The most undervalued plantation stocks

Toppick2019

Publish date: Sun, 09 May 2021, 09:39 AM

Valuation of plantation stocks - ranking by lowest PER to highest PER (latest list)

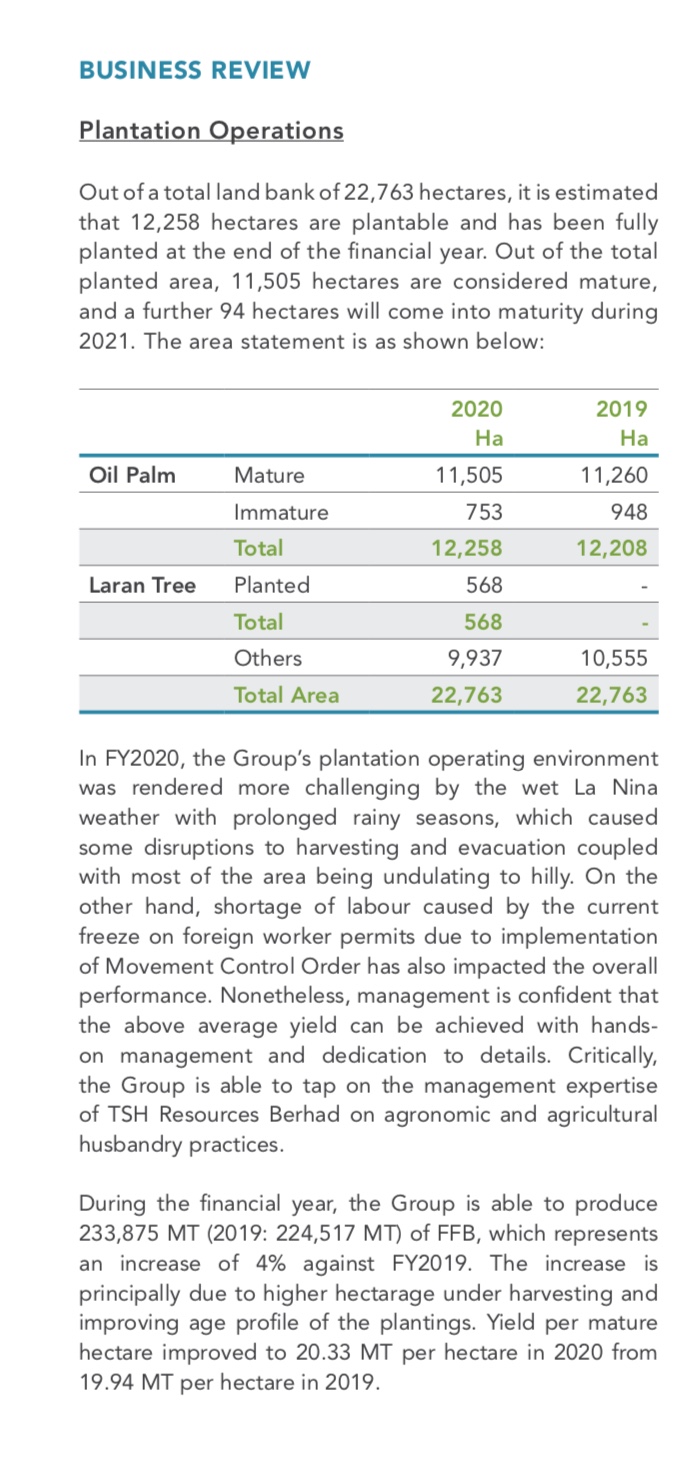

| Stock | Market Cap RM mil | Net profit | Trailing PER | DPS sen | Dividend yield (%) |

|

SWKPLNT |

708 |

61 |

11.6 |

10 |

4 |

|

UTDPLT |

5,844 |

360.3 |

16.2 |

85 |

6.1 |

|

INNO |

608 |

36.9 |

16.5 |

6.5 |

5.1 |

|

HSPLNT |

1,568 |

90.3 |

17.4 |

7 |

3.6 |

|

TSH |

1,658 |

79.1 |

21 |

2 |

1.7 |

|

IJMPLNT |

1,744 |

71.3 |

24.5 |

2 |

1 |

|

KLK |

24,345 |

962.8 |

25.3 |

50 |

2.2 |

|

SIMEPLT |

32,426 |

1,185 |

29.2 |

11.6 |

2.5 |

|

IOICORP |

25769 |

872 |

29.5 |

8 |

1.9 |

|

TAANN |

1,343 |

45.1 |

29.8 |

15 |

5 |

*Exclude companies with poor fundamentals/lossmaking/negative growth

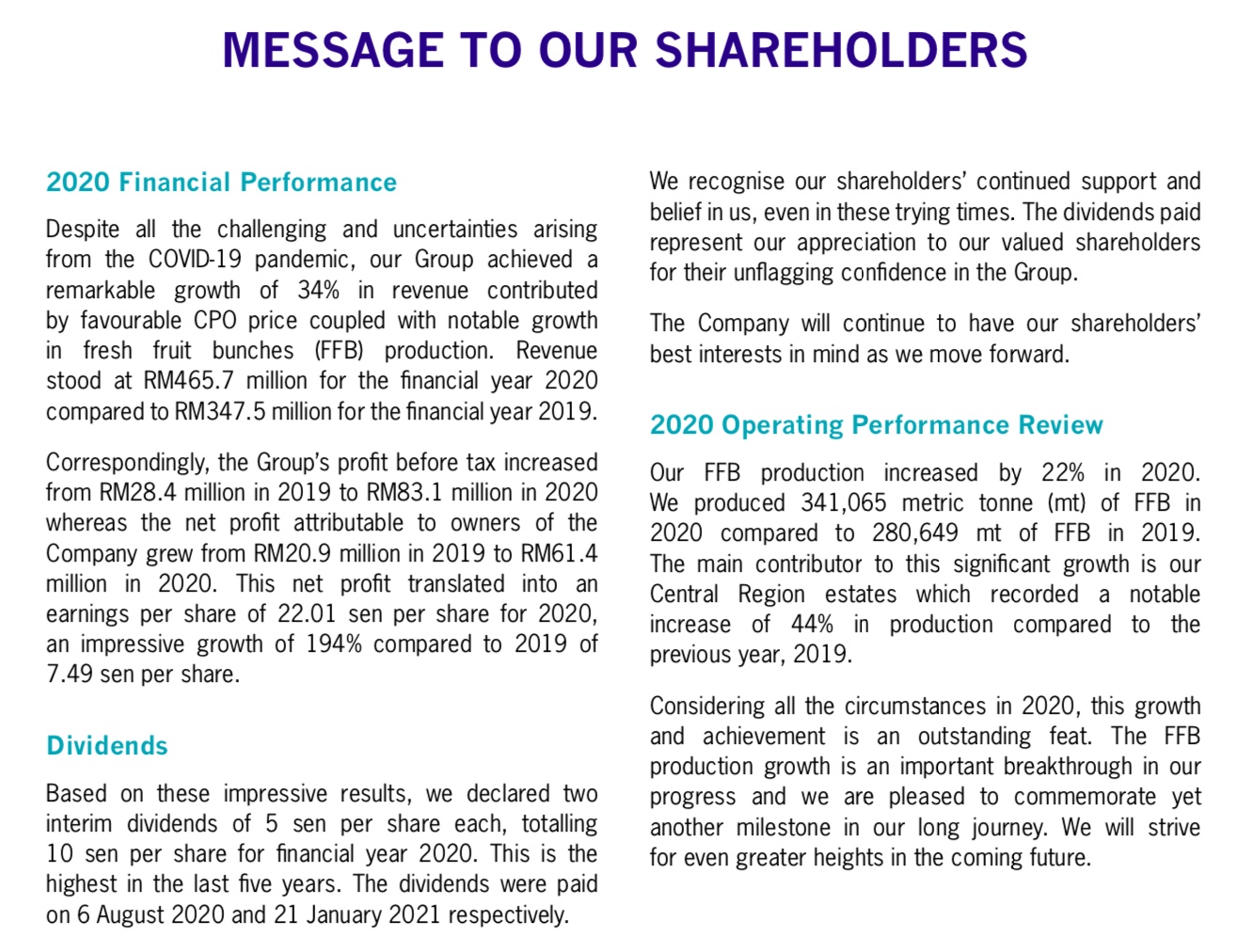

Most undervalued plantation stocks by trailing PER (2020 production growth)

1. SWKPLNT at 11.6x (production increase 22%)

2. UTDPLT at 16.2x (increase 7.7%)

3. INNO at 16.5x (increase 4%)

1. SWKPLNT (production increase 22%)

2. UTDPLT (increase 7.7%)

3. INNO (increase 4%)

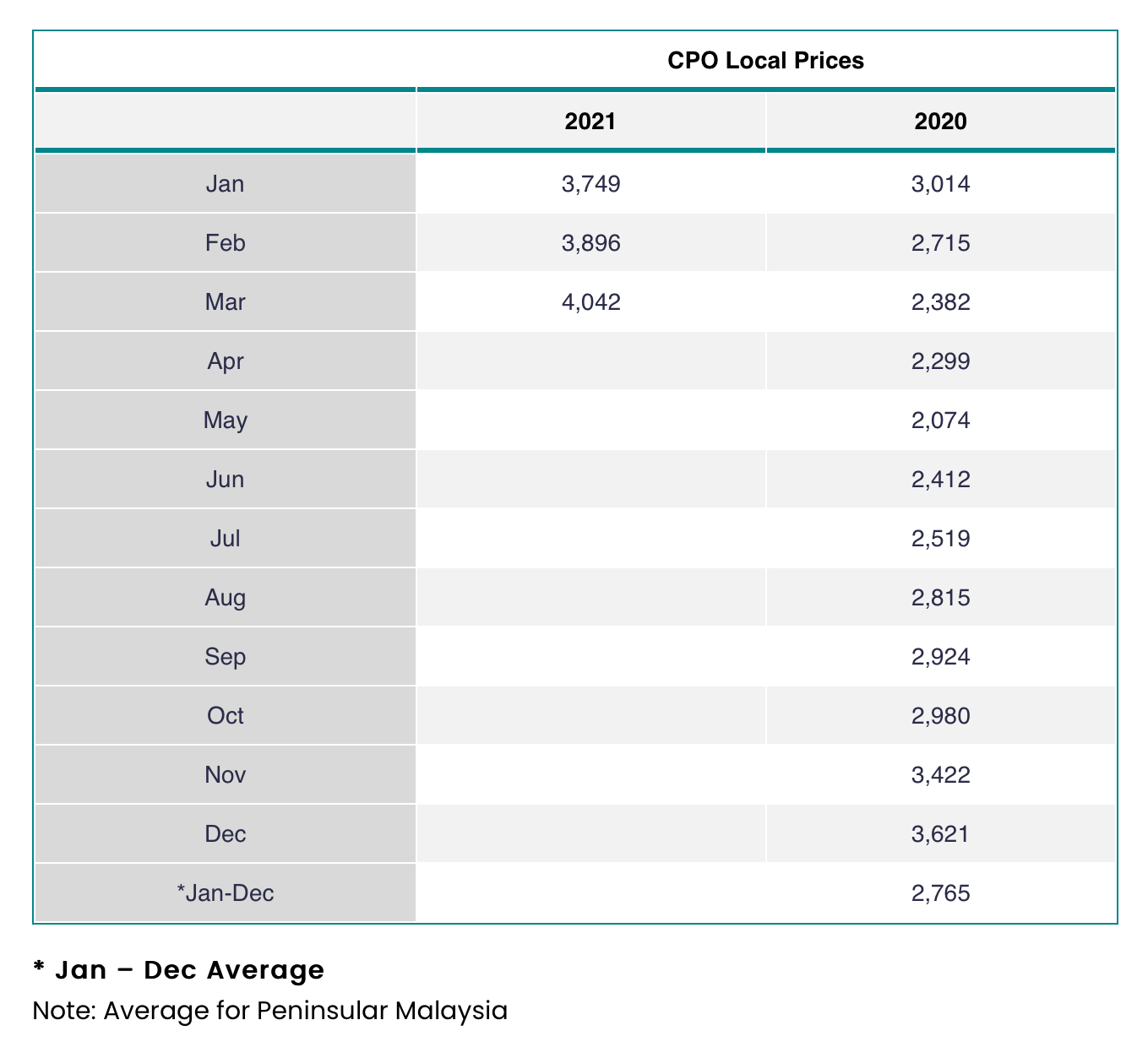

Windfall profits for plantation stocks

Plantation companies are very likely to make windfall profits in first 6 months of 2021.

Monthly average CPO prices are >RM3,800 per tonne in 1Q21, 41% more than the average RM2,700 per tonne in 1Q20.

| CPO@RM2,700 | CPO@RM3,800 | Change % | ||

| Sales | 2,700 | 3,800 | +41% | |

| Operating cost | 2,000 | 2,000 | ||

| Operating profit | 700 | 1,800 | +157% (3.8x sales growth) |

*Only applicable to Malaysia operations. CPO price in Indonesia is capped at RM2,700-RM2,800 per tonne by higher export duty.

For example, a plantation company will see operating profit increase 157% at average CPO prices of RM3,800 per tonne, assuming all-in operating cost of RM2,000 per tonne. Operating profit increase 3.8x sales growth because all the increase in CPO prices flow directly to the bottomline.

Monthly average CPO prices are ~RM2,300 per tonne in 2Q2020. As long as CPO prices remain above RM3,000 per tonne, plantation stocks will continue to make windfall profits.

Monthly average CPO prices

http://mpoc.org.my/monthly-palm-oil-trade-statistics-2021/

Disclaimer

All information provided here should be treated for informational purposes only. This is NOT a buy or sell recommendation. Do your own research or consult your investment advisor before you invest. It is solely reflecting author's personal views and the author should not be held liable for any actions taken in reliance on information contained herein.

More articles on Momentum play

Created by Toppick2019 | Nov 15, 2020

Discussions

Already confirmed palmoil plantation is going to make windfall profit ma!

Next is to make windfall gain on plantation stock price loh!

Jump in b4 too late loh!

Cpo at record rm 4700 per ton, the palmoil share price will go on rampage soon loh!

2021-05-09 11:18

Why windfall tax on palmoil & not gloves leh ?

U see palmoil is a commodity n it make use of msia natural resources like land & weather to make monies mah!

When there are super profit, the govt wants to tax on the windfall...loh!

The infra to tax more on palmoil is there mah!

Like having export tax...!!

Cess levy etc loh...!!

On top of that when palmoil do well...income tax is still being levy at existing rate the govt still collect more income tax mah!

Gloves...although it is a commodity...but it is an industrial product mah!

When super profit is make....they still pay high income tax...base on the proportionate tax rate applicable loh!

There is nothing to stop. msia govt..imposing more tax or windfall tax on gloves loh...but where do we stop from here leh ??

Then we should impose higher tax on telcos, banks, technology business as well whenever they make super profit meh ??

At the end base on this windfall policy the business men will see msia as a pariah country to do business with mah!

Thus they make invest else where loh!

They are no consistency & rule of law...if everytime, out of jealousy of people making more monies, The govt imposing new higher tax rate or windfall tax loh!

The good thing is the gloves realise there is need for social service...they have voluntary donated extra Rm 400m collectively to the msia govt for covid 19 fund loh!

Despite palmoil paying windfall profit to the Govt, palmoil plantation still make wind fall profit mah!

Posted by DickyMe > May 9, 2021 12:45 PM | Report Abuse

Plantation windfall profit??

Then it is alright to impose tax on windfall profit..

2021-05-09 12:52

U must understand loh...a weaker USD is a strong case for commodity to go up mah!

In that case investing plantation is the best hedge against inflation beside giving good cashflow in the form of dividend loh!

Thats the reason why bill gates/ w.buffet says investing in farmland or equivalent plantation mah!

Posted by pjseow > May 9, 2021 1:03 PM | Report Abuse

Miao Miao 7 , I tends to agree with you on the effect of US dollar downtrend due to huge QE by Biden . I remembered when Obama did a 2 trillion QE in 2009 and 2010 , our Ringgit strengthen from 3.8 to 3.0 . Last year D TRump did a 4 trillion QE . THis year Biden will do another 6 trillions money printing for pandemic , infrastructre and high tech investments .With oil price on the up trend our Ringgit will rise with respect to US Dollar . Unless Malaysia also print faster than US because of lower tax collections due to covid pandemic , our ringgit may remain at 4 level .

2021-05-09 13:10

Perhaps the author forgot one more small and beauty plantation co : TECK GUAN PERDANA BHD

PE less than 10

2021-05-10 11:54

Teck Guan, discovered by the Edge boss in Tong's portpolio, current PE 7.6.

2021-05-10 12:04

Ini bukan plantation...they cocoa crusher mah!

Posted by ValueInvestor888 > May 10, 2021 11:54 AM | Report Abuse

Perhaps the author forgot one more small and beauty plantation co : TECK GUAN PERDANA BHD

PE less than 10

2021-05-10 12:05

https://www.malaysiastock.biz/GetReport.aspx?file=AR/2020/6/29/7439%20-%201714524289412.pdf&name=Annual%20Report%202020%20(TGP)_compressed.pdf

They have both palm oil and cocoa plantation. All plantation companies also have mixed plantations lah...

2021-05-10 12:16

stockraider

Remember 2 of the world most richest & savvy investors w.buffet & bill gates like investing in farmland now mah!

U can emulate them now too mah....!!

Thats why the 2 richest savvy investors have taken note the point of concern that palmoil & commodity price cannot going up forever like the case of glove & eventually the commodity price will also fall 1 day mah!

To address this issue or concern w.buffet & bill gates, say buy farmland & palmoil plantation, even the commodity price fall, u still have great protection on the value of cheap plantation land & farmland mah..!

If u buy into cheap land, u have both margin of safety accorded by cheap land plus prospect of reaping great profit from high palmoil price loh!

Thus u should Quickly Buy into palmoil plantation now, b4 its price shoot up mah!

Time to be a little bit more contraian in view of mkt at reasonable high level mah!

Warren buffet says inflation is definitely coming in view of low interest interest and speculative sign such as bitcoin, rubbish stock price run up sky high and unrealistic stock valuation & expectation and now raw commodities price run up mah!

Bill Gates already bought alot of farmland at low in preparation & in anticipation for the coming armmagedoom coming mah!

Why would one the world tech best richest owner switch alot of his investment into farmland, this bcos farmland or value real estate if it is bought at reasonable low price, u cannot go wrong over longterm bcos the availability of land is limited, u cannot manufacture land like bitcoin mah!

Coming back to msia the equivalent to farmland is oil plantation, u still can get it real cheap & it is paying u reasonably good dividend loh...this is the best defensive & offensive play like bill gates and warren buffet had highlighted mah!

As calvin sifu said timber is at record price & palmoil at record price surely some optimism will spillover to plantation & timber share price mah!

But this up 1 to 2 sen is chicken feed mah, why up so little leh ??

Timber & palmoil share r suffering from lack of production mah and also huge impairment losses on its assets mah & previous falling share price mah!

Thus they are jittery on recovery of palmoil & timber share loh!! They want to see actual profit b4 jump in loh!!

That means if u base on profit...as indicator that means the share price will be lagging loh!

Then why promote Wtk leh ??

1. The owner , directors and insiders already accumulating quietly without fanfare mah!

2. The palmoil & timber production volume of wtk, mhc, jtiasa, boustead, ijm plant already creeping up loh...this is further support by the record price of its commodities. Just imagine u have higher prices & higher volume....that will be a very important sign of higher big profit coming mah!

3. The share price already corrected over 3 yrs of downtrend previously, when there is a big shakeout of all the weak holders...u can only grow more optimistic as time past by loh!

4. Wtk is sitting on some prime land that invested at a very low cost near major town & city, they are good development mah!

5. With all the liquidity & quantitative easing & low interest rate environment, u can see big inflation will be coming loh...!! Wtk in commodities business plus very big cheap land bank is a very good inflation protector mah!

Based on the above i think wtk , jayatiasa & ijmplant is the best pick to make profit & this is concur by sifu calvin findings also mah!

Posted by pjseow > May 8, 2021 6:08 PM | Report Abuse

Calvin and Ahbah , Investment timing is very important and be at least medium and long term horizon . Dont buy at the peak . Gloves stocks had came down 50 to 60 % from the peaks in August last year . I did not promote glove counters then because the earnings were still not proven , PE were high . Glove stock prices peak before its ASP peak . There was a 9 months to a year lead of the share prices over its ASPs . Glove stocks had finally PROVEN to deliver fantastic results in the last 3 qtrs after August 2020 while their prices came down 50 % . THeir PE are less than 5 while they will continue to deliver superb results in the next few years with double and tripling of capacities . The palm oil price cannot keep going up forever since it started picking up 2 years ago in 2019 .Likewise , the oil palm counters will peak soon or already peak now before its palm oil ASP peak which may happen in 3 to 6 months time or even earlier . When palm oils ASP came down finally , do the plantation counters have doubling of capacities to compensate for the drop in ASPs ?

2021-05-09 11:13