Corporate Action Study - MRCB

StallionInvestment

Publish date: Wed, 22 Nov 2017, 09:51 AM

股市行为学

Case Study 1 : MRCB

When MRCB announce Right Issue to raise fund on 17 May 2017. If i am not mistaken, this is the construction company who raise fund via right issue this year.

So, Let look at the chart on the next day. 18 May 2017.

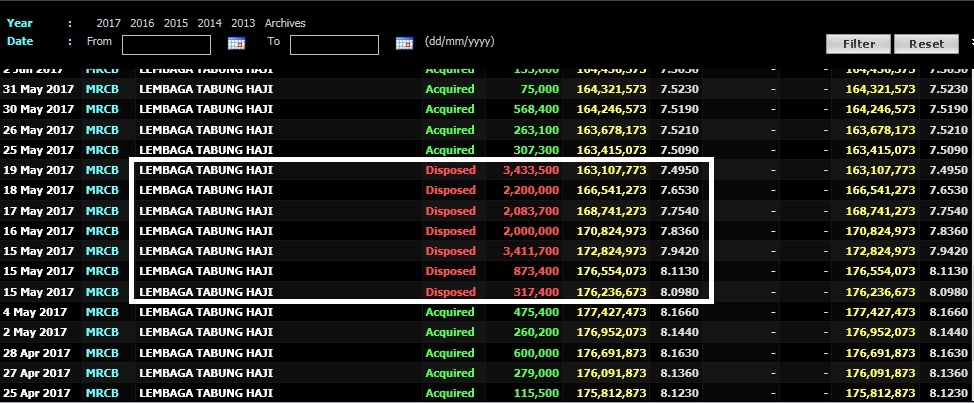

Is there any sign of BIG PLAYER DISSPOSAL? Let go through Bursa Change of Shareholder.

LEMBAGA TABUNG HAJI disposed and reduce the shares holding from 8.09% drop as low as 7.495% within 5 days from 15 May 2017 until 19 May 2017. Does this tell you some thing and it show the important follow the big fund movement.

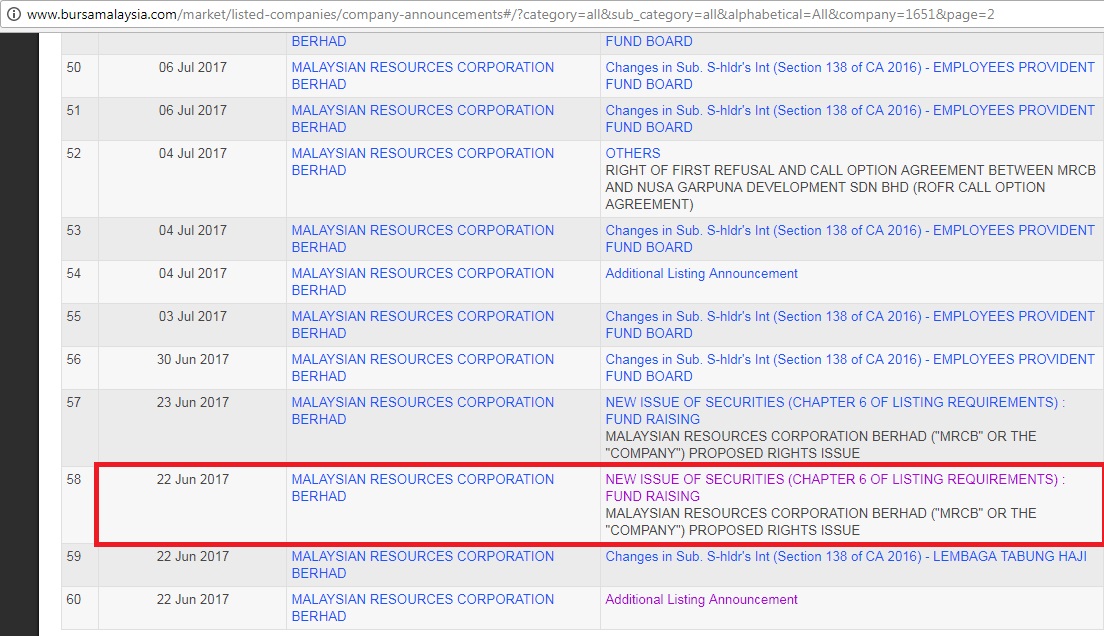

So, What's next? This is important to understand the flow of corporate action. Second Announcement was being announce on 22 Jun 2017.

This announced basically telling us major shareholders, namely EPF and GSB, that they have decided not to pursue the Proposed Exemption. This is to enable the Company to complete the Proposed Rights Issue expeditiously. So, major shareholders gonna undertake the right issue. Let look at chart when announcement being make 22 Jun 2017.

The candlestick cover with blue dotted box. So, when this announcement came out. It tell us that this corporate action will be successful and for the next 7 trading days market is slowly trending upward.

What is the upcoming announcement is to tell us the right issue detail which fall on 13 July 2017.

Above Corporate being announce but the entitlement date and exercise date was not being inform and that make investors remain cautious and once it break below the support price level at 1.31 it just keep on dropping.

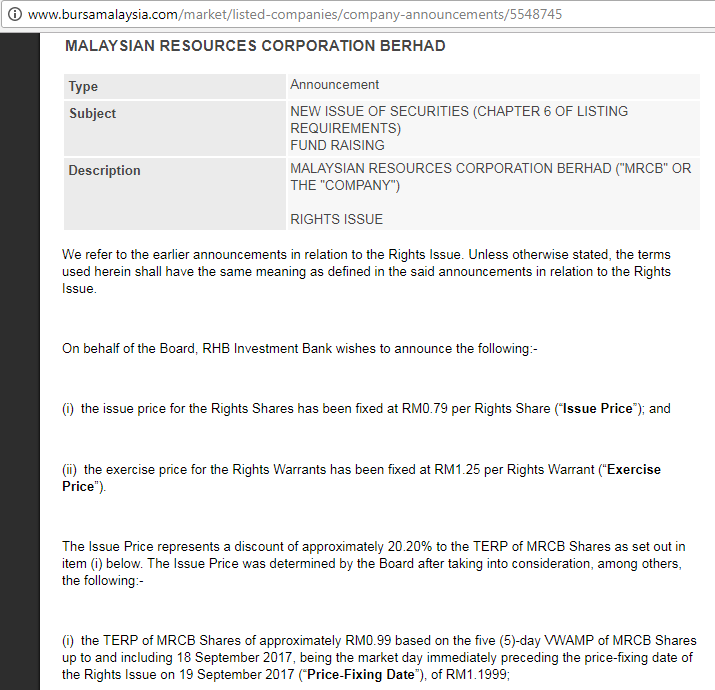

Then, later MRCB announce the detail of the corporate action on 19 Sept 2017.

So what is the shares price traded on 19 Sept 2017 for MRCB.

Obviously, people are not buying the idea and the PRICE FIX on the corporate action.

The bell shape on the right of the chart is the ex date of the corporate action. So, what happen next?

MRCB-OR go listed. So, there seem to be lot of chart. Now its time to do some mathmetical calculation.

Conclusion : Investor who bought MRCB-OR at open market : 0.075 + 0.79 = 0.865,

Assume mother share price remain the same,

Investor bought at MRCB should have another (0.925 – 0.865) = 0.06, MRCB-OR aim at 0.135

Assume You bought at 0.09 and sell at 0.135, this is 50% upside.

So, if you think MRCB-OR is risky to trade. Then, you may choose to trade on MRCB mother share.

I hope this sharing give you better understanding on corporate action of MRCB and know the flow of process and the important of corporate announcement being make into public.

However, not every coroprate action is easy to understand what the real story behind the scene. Therefore, you need to evaluate it on your.

Above is for educational case study purpose. Is not a buy call neither a sell case.

Do follow me at https://www.facebook.com/stevent.hee.33