe to say based on current revenue they are spending around 8-16 mil a year on R&D.

Other than that, we won’t have a clue if their R&D is bearing any fruit. All we have is the track record. But uncertainty is part of analysis, and we will build that into our valuation.

Oil crisis

Personally I do not have any macroeconomic insight into where oil price will be for this year, next year or beyond. The only known fact is Favelle’s orders from offshore cranes will fall for sure.

The last incident when oil price suffered a huge drop is back in 2009-2010. Although it is brief compare to the current one. Favelle’s revenue suffered an 8% fall in 2009 follow by another 28% fall in 2010 while profit actually grow due to improvement in margins.

Few things you need to take note is that back then the crisis does not originate from oil but from subprime therefore the drop in revenue comes from a mixture of slower construction throughout the world from tower to O&G. Currently the crisis comes from oil price itself. Whether we will go into another global recession is a different story.

Conclusion is we will prepare for the worst and we will build that into our valuation.

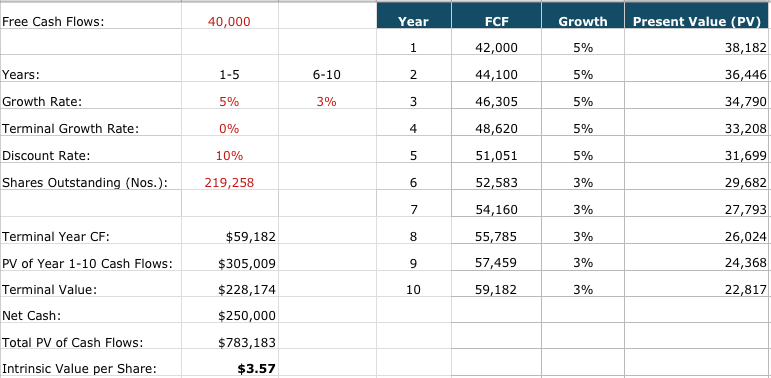

Valuation

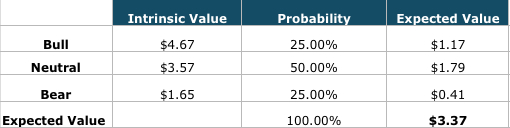

Generally it is best to create a few ‘most likely’ scenarios, assign probability to each of the scenario and estimate the value of the business.

In this case, we will create a bear case, a neutral and a bull case scenario.

Favelle’s 9 months free cash flow for 2015 is over 100 mil partly skewed by foreign exchange gain. Normally people would use the average FCF for past 3 years but I wanted to stress test Favelle, so I will go for 9 years average FCF. We will build in the margin of safety right from the start.

Bear case. In bear case we anticipate a total collapse on the offshore market. We will use 3 years average FCF of RM53 mil. Favelle’s offshore cranes contribute around 70% revenue so we expect FCF to fall to 16 mil a year (53 mil x 30%). No growth for next 10 years and no terminal growth either. We have an intrinsic value of RM1.87.

Neutral case. In neutral case I have decide to use 9 years average FCF rather than 3 years to 'stress test' the valuation. Also part of building margin of safety into the valuation from the start. 3 years average is 40 mil. We use a 5% growth on stage 1 (1st-5th year) and 3% growth on stage 2 (6th-10th year) and set terminal growth at zero. Value is RM3.57

Bull case. Lastly bull case. Using FCF of 53 mil. We assume 8% growth on stage 1, 5% stage 2 and 3% on terminal. Value is RM4.67

Lastly we assign all of them with expected probability. Don't ask me why 25% each on bull and bear. We have an expected value of RM3.37. That's about 15% above current price of RM2.85.

15% does not sounds much and especially people like me would demand a good 40-50% but as you can see we have err to the safe side from the beginning, insisting on margin of safety from free cash flow figures to growth in every scenario. Even our bull case growth assumption looks 'pessimistic'.

If you apply valuaton from multiples point of view, average 3 years EBIT is around RM90 mil, with current enterprise value of RM360 mil. We are paying 4x to own the company. Even if EBIT is to fall by 70% in worst case scenario to RM27 mil (assuming O&G sector disappear tomorrow,) EV/EBIT would still sits at 13x. And I think 13x is an okay multiple if not overly expensive.

I have applied various of other FCF and growth estimates which is too messy for me to put it here and the numbers keep falling down to the range of RM3.30 - RM4.60. And when I think it from the the point 'How much would I need to recreate Favelle Favco from scratch?", I tried to use their net asset as an anchor and do a layman asset replacement cost.

Favelle has a net asset of RM2.40, or RM526 mil. Some land or properties have not been revaluated for quite some time but those aren't that many. But one thing is clear is to buy all the lands and equipment on their assets at today's price would definitely cost more than RM526 mil.

And as I mention earlier in the post, it is a lot easier for new entrant to buy an existing crane manufacturer than building it from scratch and I think to buy the reputation, margin, ROE, everything sitting in balance sheet including the cash, it is not that demanding to pay RM700 to RM1 bil for Favelle. And that you have a range of RM3.20 - 4.56 again. With RM3.90 being the mid point.

RM3.30 ish seems to be sitting at the lower bound of my estimation. That is also why I believe the current price has already priced in the issue of oil price. And of course I also like to believe Favelle is a company worth keeping if they can continue to maintain their high ROE.

Conclusion

What we do know

Favelle has proven their capabilities by continue to roll out crane models that build some of the world’s tallest & iconic buildings over the past decade.

They have a solid balance sheet and based on track record, a well-regarded management.

Management has been successful in increasing ROE, profit margin, asset turnover & free cash flow

What we don’t know

How bad will the oil crisis affect the company is an unknown, thus we priced that into our valuation model

How well can Favelle continue to maintain their profitability (ROE above 20%) is uncertain, we can only look at back mirror and be conservative.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Intelligent Investing

Discussions

Well written analysis but sometimes cheap valuation could be a value trap despite the high roe, cash flow etc. Read about the skyscraper curse? http://www.economist.com/news/finance-and-economics/21647289-there-such-thing-skyscraper-curse-towers-babel

Perhaps as the co builds the highest tower out in the world, you have to be weary about the next financial crisis. Lastly, do comment on the Mac family's family track record in running Muhibbah and its impact on Favelle.

2016-01-27 20:18

One concern. earning sustainability as it needs to constantly need to replenish its orderbook in cranes supplies which ties back to the construction sector cyclicality.

2016-01-27 20:23

Hi JY ,this is the most detail and logic analysis i ever read ! i believe this must took you a lot of time to carry it out .thanks you so much.

this company seem like undervalue and ignore by most investor , the only reason i think is maybe due to their balance sheet .do you see that they have unusual high receivable and payable ? their total liability is much more higher than their total equity.

2016-01-28 03:00

well written, this company have too much of guessing and estimation. I will choose bearish for this company.

2016-01-28 12:12

when outlook is very uncertain, best to use TA instead of FA. Proven 100% effective

2016-01-28 18:28

Seriously, i'm cutting losses for all my stocks to preserve capital. Loss so much this 15 months.

2016-01-28 18:34

whether mkt outlook bullish or bearish...investors will stay invested, traders will continue to trade, timers time, speculators will...So nothing changes, ppl will continue...can't change old habits. No right or wrong way though, if continue to make $$, happy and harm none.

Good luck everybody!

2016-01-28 19:41

Very long & detailed discussion& analysis, Yeo always talk with something, a big LIKE, well done!

2016-01-28 20:14

Thank you JT Yeo for the most reassuring article which I need at this depressed time. In fact I began buying Favco about 2 months ago at about Rm 3.20 when I thought the oil price has bottomed out. Since then I have been collecting it every day. I have seen bear market before when I can buy very good stocks at a discount. That I is why I wrote and posted the article " Good Buying Opportunity". I also picked Favco as my top selection in the i3investor's competition.

JT Yeo, I like to meet you, please call me 017-5577822 or write yewyin33@gmail.com.

Koon Yew Yin

2016-01-29 05:53

One of the best articles in this forum.

Thanks and appreciate your sharing of your research.

You must have spent a lot of times on this,but still hoping to see your articles

on other counters.

Yes I know I am kind of too greedy.

2016-01-29 07:09

Dear Mr Koon Are you keen to set up a telegram group ? This will enable to follow your advice via mobile phone.

2016-01-31 09:31

I read your article late and being new I wander how you can write with such clarity and detail. Thanks so much for the info.

2016-05-30 13:05

kcchong and ricky are the 2 fundamental sifus that i respect the most... it seems to me that both of them are interested in the same share(s) for most of the time.. haha

2017-02-03 14:34

Op3rs

tq and appreciate your effort, im a newbie and i learnt from this

2016-01-27 19:10