Daily Futures Commentaries: [WTI Crude Oil] 7/6/2018 - EIA against API's data and drag down oil price to below 65!

InvestorsDoctor

Publish date: Thu, 07 Jun 2018, 10:40 AM

7/6/2018

WTI Crude Oil Jul 18

Previous Close: 64.73 -0.73

Crude oil declined on yesterday after EIA stated a surprise build in crude inventories, against data from API.

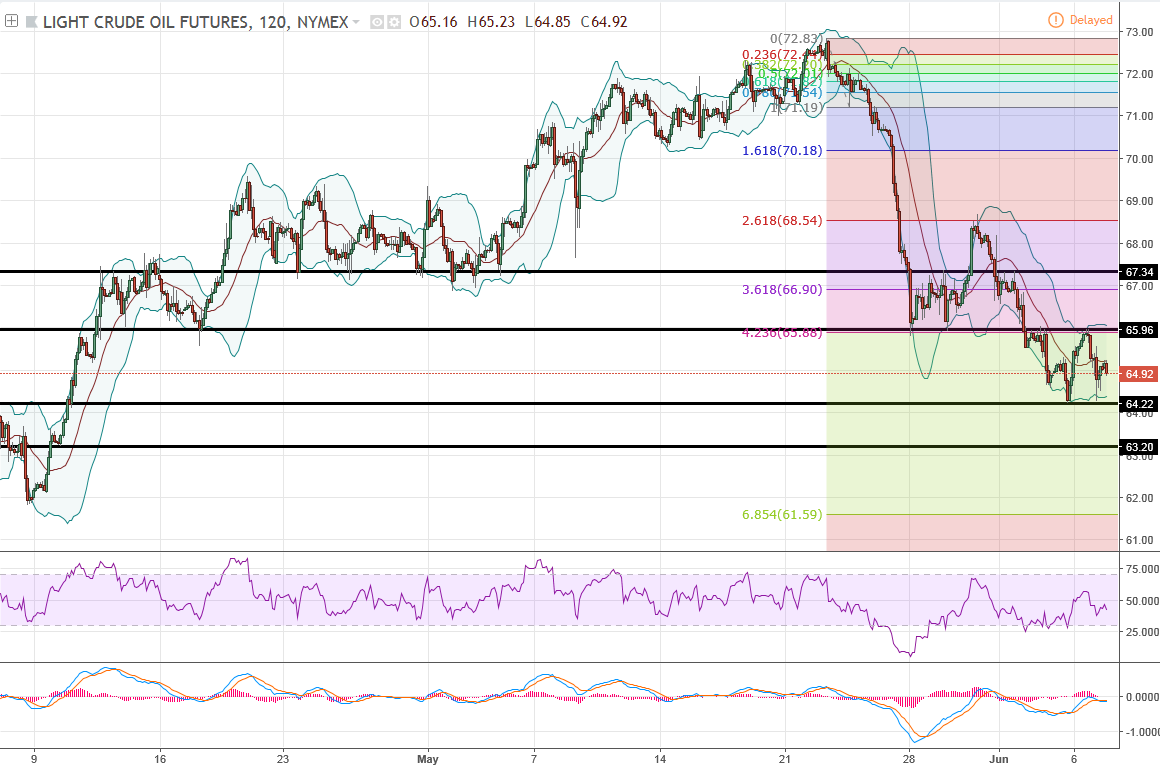

Daily chart show crude oil may head for more correction as BB expanding downside while RSI & MACD trending downside. Hourly chart also show lower lows & highs, but be cautious as there is a bullish divergence with RSI, may trigger a technical rebound in short term.

Classic Support & Resistance

Resistance: 65.96 67.34

Support: 64.22 63.20

Recommend Trading Plan for the day:

1. Buy 65.01, stop 64.91, profit 65.11/65.21.

2. Look for sell signal if break below 64.85.

WTI Oil Margin Requirement (per lot)

WTI Crude : USD 2805

Mini Crude : USD 1402.5

Join our channels to find out more!

Telegram link:

https://t.me/investorsdoctoracademy

Facebook link: https://m.facebook.com/investorsdoctoracademy

More articles on WTI Crude Oil Updates

Created by InvestorsDoctor | Dec 31, 2019

Created by InvestorsDoctor | Dec 18, 2019

Created by InvestorsDoctor | Dec 17, 2019