KESM: RESOLUTION APPROVED TP 4.55 (upside +48.7%)

tasecurities

Publish date: Mon, 11 May 2015, 05:12 PM

KESM Berhad

9334.KL

Resolution Approved

Last Friday, it was announced that the shareholders of Sunright had approved the resolution for the sale and transfer of shares in KESM Test. As this was the last condition precedent, the share sale agreement (SSA) is now unconditional. Both parties have agreed to fix the completion date on the 13th May 2015.

Corporate Restructuring

To recap, the acquisition is part of the group’s restructuring exercise. The remainder shares (34.6%) of KESM Test will be purchased from Sunright Limited at a price of RM35.0mn. This is in line with its strategy to growth its testing business. As a key shareholder of the group, Sunright will continue to benefit from future growth. It also allows Sunright to concentrate its resources on equipment development.

Impact

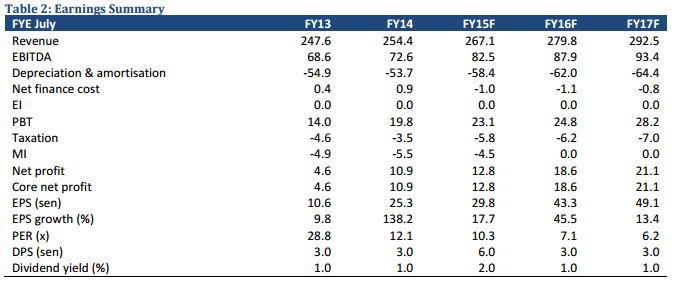

Taking into account the impact of the acquisition, we raise our earnings estimates for FY15/FY16/FY17 by +12.1%/+49.6%/+50.0% to RM12.8mn/ RM18.6mn/RM21.1mn. Valuation Increase our TP for the company to RM4.55/share (from RM3.05/share previously). This is based on an unchanged PE of 10x and CY16 EPS of 45.7sen.

Valuations

for the company remain attractive. Taking into account the accretive impact of the acquisition, the company is trading at a relatively undemanding CY16 PE of 6.7x. NOT RATED.

TP : 4.55 (upside +48.7%)

Source : TA Securities http://www.bursamarketplace.com/index.php?ch=35&pg=120&ac=14547&bb=research_article_pdf

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|