FBMKLCI MAY 2019 OUTLOOK - STEVENT HEE

StallionInvestment

Publish date: Thu, 02 May 2019, 10:25 PM

Fellow reader

Earlier i did prompt warning at telegram as well as my FB showing that FBMKLCI might have correction. Do check it out yourself, althought there is some counter move upward despite KLCI outlook is uncertain. We as ordinary human being, we are here try to make profit but at the same time try not to take unneccessary risk. So, what is waiting ahead infront of us is it a threat or opportunity.

With today showing a BEARISH ENGULGING for FBMKLCI. It is likely to press down further to retest previous low which peg at the level 1610, shall this break then next support level should be 1585. Personally i am looking it is likely to test 1585 - 1600 range first before FBMKLCI rebound.

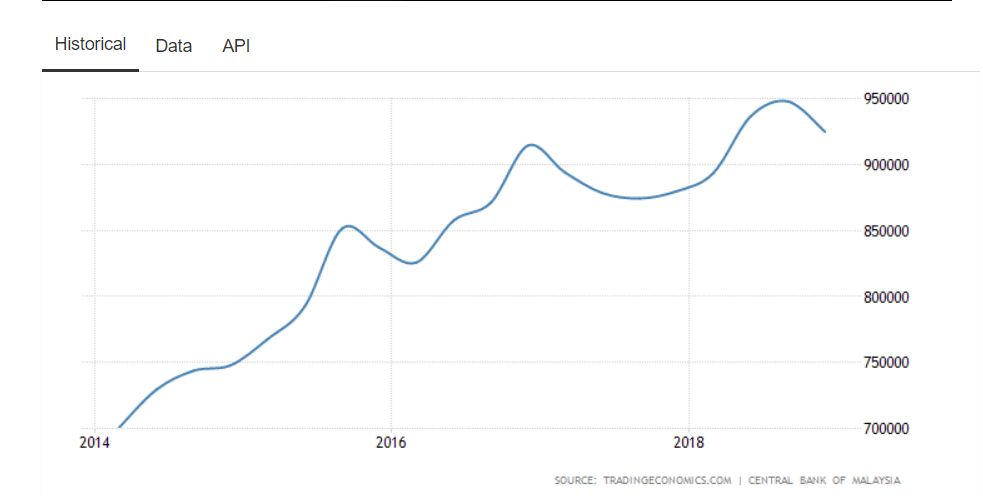

Below is the interesting chart for your reading. * MALAYSIA TOTAL GROSS EXTERNAL DEBT

Source obtain from https://tradingeconomics.com/malaysia/external-debt

Below is the USD MYR chart (5 Years Time Frame)

What we are seeing over here is USD/MYR chart showing that RINGGIT is weakening. We are seeing current government start to adopt previous economic model which GOVERNMENT take lead on construction project to stimulate the economy growth. At the same time , we are seeing PAKATAN HARAPAN is trying their best to fullfill their promise during the GE 14.

Just to name some of huge project that is already revise or renegotiate at the moment.

1. ECRL - RM 44 BILLION (ON GOING FOR THE TIME BEING)

News can be obtain by clicking this linkage : https://www.nst.com.my/news/nation/2019/04/478726/back-track-ecrl-resume-rm-44-billion

2. HSR - RM110 BILLION (PROJECT ON HOLD FOR FURTHER DISCUSSION FOR PRICE REDUCTION)

News can be obtain by clicking this linkage : https://www.thestar.com.my/business/business-news/2019/04/09/malaysia-exploring-kl-sg-hsr-cost-reduction-proposals/

3. Pan BORNEO PROJECT - RM16.12 BILLION

News can be obtain by clicking this linkage : https://www.thestar.com.my/business/business-news/2019/04/02/lebuhraya-borneo-utara-optimistic-of-rm2bil-savings-for-highway-project/

4. More Places in Matrikulasi but quota system 90 : 10 remain - COST UNKNOWN

News can be obtain by clicking this linkage : https://www.worldofbuzz.com/maszlee-places-matriculation-intake-quota-system-remains-9010/

5. Kulim Airport - RM1.6 BILLION ( STATUS SUBMISSION FOR FEDERAL GOVERNMENT APPROVAL )

News can be obtain by clicking this linkage : http://mole.my/kedahs-kulim-airport-dream-to-cost-rm1-6b/

6. Bandar Malaysia - GROSS DEVELOPMENT VALUE RM140 BILLION 9 ( COSTING NOT PROVIDED )

News can be obtain by clicking this linkage : https://www.pmo.gov.my/2019/04/government-to-reinstate-bandar-malaysia-project/

There is other on-going project which i cant stated here 1 by 1. But above is multi- billion dollar project. Some project financing via bond, via foreign financial institution, some via internal funding and other method. What ever is it, it really spending huge amount of money to keep the economy vibrant. So, with so many debt in hand, RINGGIT value will it appreciate or depreciate. I guess the chart tell every thing if you know what does the chart tell you.

So, from above scenario, trading strategy focus should fall on construction related theme play as well as export counter.

Construction Theme Play : GAMUDA, MRCB, AZRB, MMCCORP, MITRA, ADVCON, ECONBHD, IWCITY

Export Theme Play : Hevea, FLBHD, LIIHEN

You might be asking me, so many counters. Sure got 1 counter will fly sky high, but which one? I can't tell you else i become GOD of STOCK. I am here to tell you the logic and some stock that worth for your personal monitoring.

Do share my article if you think it is useful. Your support mean lot to me.

FB : https://www.facebook.com/Steventheeinvestment/

Telegram : https://t.me/steventhee628

免责申明: 以上文章纯属个人意见以及学术性分享,不构成任何买卖建议。在你做出任何买卖之前,建议您和你的股票经纪质询任何投资意见。买卖风险自负

Disclaimer: Above article is for educational sharing purpose. Kindly consult your dealer/remisier for any investment advise before you make any decision. Trade at your own risk.