Daily Futures Commentaries: [WTI Crude Oil] 14/6/2018 - Oil rises as US inventories fall on strong demand

InvestorsDoctor

Publish date: Thu, 14 Jun 2018, 10:53 AM

13/6/2018

*WTI Crude Oil Aug 18*

Previous Close: 66.52 +0.24

Please be noted that Jul 18 will be expired on 20 June, traders may choose to trade Aug 18 contract. Crude oil up slightly after a bigger than expected decline in crude inventories as reported by EIA.

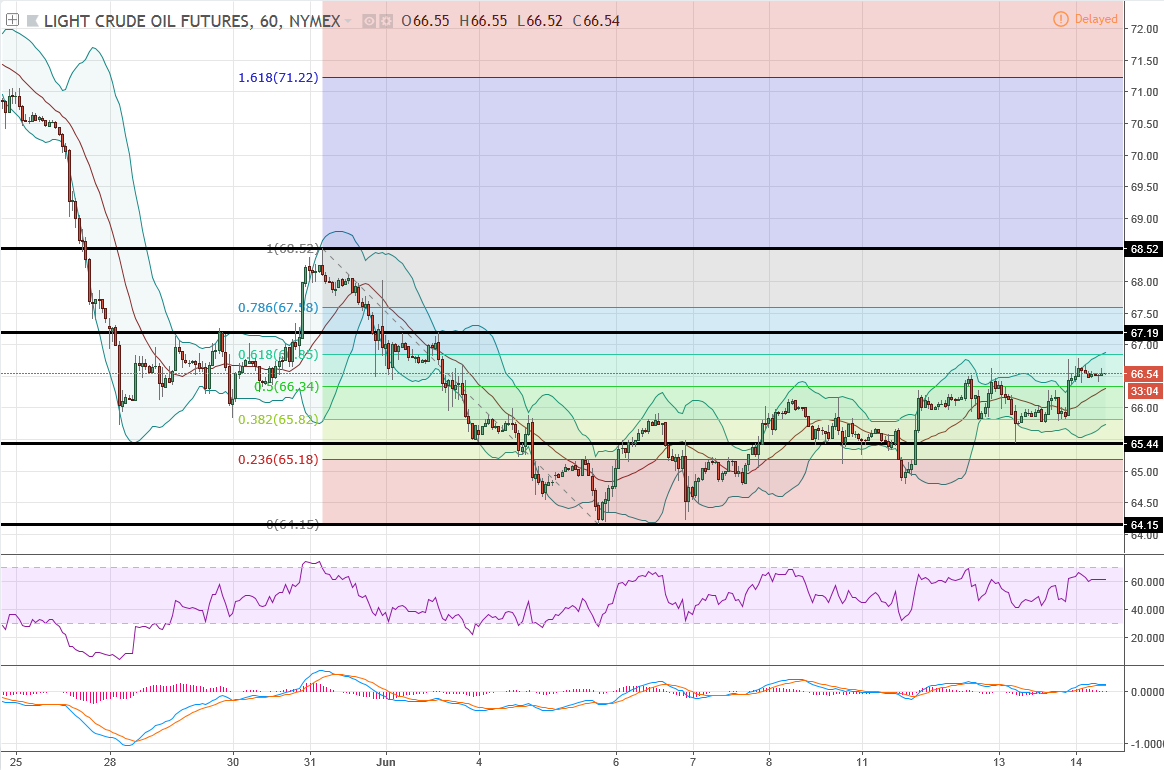

Both daily & hourly charts show crude oil testing rebound after hit lower lows. Watch out for potential hidden divergence in daily chart if RSI formed lower low while price go higher low.

*Classic Support & Resistance*

Resistance: 67.19 68.52

Support: 65.44 64.15

*Recommend Trading Plan for the day:*

1. Look for buy signal if break above 66.78.

2. Look for sell signal if break below 66.26.

*WTI Oil Margin Requirement (per lot)*

WTI Crude : USD 2805

Mini Crude : USD 1402.5

*API*

Crude +833k (-1.25mm exp)

Cushing -730k (-900k exp)

Gasoline +2.33mm

Distillates +2.1mm

*EIA*

Crude -4.143mm (-1.25mm exp) - biggest draw since March

Cushing -687k (-900k exp)

Gasoline -2.271mm (+1mm exp)

Distillates -2.101mm

Join our channels to find out more!

Telegram link:

https://t.me/investorsdoctoracademy

Facebook link: https://m.facebook.com/investorsdoctoracademy

More articles on WTI Crude Oil Updates

Created by InvestorsDoctor | Dec 31, 2019

Created by InvestorsDoctor | Dec 18, 2019

Created by InvestorsDoctor | Dec 17, 2019