WHAT'S AFTER THE STEEL RALLY? DON'T WAIT FOR NEWS

MrRightTiming

Publish date: Thu, 06 May 2021, 10:01 PM

Welcome back to another series of our simplified info about the stock market. Congratulations to those who read our previous article on Steel Sector and if you made any profits, enjoy them and hope you have learned something through that process despite a bad market condition.

As of today we will be talking on another sector that looks interesting and still has a good risk to reward ratio like how we covered Steel 2 weeks back. We are talking about the PLANTATION Sector.

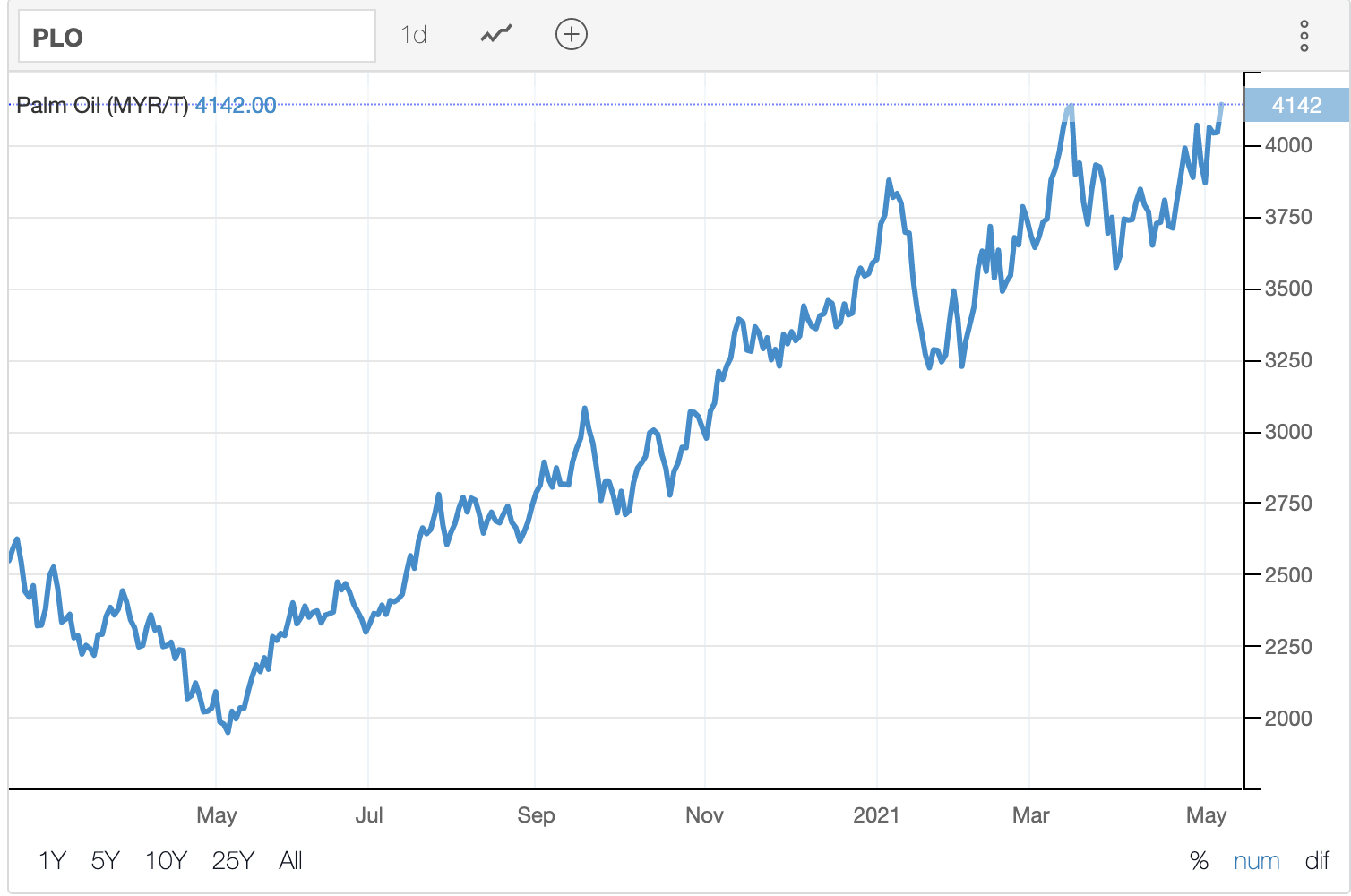

First of all, whenever we research about a specific sector, always look at the overarching element that controls the performance of the companies within that sector. In this case we will be looking at CPO prices.

Malaysian palm oil futures rose to as high as RM4,200 per tonne, the highest level since March 2008 on the back of tight global edible oil supplies and despite falling demand from India amid a deepening coronavirus crisis. Harvesting has been affected by labor shortage as oil palm estates dependent on foreign workers struggle with a shortage of manpower under a prolonged freeze on hiring by the government due to Covid-19. Meantime, April’s production is likely to rise by 8.9% from a month earlier in Malaysia and by 10.8% in Indonesia due to favorable weather and increased fertilizer use; while shipments are set to increase by 8.7% and by 14.6% respectively.

Source : https://tradingeconomics.com/commodity/palm-oil

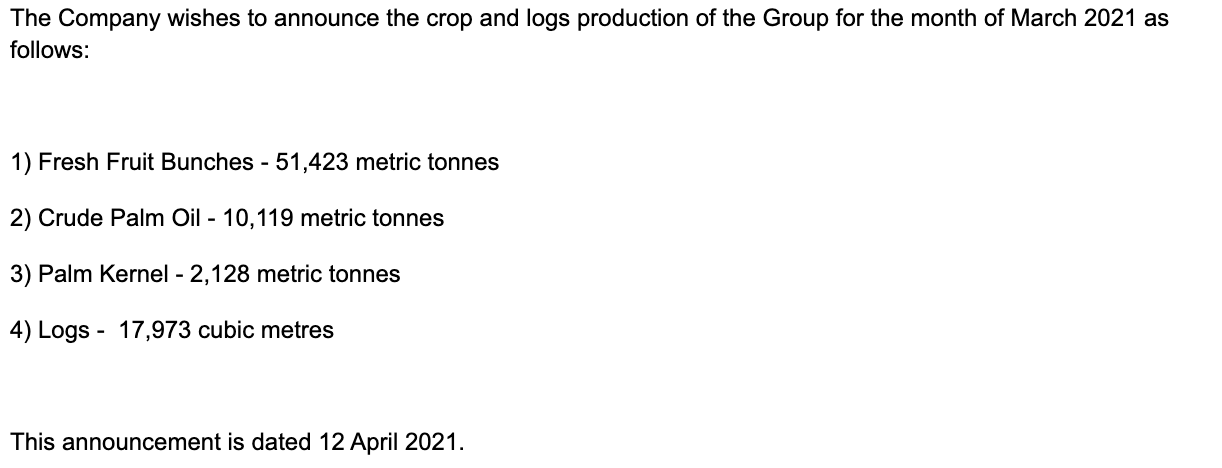

As we can see, the CPO price is at all time high since March 2008 and the production quantity is expected to increase due to the factors mentioned above. We will also validate this with a data given by a Public Listed Company in Malaysia for February and March 2021 in terms of production.

The two most important things among others that drives the price of a stock is definitely profit margin and prospects. Previously plantation stocks were facing some difficulty despite the CPO price going up is due to the uncertain prospects cased by COVID-19 and shipments obstacles. Based on the forecast mentioned in the earlier note, the second factor seems to be overcomed from the increased in shipments.

Since CPO prices are still going up and shipments are expected to increase in tandem with the high production, there is probably only one direction for the plantation stocks.

Based on these simplified analysis, we believe there will be some form of interest coming into this sector. Some of the plantation stocks in Bursa Malaysia that has been gaining attention recently includes KLK, SWKPLNT, INNO, JTIASA, KMLOONG, SIMEPLT, SOP, RSAWIT, TDM and many more.

Kindly check with a licensed investment advisor to know which of these stocks could benefit your portfolio, if any. Remember; the most important rule to make profits from the stock market is to do extensive research and coming up with relevant hypothesis before it comes out in the news.

So we hope this has increased your awareness on how the plantation sector works for you to make use of it in the future.

We have more for you! Follow us in our Telegram Channel @StockAdvisor FBMKLCI for more updates in Bursa Malaysia on a daily basis!

Disclaimer : All notes expressed here are solely individual point of views and we are not responsible for any buy or sell decisions made by others. Kindly use this as a reference reading material to add value to your current research and pleas verify any information stated here with a licensed individual in the capital markets industry before making any decisions.

More articles on StockAdvisor FBMKLCI

Created by MrRightTiming | Aug 01, 2021

Created by MrRightTiming | Apr 25, 2021

Created by MrRightTiming | Feb 13, 2021

Created by MrRightTiming | Jan 25, 2021

Discussions

The two most important things among others that drives the price of a stock is definitely profit margin and prospects. Previously plantation stocks were facing some difficulty despite the CPO price going up is due to the uncertain prospects cased by COVID-19 and shipments obstacles. Based on the forecast mentioned in the earlier note, the second factor seems to be overcomed from the increased in shipments.

Since CPO prices are still going up and shipments are expected to increase in tandem with the high production, there is probably only one direction for the plantation stocks.

2021-05-06 22:32

How long going to last?

I bought Supermax in April 2020 for Rm1.73

Supermax lasted for several months and reached Rm24.44 but still linger around Rm10.00(Rm5.00 x 2 bonus)

So just buy and hold for 6 months to 1 year

Gloves got competition as new glove factories could be set up in just 6 months so there is no barrier to competition

For palm oil there is high barrier to entry as it takes more than 3 1/2 years to plant and see first fruit harvest

So can we expect Palm oil bull to last longer than glove bull?

2021-05-07 08:32

worst for those who come late as they will pay much much higher prices for everyday delay

2021-05-07 15:24

Better pay Rm1.73 when Supermax was Rm1.73 in April 2020 than to chase Supermax after it crossed Rm20

2021-05-07 15:25

So best time to buy palm oil share now than to chase after

good news out in May 2021

great news out in Aug 2021

And fantastic news out by Nov 21 when prices are up the sky

2021-05-07 15:27

Q1 result will be catastrophe due to reinstatement of export tax of 8% on CPO.

Good luck for those who rush in now.

2021-05-07 17:44

no need to promote so hard ....retailers like to buy high and hope to sell higher. So price not high enough yet. CPO hit 5000 then maybe they will realise

2021-05-07 17:53

Cpo hit Rm5000?

quite near and quite soon

so you want to chase AFTER palm oil shares go limit up?

2021-05-08 00:06

Not only that at cpo Rm 4000, u only making super profit loh!

Posted by calvintaneng > May 8, 2021 12:06 AM | Report Abuse

Cpo hit Rm5000?

quite near and quite soon

so you want to chase AFTER palm oil shares go limit up?

2021-05-08 15:20

Why 2089 or Uplant not in the list?

Good question

Because Uplant like Batu Kawan and Klk are good stable blue chip Plantation stocks which you should buy during bad times

In good time you buy 2nd liner and 3rd liner plantation stocks better

See how Esceramic, Hlt and Careplus outperformed Topglove and Harta by percentage

Big blue chip Glove only up 200% to 300% but small cap like Hlt up from 10 sen to Rm3.20 (Up 3,000%) at peak

Now cannot chase glove but sell all glove and buy small cap Palm oil shares best

2021-05-08 22:01

The St. Goreng

Precisely.

Only Steel, Plantation and Lumber.

2021-05-06 22:29