M+ Online Research Articles

Technical Focus - Healthcare sector

MalaccaSecurities

Publish date: Mon, 15 Jun 2020, 04:51 PM

Time to Gloves-Up again

- Rising number of Covid-19 cases (close to 8.0m cases and over 400k deaths) continues to pose a stumbling block to the global economy recovery. Several part of the world saw the number of hospitalisations spiked in recent days has also sparked concern over a potential second wave of infection.

- In view of the renewed concern over second wave of Covid-19, we reckon that glove players may return to the spotlight. The recent slide towards near their margin capping price suggests that the pullback may be near tail end. Also, demand for healthcare related products and services are expected to increase overtime.

Trading Catalyst

- Comfort Glove Bhd currently runs 49 production lines housed in two manufacturing plants in Simpang and Matang, Taiping, Perak with total capacity of 430.0m pieces of gloves per month. Moving forward, the group aims to ramp up their production via the expansion of a new production plant that will house six production lines to produce additional 60.0m pieces of gloves per month upon completion. Financial wise, Comfort’s net profit jumped 94.3% YoY to RM16.3m on the back of higher productivity from new lines that captured the higher demand.

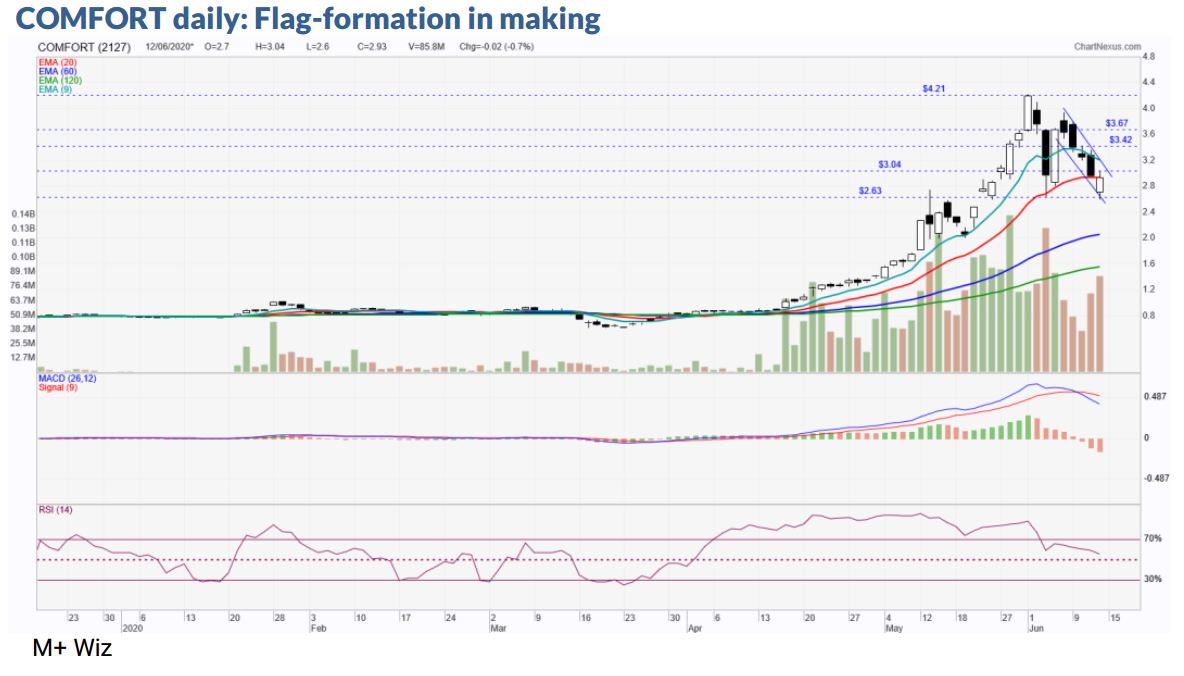

Technical Outlook

- The meteoric rise in share prices was halted by the margin capping by brokers as price subsequently pullback since the start of the month. After four consecutive days of retracement, we are anticipating for a potential flag-formation breakout above the RM3.04, targeting the next resistance of RM3.42-RM3.67 with long term target at RM4.21. Support is set at around RM2.63, while cut loss point at RM2.59.

Trading Catalyst

- Rubberex Corporation (M) Bhd (Rubberex) has since turnaround their position after disposing their loss making manufacturing operations in China back in 2018. Rubberex currently has production capacity of approximately 1.0bn pieces of nitrile gloves per year and is on track to increase double their capacity by additional 1.0bn pieces in coming months to capture the surge in demand. The capacity expansion is funded by the recent completion of private placement last month.

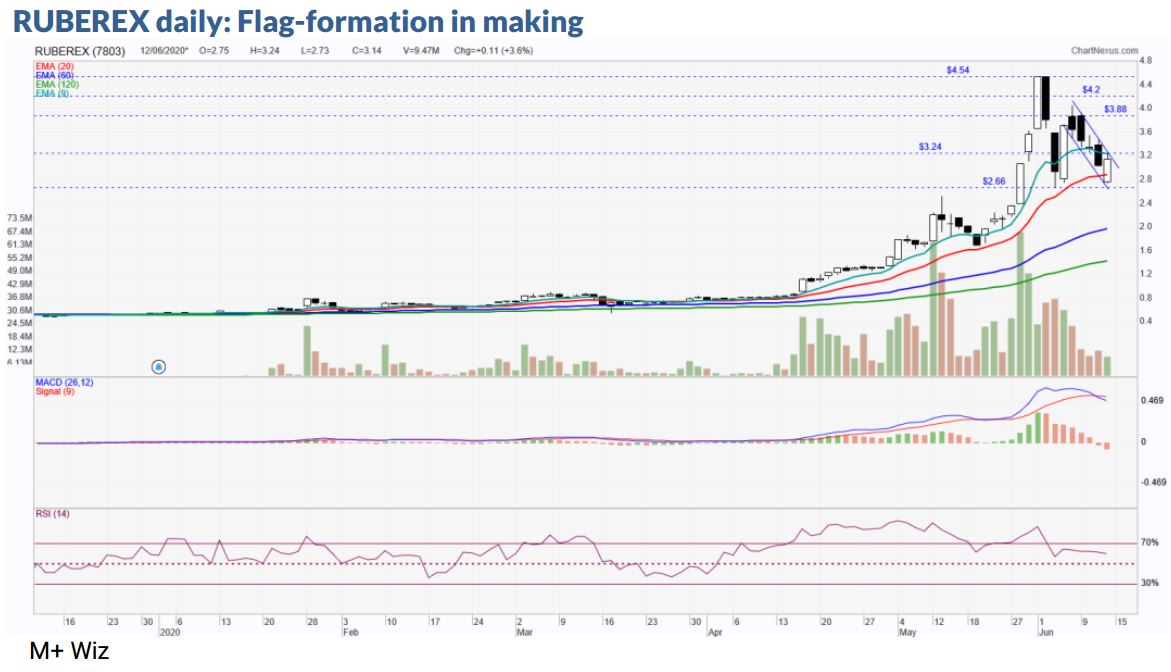

Technical Outlook

- In a similar move, Rubberex’s share price has staged a pullback towards the EMA20 level at the start of the month in tandem with the retreat across glove makers companies. After four consecutive days of retracement, we are anticipating for a potential flag-formation breakout above the RM3.24, targeting the next resistance of RM3.88-RM4.20 with long term target at RM4.54. Support is located at around RM2.66, while cut loss point at RM2.65.

Source: Mplus Research - 15 Jun 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on M+ Online Research Articles

Richtech Digital Bhd - Reload The Journey Of Future Growth

Created by MalaccaSecurities | Jan 24, 2025

mf

time to up or time to down

2020-06-15 19:49