Malaysia Stock Analysis – UWC (5292)

LouisYap

Publish date: Tue, 15 Oct 2019, 04:00 PM

Malaysia Stock Analysis – UWC (5292)

UWC - The best IPO new stock in 2019!

UWC is principally involved in the provision of precision sheet metal fabrication and value-added assembly services as well as the fabrication of precision machined components. And it is involved in semiconductors, life science and medical technology, and heavy equipment.

The company successfully listed on the stock market at RM 0.82 on July 10, 2019. And, the stock price jumped from RM1.10 and closed at RM 1.40 with a premium of 70%.

UWC can be considered the best performing IPO in 2019. UWC is included in the technology semiconductor sector and is a supportive technology stock with a current market capitalization of approximately RM 547 mil.

UWC's manufacturing services cover a wide range of metal processing, such as cutting, forming, joining, etc., to produce metal products, ranging from metal parts to precision machined parts.

These metal products were then used by UWC customers to produce a variety of finished products. The company also offers value-added assembly services. UWC dispenses metal parts into machine structures, metal casings and metal chassis, or completely assembles the finished metal products into finished products according to customer's design and specifications.

During the assembly process, UWC assists the customer in procuring the required raw materials and components, assembling into the product, and conduct testing to ensure that the assembled product operates as expected.

In addition, UWC works with customers on the initial design and development of products to reduce costs and shorten production cycles.

The company also provides inventory management to arrange production schedules based on customer needs and specified minimum inventory levels to ensure inventory is always available.

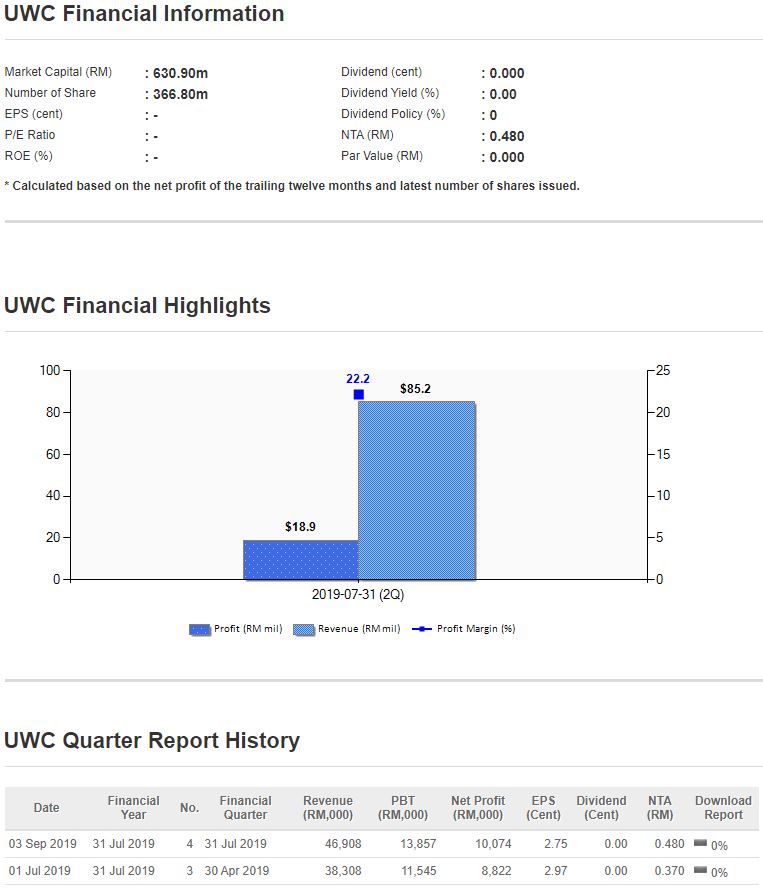

From FY2016 to FY2018, UWC's turnover is growing. However, FY2019 only released three quarters of results. Although the turnover is less than three-quarters of the turnover of FY2018, the semiconductor industry usually has a better prospect in the second half of the year, hence the turnover of FY2019 can be better than the previous year. As of FY2018, the company's turnover growth rate averaged 33.7% per year.

As for profit, FY2017's profit fell 23.4%, while FY2018's profit was more than twice that of FY2017, and the growth rate was amazing.

The profit of FY2019 was only announced for three quarters, but the total profit has almost caught up with FY2018. On top of that, the semiconductor industry usually performs better in the second half of the year. With this, UWC's FY2019's full-year profit is almost certainly better than last year.

The company's Gross Profit Margin is around 27%-32%, and the recent Gross Profit Margin has continued to improve.

Future Prospect:

Protégé Associates speculates that the market value of the Malaysian Engineering Supporting industry will grow at a rate of 6.9% per year and is expected to grow from RM 8.39 bil in 2018 to RM 11.73 bil in 2023.

The rapid development of technology is the main driving force for the increase in semiconductor demand, especially the development of 5G wireless broadband technology, providing a higher data transmission rate, which will stimulate the development of the semiconductor industry.

In 2018, the global population is about 7.63 billion people, of which 13% or nearly 1 billion people are over 60 years old. The global population is expected to grow to 9.77 billion in 2050, where nearly 2 billion people are over 60 years old. The ageing population will stimulate the life science and medical technology industries, and the demand for medical products will continue to increase.