Stock Of The Day

BRIGHT(9938) - Going to break new high soon.

wecan2088

Publish date: Thu, 19 Jan 2017, 07:37 AM

Bright Packaging Industry Berhad (“BRIGHT”)

Background

BRIGHT was incorporated in year 1988 and subsequently listed on Bursa Malaysia in year 1996. It was one of the Asia Pacific’s largest aluminium foil converting businesses, with a solid reputation of outstanding performance and quality. It’s products include aluminium foil and metalized film laminate to tissue/wood free/board and inner frame, and they are exported to countries all over the world, such as China, Thailand, Australia, UAE, Germany, etc.

BRIGHT extensively caters pharmaceutical, confectionery, liquor and cigarette packaging, such as the products below:

Tobacco Contribution

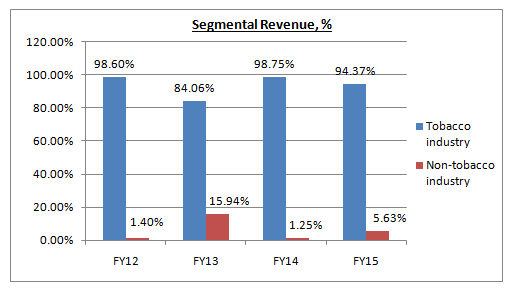

Basically, tobacco industry contributed significantly for BRIGHT in term of revenue. It contributed averagely 95% of the Group’s revenue.

BRIGHT had been focusing to provide the aluminium foil packaging materials for the tobacco industry in the past 10 years as the profit margin generated from the tobacco industry is higher as compared to other industries. Besides, the demand for its products from the tobacco industry is more stable and consistent as compared to the demand from other industries with the increasing number of smokers.

As at today, BRIGHT’s major customer is Philip Morris and its affiliates companies. Its contribution accounted 73% of the Group’s revenue in FY15.

BRIGHT had been established a long term relationship established with Philip Morris since more than 10 years ago and it had the ability to provide them with value added services such as customizing specific printing requirement for the cigarette boxes.

FYI, the leading tobacco company worldwide is Philip Morris International, generating around USD29.7b revenue in year 2015. It controls an estimated 15% of the international cigarette market and is the most profitable tobacco company in the world. Philip Morris operates in more than 180 countries, and sells 6 of the top 15 brands, including Marlboro.

Cigarette Industry - Prospect

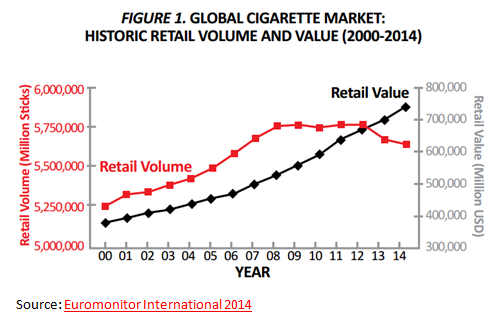

Based on market research, between 2000 and 2014, global cigarette volume sales increased by 8% while retail values increased by 121%.

Industry analysts predict that over the next 5 years (2015-2019) the global cigarette industry will continue to grow; volumes are predicted to increase by 0.9% and values by 29%. The cigarette sales and consequently tobacco packaging sales are expected to remain strong over the short to medium term.

Future Prospect/Expansion

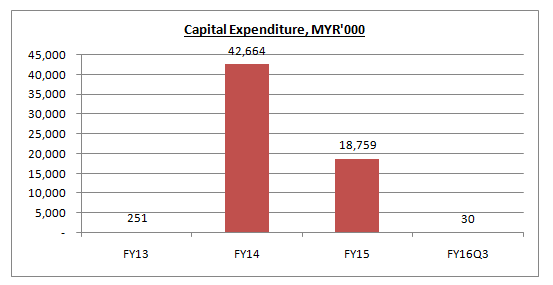

Previously, BRIGHT’s production had been running at full capacity and its clients anticipated stronger demand in the coming years. So, the management had decided to invest in new production capacity, which will allows it to capture a larger market share.

As a result, BRIGHT had expanded its production floor to cater for larger warehouses and new ancillary equipment in FY15. 2 new production lines had started operation in Apr 2015.

BRIGHT had spent MYR43m and MYR19m capital expenditure in FY14 and FY15 respectively. It had started to bear fruit with its revenue increased significantly in FY15 and FY16.

BRIGHT was expected to continue deliver good revenue in the upcoming quarters.

Financial Highlight

BRIGHT’s revenue had been increasing steadily since FY15. The higher turnover was due to increase in customers’ order from tobacco industry.

FYI, in Jan 2015, BRIGHT had secured a contract from Zao Philip Morris Izhora, a MNC tobacco manufacturing company in Russia, to supply aluminium foil at a total estimated value of USD15m. This was the main contribution for its improving revenue in these two years.

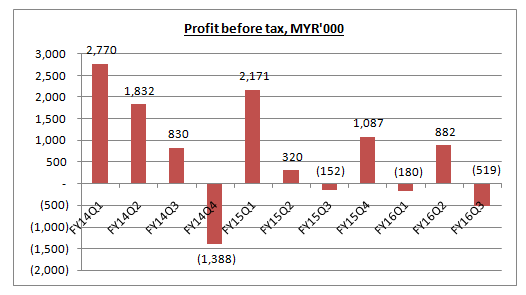

However, despite its excellent result in revenue, BRIGHT’s profit before tax was not good.

According to the management, the temporary dip in FY15 and FY16’s profit were mainly due to the business strategy of gaining market share with more competitive pricing and the impact of depreciation from the new production lines investments.

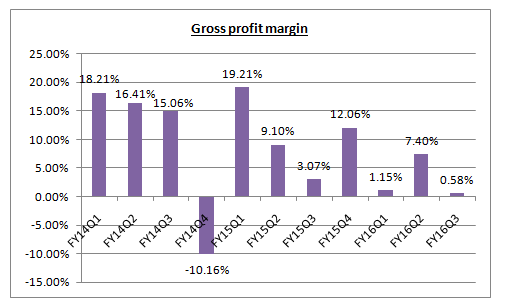

Besides, in FY16, BRIGHT was heavily impacted by the fluctuation of material cost. Its gross profit margin had dropped significantly in recent quarters as compared to FY14. The management did not explain too much on this. The main materials should be aluminium foil, paper lamination wraps and seals.

The gross profit margin for FY13, FY14 and FY15 was 19%, 11% and 11% respectively. But, the margin for FY16 so far was only 3%.

Peers Analysis

Bright Packaging Industry Berhad (Bright - 9938) had once shot into the lime light at the hostile change of ownership which saw the emergence of Dato Ricky Wong through Wong SK Holdings Sdn Bhd as a substantial shareholder for Bright with 22.7% stake on October 2013. After the ruckus in Bright, Wong SK Holdings Sdn Bhd again offer to take over TechFast in 2014 at 26 cents.

Subsequently, Wong SK Holdings Sdn Bhd continue to increase stake in Bright, which is now at the critical border of MGO, which is 33%.

According to the latest filling on the shareholding of Wong SK Holdings Sdn Bhd, it is at the borderline level of 32.936%. Which means, Wong SK Holdings Sdn Bhd just need to purchase from the open market a mere 105,128 units of share in order to trigger the MGO.

What is actually so interesting in Bright that makes Dato Ricky Wong edging nearer and nearer towards a MGO of this listed vehicle?

While an easy answer will be "Value", but what kind of values are the retailer seeing, and what kind of hidden values that the retailer could had missed ?

For most of the mass retailer in the market, the fastest way is to access is cash level, and determine the net cash position. For this case, Bright is holding on a RM 35.616 million of net cash. For a share base of 164.264 million, that is equivalent to 21.68 cents per share.

But for an experienced investor, there are more to that on just the net cash value. These value are easily missed out by retailers that are not familiar with corporate finance, hence hidden value.

Firstly, the company have a share premium of RM 15.584 million. While this amount cannot be access directly by means of dividend, but it can give Bright a potential "bonus issue" of 1 bonus share to 6 existing mother share, enlarging the share base by 27,377,333 share based on par value of RM 0.50, which can utilize RM 13.688 million. (Bonus of 1 to 6 is based on Par value of RM 0.50)

Secondly, the share is carrying a par value of RM 0.50 per share. It is possible for the company to do a par value reduction and capital repayment back to shareholder if agreed by majority of the shareholder. Take an example for a reduction towards par value of RM 0.10, that will unlock 40 cents of shareholder equity that can be repay back to the shareholder.

To take all this into account, if Bright is to do a capital reduction and repayment of 40 cents, and uses RM 30 million to pay special dividend, that would worth a total cash of RM 0.58 per share (RM 0.40 from capital repayment and RM 0.18 from dividend).

Subsequently with the lower par value of RM 0.10, then the company can undertake a bonus issue of 2 bonus share for 3 ordinary share (instead of 1 to 6 with RM 0.50 par value) which will make it more enticing for further speculation and boost liquidity of the share.

At the current price of RM 0.36, that really looks like a crazy offer, where you are paying RM 0.36 with potential of getting RM 0.58 in capital repayment and dividend, and also a chance for a bonus issue exercise. The NTA of Bright is RM 0.73 per share.

To put this into technical mean, Bright had broken 2 resistant line, one which is horizontal resistant of RM 0.34, and a long term down trend resistant line as well. It is a good indicator to see that the counter is gaining positive uptrend momentum, for this case, we will see the potential corporate exercise of MGO is the best fuel to boost the stock price higher.

To take this further, the pioneer vehicle of Dato Ricky Wong, which is Asia Media (Amedia), had went through some corporate exercise and is banging it's way upwards in the market again, sending a signal to the market that Dato Ricky Wong is "in the office and at work now".

While Bright had contracted with Zao Philip Morris Izhora from Russia for a USD 15 million aluminium foil supply, the business had saw challenging environment such as fluctuation of currency and commodity prices. With the potential cash pile in Bright and a ambitious Dato Ricky Wong, who knows if Bright will be a vehicle for some new business venture for him again after Amedia?

For this reason, the chances are bright for Wong SK Holdings Sdn Bhd to head for a MGO in the coming days. In fact, familiar sources are looking to see the MGO putting a potential price range of RM 0.50 to RM 0.60. If the offer is RM 0.60, why not ?

Subsequently, Wong SK Holdings Sdn Bhd continue to increase stake in Bright, which is now at the critical border of MGO, which is 33%.

According to the latest filling on the shareholding of Wong SK Holdings Sdn Bhd, it is at the borderline level of 32.936%. Which means, Wong SK Holdings Sdn Bhd just need to purchase from the open market a mere 105,128 units of share in order to trigger the MGO.

What is actually so interesting in Bright that makes Dato Ricky Wong edging nearer and nearer towards a MGO of this listed vehicle?

While an easy answer will be "Value", but what kind of values are the retailer seeing, and what kind of hidden values that the retailer could had missed ?

For most of the mass retailer in the market, the fastest way is to access is cash level, and determine the net cash position. For this case, Bright is holding on a RM 35.616 million of net cash. For a share base of 164.264 million, that is equivalent to 21.68 cents per share.

But for an experienced investor, there are more to that on just the net cash value. These value are easily missed out by retailers that are not familiar with corporate finance, hence hidden value.

Firstly, the company have a share premium of RM 15.584 million. While this amount cannot be access directly by means of dividend, but it can give Bright a potential "bonus issue" of 1 bonus share to 6 existing mother share, enlarging the share base by 27,377,333 share based on par value of RM 0.50, which can utilize RM 13.688 million. (Bonus of 1 to 6 is based on Par value of RM 0.50)

Secondly, the share is carrying a par value of RM 0.50 per share. It is possible for the company to do a par value reduction and capital repayment back to shareholder if agreed by majority of the shareholder. Take an example for a reduction towards par value of RM 0.10, that will unlock 40 cents of shareholder equity that can be repay back to the shareholder.

To take all this into account, if Bright is to do a capital reduction and repayment of 40 cents, and uses RM 30 million to pay special dividend, that would worth a total cash of RM 0.58 per share (RM 0.40 from capital repayment and RM 0.18 from dividend).

Subsequently with the lower par value of RM 0.10, then the company can undertake a bonus issue of 2 bonus share for 3 ordinary share (instead of 1 to 6 with RM 0.50 par value) which will make it more enticing for further speculation and boost liquidity of the share.

At the current price of RM 0.36, that really looks like a crazy offer, where you are paying RM 0.36 with potential of getting RM 0.58 in capital repayment and dividend, and also a chance for a bonus issue exercise. The NTA of Bright is RM 0.73 per share.

To put this into technical mean, Bright had broken 2 resistant line, one which is horizontal resistant of RM 0.34, and a long term down trend resistant line as well. It is a good indicator to see that the counter is gaining positive uptrend momentum, for this case, we will see the potential corporate exercise of MGO is the best fuel to boost the stock price higher.

To take this further, the pioneer vehicle of Dato Ricky Wong, which is Asia Media (Amedia), had went through some corporate exercise and is banging it's way upwards in the market again, sending a signal to the market that Dato Ricky Wong is "in the office and at work now".

While Bright had contracted with Zao Philip Morris Izhora from Russia for a USD 15 million aluminium foil supply, the business had saw challenging environment such as fluctuation of currency and commodity prices. With the potential cash pile in Bright and a ambitious Dato Ricky Wong, who knows if Bright will be a vehicle for some new business venture for him again after Amedia?

For this reason, the chances are bright for Wong SK Holdings Sdn Bhd to head for a MGO in the coming days. In fact, familiar sources are looking to see the MGO putting a potential price range of RM 0.50 to RM 0.60. If the offer is RM 0.60, why not ?

|

| BRIGHT has been trading above its upward sloping 20-Day Moving Average which is a good sign. In addition, the price just broke the resistance of 0.355 reinforcing the bullishness in the recent price movement. This breakout was accompanied by a higher than average traded volume which shows the enthusiasm of the traders to push the price higher and past this resistance hence giving a higher probability of a successful breakout. |

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Stock Of The Day

Discussions

1 person likes this. Showing 8 of 8 comments

BRIGHT fundamental very strong and good. No point to let the golden chance go ...

2017-01-19 07:52

BRIGTH will announce latest quarter results soon, which expect very good.

2017-01-19 07:52

Based on the article, the company has 22 cent per share so it does not have enough cash to pay 40 cent capital reduction plus 18 cent dividend unless it borrows more. But how easily can the company raise more debt if the operation is loss-making for the recent quarters? I am confused.

2017-01-24 15:46

hpcp

Ricky Wong's counter is a no no

2017-01-19 07:46