all weather portfolio?

lazycat

Publish date: Sun, 28 Jul 2019, 07:49 PM

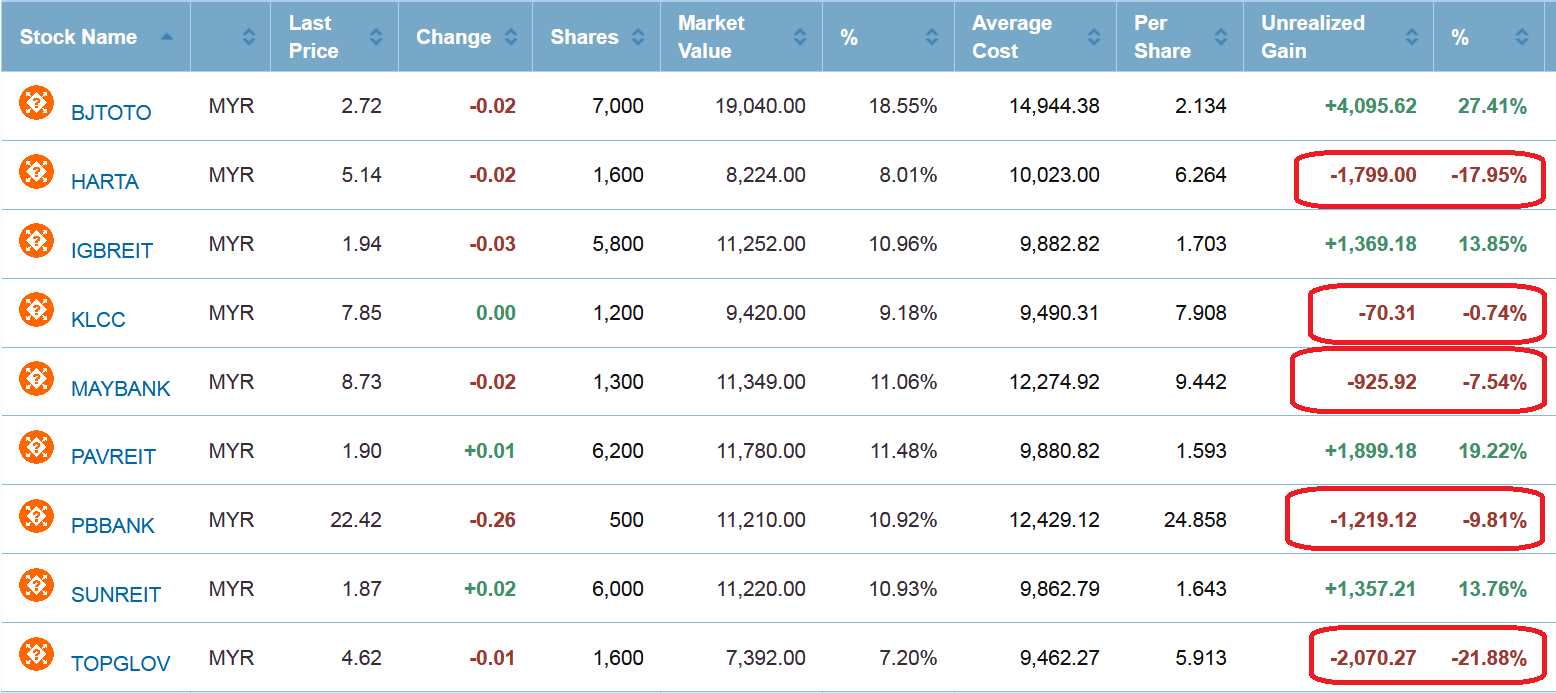

Before entering TKW 2019 stocks challenge, i come up with few sets of fictional portfolio , 1 of the portfolio i named it '' 2019 all weather passive bet '' https://klse.i3investor.com/servlets/pfs/115617.jsp

My idea is buy and hold for 1 year for the stocks i think is the most resilience, most stable, constant div pay out + modest growth , well after half year now , let see the perfomances , turn out 5 out of 9 stocks in the portfolio is in red , especially topglove and harta double digit loss, maybank pbbank more than 5% , KLCC no up no down , only IGB PAV SUN reits show green , and of course the lovely bjtoto

every stocks have the risk of going down , if you're someone 20 to 30 years old, having a all weather stocks portfolio is not going generate much wealth for you.

if you are a retiree with 10-20 years time to live, having this kind of portfolio is somewhat stable , but it always come with risks

So, what's the conclusion? there is no ''all weather'' stocks portfolio, to survive , 1 must always be willing to adapt to the new circumstances , no good then must change , don't be stubborn :)

More articles on abc testing

Discussions

i think ''beating the market'' is the term?

anyhow currently topglove and harta down 18 to 22% from Dec 2018 high present a good chance to buy low :D

2019-07-28 20:06

All-weather porfolio exists, as a combination of bonds, stocks, commodities, and cash.

A portfolio consisting only single category of investment (eg. stocks) cannot be all weather, because individual stocks are correlated.

During bear market all stocks tend to move down together, but adding another less correlated class of investment eg. bond or commodity, may reduce the swing of portfolio value, because bond may move higher during bad times as people seek refuge at government bonds or gold.

2019-07-28 23:28

But cheoky... if you cut lost will you be able to make money from Heitech Padu ?

2019-07-29 04:53

For me cut loss is an exception not a norm

I don't tactically cut lost

Only cut loss in the event of cyclical upheavals when I was trapped big time

Such as oil and gas in 2014, or steel counters in 2018

2019-07-29 05:04

Icon sifu did u received my curry ikan talapia? Did 2 major round in Htpadu. Cut loss or value investing dogmatically is never the way. Experience with tuition fee and figuring is the way forward. The pain lies in waiting market to agree with you, hopefully fast.

2019-07-29 13:39

probability

sifu hardworkingcat, true....its only by changing the angle of your sail frequently we can reach the destination faster than the wind can bring us by not doing anything...

after all we are expecting return "above average"....aren't we?

2019-07-28 19:54