Malaysia Stock Analysis – Sapura (5218)

LouisYap

Publish date: Thu, 24 Oct 2019, 11:14 AM

Malaysia Stock Analysis – Sapura (5218)

Sapura Energy Berhad ("Sapura") was founded in 2012 by Sapura Crest and Kencana, formerly known as SapuraKencana Petroleum Berhad. It is a support service provider for the oil and gas industry (oil industry).

The company's main services include installation of pipelines, auxiliary engineering, procurement, construction and commissioning, offshore support, maintenance and rental equipment.

Sapura is based on the upstream oil and gas industry, so it belongs to the “middle-stream” oil and gas company.

The company's main business:

1) Engineering, Procurement, Construction, Installation and Commissioning ("EPCIC")

2) Drilling Engineering Technology ("Drilling")

3) Exploration and Production ("E&P")

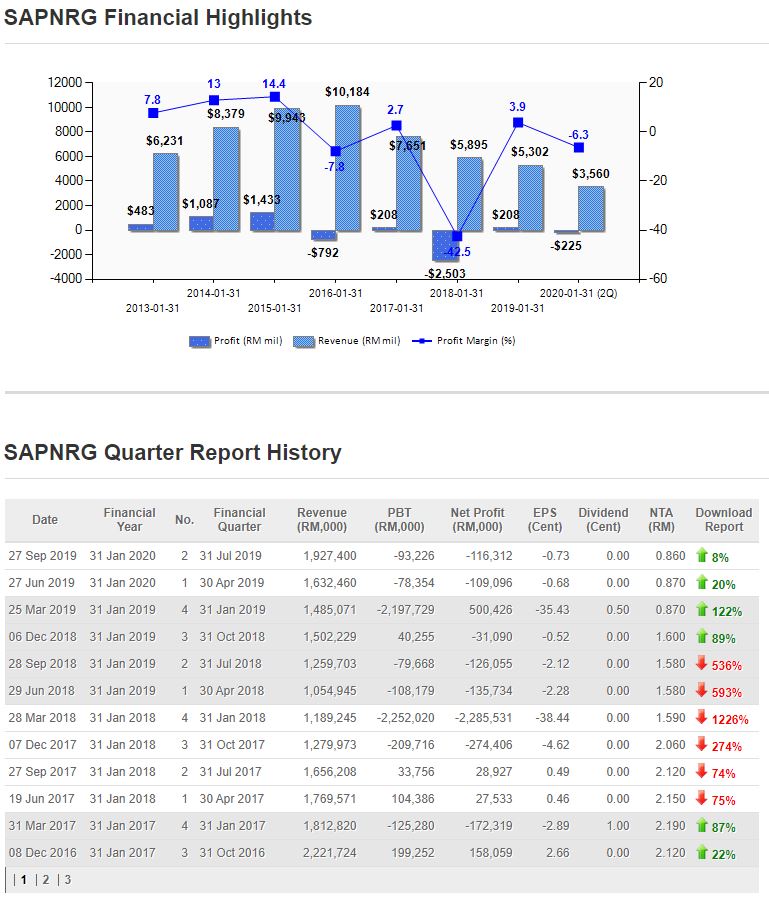

Company performance:

In the past 5 years, Sapura's turnover has continued to fall. In FY2019, the company sold half of its E&P business, so hence the next fiscal year, the E&P turnover will be reducing in contribution. In FY2019, the company's Utilisation rate is still low, and the company made an asset impairment of RM 1.5 bil, and on top of that, the operation cost and management fees have not changed much. And the high interest has burdened on the company bottom line profit.

The company from FY2016 to FY2019, a total of RM 6 bil of asset impairment, this action led to the company has been unable to return to the past peak performance. Excluding one-time impairment and profit, the company's FY2019 net loss is RM 0.9 bil, and the net profit per share (EPS) is minus 5 points, which has improved compared with FY2018.

The company invested a lot of money in FY2015 to expand because the oil price was at its peak. With the sharp drop in oil prices in the second half of the year, the company has reduce its investment expansion in the last few financial years.

Since 2018, oil prices have been adjusted back, so in the first quarter of FY2020, the company invested RM 0.05 bil to expand.

The company intends to expand in deep-sea areas and traditional land development zones in preparation for the opportunities arising from the recovery of the next oil and gas industry.

As oil prices continued to fall from the end of 2014 to 2016, affecting the company's performance, the company's share price was also affected, and oscillated between RM1.36 and RM2.00.

Oil prices were in a downward trend in the first half of 2017, so the company's FY2018 (February 2017 to January 2018) performance was not good, and then the stock price fell from RM1.27 to RM0.75 at the end of 2017.

In order to reduce the debt, the company announced that the stock price fell to RM0.35 after the announcement of the additional stock in August. After the completion of the additional shares, the stock price has reached a minimum of RM0.26.

Quarterly Performance:

Turnover: RM 1,927mil YoY up 86.7% QoQ up 18.1%

Net profit: loss RM 116mil YoY up 41.6% QoQ down 6.6%

Main Reason:

Compared with the same season last year

Sapura Energy recorded a turnover of 1,927mil, an increase of 86.7% compared to the same quarter last year. The main reason E&C business contributed to higher turnover.

The loss before tax was 93m, which was 41.6% lower than the loss in the same quarter last year.

Compared to the previous quarter:

Sapura Energy recorded a turnover of 1,927m, up 18.1% from the same quarter last year. The main reason E&C business contributed a high turnover

Loss before tax 93mil, 19% better than last year

Business details:

E&C recorded a higher turnover mainly due to more business activities and directly increased pre-tax profit.

Drilling also recorded higher turnover and also reduced losses.

As for E&P, the company has sold 50% of its shares.

Future Prospect:

The oil and gas industry is still in a challenging environment. The company's current Orderbook is RM 16.3bil, including the RM 3.1b contract from FY2020.

As for the Drilling business, this business has also received new contracts and extended two contracts for Sapura Berani and Sapura Pelaut.

The company will strengthen its resource capabilities to cope with larger business volumes and open up new markets and new customers. Management believes that the performance will be further improved.

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site: