Excel Force MSC (Defensive Yet Attractive)

Keithson Neoh

Publish date: Tue, 19 May 2015, 09:34 PM

Review

§ Excel Force MSC Berhad (EFORCE) is currently the market leader in Malaysia for the provision of financial services business solutions. With more than a decade of experience in offering information systems and services to the Banks and Stock-Broking Companies in Malaysia, EFORCE is the first IT Company in Malaysia to provide a total, comprehensive and market-proven business solution for the stock broking industry from Front Office to Back Office. Over the years, EFORCE have built up a considerable number of well-established Stock Broking customers as well as renowned Financial Institutions and have attained approximately 90% of stock broking Public Gallery Display System and 70% of Electronic Client Ordering System market share in Malaysia.

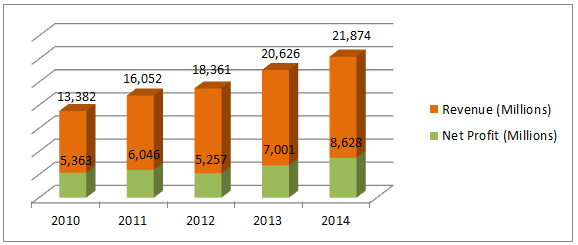

§ Eforce reported a full year FY14 Net Profit of RM8.6 million (-11.24% QOQ, +23.2% YOY). The decrease in net profit QOQ, mainly caused by the disposal of office amounting RM1.6 million (net expenses for bonus issue and warrants).

§ From previous year, Revenue rose to RM21.6 million (+5.8% YOY), mainly attributed by the increase in Application Service Provider (ASP) by RM1.61 million and Application Solution (AS) with a slight boost of RM424 K. On the other hand, Maintenance Segment revenue decreases by RM787 K.

§ Eforce revenue and profit have been growing steadily over the past 5 years in despite of the market volatility.

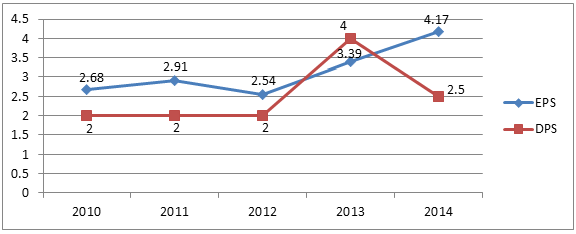

§ Eforce has been lying on a comfortable growth of average 10.33% CAGR over the past 5 years, and estimated to continue on a modest growth over the coming years.

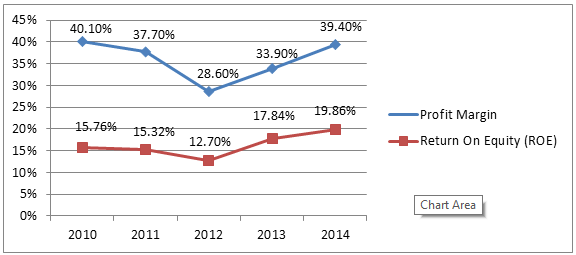

§ With an improving operational efficiency over years, EFORCE registered a 39.4% profit margin and 19.86% ROE closing FY14 with a tremendous improvement.

§ With the Current Payout Ratio of 60%, and DPS of 2.5 cent for FY14 the estimated Dividend Yield (DY %), is 4.1% based on current price of (RM0.605).

(EFORCE Balance Sheet, figures extracted from Annual Report)

|

Key Statistic (Millions) |

2012 |

2013 |

2014 |

|

|

|

|

|

|

Cash and Equivalent |

26.33 |

24.04 |

20.55 |

|

NCAV |

33.1 |

28.8 |

26.9 |

|

Total Asset |

47.4 |

43.5 |

54.5 |

|

Borrowings |

1.8 |

1.3 |

7.2 |

|

Shareholders Fund |

40.4 |

39.1 |

43 |

|

Book Value Per share |

0.20 |

0.19 |

0.21 |

|

Net Cash |

24.53 |

22.74 |

13.35 |

|

Total share outstanding |

206.77 |

206.77 |

206.77 |

|

|

|

|

|

|

|

|

|

|

Outlook

§ Existing EFORCE customer (Alliance Investment, Bimb Securities, Hong Leong Investment, Jupiter Securities, Kenanga Investment, Maybank Investment, Malacca Securities, Public Investment, RHB Investment, UOB Kay Hian) already captured 70% market shares of the Electronic Client Ordering System in Malaysia.

§ After a successful penetration in Thailand and Vietnam, next EFORCE will be focusing on the penetration of other Asian region (Hong Kong, Taiwan, Indonesia & China)

§ A bright prospect, as company in focus on enhancement, development, and implementation of their product to existing and new clients.

§ Eforce is sitting on a comfortable economic moat, a sustainable competitive advantage against its competitor N2N Connect.

§ Defensive business model, as changes in economic settings will not have a significant impact on company earnings.

Valuation

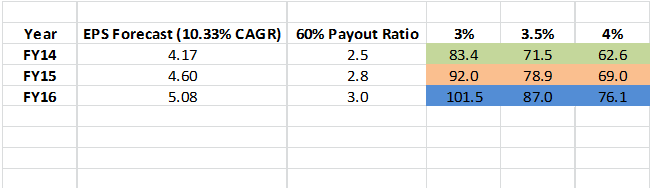

§ Target Price based on Dividend Discount Model Valuation

Current Price: RM0.605

Target Price 1: RM0.69

Target Price 2: RM0.79

Target Price 3: RM0.92

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on KlseTracker

Discussions

set objective to be capital or dividend play for eforce.selling decision rests on the objective.a good sharing.

2015-05-19 22:04

Keithson Neoh ,did u buy alot eforce?This is your first sharing.never see u here b4..now after go up so much..u say u cover this.U never contribue here before.now u want ti be the boss!!!

2015-05-20 00:24

Rosmah, don't know don't comment. Your comments no use at all. If got please show us your calculation

2015-05-20 06:47

Good sharing. However, cash is decreasing and borrowing is increasing. Mind sharing what they use the cash and borrowing for? But overall the BS is still neat and healthy.

2015-05-21 10:31

for technology company is very common... high expenditure on R&D. especially now during their expansion period. hopefully they are able to balance their gearing ratio...

2015-07-02 23:13

Keithson Neoh

http://klse-analytical.blogspot.com/

2015-05-19 21:37