How Much Should I Put in A Stock?

Ricky Yeo

Publish date: Sun, 19 Feb 2017, 09:34 AM

***

“Investing is like a piece of Lego brick that fits tightly with other Lego bricks to create a big solid structure. Those other Lego bricks are your family, career, relationship and so on. That big, solid structure is your life.”

Introduction

Position sizing or how much to put into a stock is as important as picking the right one. While one will miss the chance to earn a superior return if too little is placed into a stock that turns into a winner, having too much inside one that becomes a lemon is a disaster. Therefore, finding the middle ground is the key and here we will go through some simple ways you can apply to increase the odds of superior return while keeping risk in check.

Investment strategy

Think of it as buying a car. You have to know what you want before deciding where to place your money. For cars, factors like cost, safety, comfort, quality, driving pleasure, appearance etc influence decisions. A fresh graduate hunting for a car will prioritize cost over appearance whereas a family with kids will emphasize comfort and safety over cost. Same with stocks, you have to figure out your objectives and investment strategy.

Why do you invest? What are you trying to achieve and how are you going to get there? No, not making money, get rich, or achieve financial freedom. Those are aspirations. Are you after pocket money, income, wealth accumulation, beat inflation, retirement planning, self-development, fame, excitement, status or something else? There’s no right or wrong. You need a strategy roadmap and position sizing is how you will get there. A roadmap tells you what you can and cannot do and where you should put your focus on.

Here’s an example.

My investment strategy is to focus on great stocks that I can hold for 10 years or more. The reason behind this is I have a full-time job, 3 kids and 2 elderly to look after. Thus this limits the time I have on investing. Therefore, my situation favors a buy and hold strategy that will keep my portfolio turnover low, which reduce the need to constantly search for new stocks to redeploy my capital. This strategy should fit well with the fact that I do not need this capital for the next 10-20 years. Although these are likely to create a concentrated 5-10 stocks portfolio with higher than average volatility in the short term, it will not affect my main objective of maximizing my long term wealth.

Write it down in a few sentence using simple words and be as specific as possible. Keep it focus. Here are a few areas to help you get started.

Personal circumstances

Investing is a subset of your life and it must fit with your personal circumstances. Think of investing as a piece of Lego brick that fits tightly with other Lego bricks to create a big solid structure. Those other Lego bricks are your career, relationship, family etc. That big, solid structure is your life. If they are disconnected, you will have many conflicting objectives. For example, your life objectives might be a great dad that spends lots of time with kids; a successful startup entrepreneur; and a super investor. But they are all conflicting. You cannot be everything to everyone. There’s opportunity cost involved and you have to make a hard choice. Determine your priority in life will make it easier in shaping your strategy.

Time

Think about the time that’s available for you for investing. If you are available an hour a day, that’s 365 hours for a year. And spreading your capital across 30 stocks with an annual turnover is going to be challenging (you need to find an investable stock every 12 hours). But this strategy might possibly work for a full-time investor or someone that have more time.

Investment horizon

When do you need the money? If you invest for income, you will prioritize on stocks that are mature, stable and delivers consistent dividend over a young but risky stock that is growing aggressively. While an investor who doesn’t need the money for the next 10 years will have more flexibility in shaping his strategy and if used wisely, creates an edge (moat) for himself through time leverage.

Edge

What is your strength? The 4 main edges are analytical, informational, psychological and time. Analytical edge means you have a strong ability to analyze a large amount of information and make good decisions. You possess informational edge if you have access to information not available to general public. Psychological edge gives you emotional stability in the face of an uncertain situation. Lastly, if you can afford to think long term 10-20 years, you have a time edge over others that do not. Finding where your edges are and leveraging on that is a powerful weapon.

Volatility

Volatility or the movement of share price itself does not represent a risk of permanent capital loss, but it is a main consideration if you are risk-averse or have a short investment horizon that requires regular drawdown. A concentrated portfolio is likely to experience higher than average volatility compares to one that is more diversified.

“It is as important to decide what not to do in investing as it is to determine what to do.”

Having a strategy is about making the hard choice and decide what not to do. If the focus is on finding durable businesses that can sustain competitive advantage for a very long time, the only way to execute it is to decide no turnaround stories; no stocks riding on government policies; no deep value; no cigar butt, or anything that doesn’t meet the description. Focus on building a portfolio that serves your objectives and ignores what everyone else is doing.

Criteria selection

Once you have written down your strategy, find 3 to 5 criteria that will measure your stocks. For 10 years buy and hold strategy, criteria like quality of the business model, management quality, industry dynamic will carry more weight over others. Whereas a strategy that relies on investment as a source of income will use dividend, earnings consistency, track record to evaluate stocks. You can choose from the below or come up with your own.

Quality

In a broad sense, quality examines the durability of the business, the business model, competitive advantage, switching cost of products/services, industry dynamics etc. If quality is one of the criteria, you will rank stocks based on current and historical ROE or ROIC as well as other important intangibles like moat or culture.

Margin of safety

The larger the gap between share price and the business value, the higher proportion of capital should be allocated. But there’s more to the margin of safety than just the gap between price and value, read more here.

Consistency

More applicable to investors with long investment horizon, companies that have established a consistent set of record, whether that’s ROE, margin, revenue etc is likely to continue delivering it compare to turnaround stories or ones that have not proven to do so in the past.

Market Expectation

This criterion can be hard to determine but nonetheless useful if applied correctly. The biggest mispricing comes from stocks that are largely misunderstood or ignored by the market, and those are the potential ones to place a sizable amount if the investment thesis is clear and simple.

Investment thesis

A simple, straight forward investment thesis deserve more capital than ones that requires many variables to get it right. If you haven’t done so, write down a simple thesis for all your stocks – What do you see in this stock that will deliver a satisfactory return? The more if’s is in there, the least probable it will turn out well.

Multiple tailwinds

On the opposite end of many variables, a stock with many tailwinds or catalysts deserves higher allocation than those that don’t. Tailwinds or catalysts can come in all forms from the balance sheet, near term events, government policies to industry development, corporate actions and so on. More tailwinds increase the probability of a favorable outcome for a stock.

Dividend

If your focus is on the dividend, pay attention to dividend yield, payout consistency record, and business stability and rank them accordingly. Instead of screening stocks using current dividend yield, investigate deeper. A stock might currently give you a 3% dividend but if it continues to grow while maintaining its payout ratio, it is entirely possible to reach 8-10% yield (on the initial investment) few years down the road.

Downside

Similar to the margin of safety, the smaller the downside there is, the more you can afford to allocate without taking on higher risk. Things that reduce downside comes in many forms from strength on balance sheet, earning power, current share price, business quality and so on. Beware of value trap.

Management

The strength of the management, integrity and capital allocation skills are critical in deciding a business’s long-term return. Compensation structure, did management kept their previous promises, did they walk the talk etc are some areas you can measure the management against as well.

Conviction level

This criterion is more of a sum up. Your confidence level on a stock will determine how much capital you’ll eventually allocate to it. How confident are you in this stock? Does it allow you to sleep well at night? Beware of overconfident bias. Don’t let the recent gain in share price fool you either. The last thing you want is to put a large amount of capital into a stock you little conviction at all. A sudden market volatility is enough to break and force you into making the stupidest decision ever.

“My most specific and most heartfelt advice is this: The surest way to achieve superior performance is by investing significant amounts with individuals and firms that can be depended on for investment skill, risk control, and fair treatment of clients.” – Howard Marks

Rank & Score

Once you’ve decided the criteria, rank your stocks against each of them. If you have picked ‘Dividend’ as one it, let your stocks fight it out against each other and see which deserve the first, second or third and so on. Do this for all the criteria you have picked. You have no idea exactly how much you should put in each stock, but by comparing your stocks against one another based on the criteria you’ve picked, you get a sense which stock deserve a bigger pie over another.

“We believe in constructing the portfolio so that we put our biggest amount of money in our highest-conviction idea, and then we view the other ideas relative to that…if we find something where we have a good understanding of why it’s mispriced, where we think the mispricing is very large and theoverall risk is very small, we take an outsized position…” – David Einhorn

“Value investors should concentrate their holdings in their best ideas; if you can tell a good investment from a bad one, you can also distinguish a great one from a good one.” —Seth Klarman, The Baupost Group

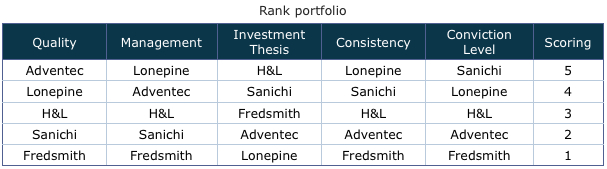

Here’s an example of 5 stocks ranked against 5 criteria. If you find it difficult to rank stocks based on the criteria you’ve picked, try to replace it with something quantifiable i.e metrics. Instead of using Quality, replace it with Return on Equity. Investment thesis with numbers of moving parts/variables (less the better) etc.

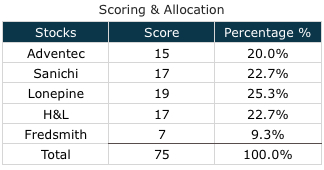

You will score the stock based on its ranking in each criterion. A stock that rank 1st in each criterion gets 5 points, 4 points for the 2nd, 3 points for the 3rd and so on. This scoring system is not set in stones. You can create your own. If you think ‘Conviction level’ is more important than other criteria, you can apply a double scoring where the 1st gets 10 pts, 2nd 8 pts and so on. Total up the score for each stock and the ones with the highest score would be the best idea.

If you want to go one step further, divide the score by the total will give you roughly how much percentage should be allocated to each stock. But this is entirely optional. What matters isn’t the exact allocation but which one has a better odds relative to others so you can tilt your portfolio towards that direction.

Beating the next best ideaIf you want to go one step further, divide the score by the total will give you roughly how much percentage should be allocated to each stock. But this is entirely optional. What matters isn’t the exact allocation but which one has a better odds relative to others so you can tilt your portfolio towards that direction.

This method is applicable to the stocks on your watchlist too. Your watchlist stock with the highest score needs to beat the portfolio stock with the lowest score in order to be added to the portfolio. The exception is when the portfolio is overly concentrated and increasing numbers of holdings are the goal.

“A tool only works as good as the person using it, a great strategy without the right temperament is a useless one.”

Conclusion

There’s no exact science to position sizing but rather than doing it intuitively, we can structure it in a way that increases return and lower the risk by using comparison method and allocate more into the few best ones. Your best ones are not going to be the same as mine because our circumstances are different. So you need a clear sense of your investment strategy in order to find what works best for you. A strategy is not about finding what’s cool, what’s in trend, or ones that you have to change every 3 months. It should be one that is focused, uncovers your edge, fits your circumstances, defines what you are not going to do and reliably, one that lasts for a long time.

The first place would be figuring out the key factors that have the biggest influence over how you going to invest such as time, career and so on. From there, decide 3 to 5 key criteria to measure your stocks against and rank them accordingly. Any stocks in the portfolio that do not measure up against those criteria should either be sold or reduced to allow rooms for the next best ideas.

If you would like to discuss further, write to me ricky.yeo@musingzebra.com

If you find this helpful, please share it with your friends & subscribe to us http://bit.ly/2fQzRoa

More articles on Intelligent Investing

Discussions

imagine u found a good stock, like RCECAP which Calvin Tan recommended at 80sen.

if u SAI LANG all your money in RCECAP, you would have DOUBLED your money, now that RCECAP is 1.60

2017-02-19 10:57

With alternative histories, u sailang u might as well go broke if a tail event happened. U should pray to God, Allah or Amitanba every time u make a buy. That is the best act compared to dynamite investing.

2017-02-19 11:14

THE ARTICLE ON POSITIONING SIZING VERY COMPREHENSIVE BUT COMPLICATED LOH.....!!

RAIDER LIKE TO SUMMARISE BEST PRACTISE & SIMPLE WHERE U CAN BALANCE RISK & REWARD LOH......!!

1.CONSERVATIVE AT LEAST MORE THAN 30 COUNTERS....WITH MAX PER STOCK ALLOCATION NOT MORE THAN 5% PA OF YOUR OVERALL PORTFOLIO VALUE

2. MIDDLE ROAD AT LEAST NOT MORE THAN 30 COUNTERS.....WITH MAX PER STOCK ALLOCATIONS NOT MORE THAN 12% PA OF YOUR OVERALL PORTFOLIO VALUE.

3.AGRESSIVE AT LEAST 10 COUNTERS......WITH MAX PER STOCK ALLOCATION NOT MORE THAN 25% OF YOUR OVERALL PORTFOLIO VALUE LOH...!!

WHY RAIDER DO NOT ADVOCATED ON SAILANG ON 1 SINGLE STOCK ?

LOOK OF PROBABILITY DO WORK ITS WAY LOH....FOR EXAMPLE TO STRIKE 1ST PRICE IN 4D IS QUITE DIFFICULT....BUT PEOPLE DO STRIKE MAH...!!

SO NO MATTER HOW COCK SURE UR INVESTMENT...U BETTER THINK OF JUST IN CASE ISSUE LOH..!!

ANYHOW IF YOUR INVESTMENT IS A SOUND SUCCESSFUL SYSTEM, U R BOUND TO BE RICH LOH....BCOS OF THE POSITIVE EXPECTED VALUE EFFECT LOH...!!

DON PUSH YOUR LUCK TOO FAR JUST IN CASE LOH...!!

ON CHOSING...CONSERVATIVE...MIDDLE OR AGGRESSIVE....IT IS YOUR CHOICE LOH....!!

GENERALLY IF U R YOUNG....U GO AHEAD WITH UR AGGRESSIVE POSTURE

IF U R MIDDLE AGE....HAVE COMMITMENT...CHOSE THE MIDDLE ROAD OR CONSERVATIVE LOH....!!

IF U ARE ALREADY RICH AND ALREADY AGE....WHY PUSH UR LUCK TOO FAR ??...CHOSE CONSERVATIVE LOH....!!

ALL THE APPROACH CAN MAKE U RICH...IF UR INVESTMENT SYSTEM IS SOUND LOH.....!!

2017-02-19 11:41

Good article, big like first.

Thx ricky yeo for your Stock Strategy Road map.

(Sometimes, can always start very little and testing again & again; to practice and to know what kind of Investors u are).

The imperfection sometime is our best guru to knkw truely who we are :)

2017-02-19 11:45

if you will never buy a stock unless you are willling to sailang..........................

that would be the fulfillment of ricky yeo strategy.

2017-02-19 11:55

Sailang means putting all the eggs in one basket. Typical a poker game altogether. Win big or lose big.

2017-02-19 12:16

sailang means don't buy any thing until/ unless you are willing to bet the farm.

2017-02-19 12:19

sailang is an art. i hope sifu stockmanmy can share some real experience of his on his sailang art. Not everyone can master this.

2017-02-19 12:25

I like most on the part of age grouping, when you reach certain stage, needs to change strategy. Gambler maybe sailang, for me..maybe 30% of wealth in stock.

2017-02-19 12:26

agreed with you sailang is an art, one of the most difficult for normal people to do. But, on the other hand, it is the pathway to unimaginable wealth practised by all super investors including the ever so cool Warren Buffet who talks one thing and spends his life in sailang world.

joekit > Feb 19, 2017 12:25 PM | Report Abuse

sailang is an art. i hope sifu stockmanmy can share some real experience of his on his sailang art. Not everyone can master this.

2017-02-19 12:38

my own experience.............

I am doing much better now that I choose to be more focused, more selective, take bigger positions, accept more risk,

and recognizing that in the natural state people prefers a bird in hand more than 3 in the bush even when probabilistic speaking 3 in the bush is worth more....that people prefers safety to rewards but super investors has over come such limitations.

2017-02-19 13:19

is it safer to be a loser, I wonder?

silom > Feb 19, 2017 02:00 PM | Report Abuse

manmy, sailing risk is very high, like a poker game when you have full house, but doesn't guarantee win, diversify safer for most ppl

2017-02-19 14:09

stay focused, learn from experience and continue learning.

if stockmarket is a business,

you have to have a business like approach, not a mediocre approach.

2017-02-19 14:36

Mammy...saying...sailang...sailang....!!

If he doing what he saying on UMWOG and CSC...sailang....he is a bankrupt by now loh.....!!

Obviously....he is saying....not what he is dong loh....!!

DON TRUST THIS MANIPULATOR...LOH....!!

2017-02-19 15:13

well....both UMWOG and CSC is one of the better propositions in the KLSE today..................but probably not suitable for sailang.

especially since I don't have any.

2017-02-19 15:31

just a wild taught if asb return us happy meaning... the trade..... he conducted is not exceeding the figures generated by asb... just my 2 cts. yo

2017-02-19 15:57

For the year ended 2016, CSC has an operating cash flow surplus of $ 114 million. or 30 sen per share. ....and they call that a difficult environment and bad quarter?

CSC remains a very good proposition., with record revenue in the last quarter.

As for UMWOG...............well, if PNB cannot trust, no need play shares in Malaysia loh.

Petronas wants the consolidation, Petronas will make sure UMWOG succeeds.

2017-02-19 16:00

Posted by stockmanmy > Feb 19, 2017 03:31 PM | Report Abuse

well....both UMWOG and CSC is one of the better propositions in the KLSE today..................but probably not suitable for sailang.

especially since I don't have any.

WHAT TYPE OF RUBBISH TALK THIS MAMMY...NO POSITION ON UMWOG AND CSC, WHEN HE PROMOTE THESE STOCKS LIKE CRAZY EARLIER. ..WHEN HE DON HAVE ANY ??

THATS WHY U CANNOT TRUST THIS MANIPULATOR !!

HE IS JUST A CONMAN LOH....!!

2017-02-19 16:21

sailang means you are willing to bet the farm...and keep buying if it keeps going up, to a certain extend.

it obviously means a very very small number of core holdings not like those unit trusts who sprinkle over a hundred stocks.

sailang means take a meaningful size ...it must be meaningful or forget it.

2017-02-19 17:21

sailang means dump all ur money into one counter. i believe none of us dare to do this. lol

2017-02-19 17:37

That portfolio in the contest is not a Dynamic Portfolio.

It is a dead portfolio because I cannot sell within the year.

My own portfolio is a Dynamic Portfolio very focused on 3 stocks only.

2017-02-19 17:40

I declare that for the rest of 2017, I intend to carry at most 3 stocks at any one time.

If I buy another stock it will have to be so superior that I am willing to sell one of the three to buy it.

ain't going to happen without very good reason.

ps...each of my existing stocks is already sitting on unrealised gain of > 25%........and all three were purchased in 2017.

2017-02-19 17:51

If I can find the One Key that unlocks them all.....I will focus on just one.

2017-02-19 18:18

curious2

What stocks to buy or what must sell? Saw Sanichi can buy and why?

2017-02-19 10:31