What do you understand about intraday Trading (FIAVEST)

StallionInvestment

Publish date: Sat, 07 Apr 2018, 06:06 PM

I am writing this because one of my students who attend my technical course 101 to ask me write more on a software which is Fiavest.

In the world of stock market, there is many people adopt different approach from intraday, short term, swing trading, mid term and long term. Each and every has it own pros and cons. In overseas, intraday trading is widely accepted and people see it as a path of achieving financial freedom using relatively small capital. How does it work, there is a saying " SIKIT SIKIT, LAMA LAMA JADI BUKIT"

To understand further what is all about day trading, you may click below linkage for further reading.

https://en.wikipedia.org/wiki/Day_trading

Actually different trading strategic adopt the best at different stage work the best.

During Recession phase, there is many under-value counter which we may adopt value investing and be patient wait for the day to harvest the fruit when market is back. That provided you have excess of fund and you are not going to utilise it. On top of that, you need to adopt averaging on the lost position. Not only that, you require to have faith that company able to survive during the crisis. If your analysis go wrong, then you may face siginificant losses.

During Recovery phase , you may choose the market leader that showing good revenue and earning growth which you may adopt Fundamental Analysis, possible combine with Technical Analysis to invest. As history showing us when there is a recovery, market leader will take the lead then follower by second/third liner stock.

During Bullish Phase, you may notice many Ace counter, Penny stock easily fly high and provide you wonderful return over a short period of time. You may notice those early on the growthing stock may face slower growth on stock price but second/third liner stock which their financial result or business model does not sound promising fly high. That is the stage we should adopt Technical Analysis to maximise our return.

During the Peak/ Uncertainty Phase, adopt Value Investing, Fundamental Analysis and Technical Analysis for mid-long term position giving you the exposure of sudden plunge which we experience past few days due to Trade War between China- US. So, no matter how good is the fundamental and technical outlook of a stock. You can't predict the trend or what is gonna happen on the next day. This put you into a relatively higher risk position if you do not have sufficient profit margin as a buffer to cushion sudden change of trend. So, during uncertainty period of time, adopt intraday or contra trading using relatively smaller capital may be a wise decision for retail trader. However, seasonal trader who know well the stock market may either quit the market or capture individual stock for coroprate announcement, result play, dividend play or any strategic which they used the best.

So, now come to the point. What you need to do for Intraday Trading. So, the question is out of thousand stocks available in Bursa, which counter which is likely to move? No one will know unless you are the big player, operator, syndicate, fund manager. So, as a retail trader, we have limited access to those insider information, but let assume any position of those player they take place, it has to come with the volume. So, when there is the huge volume coming, retail trader will follow. So is the race game of " FAST FISH EAT SLOW FISH" and no longer the game of "BIG FISH EAT SMALL FISH". There is a similiar function provide by many stock market which is market trade monitor to provide you real-time trading stock in the screen which cost you zero cent. Sound like i am not able to sell Fiavest by sharing this tactic to the public.. Haha... Hopefully it help you all to be better trader. This Market Trade Monitor does not come with the Screener function.

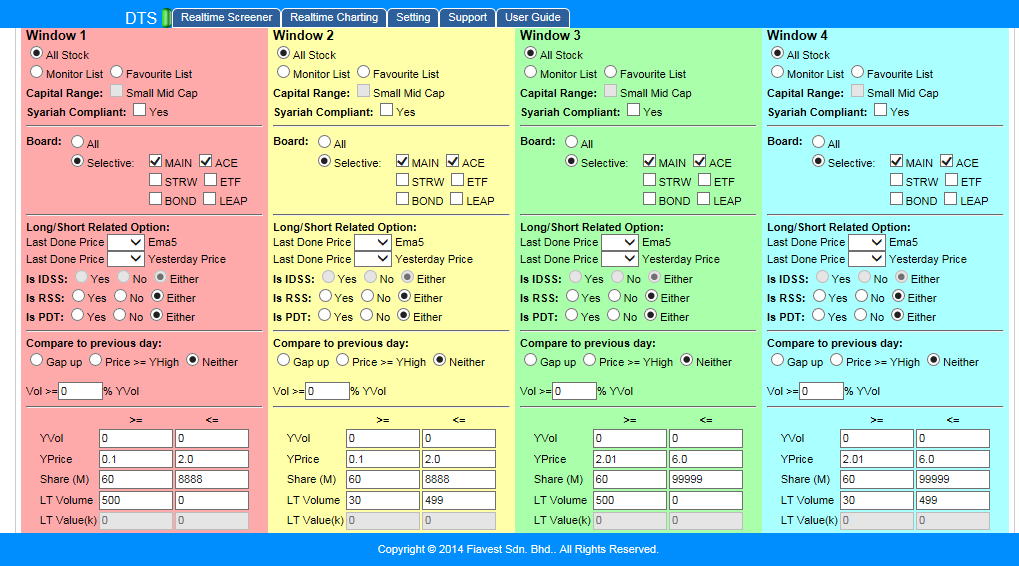

Fiavest is design to cather full time trader to monitor the movement of the stock by setting the criteria base on price and volume. Let me explain what can Fiavest Setting do to meet your trading goal.

1. Setting Price Range

For those small - mid cap lover who wish to leverage on the stamping waiver by the Bursa to reduce their cost of transaction. Every tick of movement of those relatively cheaper stock will be having higher percentage of changing when it move up by one tick.

2. Setting Shares Issues

For those syndicate/operator, they will prefer counter which is relatively smaller shares issue because it will be easier for manipulation. Unless those syndicate/operator are cash rich then they able to play at bigger stage. So, our focus will be those who trade at the smaller stage.

3. 2 Windows Setting

It allow trader to split their stock monitoring screen to monitor big fund flow and small fund flow by transacted size of volume. When big fund is disspose and retailer is buying stock. Then we aware of the potential risk of this stock going down further.

4. Volume Setting

There is 2 type of volume setting. 1 type of volume setting which is i commonly use such as at 10.00am, i will set today volume more than 20% of yesterday volume. As a intraday trader, if we get in but we not able to get out. then that is too bad for us. So, traded volume is crucial for us. Those counter which traded at 10.00am should have at least 20% of yesterday total volume. Another setting is to find sudden explosive counter which is yesterday volume relatively thin but today showing great explosive volume. Wanna know more, then look for my FB Stevent Hee and join my upcoming seminar talk to understand how it work.

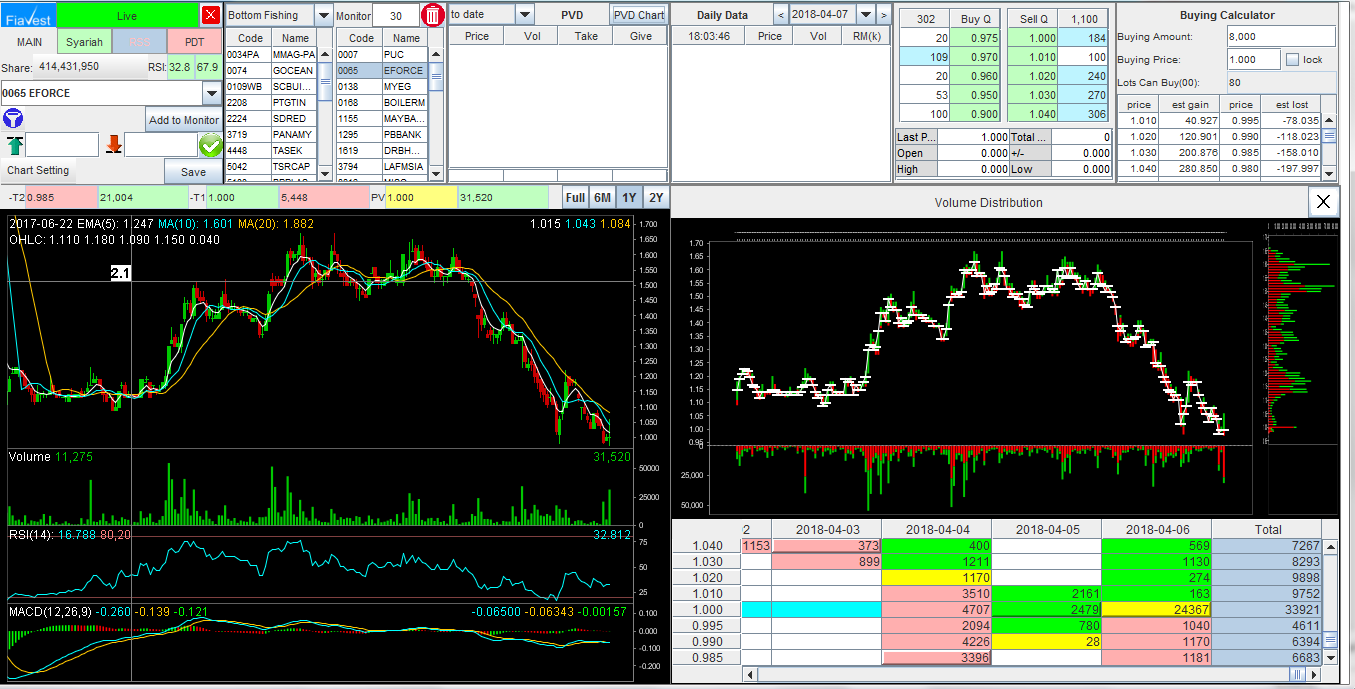

5. Price Volume Distribution Chart

We have learn the traditional volume which is showing at below the chart (daily volume) but world has evolve and change to this called price volume which is the particular price traded across a period a time. Why is it so? Let assume majority operator, big player they will accumulate at the low then push up the stock price. Traditionally, what we learn if a stock not moving for some time and moving sideway. It may explode. It is true, but as a precise trader who wanna know better detail at what the price most likely the big player accumulate then you need this software. Another way, is you do homework and put into excel without paying single cent for the software...

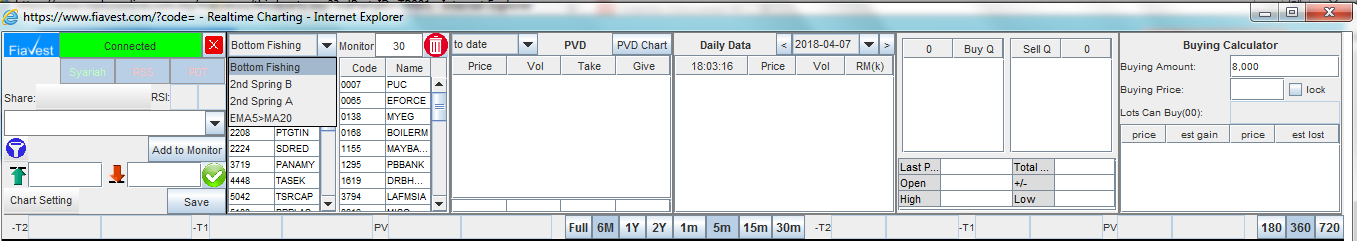

6. 4 types of Formation Screener

Bottom Fishing, 5EMA cross Above 20 MA, Spring A & B which telling us the sideway trend, potential uptrend, on the rally stock. That will help you to reduce your time to do homework.

7. New feature for Intraday

All of us knowing that when a stock momving upward, it will face the gravitiy that slow down the momentum on going up but when drop the speed is like a free fall just like fast and furious. If you wanna capture the opportunity of making money during the bearish market, then this is the time you should not miss it to understand how this software work.

Many time people may think that is not a good idea to spend on software which they think even using a software does not guarantee making money. Then, i was thinking majority parent did send their kids to tuition, does the tuition teacher guarantee their children for sure getting A in their exam. Nope. What i am trying to say is this is a method and you need to put your effort. Money dont come easily in life. World has change. Without your notice, little thing may create butterfly effect in the future. If you refuse to change, the world wont stop changing because of you. So, spend your time to understand the era of Intraday Trading Software. Let make the stock market more lively and exciting. Feel the beat of the stock. Feel the movement.

I will attach a few screen capture of this software.

4 Windows Setting Criteria

4 Types of Formation

Price Volume Distribution Chart

Stay tune and follow my FB and telegram

https://www.facebook.com/stevent.hee.33

https://t.me/steventhee628

aiinvestor

There’s a New Problem With Trump’s Attacks on Amazon

https://www.motherjones.com/politics/2018/04/theres-a-new-problem-with-trumps-attacks-on-amazon/

2018-04-07 23:22