CNY POST RALLY? - 1 WINNING SECTOR & 2 WINNING STOCKS TO WATCH CLOSELY

MrRightTiming

Publish date: Sat, 13 Feb 2021, 02:07 AM

While many investors were hoping for a Pre-CNY Rally, we are in the thoughts that there will be a post CNY Rally instead!

Why do we say so? There is actually a net inflow of foreign funds into the market for the past one week. While many were observing profit taking scenarios, we were looking at who has been buying and supporting the market.

FOREIGN FUNDS HAS BEEN THE NET BUYERS IN OUR MARKET! And we know what happens when they are the net buyers --> Its up time for the market

We also saw a peculiar investment inflow globally where it reached record high all around the globe, especially into the technology sector.

EQUITY MARKET SHOWED RECORD HIGH INFLOWS

TECHNOLOGY SECTOR HAD THE HIGHEST INFLOW OF $7.2 BILLION, THE BIGGEST SINCE MID-MARCH 2019

Source : https://www.reuters.com/article/us-global-markets-flows-idUSKBN2AB0O0

Like we said, observation is the key in the stock market. It allows you to detect opportunities based on peculiar patterns of buying and selling. We also saw great inflows of funds into technology sector, which rebounded heavily after retailers did some profit taking.

So let's head into which stocks can potentially go big this FEBRUARY! We are particularly interested in stocks involved in "Electric Vehicles"

1) GENETEC TECHNOLOGY BERHAD | GENETEC (0104) | SYARIAH

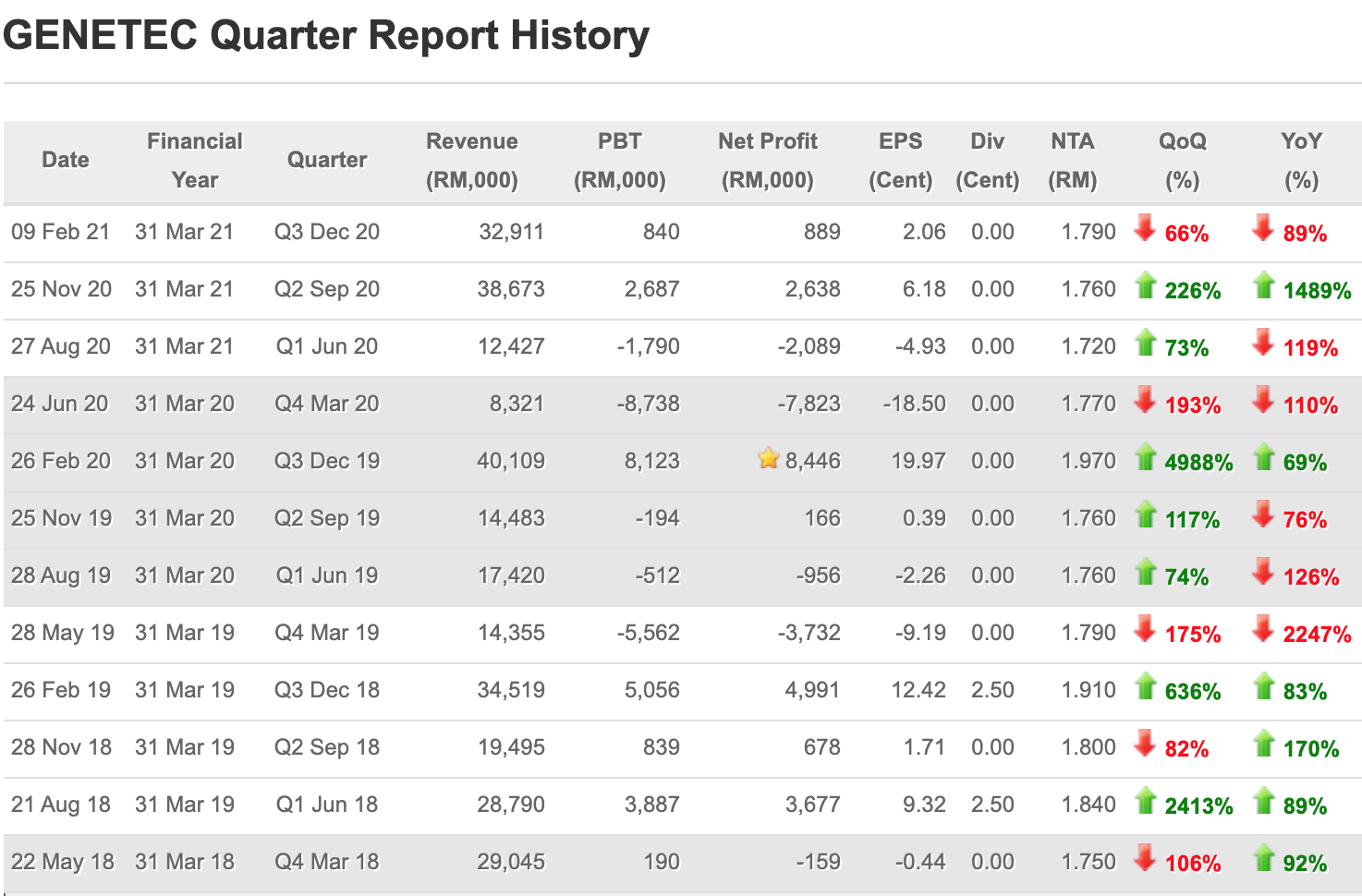

Genetec has been rallying up strongly since mid January and there is still room to go for GENETEC both fundamentally and technically. Genetec Technology Berhad is engaged in the Industrial Automation Segment especially in the automotive, hard disk drive, semiconductor and electronics industry. They have almost similar business model to Greatech Technology Berhad.

Despite the stock performing negatively in the previous quarter, the price continues to be supported above RM4 and travelled upwards closing at RM4.75 on Thursday. This is due to the positive outlook on the Electric Vehicle (EV) sector that is booming all around major economies of the world.

Technically, this stock just brokeout from its previous high of RM4.70. We are anticipating it to go to the next level of RM5.50 and RM6.00.

2) D&O GREEN TECHNOLOGIES BERHAD | D&O (7204) | SYARIAH

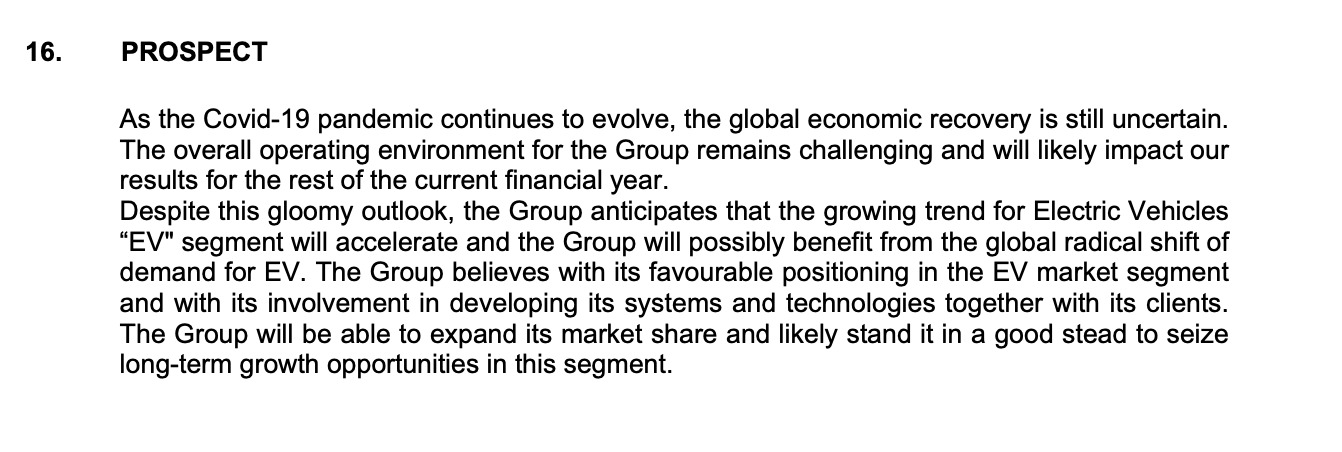

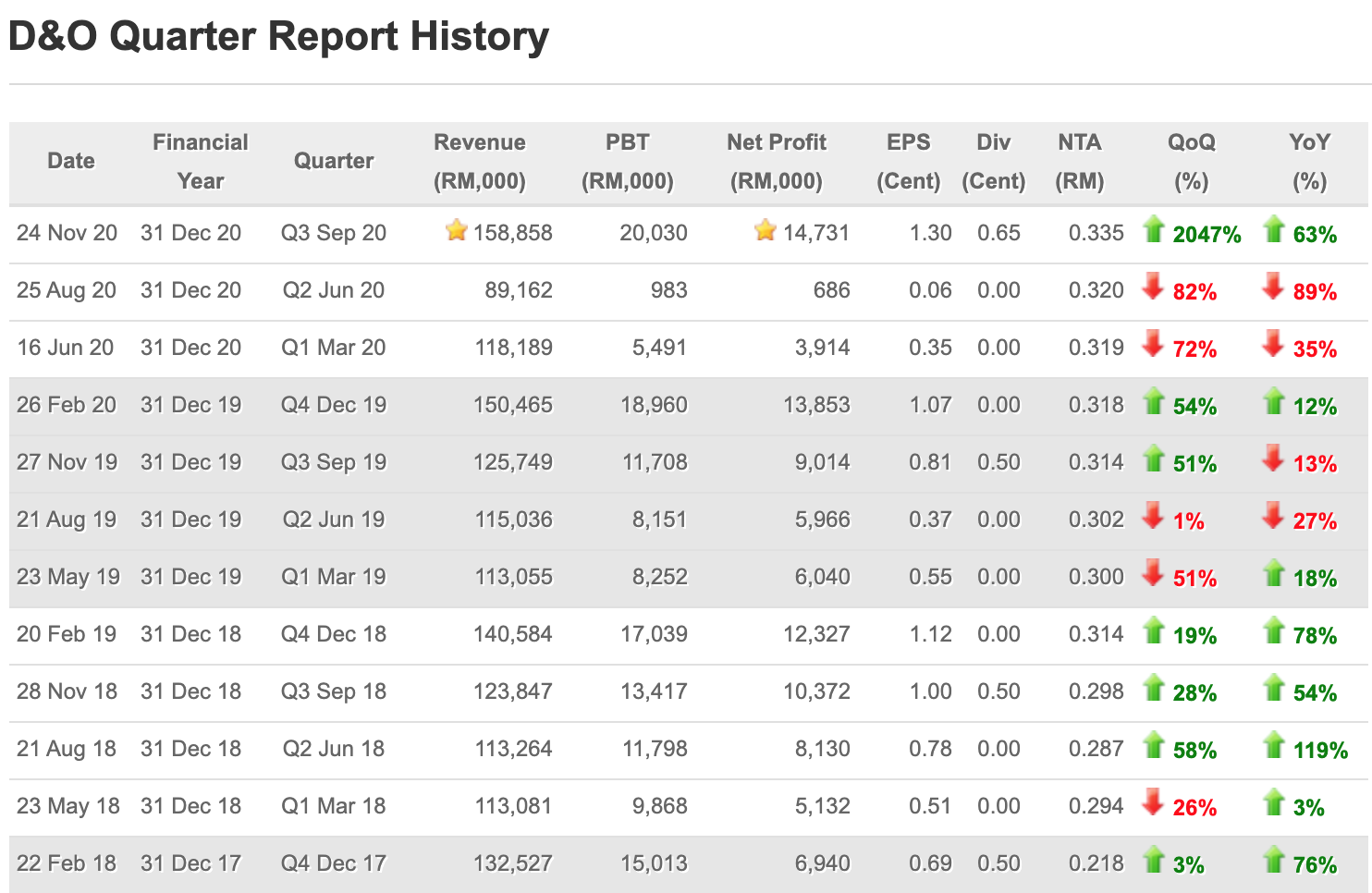

D&O Green Technologies Berhad is involved in manufacturing and merchandising of semi-conductor components. It is also involved in the development of semiconductor application technology, installation, electric components, electrical equipment for lighting, electronic display screen, and lighting fittings.

D&O posted record high earnings last quarter and is expected to perform even better in the upcoming quarter which is due on the last week of FEBRUARY. As you can see in the prospects, the increasing demand for EV globally is going to be the main contributing factor for the continued uptrend of this stock.

Technically D&O is already looking strongly high but there might be more upside towards the quarter results. We are looking at the next level of RM3.60 and RM3.80 respectively due to the positive fundamentals.

We are keeping it simple. Understand that the main point here is to select winning sectors, winning stocks, understand global demands and look at potential upside!

We have more for you! Follow us in our Telegram Channel @StockAdvisor FBMKLCI for more info on stocks movements in Bursa Malaysia on a daily basis!

Disclaimer : All notes expressed here are solely individual point of views and we are not responsible for any buy or sell decisions made by others. Kindly use this as a reference reading material to add value to your current research and pleas verify any information stated here with a licensed individual in the capital markets industry before making any decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on StockAdvisor FBMKLCI

Created by MrRightTiming | Aug 01, 2021

Created by MrRightTiming | Apr 25, 2021

Created by MrRightTiming | Jan 25, 2021

Discussions

Posted by PureBULL ... > on Feb 3, 2021 4:45 PM | Report Abuse X

EV.CAR material co on KLSE r :

i. metals : PMETAL, PMBTECH, MSC

ii. semicon : D&O, MPI, UNISEM

EMS stocks r VS, SKPRES, ATAIMS, FPI

2021-02-14 09:12

Posted by PureBULL ... > on Feb 14, 2021 5:46 AM | Report Abuse X

PMETAL being the cheapest producer of ALUMINIUM in the world has a huge prospect. koon bros will be so RICH on world stage. Watch their corporate moves.

EV has to use Al. Being 3 times lighter than steel, EV can travel more miles per battery charge.

Only compact cars like the TESLA Model.3 uses special steel combined with aluminium to reduce cost.

All the big size car to SUV to truck n bus n lorry must use Aluminium.

A typical mid size car uses abt 200 kg of Aluminium.

U imagine how high can the new DEMAND be for Aluminium ...

n the heaviest stuff in EV is the battery pack.

In the near future, SILICON batteries are the latest tech for rechargeable batteries. PMBTECH, also the lowest cost producer of SILICON is position well for the huge mkt.

2021-02-14 09:13

sensonic

Post removed.Why?

2021-02-13 12:13