Mplus Market Pulse - 13 Nov 2024

MalaccaSecurities

Publish date: Wed, 13 Nov 2024, 10:02 AM

Corporate Earnings Will Be The Primary Focus

Market Review

Malaysia: The FBMKLCI (-0.05%) ended flat, as gains in the Banking and Plantation heavyweights were offset by losses in the Industrial Products & Services heavyweights; the latter declined in view of analysts' underweight stance on PCHEM, which may have spurred selling pressure in the sector.

Global markets: While Wall Street closed lower, Treasury yields climbed, and the Dollar Index hit a fresh high ahead of the release of CPI data, which could influence the rate-cut decision in the FOMC meeting going forward. Meanwhile, both the European and Asian markets closed on a negative note.

The Day Ahead

The FBMKLCI ended flat as selling pressure persisted on selected index heavyweights, though Banking and other heavyweight stocks were mostly positive ahead of their respective earnings releases. Meanwhile, a Trump 2.0-induced rally on Wall Street lost steam, as profit-taking activities emerged as most positive catalysts, such as (i) lower corporate tax rates and (ii) higher tariffs on trade deficit nations, largely priced in. We believe the focus will shift back to the US earnings season. Market participants will also closely monitor key economic indicators, including (i) CPI, (ii) PPI, (iii) Retail Sales, and (iv) Malaysia's 3Q2024 GDP data. In the commodities market, Brent crude oil traded flat after OPEC+ cut its forecast for global oil demand growth next year. Gold prices retreated further to USD2,598 as the dollar gained momentum. The CPO price remains above RM5,000.

Sector Focus: We believe export-oriented sectors such as Technology and Gloves will benefit from a stronger dollar environment. While CPO prices have retreated on a slower export pace, we maintain a positive outlook on the Plantation sector in the near term, supported by Indonesia's higher biodiesel mandates, which will likely bolster CPO prices. Also, selected Construction, Property, and Building Materials stocks are expected to gain momentum ahead of their earnings releases.

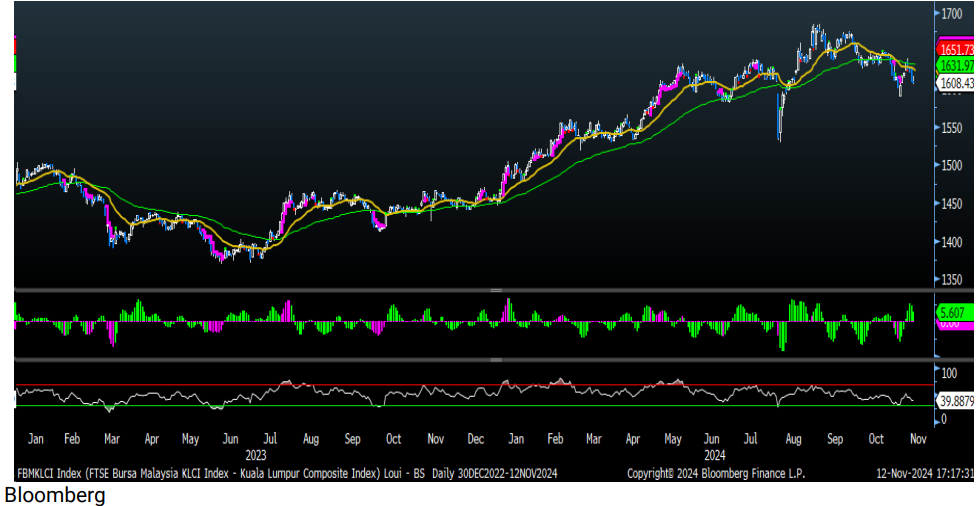

FBMKLCI Technical Outlook

The FBM KLCI index closed lower towards the 1,608 level. Meanwhile, the technical readings on the key index were mixed, with the MACD histogram formed another positive bar, while the RSI trended below 50. The resistance is envisaged around 1,623-1,628, and the support is set at 1,588-1,593.

Company Briefs

Malayan Banking Bhd (MAYBANK) is considering options including buying out Ageas SA’s minority stake in Etiqa, as Malaysia’s biggest lender seeks to boost the value of the Southeast Asian insurer, according to people with knowledge of the matter. Maybank, as the Bursa Malaysia-listed lender is known, may also seek to replace Belgium insurer Ageas with another minority investor, said the people, asking not to be identified as the deliberations are private. Maybank owns 69% of Etiqa, while Ageas holds the remaining 31%. A potential deal could value Etiqa at as much as US$4bn (RM17.72bn), the people said. Other options include renegotiating existing bancassurance agreements to help distribute insurance products, they added. Deliberations are ongoing and no final decisions have been made, the people said, adding that Maybank could decide against pursuing any transaction. (The Edge)

Hartalega Holdings Bhd (HARTA) saw its net profit fall 69% in the second quarter as export revenue declined with the rising ringgit while raw material costs surged. Net profit for the three months ended Sept 30, 2024 (2QFY2025) was RM8.63m. The company would have made a pre-tax loss of RM47.45m without deferred tax income from incentives for capital investments for its domestic expansion. Revenue for the quarter surged 44% year-on-year to RM652.07m, thanks to higher volume. It declared a first interim dividend of 0.56 sen per share, payable on Dec 11. Headwinds persist for the industry due to ongoing global oversupply even as the sector continues to undergo “supply-chain stock adjustments and move towards equilibrium”, Hartalega flagged. (The Edge)

Heineken Malaysia Bhd's (HEIM) net profit jumped 28.6% to RM112.29m in the third quarter ended Sept 30, 2024 (3QFY2024), from RM87.33m a year earlier, lifted by higher revenue and effective cost management. The brewer's quarterly revenue grew 3.2% to RM618.99m from RM599.66m in 3QFY2023. No dividend was declared for the quarter. For 9MFY2024, its net profit rose 13.3% to RM325.89m from RM287.73m in 9MFY2023, while revenue grew 3.4% to RM1.97bn from RM1.91bn, driven by effective execution of its Chinese New Year campaign in the first quarter. (The Edge)

Construction and engineering firm Kelington Group Bhd (KGB) has reported a 3.94% increase in its third quarter net profit to RM32.92m from RM31.67m a year earlier, thanks to higher gross profit margin driven by a "strategic focus on revenue composition", favourable project mix and higher contributions from the industrial gases division. The higher profit was achieved despite a 23.52% year-on-year fall in quarterly revenue to RM307.31m from RM401.82m as several major projects in Singapore and Malaysia had transitioned out of their accelerated phases and are nearing completion. It declared a third interim dividend of two sen per share, payable on Dec 23. (The Edge)

Logistics and warehousing services provider Tiong Nam Logistics Holdings Bhd (TNLOGIS) has declared a share dividend to reward its shareholders, on the basis of one treasury share for every 40 existing shares held. The share dividend will involve the distribution of up to 12.9m treasury shares to all shareholders of Tiong Nam. The ex-date for the dividend is Nov 26, and the shares will be credited on Dec 18. (The Edge)

The reason Fajarbaru Builder Group Bhd (FAJAR) pulled out from participating in the affordable housing development in Putrajaya dubbed Residensi Cemara, which is estimated to have a gross development value of RM192m, was that it had deemed the project "not sustainable" following a change in requirements. (The Edge)

Paragon Globe Bhd (PGLOBE) has secured the rights to develop 67.42 acres of land in Iskandar Puteri, Johor, for a residential project with an estimated gross development value of RM733.12m. The development rights were obtained through an agreement between the group’s unit Paragon Globe Properties Sdn Bhd and Iskandar Capital Sdn Bhd. This grants the Johor-based property developer the rights to develop two prime freehold parcels: an 11.5-acre site about 450m from Jalan Ismail Sultan and a 55.92-acre site about 450m from Lebuh Kota Iskandar. The project, which marks its entry into the landed property market, will feature 340 properties, comprising 324 semi-detached houses, two bungalows, and 14 bungalow land lots. (The Edge)

Atlan Holdings Bhd's (ATLAN) 75.53%-owned unit Duty Free International Ltd (DFIL), which is listed on the Singapore Exchange, said it is not satisfied with the RM69.9m compensation for two pieces of land in Bukit Kayu Hitam, Kedah, that Malaysia's Ministry of Home Affairs (KDN) has compulsorily acquired for a road construction project. The lands were being acquired by KDN is for a new road alignment to connect the Bukit Kayu Hitam ICQS Complex in Kedah to the CIQ Sadao facility in Thailand. (The Edge)

Seremban Engineering Bhd (SEB) has been served with a counterclaim for RM24.94m in a lawsuit related to a manufacturing plant project in Bandar Enstek, Negeri Sembilan. The counterclaim was filed by CN Eleco Engineering Sdn Bhd in a follow-up to the original suit filed by MIE Industrial Sdn Bhd, a majority shareholder of SEB with a 69.7% stake, against CN Eleco. MIE, in the main suit, is accusing CN Eleco of breaching its contractual obligations with regards to the 'Big Blue Project' at Bandar Enstek awarded by Dutch Lady Milk Industries Bhd (DLADY) in April 2022. MIE is claiming RM21.14m in back charges from CN Eleco for the alleged breaches. In the counterclaim, CN Eleco contended that there was no breach on its part and alleged that the back charges are unwarranted and an afterthought by MIE. CN Eleco is also alleging conspiracy by SEB and MIE to injure its business. SEB said the High Court has set Nov 21 for case management. (The Edge)

Sapura Energy Bhd (SAPNRG) has accepted the terms and conditions set forth by its multi-currency financing creditors for the proposed disposal of its 50% stake in SapuraOMV Upstream Sdn Bhd to TotalEnergies Holdings SAS for US$705.3m (RM3.37bn). Among the conditions is that net proceeds from the disposal will be held in a segregated account held by Sapura Energy’s unit Sapura Upstream Assets Sdn Bhd (SUA) at either Maybank or Maybank Islamic Bank Bhd. SUA will then create a first ranking fixed charge or priority claim over the net sale proceeds and the segregated account in favour of Maybank Investment Bank as the security agent for the MCF creditors. The charge will remain in place until the restructuring process is finalised, with the funds designated to pay down Sapura Energy’s debt as part of its ongoing debt restructuring plan. (The Edge)

Automotive parts manufacturer MCE Holdings Bhd (MCEHLDG) plans to raise up to RM26.5m via a private placement of shares to partly finance a new manufacturing factory in Serendah and projects it has secured. The placement will involve up to 18.53m new MCE shares or 10% of its total number of issued shares at an issue price to be determined later. (The Edge)

Jati Tinggi Group Bhd (JTGROUP), which was listed on Bursa Malaysia’s ACE Market in December last year, plans to raise RM14.1m via a private placement to fund new projects. The cash-call involves the issuance of up to 39.18m new shares, representing up to 10% of the company's issued shares, to third party investors at an issue price to be determined later. (The Edge)

Source: Mplus Research - 13 Nov 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-21

FAJAR2025-01-21

FAJAR2025-01-21

FAJAR2025-01-21

FAJAR2025-01-21

FAJAR2025-01-21

HARTA2025-01-21

HARTA2025-01-21

JTGROUP2025-01-20

FAJAR2025-01-20

HARTA2025-01-20

HEIM2025-01-20

JTGROUP2025-01-20

KGB2025-01-20

KGB2025-01-20

MAYBANK2025-01-20

MAYBANK2025-01-20

MAYBANK2025-01-20

SAPNRG2025-01-17

JTGROUP2025-01-17

JTGROUP2025-01-17

JTGROUP2025-01-17

MAYBANK2025-01-17

MAYBANK2025-01-16

KGB2025-01-16

MAYBANK2025-01-16

MAYBANK2025-01-16

MAYBANK2025-01-15

ATLAN2025-01-15

ATLAN2025-01-15

ATLAN2025-01-15

ATLAN2025-01-15

FAJAR2025-01-15

HARTA2025-01-15

HARTA2025-01-15

MAYBANK2025-01-15

MAYBANK2025-01-14

HARTA2025-01-14

HARTA2025-01-14

PGLOBE2025-01-14

SAPNRG2025-01-14

SAPNRG2025-01-14

SAPNRG2025-01-13

HARTA2025-01-13

HARTA2025-01-13

MAYBANK2025-01-13

MAYBANK2025-01-13

SAPNRGMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Jan 08, 2025