Ranhill’s Energy segment bearing fruit

winsenlim68

Publish date: Mon, 28 Nov 2022, 04:27 PM

MIDF had an update report on Ranhill and I find it very informative. It explained that the company may potentially benefit from Sabah’s ongoing power issue.

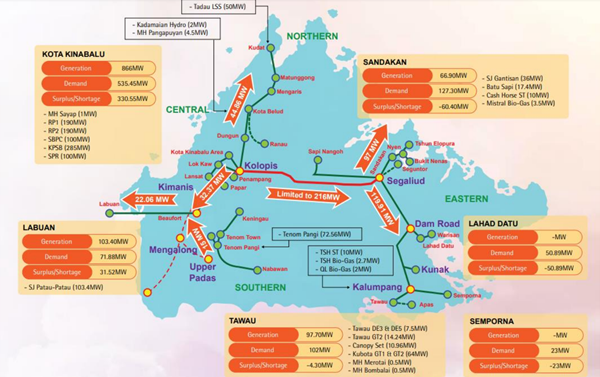

For some who may not know, there is an ongoing mismatch in power supply between West Sabah and East Sabah.

| | West Coast | East Coast | Total |

| Dependable Capacity (MW) | 1048 | 219 | 1267 |

| Peak Demand (MW) | 702 | 344 | 1046 |

| Reserve Margin | 49% | -38% | 23% |

Source: MIDF

As you can see from the diagram above, the current transmission line capacity can only transfer 216MW, resulting in a shortage in a certain area. As such, upgrade works are being undertaken to improve the transmission line to 400MW which translates to an increase of 85% capacity.

At the moment, Ranhill’s capacity is as such:

RP1 | FY19 | FY20 | FY21 |

Equivalent availability factor | 95% | 93% | 93% |

Unplanned outage | 1% | 3% | 2% |

Capacity factor | 77% | 69% | 69% |

RP2 | FY19 | FY20 | FY21 |

Equivalent availability factor | 94% | 96% | 98% |

Unplanned outage | 3% | 3% | 2% |

Capacity factor | 64% | 69% | 71% |

Source: MIDF

You may notice there is ample room for Ranhill to ramp up its current capacity. According to the MIDF report, every 10% improvement in capacity factor would improve the company’s earnings by RM3.5 mil/year. This roughly translates to about 10% increase in their earnings based on FY21 results.

At the same time, MIDF also mentioned that Ranhill is tendering an additional 100MW CCGT power plant in Sabah. If Ranhill successfully wins the bid, the company will have a total of 480MW capacity in Sabah, putting them as the biggest IPP in Sabah.

Another important highlight from MIDF report is that Ranhill’s LSS4 project is on track and targeted to complete ahead of schedule by September 2023 vs the deadline of December 2023. As a result, the PPA extension granted by the Energy Commission is expected to benefit Ranhill. All in all, the company’s energy segment seems to be on track and poised to contribute higher earnings in the coming financial years.

With several upcoming catalysts, the company’s valuation seems attractive at the current price level. Meanwhile, the company’s share price looks like it has bottomed out from a technical point of view. With all the upcoming and ongoing plans from the company, the entry price now seems to have a better margin of safety.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|