Strongest Steel - Annjoo

warmblood

Publish date: Sun, 12 Feb 2017, 05:23 PM

2017 market is quite bullish after 1.5 months.

Had been awhile Market did not discuss about the Steel sector.

Basically in steel sector there are 2 major product -- long product (bar ) & flat product ( CRC )

Major Long product related company - Annjoo , Masteel , Ssteel , LionInd.

Major Flat product related company - Cscsteel , mycron , YKGI and etc

After Megasteel closure , Flat product had benefical alot by importing cheap HRC from oversea that lead them to higher margin but revenue remain flat or slighty downsize. Current share price of Flat stee product company is almost fair value.

Today we going to discuss about the long product related company,

There are few points for choosing Annjoo where

by comparing the Margin of the other steel (masteel , Ssteel and lionind), we going to choose for Annjoo due to it have the advantage of it super cool hybrid BF-EAF technology.

What so cool labout this hybrid BF-EAF technology ; there able to consumer less natural gas to operate where give them lowest impact when natural gas price hike; second this super cool furnace able to to opte the raw mat to feed into the furnace blast to produce the steel which mean Annjoo able to choose scrap material or iron ore as raw mat whenever which is cheaper they will purchase that. Currently there are using scrap steel due to cheaper source as IRON ORE price surge alot.

90% of its operational cost comes from a combination of raw materials, fuel and electricity, as well as logistics. This is why it lead Annjoo to have the highest margin among other competitor.

Annjoo also benefit from geographical location , where their plant is locate somewhere near to the port.

The reason not choosing Masteel and Ssteel are lower margin ; eroded by the increase of iron ore prices. Ssteel involved in wide range of product eventhough the revenue is higher than annjoo but there are possibility for ssteel to further write off the SHRC.??? All those employee on SHRC divisioin had switched to other department.

-- Beneficial from the ADD law by MITI http://www.miti.gov.my/miti/resources/Media%20Release/PR-ENG-PD_REBAR_SWR_vF.pdf.

Total of 13.40 for rebar steel. from 26th September 2016 for 200 days. Miti will review the ADD after 200 days.

Now let us look at the average rebar price for Q4 for Annjoo. (thanks to LEO )

And also the chart for China rebar steel price. lets took an average of 3100 for Q4 and convert to ringgit.

3100 x 0.65 (RMB) x 1.194 (import tax + ADD) = 2405. After logistic fee the China influxed steel rebar stand on the price range of 2300 - 2450.

Where Annjoo definately able to compete with the oversea steel. This will encourage the local customer to switch back to ANNJOO.

22-9-2016 Ann Joo price :-

22-9-2016 Ann Joo price :-

Y16-Y32 = 1,780

Y10-Y12, *R10*, Y40 = 1,930

Round Bar = 1,980

26/9 SSM

1850 Y16-32

2000 Y10,12,40,R10

2050 R6,8,12,16,20

29.9.16

Y16-Y32 = 1880

Y10-Y12, *R10*, Y40 = 2030

Round Bar = 2080

21.10.16

1830 Y16-32

1980 Y10,12,40,R10

2030 R6,8,12

03.11.16 (SSM)

1860 Y16-32

2010 Y10,12,40,R10

2060 R6,8,12

10.11.16(Ann Joo)

Y16 - Y32 = RM1880.

Y10, Y12, Y40 & R10 = RM2030.

R6, R8, R12, R16 = RM2080.

10/11 (Ann Joo)

Y16 - Y32 = RM1930.

Y10, Y12, Y40 & R10 = RM2080.

R6, R8, R12, R16 = RM2130.

16/11 (Ann Joo & SSM)

Y16 - Y32 = RM2080.

Y10, Y12, Y40 & R10 = RM2230.

R6, R8, R12, R16 = RM2280.

28/11 Monday. (Ann Joo,SSM & Amsteel)

Y16 - Y32 = RM2160.

Y10, Y12, Y40 & R10 = RM2310.

R6, R8, R12, R16 = RM2360.

29/11 (ANN JOO & SSM)

Y16 - Y32 = RM2200.

Y10, Y12, Y40 & R10 = RM2350.

R6, R8, R12, R16 = RM2400.

30/11 (Ann Joo & SSM)

Y16 - Y32 = RM2230.

Y10, Y12, Y40 & R10 = RM2380.

R6, R8, R12, R16 = RM2430.

1/1/17

1.RM2340(Y16,Y20,Y22,Y25,Y28,Y32)

2.RM2490(Y10,Y12,R10,Y40)

3.RM2540(R6, R8,R12,R16)

Profit prediction on Q4.

Q4 revenue not expect to increase so drastically due to local customer still clear up the inventory of the china stock and also Local customer wont build up high level of inventory due to Steel price increase (customer behaviour) .

So revenue expect to stand above 400 m to 500m while the Profit estimate will be around above 44 mil to 55 by taking 10- 12 profit margin.

EPS before diluted estimated to stand at 9 to 11. Annual EPS will be around 33- 36. by giving Pe of 8 - 10. Annjoo Price should stand on 2.7 - 3.3.

RISK -

-Weaken ringgit will give a some forex loss due to raw material is denominated by USD ?

-Cancellation of ADD , due to Ah jibby gor wanna bias to CHINA side.

Opportunity .

- Trump will execute and build the infrastruture - lead steel price continue to going up.

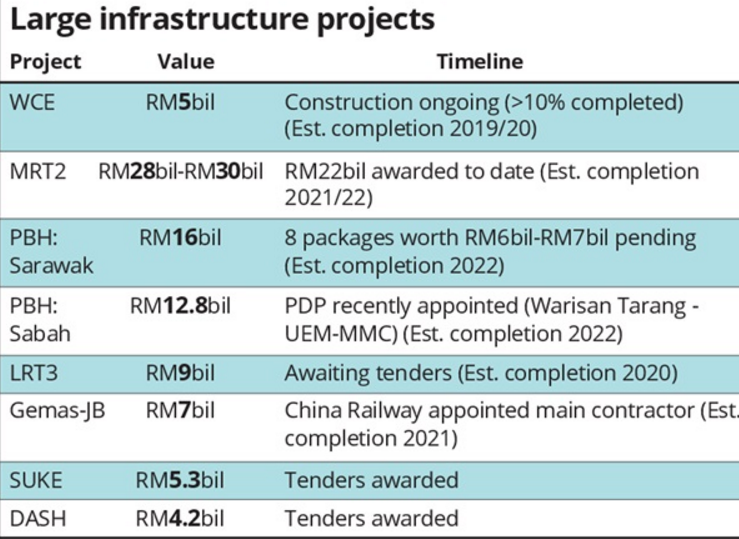

- ton of Construction project up coming in entire malaysia

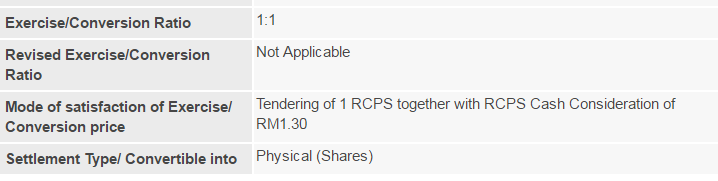

Most of the website state ANNJOO - PA exercise price is RM1.80.

But upon subcribe of the RCPS of Annjoo, shareholder already paid 0.50 for the Annjoo- PA.

The current PA price is 1.33 and mothershare 2.43. the premium is below 10 percent.

*most of the fundamental investor wont invest on ANNJOO nor Ssteel due to it poor balance sheet and cash flow. So please invest at your own risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Learn to Invest

Discussions

Now market sentiment is good, better buy 1 or 2 steel counters since steel prices has increased 30% from September to December last year. Another wave for steel will come anytime.

Recommended steel counters.

Long steel : SSTEEL

CRC : CSCSTEL and MYCRON

Distributor : AYS

2017-02-12 19:05

PE 10,

annjoo hit rm 3.50 not probrem,annjoo PA i think will hit rm 1.80 after finance result~buy and hold...

2017-02-12 19:54

"What so cool labout this hybrid BF-EAF technology ; there able to consumer less natural gas to operate where give them lowest impact when natural gas price hike; second this super cool furnace able to to opte the raw mat to feed into the furnace blast to produce the steel which mean Annjoo able to choose scrap material or iron ore as raw mat whenever which is cheaper they will purchase that. Currently there are using scrap steel due to cheaper source as IRON ORE price surge alot"

Are you really sure about this? I dont think so.

2017-02-12 21:48

Annjoo optionally run blast furnace or Eletric Arc Furnace. At the moment, still prefer blast furnace using iron ore and coal. They did collect a lot of steel scrap from the market in case iron ore hike over USD100

2017-02-13 13:26

moneySIFU

Thanks for sharing, a big like!

2017-02-12 18:53