Bonus Issue is Completed! What is the Next Step of The Company?

TehBeng

Publish date: Mon, 07 Nov 2022, 06:23 PM

The early investors of Seni Jaya Corporation Bhd (SJC) are certainly enjoying their post-bonus issue rally by now, as the share price had gone up by another 6.2% on top of additional liquidity that the company had spurred to the market.

The company, is also in the midst of clearing off unutilized assets on hand such as the proposed disposal of five (5) parcels of shop offices to UOB Equity Sdn Bhd.

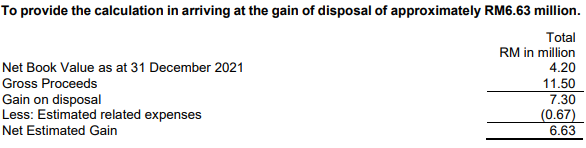

Under the proposed disposal, the company is expected to retrieve RM11.50 million in total gross proceeds with RM6.63 million in net gain. With the current market capitalization of RM133.5 million of the company, an additional RM6.63 million gain represents 4.96% gain in the value of the company at the current price, which is quite sizable at this juncture.

Notably, the financial performance of SJC had also on an improving trend, which is in-line with the recovering of Out-of-Home advertising spending in the country. It is likely for SJC to continue perform well in the upcoming quarters.

Generally, the media industry as a whole have not received attention from the public investors yet. This is further proven with the limited traded volume of SJC for the past weeks.

Nevertheless, with a low market capitalization of RM133.5 million, the opportunity is still open for investors who are keen to invest in the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|