MYEG - ELECTION THEME PLAY COUNTER 2018

StallionInvestment

Publish date: Tue, 26 Dec 2017, 10:34 AM

ELECTION THEME PLAY COUNTER : MYEG 0138

SHARE ISSUED : 3.606B

SYARIAH : YES

PE : 38.46

NAB : 0.168

COMPARISON MYEG FINANCIAL RATIO YEAR 2013 AND CURRENT

YEAR 2013 YEAR 2017

NET GEARING RATIO NET CASH NET CASH

CURRENT RATIO 2.36 2.30

PROFIT MARGIN 45.56% 53.89%

NTA 0.20 0.15

NET DIVIDEND YIELD 0.76% 1.16%

PE 26.73 40.27

PRICE TO BOOK 14.66 6.67

Above information obtain from Financial Insage.

MYEG 2012-2013 SCENARIO

SHARES PRICE 2 JAN 2013 : 0.79

ELECTION DATE : 5 MAY 2013

PRICE AS OF 3 MAY : 0.84

RALLY TILL PULL BACK : 15 JULY 2013 : 2.21

% GAIN TILL 15 JULY 2013 : 179.75%

% GAIN TILL 3 MAY 2013 : 6.33%

Opinion :

Share base of MYEG enlarge by 4x because there is 2x bonus issues 1 for 1 which happened 8 Jan 2015 and 31 Dec 2015. When shares base enlarge, momentum will be relatively slower. So, if we discounted this factor. Then, this coming year 2018, MYEG theoretically would not be enjoying such as crazy rally compare to the earlier year election. However, there is a saying in mandarin which say “ IF GOD WANNA DESTROY YOU, IT HAS TO MAKE YOU GO CRAZY” The strong rally come after the BN won in the GE13. So, before GE 13, It should have a small rally before the election.People been talking about election might fall around Feb, and some say might be around Jun. What ever is it . We have approximately 7 months to have coming election. So, make use of the period of time to pick the right stock in the stock market.

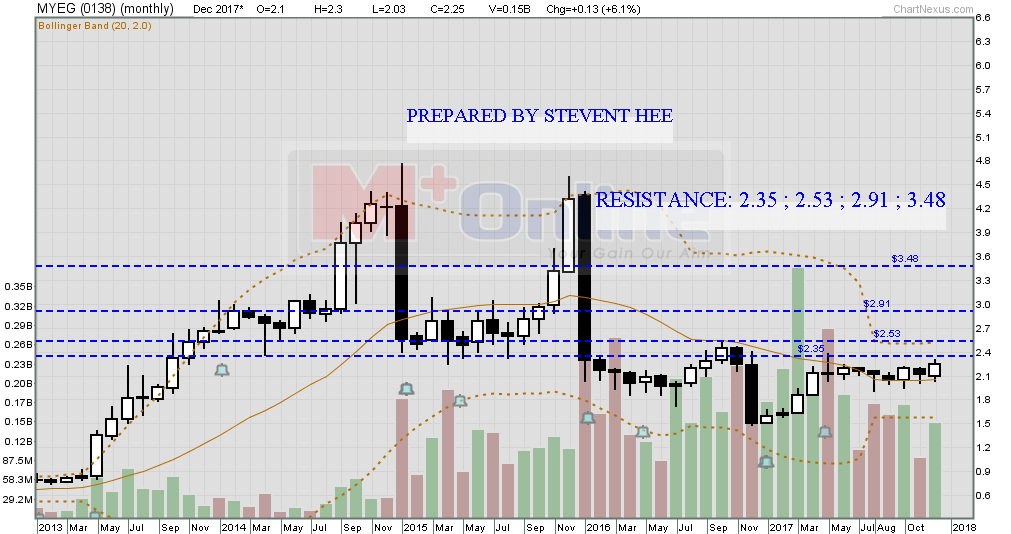

So, I would comment base on technical point of view. I am using chart disable bonus split and dividend to have a better picture where the support/resistance is.

SUPPORT : 2.12

RESISTANCE : 2.35 ; 2.53 ; 2.9 ; 3.48

Disclaimer : TRADE AT YOUR OWN RISK. PLEASE CONSULT YOUR DEALER/REMISIER FOR ANY INVESTMENT DECISION. Above is merely for educational sharing purpose.