Suria Capital Holdings Bhd - Rewarding Shareholders

MalaccaSecurities

Publish date: Wed, 05 Dec 2018, 10:31 PM

Highlights

- Suria Capital Holdings Bhd’s (Suria) has proposed a bonus issue of up to 58.3 mln new shares on the basis of one bonus share-for-every five existing shares held on the entitlement date to be determined later.

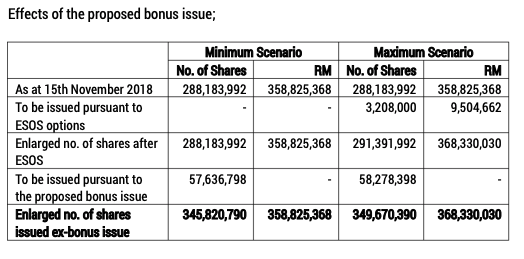

- As at 15th November 2018, Suria's share capital stood at RM288.2 mln comprising 288.2 mln shares and 3.2 mln outstanding options granted under the employees’ share scheme (ESOS). Assuming all the outstanding ESOS options are exercised prior to the implementation of the proposed bonus issue, 58.3 mln bonus shares will be issued.

- This will result in an enlarged issued share capital of up to RM368.3 mln comprising 349.7 mln shares. (see below). The proposed bonus issue is expected to be completed by 31st January 2019.

Valuation And Recommendation

We are positive on the proposed bonus issue announcement. The aforementioned corporate exercise serves as a reward for Suria’s existing shareholders and it will also improve the trading liquidity of Suria’s shares. Current 3-months average daily traded volume stood at 27,448 shares, representing an average of only 0.01% of the total no. of shares in issue.

There are no changes made to our earnings forecast. Therefore, we maintain our BUY recommendation on Suria with an unchanged target price of RM2.20 (ex-bonus adjusted price of RM1.83). We continue to like Suria for its position as the leading port operator in Sabah, having secured long-term concession agreements with Sabah State Government until 2034 (with an option to renew for another 30 years) and a relatively large-scale expansion plan in the pipeline.

We value Suria through a sum-of-parts (SOP) approach as we valued both its port operations and property development segments on a discounted cash flow approach (key assumptions include a WACC of 8.5%, terminal growth rate of 1.5%) to reflect its ability to generate recurring revenues and steady earnings growth over the longer term.

Source: Mplus Research - 5 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024