What the PROBLEMS of HIBISCS?

KLmorGan216

Publish date: Mon, 26 Dec 2016, 11:55 AM

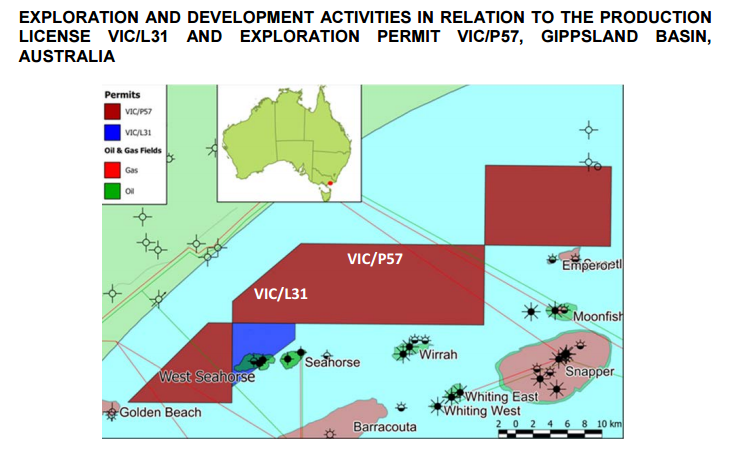

Hibiscus Petroleum Bhd. is an investment holding company, which engages in the businesses of exploration and development of oil and gas. It operates through the following segments: Investment Holding and Group Activities; Lime; 3D Oil, VIC/L31 and VIC/P57; and HIREX.

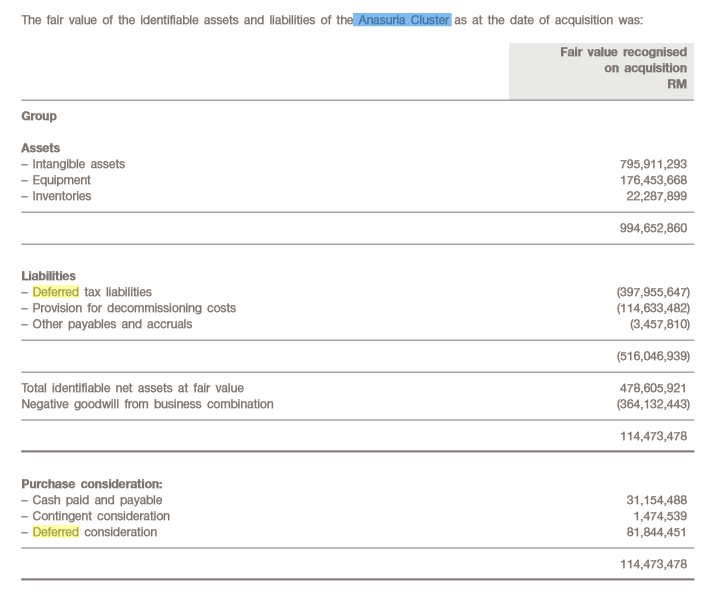

Compared between 2015 and 2016: The group has increased total assets by RM755million from RM551m in year 2015 to RM1,306m in year 2016. Why the total assets had been boost up? The is because the intangible assets has been increased by RM853million from RM144m in year 2015 to RM997m in year 2016. The reason of intangible assets increased due to the Group acquired 50% of the shares of Anasuria Hibiscus. Included in rights and concession is the carrying amount of producing field licenses in Anasuria Cluster amounting to RM761,900,810 (2015: Nil) and capitalised acquisition and related transaction costs of VIC/P57 and VIC/L31 amounting to RM100,599,050 (2015: RM99,188,116). Capitalised expenditures are measured at cost less any accumulated amortisation and any accumulated impairment losses.

Based on above picture, it shows the geographical area of VIC/P57 and VIC/L31.

The key assumption used to determine recoverable amount for VIC/P57 and VIC/L31 by HIBISCUS

For the VIC/P57,

(i) Discount rate of 11% (2015: 10%)

(ii) Exploration well costs of USD28 million for a 1,800 metres depth for oil well (based on an (iii) external independent consultant report)

(iv) Brent oil price of USD69.27, USD78.81 and USD78.81 per bbl for 2019, 2020 and 2021 respectively (2015: USD70.00, USD72.50 and USD75.00 per bbl for 2017, 2018 and 2019 respectively) and 2% premium to Brent oil prices.

During the previous financial period, the Group acquired an additional 5% interest in VIC/P57, increasing its interest in the permit to 55.1%. During the financial year, the exploration period for VIC/P57 has been extended to 9 January 2018.(second exploration wells) Further, with the acquisition of Gippsland Hibiscus, the Group’s interest in VIC/P57 increased by an additional 20% to 75.1%. The terms of the VJOA remain unchanged and hence the permit continues to be classified as a joint operation.

For the VIC/L31

(i) Discount rate of 10% (2015:10%)

(ii) 3 years projections from 2019 to 2021, First oil being achieved in July 2019

(iii) Total project capital expenditures of approximately USD69 million

(iv) Brent oil price of USD69.27, USD78.81 and USD78.81 per bbl for 2019, 2020 and 2021 respectively (2015: USD70.00, USD72.50 and USD75.00 per bbl for 2017, 2018 and 2019 respectively) and 2% premium to Brent oil prices

A production licence, VIC/L31, has been granted by the Australian authorities within the VIC/P57 permit on 5 December 2013. As at that date, Carnarvon Hibiscus had a 50.1% participating interest in VIC/L31. During the previous financial period, the Group acquired the remaining 49.9% interest in VIC/L31.

The Group acquired Anasuria Cluster with cash of RM31m , contingent consideration of RM1.4m and deferred consideration of RM81m. The value of the net assets at fair value on the date of acquisition is RM478m, but The group purchase Anasuria Cluster with RM114m. Therefore, the Group will recognize the profit of RM364m in the income statement in the future. (RM478m minus RM114m). This is because the value of net assets is greater than the purchase consideration.

Apart from this, deferred tax liabilities has been increased to the amount of RM390m in year 2016. That mean the government still not receive the tax money from the HIBISCUS group yet. Why the deferred tax liabilities increase so much in year 2016? Because acquired Anasuria Hibiscus.

The sales revenue boost up from RM15m in year 2015 to RM81m in year 2016. This is because the company acquired Anasuria Cluster. So, most of the revenue contributed by the subsidiaries of Anasuria Cluster.

For the newest quarter report of 2017Q1, sales revenue has been increased by 22244% from RM245k in the corresponding quarter as compared to RM54.7m in the current financial quarter. Increase in revenue due to the sale of oil and gas products from the Anasuria Cluster.

The net profit increased to RM80m because gain in tax of RM72m. Gain in tax because reversal of the deferred tax liabilities, Deferred tax liabilities relating to fair value of the identifiable assets and liabilities of the Anasuria Cluster recognised as at 30 June 2016 were measured at the tax rate expected to apply to the period when such liabilities are settled, based on the tax rate (and tax laws) that have been enacted or substantively enacted by the end of the reporting period.

Therefore, the net profit boost up can be considered as one-off gain (cannot keep earn the profit in the long-term).

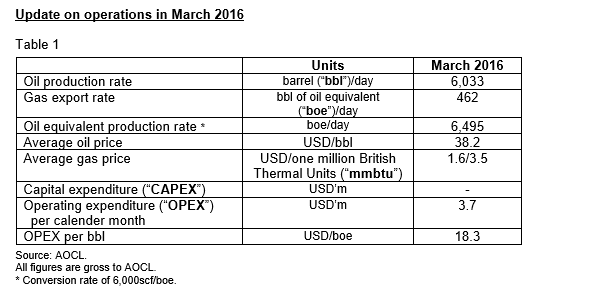

Compared March and September 2016, the oil production rate has been decreased by 3,001 bbl/day from 6,033 bbl/day in the March 2016 to 3,032 bbl/day in the September 2016. In addition, the gas export rate has been decreased by 88boe/day from 462 boe/day in the March 2016 to 374 boe/day in the September 2016. In the overall, the performance has been dropped but the average oil price has been increased by 18.35% from USD38.2/bbl in March 2016 to USD45.21/bbl in Sep 2016.

Conclusion, The group acquired Anasuria Cluster because Anasuria Cluster have 2 production license which is VIC/P57 and VIC/L31.

Risk: The revenue of the group might be suddenly decrease when the license at the expiry date.

The net profit boost up due to the one-off gain. Exp: negative goodwill from business combinations, reversal of deferred tax liabilities and others. The net profit increased isn`t healty and cannot sustain in the long-term.

The oil production rate of exploration wells has been reduced, the wells might be cannot produce oil as much as.

VIC/L31, first oil being achieved in July 2019, the revenue not recognized yet.

Benefit: Oil price keep increasing in the coming years.

If the license has been renewed and extend period of time.

VIC/P57 has been extended to 9 January 2018.

Noted: This post was prepared to be used solely for blogging purposes. It is not to provide investment advice or a solicitation of such an offer. As an investor, you should thoroughly research any security before making any investment decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on KLmorGan216

Discussions

Conclusion, The group acquired Anasuria Cluster because Anasuria Cluster have 2 production license which is VIC/P57 and VIC/L31.

not right

2016-12-26 14:56

Superbjet: May i ask why the group acquired Anasuria Cluster??

Is it because Anasuria Cluster have a lot of Property, Plant, Equipment??

Can u teach me? TQ...

2016-12-26 16:40

Ask Dr. Kenneth Pereira

Why not right? The group acquired Anasuria Cluster because Anasuria Cluster have 2 production license which is VIC/P57 and VIC/L31.

Anasuria Cluster was from Shell U.K. Limited, Shell EP Offshore

Ventures Limited and Esso Exploration and Production

UK Limited

Jurisdiction of VIC/P57 and VIC/L31 belong to the Australian authorities

2016-12-26 17:19

The March and September oil production differ by almost 50%. Could it be due to Anasuria is only 50% owned by Hibiscus ? Just curious to inquire about this. Thanks.

2016-12-26 22:51

Once the aquisition of the Shell fields in Sabah is approved, that will add a significant amount of producton. The 4 fields should increase hibiscus production 5x.

2016-12-28 16:48

2017 is for o&g stocks to rocket-up. Buy, keep, wait & u will rewarded handsomely

2017-01-01 18:27

https://www.facebook.com/StockInvestMalaysia/posts/10157940452095705:0 HIBISCUS PETROLEUM BHD is the next emerging stock! Today achieved new high at RM0.455! Trading volume more than 500k! Before cruel oil crisis, it more than RM3!

2017-01-05 07:19

@james wong: u will loss a lot of money if u like to play goreng counter...

2017-01-10 20:50

VenFx

Juz follow closely for their next qtr production.

Hibiscus may foresee the price hike post Opec cut.

Anyway, thanx to the highlighted pointing.

2016-12-26 12:24