Why VIVOCOM revenue boost up but Share price keep declining?

KLmorGan216

Publish date: Mon, 19 Dec 2016, 01:40 PM

The purpose of writing this article is to share my opinion about VIVOCOM to the investors. I would like to allow people to realize why ViVOCOM’s share price is down although investors thinking that VIVOCOM’s fundamental analysis is “good”. I personally think that VIVOCOM is bad, let’s discuss this stock below.

What the investors would like to see?

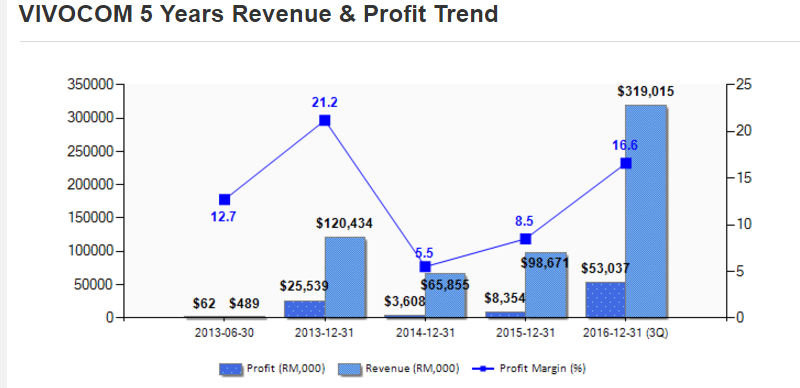

The above picture is a snap shot of the company from Malaysia Stock Biz.

Based on above data, the revenue and net profit margin continuously increased. Is it looks like healthy and is a very good company? Investor like the company which revenue rapidly increase but didn`t figure out what the reason revenue boost up? Is it temporary or one-time gain? I think that many investor should be know the revenue boost up contributed by the construction segment. By the way, Will the company continuously increase the revenue and NPM in the future?

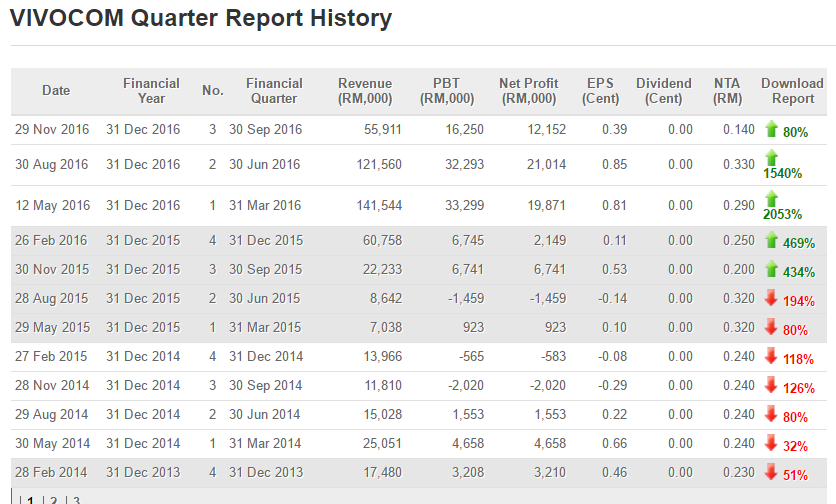

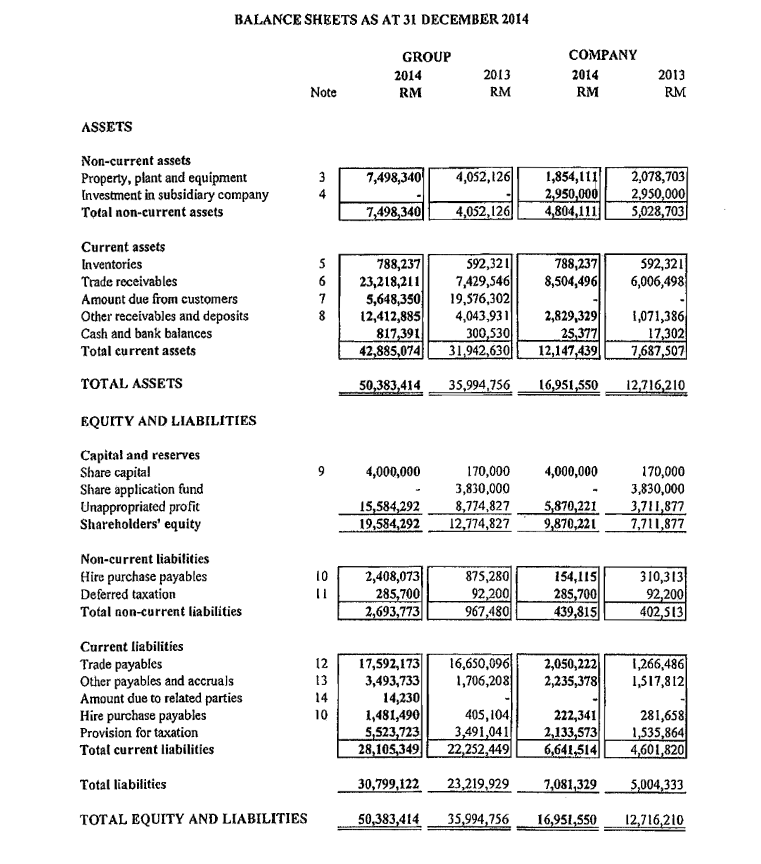

The above picture is a snap shot of the company’s balance sheet from CIMB Platform.

The first Question is “Why did the total assets boost up?” This is because the short-term receivables and intangible assets increased. Short-term receivables increased from RM39m in year 2014 to RM118m in year 2015 and the intangible assets increased from RM83m in year 2014 to RM192m in year 2015.

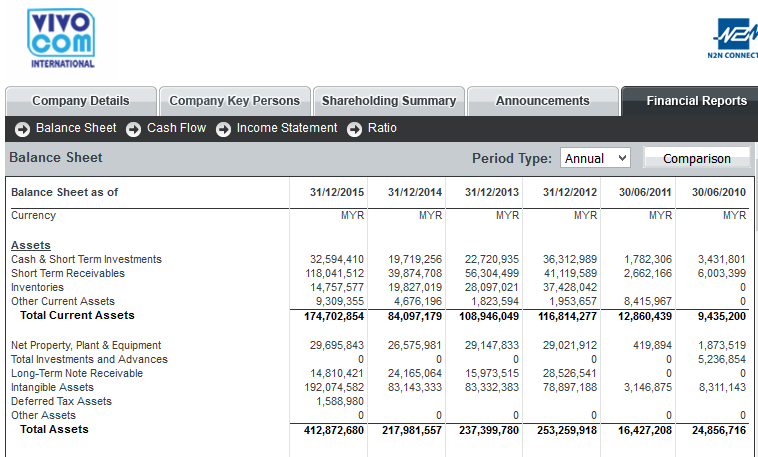

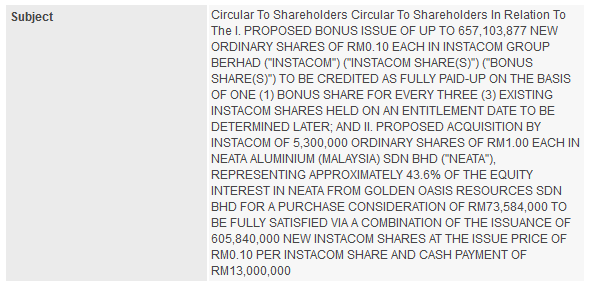

The above picture is a snap shot of the company from Bursa.

In order to become a good trader or analyst, the question “Why?” should always be thought of when an action is presented by a company. The 2nd question: Why did the intangible assets boost up twice? According to the above Bursa information, INSTACOM Group Berhad (Before they changed their name be VIVOCOM) purchased 43.60% of Neate Shares by combining cash payments of RM13m and issuance of 605,840,000 new Instacom shares are at an issue price of RM0.10 per share. The total amount of purchase consideration is RM73,584,000. This is reason why intangible assets and trade receivables boost up since they acquired Neata.

The above picture is a snap shot of the company from Bursa. This information can be found in Bursa and it is not insider information.

The 3rd question: Why did Instacom acquire Neata? According to the above information, Instacom acquired Neata because Neata has a contract value of RM82.480m. For this Neata company, it does not have much property, plant & equipment. The most valuable of Neata is only this contact.

Let us think about it, Instacom used RM73,584,000 acquired 43.6% of Neata shares, IT`S NOT 100% equity of Neata. If the value of NEATA is RM87,780,00, except other assets and liabilities. How much should Instacom acquire? RM87,780,000 X 43.6% = RM38,272,080. We can see that instacom used a higher price to acquired NEATA.

It looks like unfair, right? Since we didn’t include the assets and liabilities. If the total equity of NEATA is higher, then the effect of contract will be lower. Okay! Let us calculate this, total assets minus total liabilities. RM50,383,414 – RM30,799,122 = RM19,586,292. RM19,586,292 X 43.6% = RM8,539,623. So, the total acquisition price should be RM38,272,080 + RM8,539,623 = RM46,811,703. After calculation, it can be concluded that Instacom still uses a higher price to acquire.

What the problem about this acquisition? If the revenue of contract has been recognized, then can VIVCOM continue grow in the long-term? If the revenue of contract has been recognized rapidly by using financial number games strategies, then will the share price sustain??

Noted: Above of the information cannot affect investor make buy or sell decision.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on KLmorGan216

Discussions

I think whole world already know this is a con job led by con artist from CIMB. What was the name of the analyst again?

2016-12-19 14:24

there are contracts secured these 2 years that will drive revenue moving forwards.

These contracts will lead profits for the coming few years but i think the current share price is still considered ok (neither over price nor cheap).

2. intangible asset is my concern as well. There is no further clarification on that.

3. I think we should look at the current contracts secured. To me, the acquisition of the NEATA is the right decision as VIVOCOM Enterprise(subsidiary of NEATA) earns the money for INSTACOM.

2016-12-19 15:38

gamer, your comments is very fair. If writer don't understand, go direct their office and get more informations from the right person. See at your own eye the actual expansion in Vivocom office and business growth. Your article was writing based on emotion to the share price drop , so the conclusion everything is bad. If the Vivocom share price go up later, then what another story u want to create. Though of days.

2016-12-19 17:22

Secondly, a company making good revenue does not guarantee a share price always go up. How about FGV, Goodway, Mextex, Johan? This all counter not making good revenue but share price still go up. Does this counter meaning good to you as well. Everything about timing and depend when fund manager want to RERating the share. And of course got news to goreng.

2016-12-19 17:51

CKNYAM, dont be so arrogant, listen to people and dont think you know everything and everything you know is correct and other is wrong.

2016-12-21 12:57

@gamer: I`m agree with u that not including the existing contract value yet.

But, i disagree with u that acquire NEATA is a right decision. A clever businessman wouldn`t buy the company with such a high premium.

2016-12-22 15:18

Instacom average revenue a year used to be RM100mil. But now Vivocom as at Q3 2016, revenue has gone up RM300mil with orderbook close to RM3bil. So judge yourself, the value that paying to neata is justified or not. It will keep them busy till 2018. If you accepted the bonus issue share, you have to prepare to hold longer to appreciate it value. A lot of negative emotion surrounding Vivocom because it's share price drop. But what if share price rise up again, and will you write acquisition Neata is a good bargain and turnaround to the company?

2016-12-24 10:56

isnt it obvious, vivovom is what it is bkos of CRCC work orders, and how was it obtained, thru a related party, whos the related party = Dr Yeoh Seong Mok.... and would Yeoh do this for free? Of course not.... whats the payment? purchase of neata.... who is neata? Yeoh :-) is vivo under valued? If you fully believe the CRCC work oders are 100% valid .... then yes 100% undervalued

2017-01-05 22:36

Raymond, good point. Project Award announcement must be legal biding and valid before announcement. Through DS Yeoh connection another project saving for Rm19.3 mil from Oriental Mace Sdn Bhd for the appointment as Main Contractor for the construction of factory, warehouse and office buildings on Lot 886 Bandar Baru Enstek, Daerah Seremban, Negeri Sembilan Darul Khusus. This project was earlier awarded to Versatile Bhd. And this project also non CRCC job.

2017-01-05 23:30

.png)

Mini Bull

con con con

2016-12-19 14:19