Another Fantastic Set of Results!! (TWL Holdings Berhad)

AlzranMohamed

Publish date: Fri, 29 Nov 2024, 11:21 PM

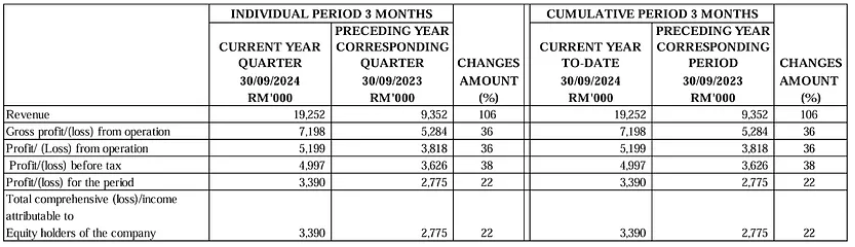

Fresh in today, TWL Holdings Berhad (TWL, 7079) announced their Q1 FY2025 results, where the company achieved an outstanding revenue of RM19.3 million, a 106.0% growth as compared to preceding year’s corresponding quarter.

The substantial growth in the financial results of TWL is largely attributed to the property development & construction segment of the group, where one of the significant contributors could be the signature Telaris Alam Impian project.

For the uninitiated, the Teleras Alam Impian project has been completely sold, and it is now awaiting for revenue contribution on superstructure works.

In terms of profit, TWL’s batching plant has supported the property development & construction segment with a RM0.3 million profit, while the property development & construction segment contributed RM4.9 million in terms of profit before tax (PBT), where TWL’s PBT had increased by 38.0% compared year-on-year.

Most notably, investors can expect more excitement coming from the upcoming quarters of TWL. The company had mentioned that with TWL’s launched in 2024/2025, the gross development value (GDV) is amounted to RM1.2 billion with the theme of “comfortable living space” and “affordable building”.

Financially, if we take a conservative 70% take-up rate on the projects, the revenue recognition over the next 2 financial years could be RM840.0 million, and with a conservative 15.0% net profit margin for developers, TWL could rake in RM126.0 million in net profit.

Currently, TWL is trading at RM187.6 million in market capitalisation, while being a net cash company, the company currently holding a cash pile of RM120.0 million, with RM126.0 million to be recognised over the next 2 years.

Effectively, TWL is trading at two-thirds of net cash level and less than 2 times in PE ratio.

No doubt, this company is of deep value, but due to the lack of recognition from public investors, TWL has yet to reflect its value. This could easily be a 3 to 5 bagger in 2 years down the road!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-02-01

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL2025-01-23

TWL