Reasons Not to Hold Cash

Ricky Yeo

Publish date: Wed, 10 Feb 2016, 08:52 AM

Some of the reasons below are taken from the article 'The Wisdom of Great Investors'.

1. Historically, Periods of Low Returns Were Followed by Periods of Higher Returns

After suffering through a painful period for stocks, investors often reduce their exposure to equities or abandon them altogether. While understandable, such activity often occurs at precisely the wrong time. Though extremely challenging to do, history has shown that investors should feel confident about the long-term potential of equities after a prolonged period of disappointment. Why? Because historically low prices have increased future returns and crisis has created opportunity.

2. Don’t Attempt to Time the Market

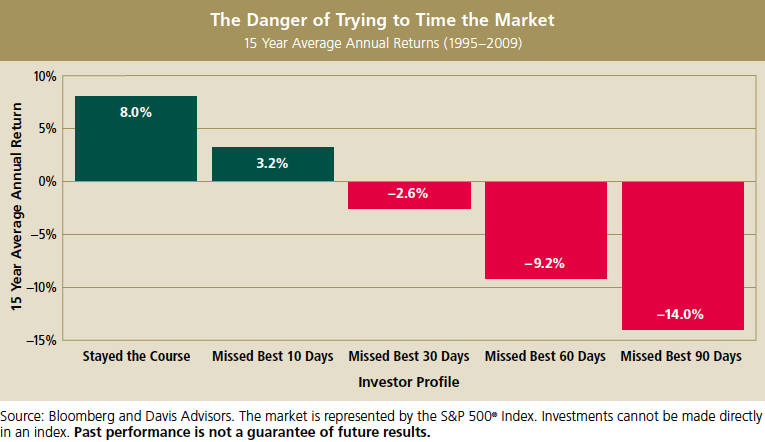

Market corrections often cause investors to abandon their investment plan, moving out of stocks with the intention of moving back in when things seem better–often to disastrous results.

Low returns are usually followed by high returns. The chart below shows what happens if you hold your money in cash. if you missed the best 30 days (out of the past 15 years) your return is -2.6%. Missed the best 90 days, that's -14%. We are talking about best 90 days out of 15 years, not 1 year. If you think you can time the market and know which 90 days are the best (so you can enter at the right time), then go ahead and hold cash.

3. The only time you should hold cash

Normally the only time you should hold cash is when things in your portfolio is way overvalued prompting you to sell or when you can't find anything that's cheap to buy in the market. Some people has preference of insisting 10-20% cash in their portfolio. Other than that, you should stay fully invested.

3. Stock market fluctuate in the short term, but it always go up in the long term

Think 1997 Asian crisis, 2000 dotcom bubble, 2008 GFC, 2011 Europe crisis etc. The market always bounds back stronger after a large crisis or correction.

4. You are answerable to what are in your portfolio, not the economy

You don't have much control over the economy and they are things that will always be outside of your control. And people call it macroeconomic because there's thousands of variables. So quit trying to forecast what is the weather next month.

Focus on your portfolio. You are accountable for what you own. Do you know what you are buying, why you are buying? Do you have margin of safety? Though it is not easy, but it is way way way easier to study a company in your portfolio than to understand the global economy.

5. Wait for rainy days?

Many people will say 'hold cash, wait for rainy days' or 'be fearful when other is greedy'. Then what is the exact definition of 'rainy days? Is it sunny, drizzling, rainy or pouring cats & dogs right now for the market?

Normally people that ask you to wait for the rainy days are the one that will only enter the market when it started to rebound, aka sunny days. Because the reason is simple, if they are holding cash now, what makes you think they will enter if the market dropped another 10%? They won't! They will extrapolate the worst is yet to come, so they will keep holding cash until the market showing sign of rebound. By then my friend, you have just missed the best 90 days.

More articles on Intelligent Investing

Discussions

JT Yeo, thanks for the great article. Can I ask one question just for my reference of how others do it?

How many percent you allocate your fund into stock, mutual fund, FD, cash and etc....?

2016-02-10 09:43

N00b start with 1950

https://research.stlouisfed.org/fred2/graph/fredgraph.png?width=880&height=440&id=NIKKEI225

2016-02-10 09:46

I agree. Those who sat on the sideline waiting for market to recover often end up joining the bull market at the peak. Forget about timing the market. Just continue to buy good stocks cheap and u will be fine.

2016-02-10 10:16

But is stock value keep on decreasing like what us happening currently, might as well keep until lower price....no urgency to buy

2016-02-10 13:33

I agree with soujinhou...., just understand Walter schloss principles will survive........,just buy with high mos....ok you will have your day....

Just to ask around bro or sis I would like to find dr neoh manuscript... Does anyone know where to get it...many thks

2016-02-10 13:39

Smart guy.....

Psychologists know some thing you all don't.........

Psychologists all know that people are not as capable not as good as they believe.

That everybody not as competent as they believe they are.

2016-02-10 13:41

Removing the issue of competent and alpha performance.....

There are still two truism.....

1...... That in an environment of low interest rates below inflation......to borrow is smart, to save not so smart......to borrow and invest is the smartest.

2........ That the only free lunch in town is diversification.....that is why CFA and universities teaches you to diversify. Problem is, too much diversification, you will never be rich as Bill Gates.

Add every thing together, stock discovery in growing companies is still the smarter choice.

2016-02-10 13:49

There is no need for further postings in this issue other than the two post I created above.

That is my opinion, but I too maybe not as smart as I think I am.

2016-02-10 13:58

Smart guy....you think you are so smart.....but psychologists know that you are not that smart.

That what you think will go down

Actually go up then how?

2016-02-10 14:08

Money cannot finish earn....there are always opportunities out there.....sometimes just need to be cautios

2016-02-10 14:26

If you are consistently smarter than mart, and can reliably predict mkt tops and bottoms...then go ahead and be a market timer or trader. Otherwise, just stay invested for the long term and ride or ignore all the inevitable mkt wild up and down swings.

The only right method is the one that makes you happy, $$$ and harm nobody...

Good luck to all investors, traders, timers, hold forever...

2016-02-10 14:36

Smart investor........In that case, go back to step one,

Removing the issue of competent and alpha performance.....

There are still two truism.....

1...... That in an environment of low interest rates below inflation......to borrow is smart, to save not so smart......to borrow and invest is the smartest.

Think about it.....removing the issue of competent and alpha performance....the current world and Malaysia monetary policy suggest that the smarter one is the one stays invested at all times.......that every bear market is an opportunity to buy shares.........on one principal assumption..........that the investor has unlimited capacity to borrow.

Since no one has unlimited capacity to borrow we adjust the strategy accordingly. We have to sacrifice infinite earnings for reasonable earnings.

2016-02-10 14:44

when the idea of having QE ( practically printing money in large amount..your money become small in real value, when banks start practicing zirp policy means your money stop generating more money,, worst still negative interest ..forcing you to do something to your money and not just holding it...what does that lead too...have to lock it somewhere that would create increasing value..invest in good stocks.and different assets class...not cash ..not cash .. just my one sen common sense kikiki

2016-02-11 10:54

so follow najib or dont follow najib? http://www.themalaymailonline.com/malaysia/article/dr-m-najib-told-me-cash-is-king

2016-02-11 14:10

hi ks55,

mind sharing with us the answers ?

What are the symptoms associated with each hour of the Investment Cycle Clock? 1 o'clock ( or 2 o'clock ) = anxiety

What is the time on the Investment Cycle Clock now? 1 o'clock ( or 2 o'clock ) = anxiety

thanks in advance

2016-02-11 18:52

Anyone can always find a reason to disprove that 'stock always go up'. And at the end of the day, everyone in this forum is buying individual stocks not buying the whole stock market. A broader market in Japan hasn't gone up doesnt mean you can't make money in individual stocks.

NOT SURE how to go about - Is there ever a sure thing in market? There are only probability, no certainty.

2016-02-12 12:28

yes stock always go up, but let said you buy a stock at 1.0 in this market condition, it drop to 80 cent before start rebound ... can you stand to see a paper loss of 20 cent ?

2016-02-12 12:31

I think my time is better spent on understanding the companies im interested to buy and determine their value than studying investment cycle clock. That doesnt mean im ignorance about the market sentiment, we still need to roughly know if investors are aggressive or cautious, optimistic or pessimistic, greedy or fear etc. And going by your sentiment, you are definitely very cautious and pessimistic; i've experienced that for the past 2-3 years, now im on the opposite sentiment

2016-02-12 12:34

like you said it is just a paper loss not a permanent loss unless you are forced to sell it. As long the business behind remain intact, nothing will change. I bought Aeoncredit at $15.80, now it is $11. But I cannot find any other financial companies that can compound net asset faster than Aeoncredit besides Public Bank, so I am happy to hold it. The only time that i would sell and realized a loss is when I found another similar quality stock that has a cheaper price in relation to it's value. And that's another reason im looking at SGX companies

2016-02-12 12:40

JT Yeo, I am finding super bargains on SGX and HKEX now which are in deep bear territory. Perhaps we can exchange ideas through a private forum. There are other like minded international investors too. Please leave me your email address if you re interested.

2016-02-12 13:49

investing like trading is a win some lose some game, But investors unlike traders need only to be lucky enough to be able to pick just one superstar winner, or at least 2 winners out of 10 to 15 names and hold for many years...

Anyway, to all all traders, timers, investors, hold forever...good luck!

2016-02-12 14:41

I always treat the share markets as banks, counters that have good PE, steady earning records, comfortable NTA with good steady dividend yield above bank rates ( that I feel the peacefulness even widen markets crash),

2016-03-04 13:08

N00b

"Stocks always go up..."

http://s12.postimg.org/j9vqv5dal/stocks_always_go_up.png

2016-02-10 09:32