A Simple Way to Value Banks

Ricky Yeo

Publish date: Sun, 30 Apr 2017, 09:00 AM

The starting point to value banks is to understand how banks make money. Banks use the funds provided by their customers in the form of deposits and lend it to other customers that require financing whether that’s for credit card, house, car, business, personal or so forth. The spread between the deposit rate and financing rate is what the bank earns.

So if a bank lets depositor park his savings and pays him 3% p.a while lending those funds to finance a housing loan at a 4% interest rate p.a, the 1% spread (4-3%) will be the bank’s profit. It is also called net interest margin (NIM).

Of course, there are many other ways a bank can make money such as financial and investment products and other fee commission based income. But our focus here will be on retail banks that makes the bulk of their profit through interest income.

Look it through another lens, NIM is similar to a bank’s earning power. Earning power is what you should focus on when analyzing a business and it is different from accounting earnings. The earnings that you normally see in a financial statement tends to fluctuate and it is affected by various temporary factors such as forex gain/loss, extraordinary charges, provision for bad debt and so on. Whereas earning power is a normalized figure that can reliable reflect what a business is expected to earn year in year out unless there is a dramatic change to its fundamental such as its business model or industry dynamic.

Let’s look at a few example.

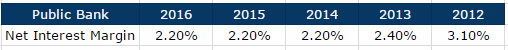

Below is the NIM for Public Bank over the past 5 years. On average their NIM is around 2.4%. We will take a range of 2.2-2.4% for their NIM. In 2016, PBB has total deposits of $310 bil. So if PBB can earn around 2.2-2.4 cent for every dollar they lend out, a deposit of $310 bil will give them an earning power of around $6.8-7.4 bil or $1.76-1.92 per share.

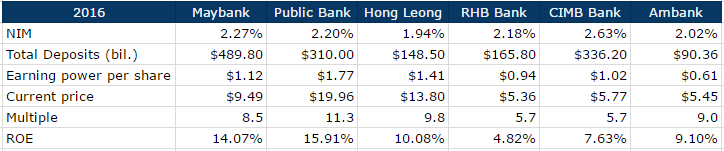

Now say you think Public Bank deserve a 10x multiple, you would value them at somewhere around $17.6 to $19.20 per share. Current price sits at $19.96. Here are a few of other big banks in Malaysia.

Here, by multiplying NIM with total deposits and divided by outstanding shares will gives you earning power per share. This comparison shows that RHB and CIMB are selling at a lower multiples in relative to their peers. And the main reason is due to their poor ROE. If you are banking on the probability that their ROE will eventually revert back to normalized level, they could be potential stocks for you. Again, this valuation totally ignores important factors such as management, asset quality etc and does not include other types of income that could easily make up 10-20% of their total revenue or probably more. However, it is a simple way to understand how and where retail banks derive their earning powers from.

Subscribe here and learn to be a better investor.

More articles on Intelligent Investing

Discussions

Many including me like Banking stocks. I currently holding May bank, CIMB and Affin.

2017-04-30 12:35

Shortinvestor77

Wow , you hold 3 banking stocks .....so good meh banking sector ?

Why don't you diversify to other more profitable sector for capital gains

2017-04-30 12:41

If you are banking on the probability that their ROE will eventually revert back to normalized level, they could be potential stocks for you.

I guess the Deposit level to Equity of RHB and CIMB is much lower than the rest...would be interesting to know why is this so? Is their Debt fraction lower?

2017-04-30 16:18

Equityengineer

Thanks for the basics on the bank valuation . Never liked banking stocks . Hope you can elaborate all the variables and ratio ..

2017-04-30 12:20