(My Alert On) GENETEC (0104) WahLau Alerted

Wah Lau

Publish date: Sun, 05 May 2019, 06:35 PM

Just sharing for study propose. No call buy, Take your own risk in investment ><"

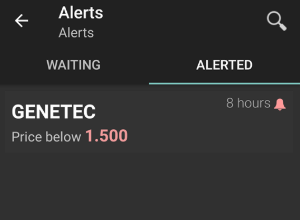

1 of share my of alert list was "Alerted".

I share action I taken, please advice me if you have any idea to improve it and thanks.

Software using "KLSE Screener (Bursa)

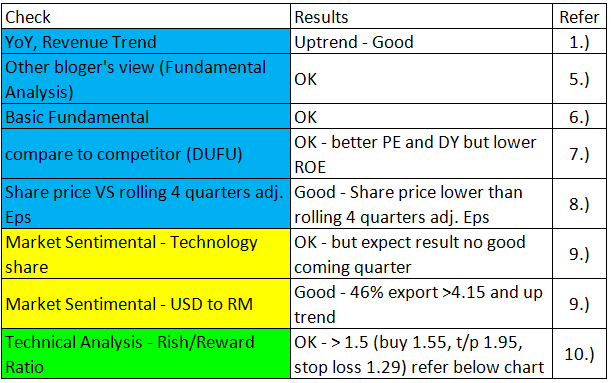

My "Alerted" step

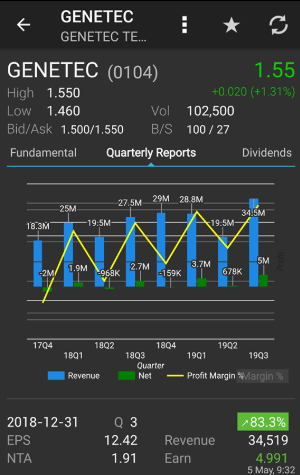

1.) Check financial reports

EPS, YoY and revenue in up trend

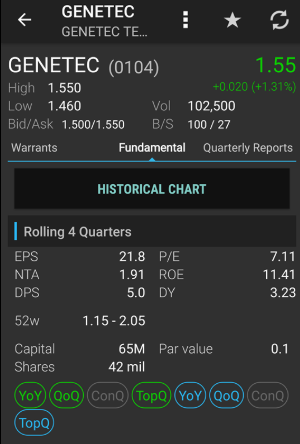

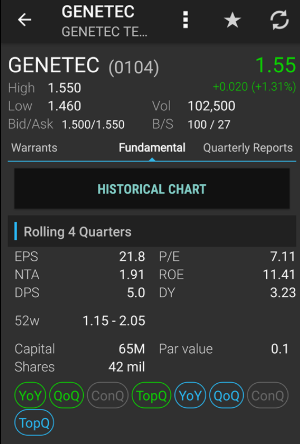

2.) Check Fundamental and check the price I need to set alert.

Good results but need to find good buying points to keep.

Use tradingview to check

Around 1.5 risk/reward ratio 2.4 or >2https://www.tradingview.com/chart/ryhlMhaU/

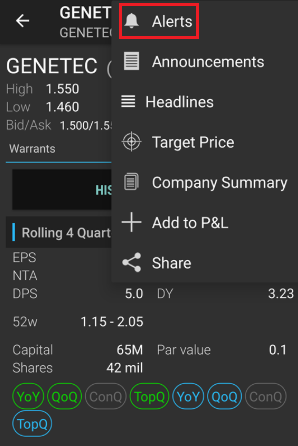

3.) Select "Alerts", set lower bound price and save.

4.) Wait and Alerted

5.) Check again view of other blogger. - Good

https://klse.i3investor.com/blogs/undervalue/171982.jsp

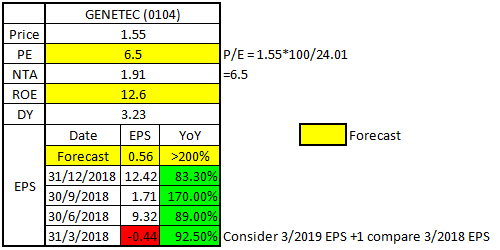

6.) Basic Fundamental - Ok

PE <10, ROE>10 and DY>3

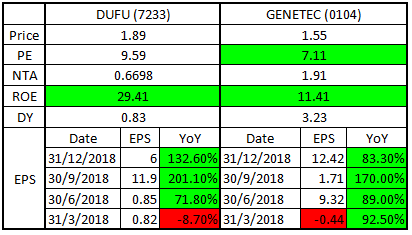

7.) Compare it with competitor DUFU (why select Dufu refer No9) - OK

Have better PE and DY but lower ROE

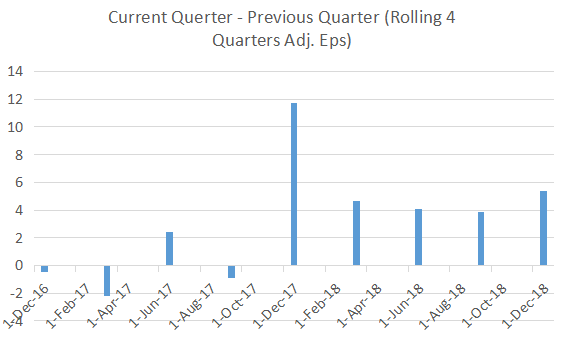

8.) Compare both chart for Rolling 4 Quarter Adj. Eps VS Share Price (hard and lazy to take data)

Currently share price not follow rolling 4 quarters adj. Eps.

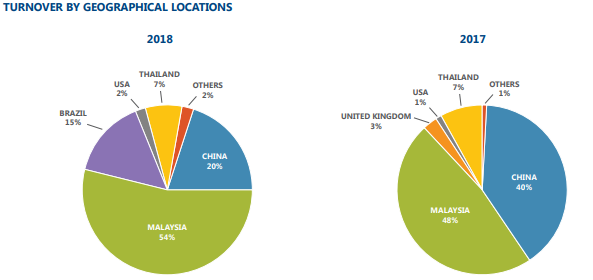

9.) Market Sentimental

Technology share - good

https://m.malaysiastock.biz/Listed-Companies.aspx?type=S&s1=17

Export 46% and USD to RM >4.15 - good

10.) Current Risk/Reward Ratio (buy 1.55, t/p 1.99, stop loss 1.29) refer below chart

11.) Conclusion

Last 2 quarter Current Querter - Previous Quarter (Rolling 4 Quarters Adj. Eps) about +2. If result EPS +1

*Thanks for reading and have suggestions please advice it in comments.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on WahLau Share Forecast

Created by Wah Lau | Aug 31, 2020

Created by Wah Lau | Jan 19, 2020