Background

KESM Industries Berhad is a semiconductor company primarily involved in the

provision of burn-in and test services. It is the largest independent burn-in

service company in Malaysia. The company serves as a sub-contractor to

electronic multi-national corporations. Operations are located across Malaysia

and China. As its largest shareholder, the group is an associate of the Sunright

group of companies.

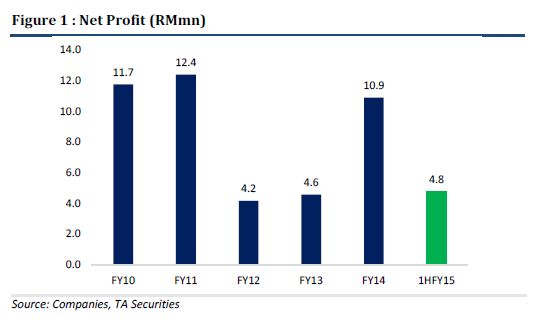

Story So Far

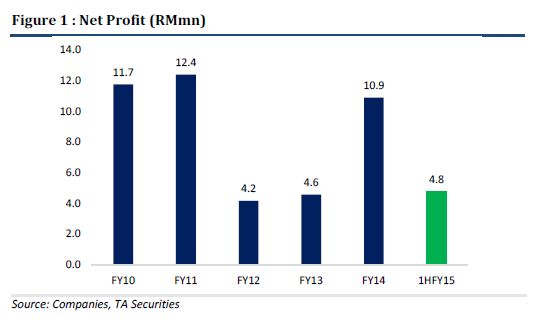

Enduring a tough spell, FY12 and FY13 were challenging years for the group. In

FY12, profit declined by 66.4% YoY to RM4.2mn. The reason for the slip was

attributed to a lower than anticipated production ramp up in China. This was

made worse by escalating labour costs in China. Also, an impairment of trade

receivables totalling RM7.0mn was recorded – as a customer in its electronic

manufacturing services (EMS) business ran into credit risk. Fortunes extended

into the following year amid weak industry demand and the implementation of

minimum wages locally.

Nevertheless, the weakness was short-lived as overall performance rebounded

in FY14. Mimicking the recovery of global semiconductor sales, the group

achieved internal records of over one billion semiconductor devices shipped.

Also, it enjoyed benefits from better productivity and positive cost control

measures. All in all, earnings recovered by 138.2% YoY to RM10.9mn. This was

in spite of higher electricity costs during the period.

Maintaining its momentum, the group recorded a net profit of RM4.8mn

(+70.5% YoY) in the 1HFY15.

Driver Seat

Current strategies are guided by two key initiatives. The first of which is to ‘build long term

growth in the auto market segment’. At approximately 70% of total revenue, the automotive

segment is by far the group’s largest contributor by end market segment. As a sub-contractor

to various electronic multi-national corporations, its products are predominantly found in

upper-tier auto manufacturers.

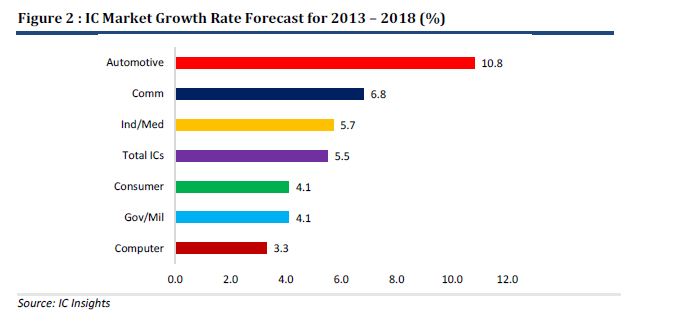

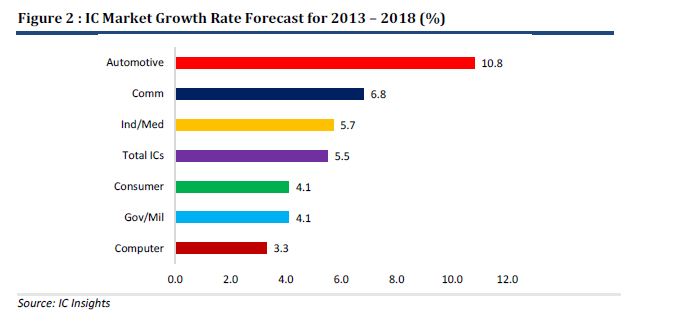

Analysing by end use applications, the automotive segment is forecasted to have the highest

future growth rate. IC Insights expects the segment to increase by a CAGR of 10.8% YoY

between 2013 and 2018. Partly attributed to its smaller base, this will be driven by an

increase in IC contents across new cars. Applications include vehicle-to-vehicle

communications, mandatory back up cameras and various driver assist systems. Certain

manufacturers have also exhibit prototypes of ‘driverless’ cars which provide a glimpse of

future capabilities.

Test Growth Engine

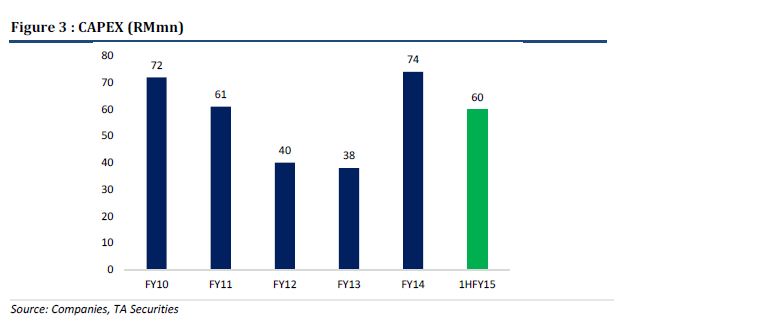

Its second initiative is to ‘strengthen its test growth engine’. Amid rapid technological

changes, testing services remain a fundamental part of the semiconductor manufacturing

process. Currently, the company has a capacity of 100 installed testers. Operating on a

controlled growth approach, plans are to add an additional 5 to 10 testers annually. On

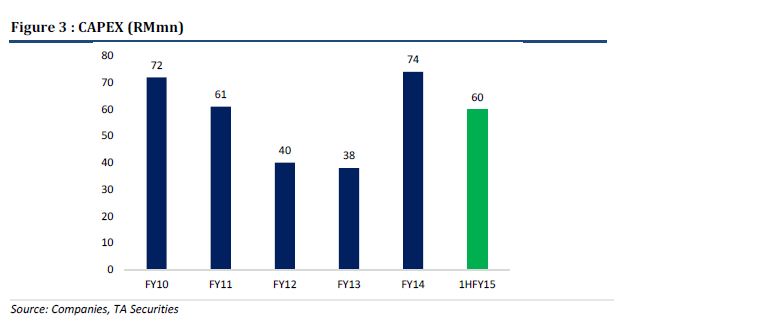

average, test equipment cost between US$1.0-2.0mn each. In the 1HFY15, the group spent a

total of RM60mn on CAPEX – representing 81% of last financials year’s amount. We interpret

this as a positive signal of a brighter outlook ahead.

Resilient Business

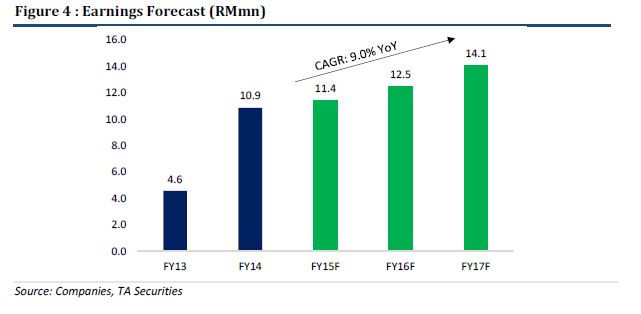

Relative to the industry’s cyclical nature, business operations have been stable and resilient.

Boasting a sturdy track record, all of its full year results have been profitable since listing in

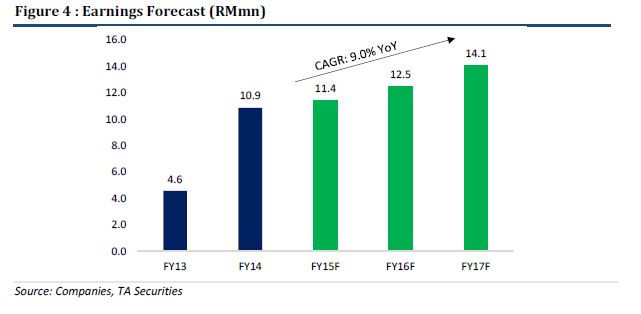

1994. Moving forward, in line with plans to add an additional 5 to 10 testers annually, we

assume a capacity of 105/110/115 testers for FY15/FY16/FY17. This is accompanied by an

average utilisation rate of 80% (currently between 80-85%). Together, we estimate

FY15/FY16/FY17 earnings of RM11.4mn/RM12.5mn/RM14.1mn. This translates into a three

year CAGR of 9.0% between FY15 and FY17.

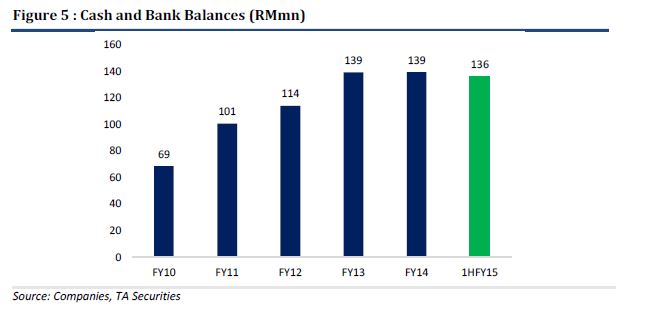

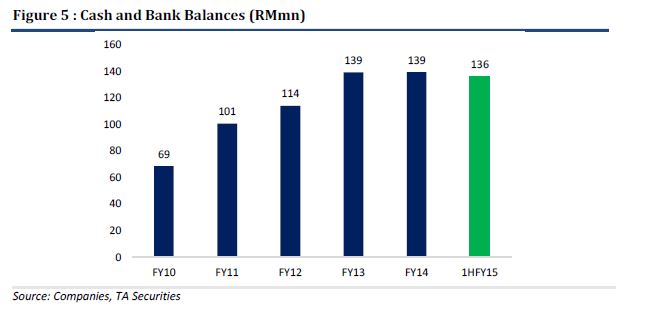

Cash Rich

From a balance sheet perspective, the company has a strong net cash position of RM47.4mn

or RM1.10/share (38.9% of share price). Given the capital intensive nature of the industry, it

maintains a high cash reserve to capture potential business. This ensures it is not beholden to

traditional sources of finance. Recently, it rewarded shareholders with a special dividend of

3.0sen/share. No dividend policy has been fixed.

Corporate Restructuring

Recently, it announced the proposed acquisition of remainder shares in KESM Test from

Sunright Limited. This will be priced at a cash consideration of RM35.0mn for the 34.6% stake

– translating into a FY14 PE of 6.4x. The disposal is part of a corporate restructuring exercise

that allows KESM to gain full control of the test business. Meanwhile, Sunright will then focus

on equipment development. Ultimately, as KESM is an associate of Sunright, it will still benefit

from growth in the test business. The exercise is expected to be completed by the first half of

2015. Assuming the deal goes through, we estimate EPS could potentially rise by ca. 41.9%.

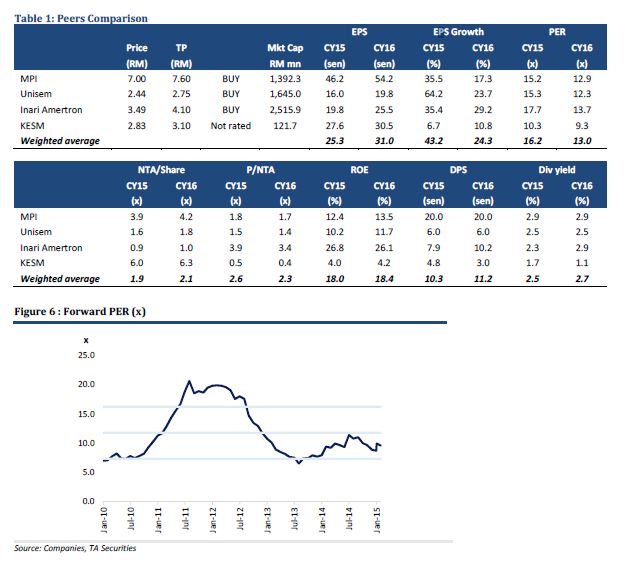

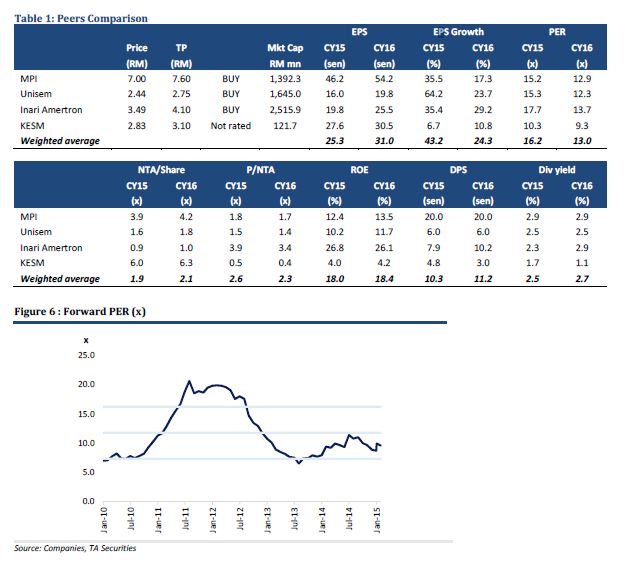

Attractive Valuations

We value the company at a TP of RM3.05 – based on a PE of 10x and CY16 EPS of 30.5sen.

Although it can be argued that the company has a smaller market cap and lower earnings

growth, we opine that this is well accounted for by our discounted PE of 10x vs. our industry

target of 14x. Based on our estimates, the company is currently trading at a relatively

undemanding CY16 PE of 9.3x. Stripping out its net cash holdings, its effective CY16 PE

stands even lower at 5.7x. In the event the acquisition of KESM Test proceeds,

our TP may be revised upwards to RM4.55/share (potential upside of +60.8%). Not Rated.

Source: TA Securities

NOBY

Actually the acquisition is already a done deal.

http://www.bursamalaysia.com/market/listed-companies/company-announcements/4704201

2015-04-22 23:02