PEER ANALYSIS (PHARMACEUTICAL OR HEALTH CARE RELATED)

Counter Name PE Q-Q Earning Growth NTA PRICE PREMIUM/ DISCOUNT

1. PHARMANIAGA 15.98 Declining 2.02 3.27 PREMIUM

2. BIOHLDG 19.49 Declinining 0.1679 0.25 PREMIUM

3. CCMDBIO 19.16 Declining 0.74 1.25 DISCOUNT

4. KOTRA 20.42 Declining 1.10 1.85 PREMIUM

5. YSPSAH 21.44 Improving 2.17 2.80 PREMIUM

Base on above comparison, YSPSPAH appear to be the better choice compare to the rest of the 4 others counter.

Why are we looking at the Pharmaceutical counters, because transparency and open tender is the slogan of the Pakatan , our current rulling government. On top of that, our Lovely Minister of Finance strike to reduce debt of the country and this open up the space for more Pharmaceutical firm to bid for the contract to supply medicine and vacine to the Hospiteal/ Clinic. Most important those nonsense which practice by our previous Minister of Health saying that dispposable item can be reuse which totally ignore the possible patient who seek for treatment might get infection due to reuse of the item. This news can be read by clicking below linkage.

http://www.freemalaysiatoday.com/category/nation/2017/10/25/safe-to-reuse-disposable-devices-says-health-ministry/

Again, only stupid fellows believe such statement from the previous rulling party and this happen due to poorly manage country budget and finance. However, we hope that new government does not repeat the similiar mistake what happen in the past.

On top of that, Minister of Health aim to reduce to cost of drug for medical usage as it will burden Malaysian who seek for medical treatement.

There is a statement which i think carry out a meaningful message.

The Health Ministry currently does not have the power under the law to regulate the prices of drugs supplied in the private sector, says Dr Dzulkefly Ahmad.

However, the Health Minister said that the ministry intends to address the issue and will also get feedback from the Health Advisory Council.

Asked which law had to be changed, he said: “Wait for the Pharmacy Bill.”

Read more at https://www.thestar.com.my/news/nation/2018/07/06/govt-powerless-over-prices-of-drugs-dzulkefly-no-right-under-the-law-to-regulate-cost-of-supplies-in/#gU5qBAk8xjwFsqyF.99

So, a totally new environment which is more transparence and more competitive will be seen in a year time which the monopoly scenario supply medicine to the government will not happen in the future.

Therefore, investor and public is waiting more good news to be reveal in the future.

What happen we have seen more trading interest occur in the pharmaceutical counters.

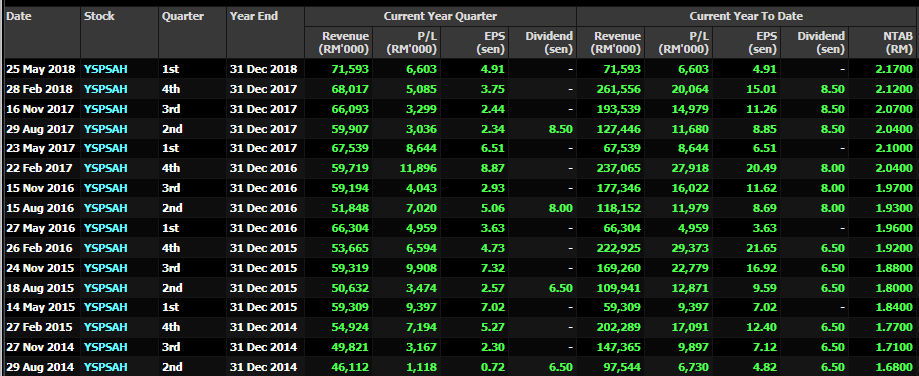

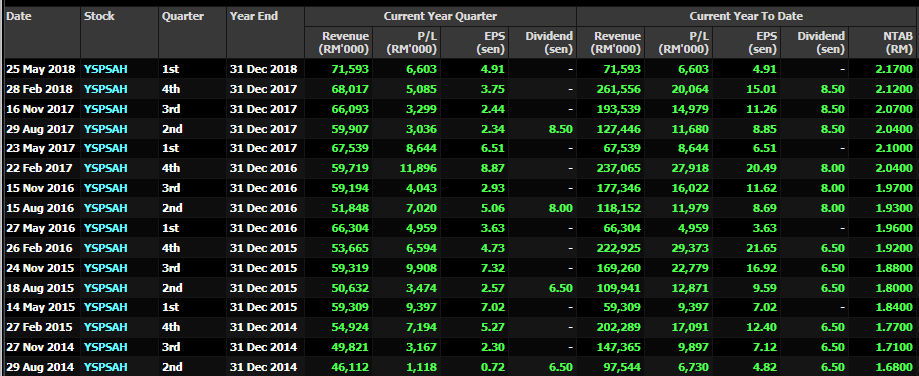

Today, i would like to point out some of key point about YsPsah.

1. Improving Quarter result and coming quarter will be release soon around mid of Aug 2018

2. Improving Dividend payout amount for the past 3 years which will attract investor slowly accumulate and waiting for next year

3. Target Price given by Affin Hwang 3.70 which represent upside of 0.90 which equivalent 32.14%

4. Net Cash company

TECHNICAL CHART READING :

Trading interest is slowly build up and it may be the start of trend to go up higher with the condition it should not break 2.65.

Advisable not to enter big position as there is lack of liquidity.

It may suitable for small position trading or slowly accumulation rather than 1 time all in.

Disclaimer : Above is my personal point of view. Trade at your own risk. This isnot a buy/sell call for the counter, kindly consult your dealer/remisier for any investment advise.

FB : https://www.facebook.com/Steventheeinvestment/

Telegram : https://t.me/steventhee628

stteck

should ahealth be included as peer ?

2018-07-29 12:08