Doubling in returns beyond IPO!! What’s next for Synergy House (KLSE: 0279)?

Vista99

Publish date: Sun, 31 Mar 2024, 02:47 AM

Early investors of Synergy House Bhd (KLSE: 0279) are surely laughing at the bank as the cross-border e-commerce furniture distributor had delivered substantial returns of 89.8%* since their IPO in June 2023.

*Inclusive 2 dividends payment of RM0.006 and RM0.010.

Financially, Synergy had been delivering remarkable QoQ growth since their IPO. The company registered PAT of RM2.62 million, RM6.19 million, RM8.07 million and RM10.27 million from Q1FY23 to Q4FY23 respectively. Bear in mind where in the corresponding period, we are seeing a slowdown of business from local furniture makers.

The business-to-consumer (B2C) plays a big part in contributing to Synergy’s success. According to an interview of Synergy with The Edge, the company mentioned that they expects to maintain an annual revenue growth rate of at least 30%, as they were tapping into the growing demand of the United States and the United Kingdom market.

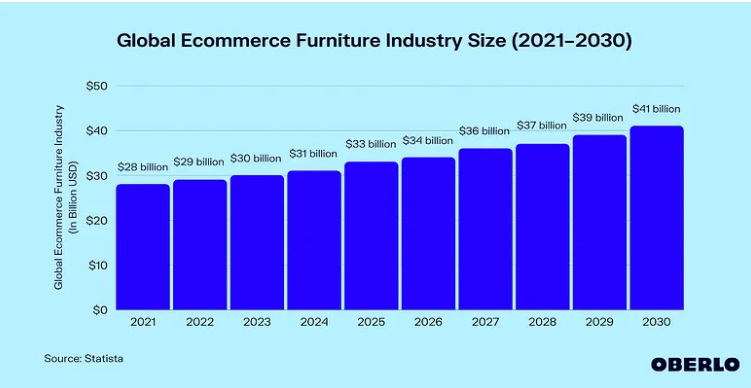

According to Oberlo, the leading application to assist dropshipper to identifying products to sell and Statista, the global e-commerce furniture industry is likely to show a total sales of $30 billion in 2023, marking an annual increase of 3.4% from the previous year.

But looking ahead, e-commerce sales are expected to rise by 3.3% in 2024 to $31 billion, before increasing another 6.5% in 2025 to $33 billion, which makes sense as we are seeing lower inventory glut in the United States market.

Synergy had first started selling on Wayfair US in 2020, followed by Wayfair UK, Amazon and Amazon UK in 2022. The company is also expanding into Mano Mano, eBay Uk, Cenports US, Wayfair Canada and Wayfair Germany thereafter. These regions are relatively “fresh” for the local furniture industry, as managing an e-commerce distribution business is a completely different ball game.

Moving forward, Synergy will continue to expand into Amazon Germany, Amazon Canada, Amazon France, and Mano Mano France, given the untapped potential of these regions.

Note: Synergy does not manufacture any furniture in-house, hence would see lower fixed costs.

In the past 3 years, Synergy had invested over RM2.2 million in IT infrastructure and market intelligence software to identify the next desirable furniture design and product. As of now, Synergy has over 2,000 Store Keeping Unit (SKU) compared to 1,608 in 2023, where most of their products are priced below $300 as their pricing strategy.

Most notably, RHB Research also quoted a RM1.08 in terms of target price to Synergy, where the potential upside here could be approximately 35.0% for investors to reap.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Income

https://youtube.com/shorts/wcVy0bxZvgY?si=3oyqggi2yCIekXdS

2024-04-02 10:55