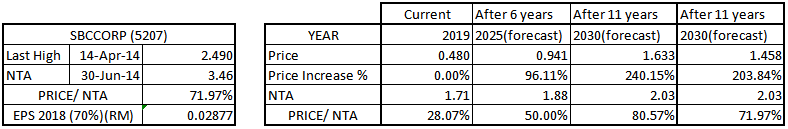

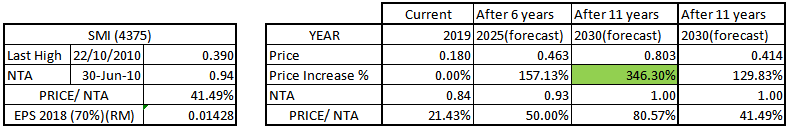

(Forecast) HUAYANG (5062), SBCCORP (5207), SMI (4375),IVORY (5175) Back to Best NTA/Share Price

Wah Lau

Publish date: Sun, 24 Mar 2019, 09:52 PM

Just sharing for study propose. No call buy, Take your own risk in investment ><"

I start this topic because some of my friends start search good value property to invest.

About property status, mostly agree with property price still in down trend or no yet go up.

Malaysia property price drop 10-30% from top, but some of properties share drop more 50% in Share Price/NTA (Share Price/Book Value)

About NTA:https://www.investopedia.com/terms/n/navpershare.asp

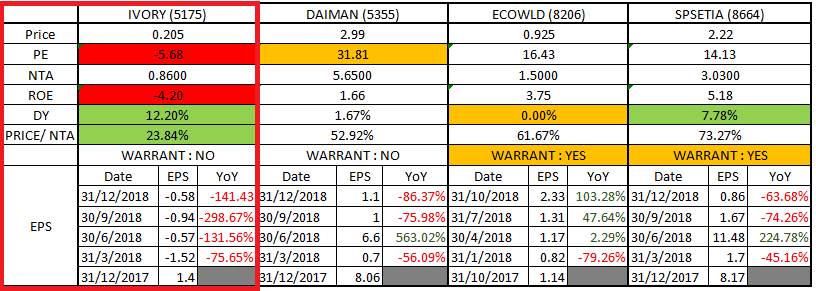

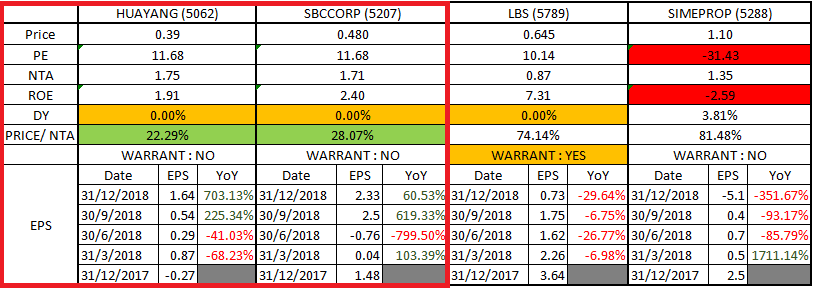

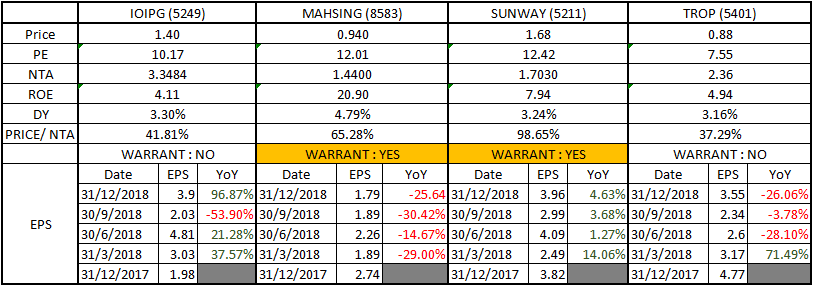

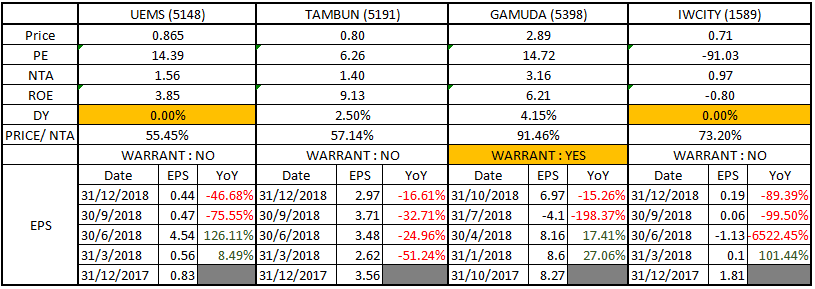

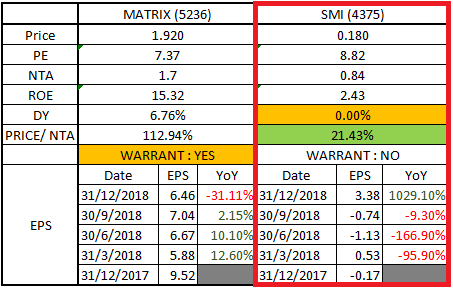

Some of Malaysia property share as below:

I choose 4 with share price/NTA <30%.

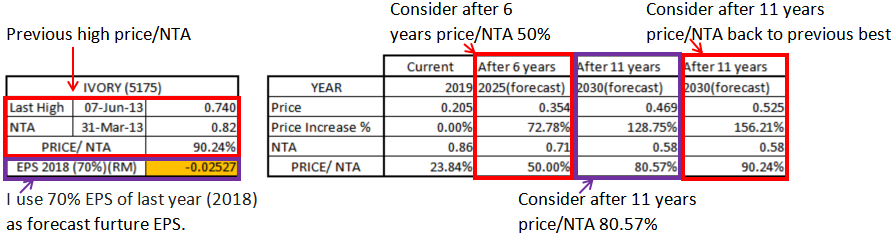

I use 70% EPS of last year (2018) as forecast future EPS.

Average best price/NTA = 80.57% from 2010 to 2014.

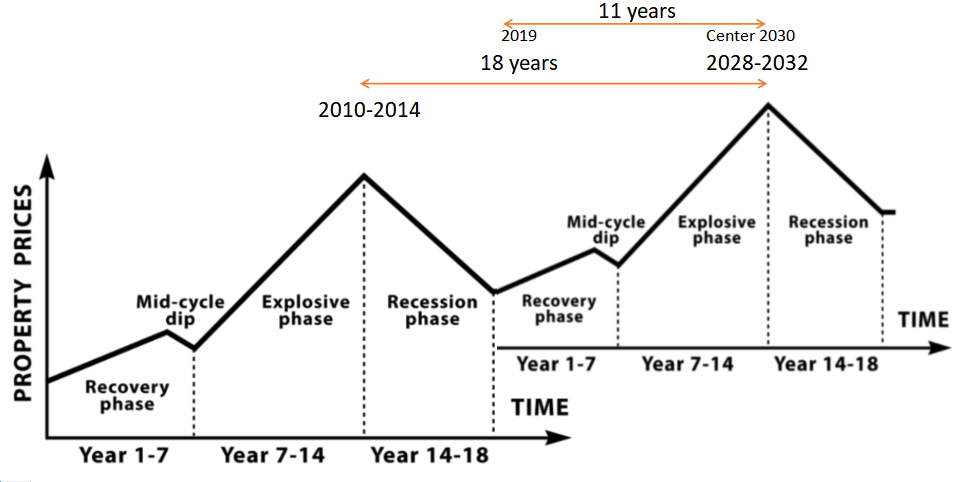

Here about property cycle : https://www.propertygeek.net/article/the-18-year-property-cycle/

I combined 2 chart to get:

Ok, now start forecast =.=V

-Ivory 2018 EPS no good, forecast will change when Ivory start profit.

*2017 EPS:2.8sen

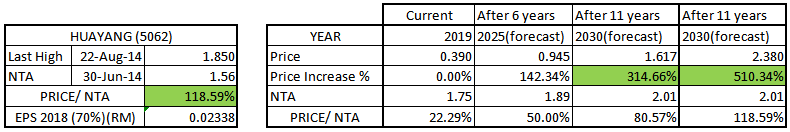

-Huayang have high previous Price/NTA: 118.59% and best price increase % if can come back previous best Price/NTA.

*Continue 2003 until 2017 have dividend payout (My data start from 2003)

*2017 EPS:3.08sen

*Good last quarter EPS1.64

*Continue 2003 until 2016 have dividend payout (2002 not payout dividend)

*Good last 2 quarter EPS 2.33send and 2.5sen.

SMI lower previous high Price/NTA and current Price/NTA. Maybe due to never payout dividend.

*Good last quarter EPS 3.38

*Last high data I refer from 2007 until now

Conclusion

Base on that 18 years property cycle, we need to wait about 11 years to next top. (How many people can hold 11 years =.=")

HuaYang have good potential (If can maintain good EPS, better have dividend payout =.=V)

Company have paying dividend have better Price/NTA

That forecast will change time to time base on EPS.

As normal I come here to learning and sharing, your opinion, advice, suggestion are welcome and thanks.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on WahLau Share Forecast

Created by Wah Lau | Aug 31, 2020

Created by Wah Lau | Jan 19, 2020